You know, when I first started trading options, I thought volume was all that mattered for understanding market activity.

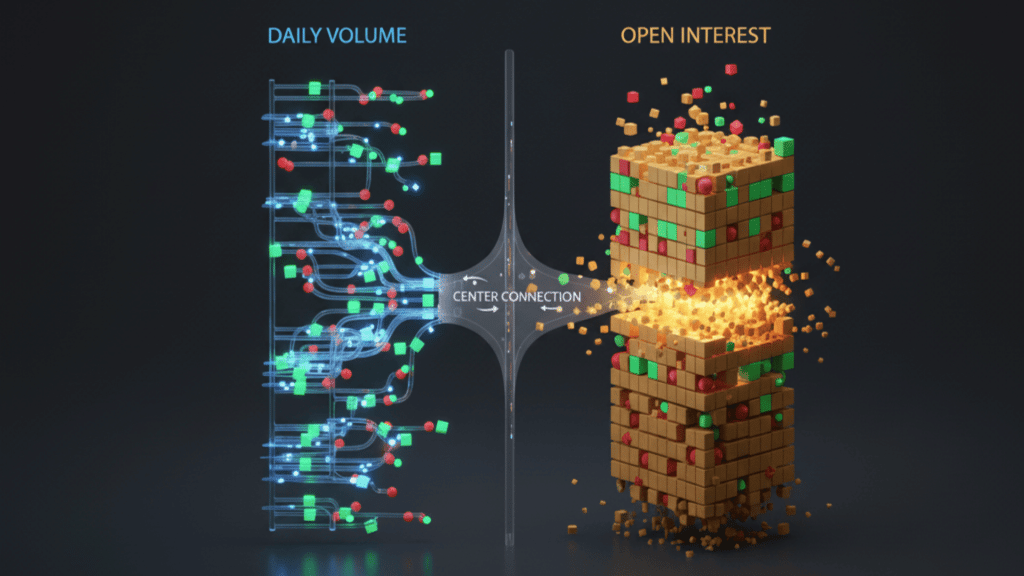

Then I came across open interest, and it completely changed how I read the market. Think of it this way: while volume tells you how many contracts traded hands today, open interest reveals something deeper.

It shows you the total number of outstanding options contracts that are still alive and kicking, waiting to be closed or exercised. It’s like seeing not just today’s traffic, but how many cars are still on the road from previous days.

In this post, I’ll walk you through what open interest really means, how it shifts as traders enter and exit positions, what those changes actually tell us, and most importantly, how you can use this insight to make smarter trading decisions.

What is Open Interest in Options?

So let me break down what open interest actually is. It’s simply the total number of open contracts, both calls and puts, that haven’t been closed, exercised, or expired yet.

Now, here’s where people get confused: open interest isn’t the same as volume. Volume shows me how many contracts changed hands today, like a daily scorecard.

Open interest, on the other hand, tells me how many positions are still open from all previous trading days. When I look at a specific strike price or expiration date, high open interest signals strong ongoing participation and liquidity.

It means there’s real commitment to that option, not just fleeting activity.

How Open Interest Works?

