If you’ve ever looked at a company’s balance sheet and wondered what “additional paid-in capital” means, you’re not alone. I remember the first time I saw it, it sounded more complicated than it really is.

In this guide, I’ll break down what additional paid-in capital is in simple terms so you can finally understand it without the accounting jargon. You’ll learn what it means, how it’s calculated, and why it matters for both investors and businesses.

By the end, you’ll know exactly how to spot it on a financial statement and what it tells you about a company’s financial strength.

What is Additional Paid-In Capital (APIC)?

Additional paid-in capital (APIC) is the amount investors pay above the par value of a company’s stock when they buy shares.

For example, if a company sells stock with a $1 par value but investors pay $10 per share, the extra $9 per share is recorded as additional paid-in capital.

This isn’t revenue or profit; it’s part of the total money investors contribute to help the company grow.

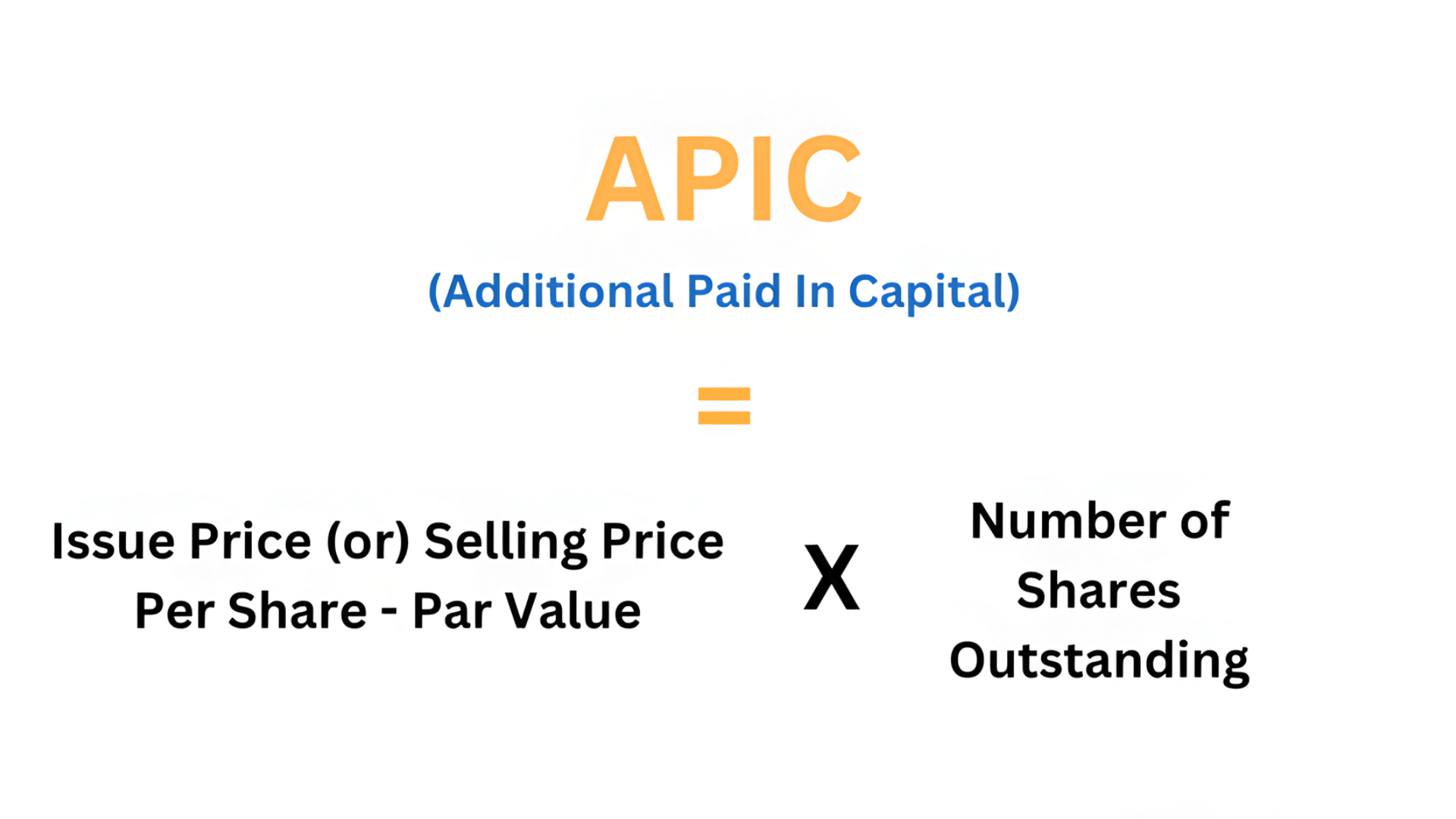