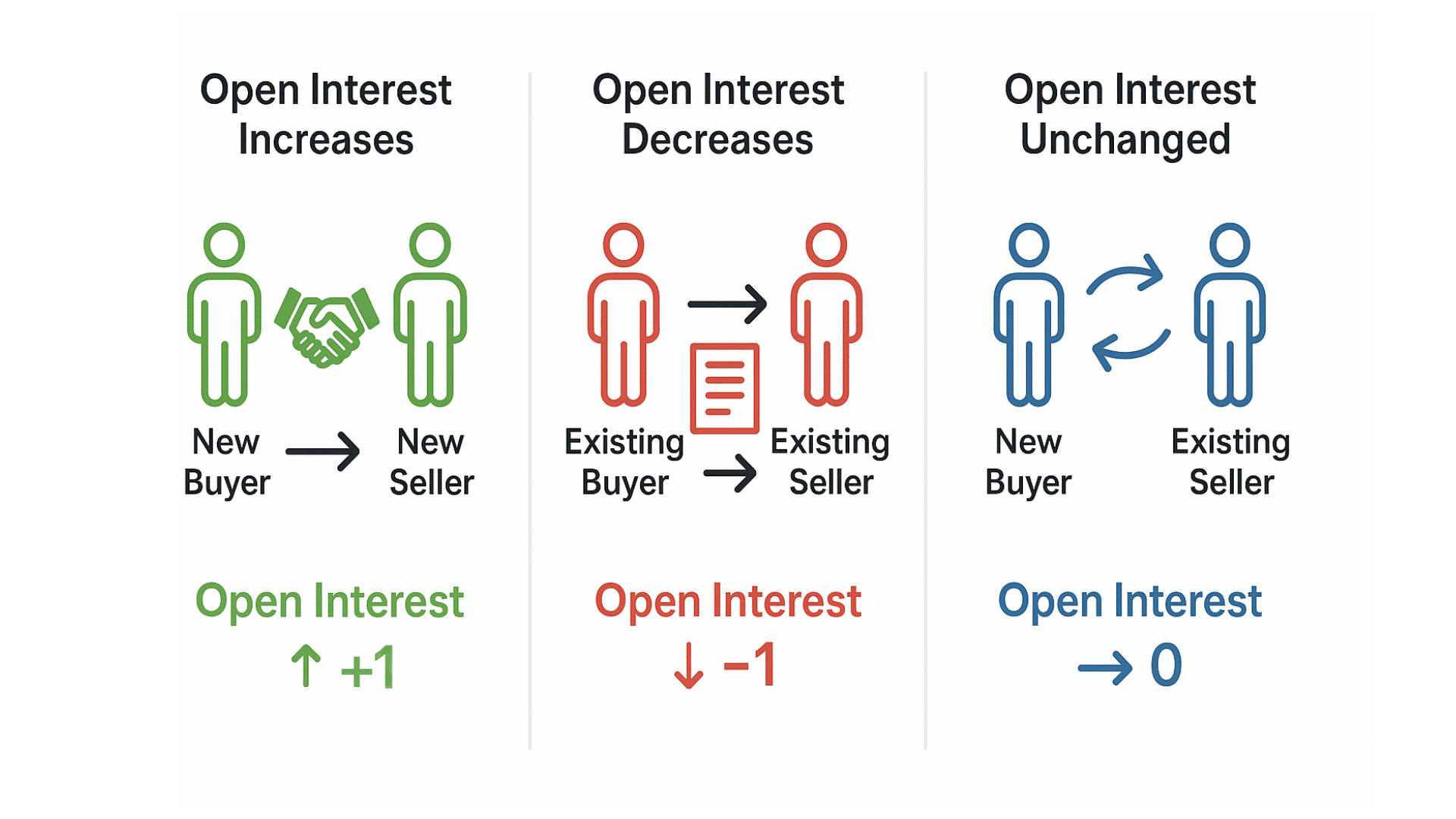

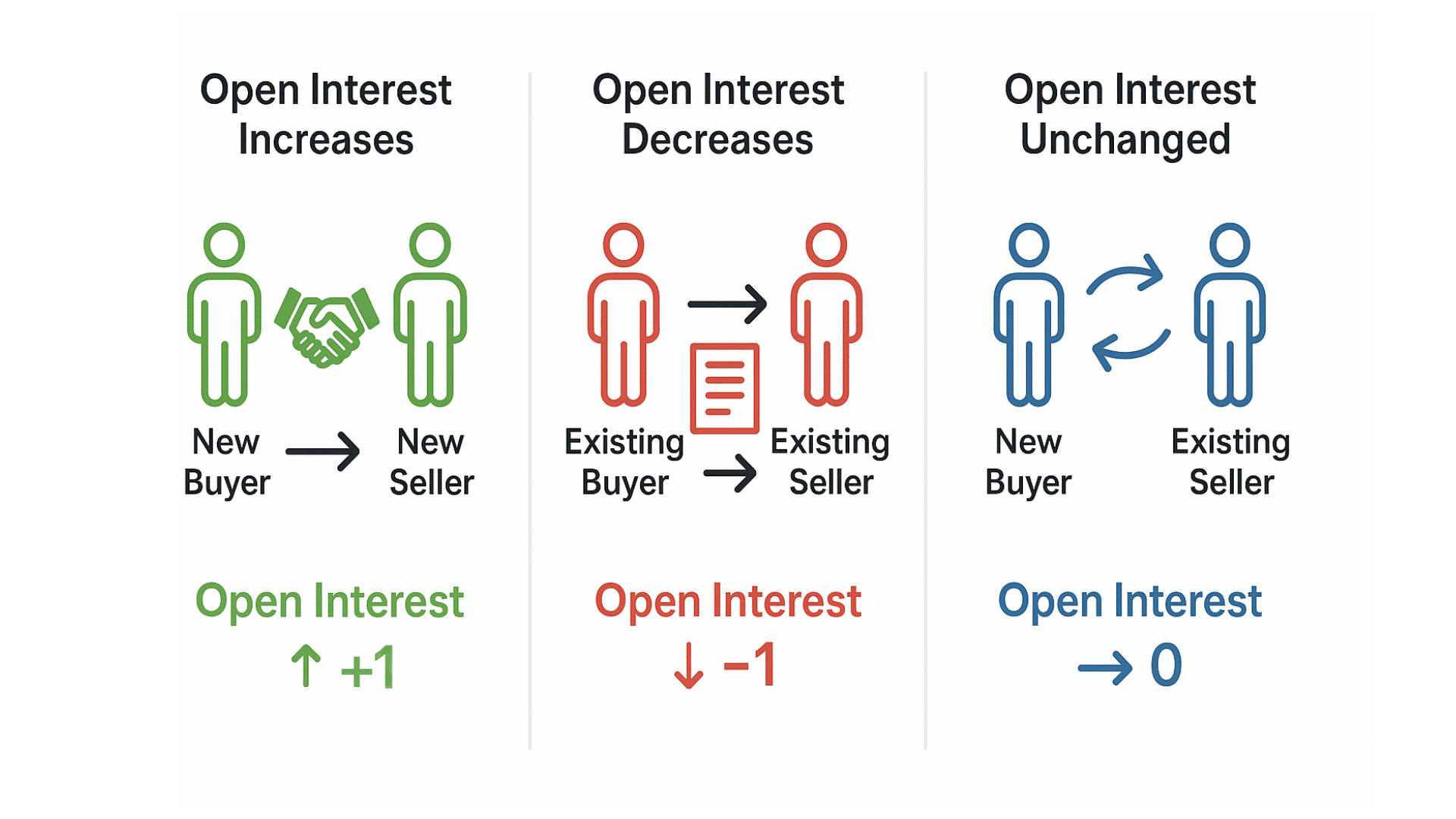

Understanding how open interest moves is crucial because it tells me what’s really happening beneath the surface. Let me walk you through the three scenarios that cause open interest to change, or stay put.

When Open Interest Increases

Open interest rises when a new buyer and a new seller come together to create a brand new contract. Neither party had a position before, so this adds to the total number of outstanding contracts in the market.

I see this as fresh money flowing in: new traders establishing positions with conviction. It signals growing interest in that particular strike or expiration, and often indicates that more market participants are taking a stance.

Think of it as the crowd getting bigger.

Recent Market Trend Insight: I’ve observed surging open interest in tech stock options during product launch cycles, as both bulls and bears establish larger positions, anticipating significant price movements.

When Open Interest Decreases

Open interest drops when both the buyer and seller close out their existing positions. Maybe I decide to sell the call I bought yesterday, and you simultaneously buy back the call you sold.

We’re both exiting, so that contract disappears from the open interest count. I interpret this as money leaving the table; participants are reducing their exposure or taking profits.

When I see declining open interest, it often means traders are losing conviction or the trade thesis is playing out.

Recent Market Trend Insight: During major earnings announcements, I’ve noticed open interest frequently drops as traders close positions to lock in gains or cut losses before volatility spikes.

When Open Interest Stays Unchanged

This one’s interesting; open interest remains flat when one trader opens a new position while another closes an existing one.

So if I buy a call to open a position, but you’re selling to close your position, we’re just swapping places. The total number of contracts doesn’t change.

I find this scenario tells me there’s rotation happening; new participants are replacing old ones, but the overall commitment level stays constant.

Recent Market Trend Insight: In sideways markets, I often see stable open interest with high volume, indicating active trading but no net change in market conviction; traders are simply rotating positions.

Here’s something important I always keep in mind: exchanges update open interest figures once daily, after the market closes. So the numbers I see reflect yesterday’s final tally, not real-time activity.

Example of Open Interest Changes

Let me walk you through a real-world scenario so you can see exactly how this plays out day by day.

The Scenario

- Day 1: Trader A decides to buy a call option, and Trader B sells that same call. Both are opening new positions, so we’ve just created a brand new contract. Open interest increases by one.

- Day 2: Both Trader A and Trader B decide they’re done with this trade. Trader A sells to close, and Trader B buys to close. The contract they created yesterday now disappears. Open interest decreases by one.

- Day 3: Trader C buys a call option while Trader D sells to close an existing position. One enters, one exits, just swapping places, so open interest remains unchanged.

Volume vs. Open Interest Progression

Here’s how I track the difference between daily volume and cumulative open interest:

| Day | Trading Activity | Daily Volume | Open Interest | Change in OI |

|---|---|---|---|---|

| Day 1 | Trader A buys (new) + Trader B sells (new) | 1 | 1 | +1 |

| Day 2 | Trader A sells (close) + Trader B buys (close) | 1 | 0 | -1 |

| Day 3 | Trader C buys (new) + Trader D sells (close) | 1 | 0 | 0 |

| Day 4 | Trader E buys (new) + Trader F sells (new) Trader G buys (new) + Trader H sells (new) |

2 | 2 | +2 |

| Day 5 | Trader E sells (close) + Trader F buys (close) | 1 | 1 | -1 |

Notice how volume resets every day; it only counts that day’s activity. But open interest is cumulative, showing me the total number of contracts still alive in the market.

Importance of Open Interest in Options Trading

Open interest is more than just data; it’s a critical lens for reading the market. Here’s why I rely on it:

- Acts as a Liquidity Indicator: High OI indicates tighter bid-ask spreads and smoother execution; low OI signals wider spreads and potential slippage.

- Reflects Market Participation and Trader Confidence: Shows me where traders have conviction, with concentrated OI revealing where the real money is positioned.

- Helps Identify Support and Resistance Zones: High-OI strikes act as price magnets, especially near expiration, creating mechanical buying or selling pressure.

- Used to Confirm Trend Strength or Weakness: Rising price with rising OI confirms strength; rising price with falling OI warns of weakness or profit-taking.

Bottom line? Open interest gives me the context I need to trade smarter: confirming trends, timing entries, and avoiding illiquid traps.

Open Interest vs. Volume: Key Differences

I’ve seen traders confuse these two metrics constantly, but they’re fundamentally different. Let me clear up the distinction once and for all.

| Feature | Open Interest | Volume |

|---|---|---|

| What It Measures | Total number of active contracts still open and not yet settled | Total number of contracts bought and sold during a single trading day |

| Time Perspective | Cumulative count from all previous days; shows what’s still alive | Resets to zero each day; only counts today’s trading activity |

| What It Tells Me | Market commitment and liquidity; who’s holding positions and where | Trading intensity and interest: how active the market is right now |

| When It Updates | Once daily after market close, it reflects end-of-day positions | Continuously throughout the trading day in real-time |

| Typical Reading | OI = 50,000 means fifty thousand contracts are currently open | Volume = 5,000 means five thousand contracts traded today |

Both metrics are essential, but they tell me different stories. Volume shows me the action, how many contracts changed hands today. Open interest shows me the conviction, how many traders are still holding positions.

When I use them together, I get a complete picture: volume reveals intensity, while open interest reveals commitment.

How to Interpret Open Interest Data?

Reading open interest isn’t just about the numbers; it’s about combining those numbers with price movement to understand what’s really happening.

Here’s my framework:

- Rising OI + Rising Price: Bullish confirmation; new money entering long positions, trend has strong participation and momentum.

- Rising OI + Falling Price: Bearish confirmation; fresh short positions or protective puts building, indicating downside conviction.

- Falling OI + Rising Price: Short covering rally; shorts exiting creates upward pressure, but lacks new bullish participation for sustainability.

- Falling OI + Falling Price: Long liquidation; longs closing positions, weakness confirmed as participants exit rather than hold through decline.

Remember, I never interpret open interest in isolation. Context matters: the prevailing trend, volume confirmation, and broader market conditions all shape what these signals actually mean.

What looks bullish in an uptrend might just be noise in a choppy market.

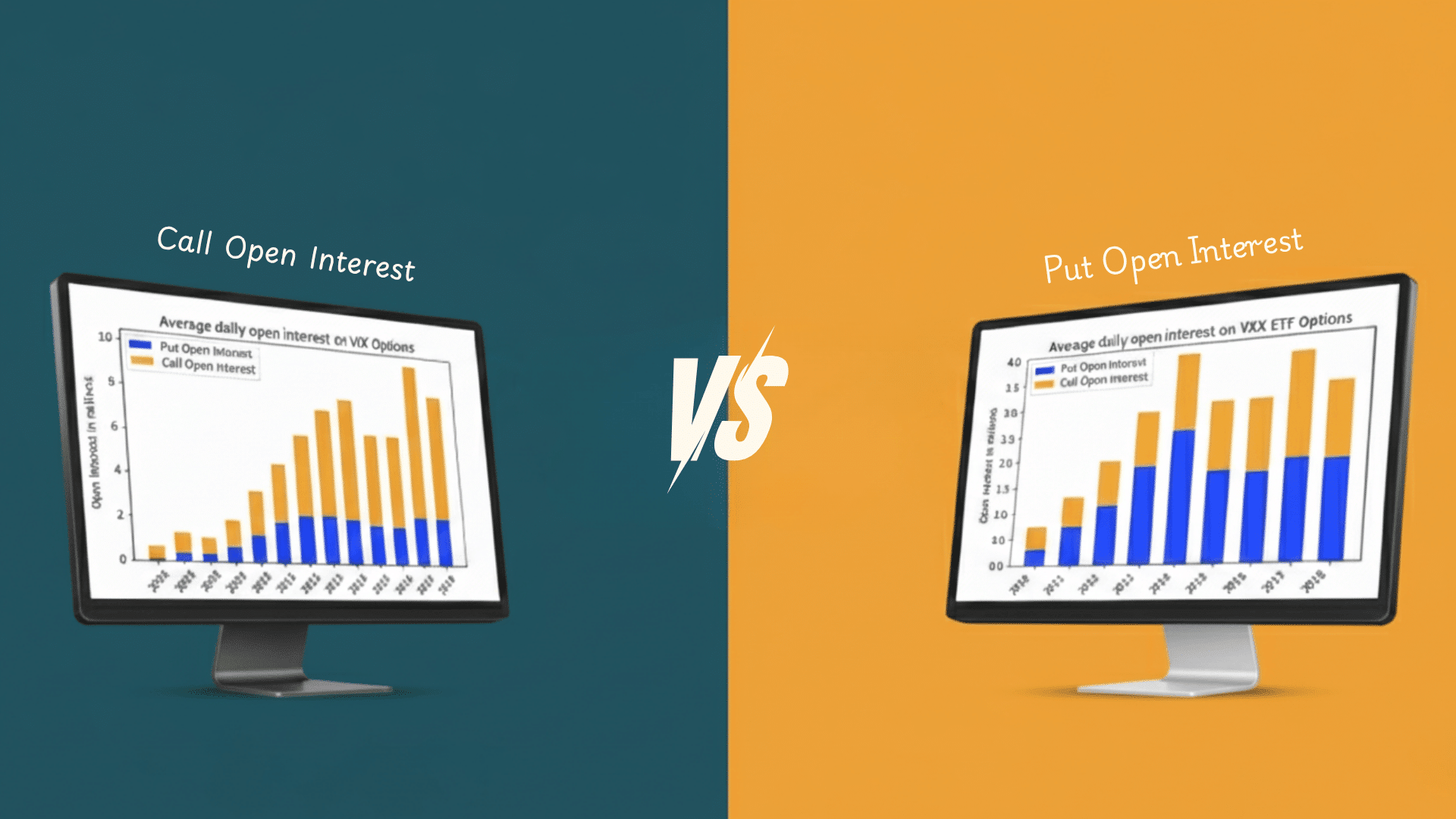

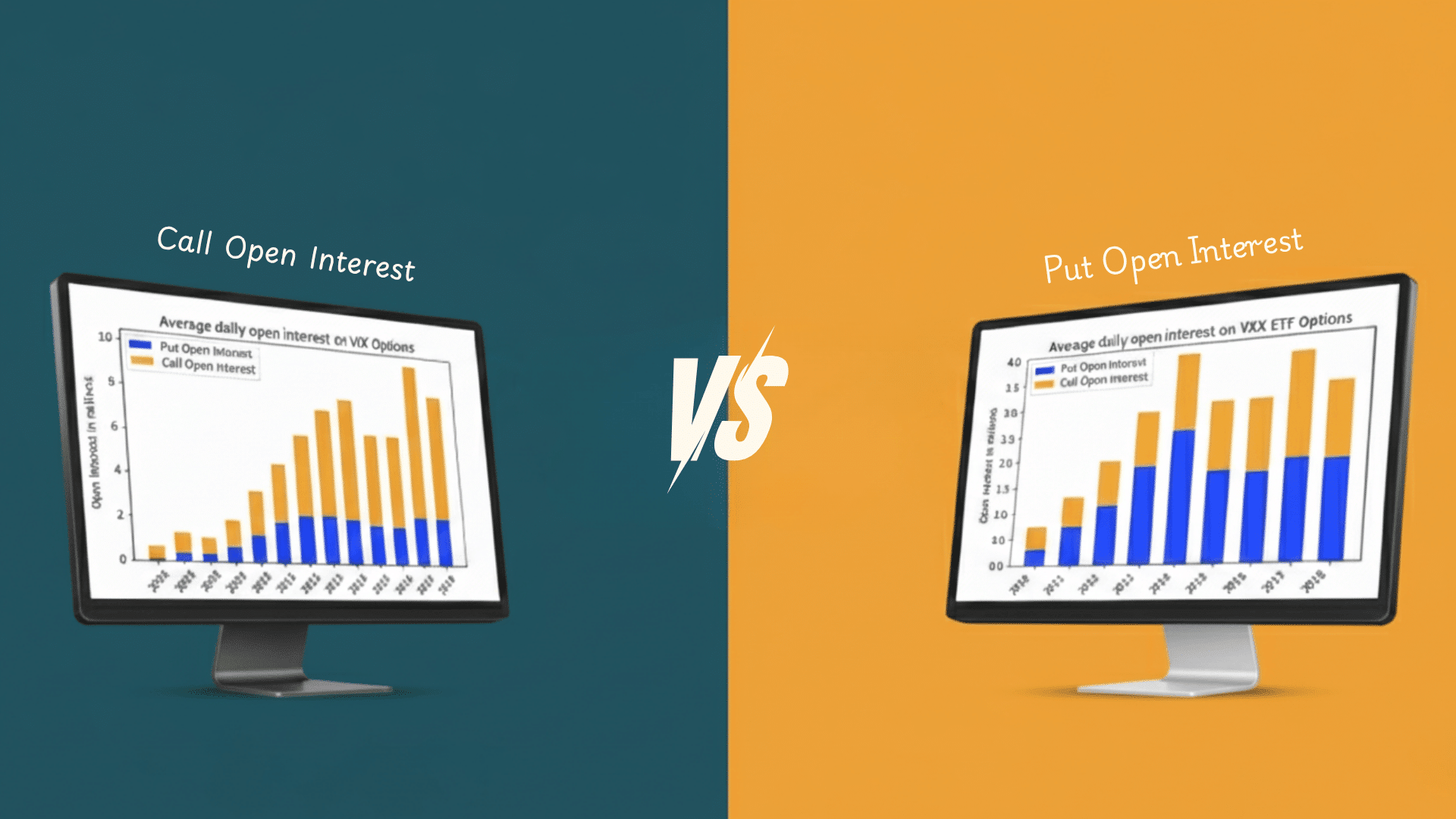

Open Interest in Calls vs. Puts

Not all open interest is created equal. Whether that OI sits in calls or puts completely changes what it tells me about market sentiment.

Understanding Call vs. Put Open Interest

High call open interest typically signals bullish positioning, though it can also reflect covered call strategies for income. High put open interest usually indicates bearish sentiment or protective hedging.

The key is context: strike placement and market conditions help me distinguish between directional bets, income strategies, and defensive positioning.

The Put/Call Open Interest Ratio

I calculate this by dividing the total put OI by the call OI for a quick sentiment gauge. A ratio above one suggests bearish sentiment or heavy hedging.

Below one indicates bullish positioning. I track it over time rather than single readings. Extreme ratios often signal overcrowded trades that could reverse.

How Traders Use Open Interest in Strategy?

I don’t just look at open interest; I actively use it to shape my trading decisions. Here’s how I integrate OI into my practical strategy:

- For Confirmation: Check OI alongside price and volume before entering trades; all three must align for conviction in the move.

- For Strike Selection: Choose strikes with higher OI for better liquidity, ensuring tighter spreads and smoother execution without slippage.

- For Expiry Positioning: Analyze where OI clusters near major expirations to identify “max pain” levels where prices often gravitate due to hedging dynamics.

- For Options Spreads: Ensure both legs have sufficient OI to maintain balanced liquidity across the entire spread structure and avoid execution risks.

Common OI-Based Strategies

Beyond these tactical uses, I rely on three core OI-based strategies that consistently improve my trading decisions:

| Strategy | Application | What I Look For |

|---|---|---|

| Trend Confirmation | Validate breakouts and trend strength | Rising OI with rising price (bullish) or falling price (bearish) |

| Reversal Detection | Spot potential trend exhaustion | Divergence between price movement and OI direction |

| Max Pain Analysis | Anticipate price behavior near expiration | High OI concentration at specific strikes where pinning may occur |

These strategies aren’t standalone signals, but when combined with solid technical analysis and risk management, they give me an edge in reading market dynamics and timing my entries and exits more effectively.

Limitations of Open Interest

Open interest is powerful, but it’s not perfect. Here are the key limitations I always keep in mind:

- Doesn’t Show Direction of Trades: OI reveals quantity, not whether buyers or sellers initiated positions.

- Lags Due to Daily Update Delays: Updated only after market close, meaning the data is always one day behind.

- Sudden Spikes Can Be Hedging, Not Speculation: Large OI increases often reflect institutional hedging, not directional conviction.

- Should Be Used With Other Tools, Not Standalone: OI works best combined with price action, volume, and technical indicators.

Open interest confirms what’s happening but doesn’t predict what’s coming next. It’s a validation tool, not a crystal ball.

Risk Advisory: Never base trading decisions solely on open interest. Market conditions can change rapidly, and OI data reflects past positioning, not future direction. Always employ proper risk management and diversification.

Example: Analyzing Open Interest on a Live Stock

Let’s look at Apple (AAPL) options to see how I read open interest in practice:

Sample Data:

- $190 Call: OI = 25,000 | Volume = 2,000

- $185 Put: OI = 30,000 | Volume = 1,500

My Interpretation: The $190 call shows strong open interest with moderate daily volume, suggesting sustained bullish positioning at that strike. The $185 put has even higher OI, indicating significant downside protection or bearish bets below the current price.

If AAPL’s price is rising while call OI increases, that confirms bullish sentiment with new money entering. The put wall at $185 likely acts as support.

This is an illustrative analysis only, not a trade recommendation. Market conditions change rapidly, and past open interest patterns don’t guarantee future price movement. Always conduct your own research and consult options education resources before trading.

Conclusion

Open interest has become one of my non-negotiables when analyzing options. It’s not just another metric; it’s the total count of active contracts that reveals liquidity depth and where traders are truly committed.

I’ve learned that combining OI with volume and price action gives me confirmation that standalone indicators simply can’t provide.

The insights hidden in open interest patterns have helped me avoid illiquid traps, validate trends, and time my entries with far more precision. So here’s my challenge to you: make open interest part of your pre-trade checklist.

What’s your experience with open interest? Have you spotted patterns that changed your trading approach? Drop your thoughts in the comments below!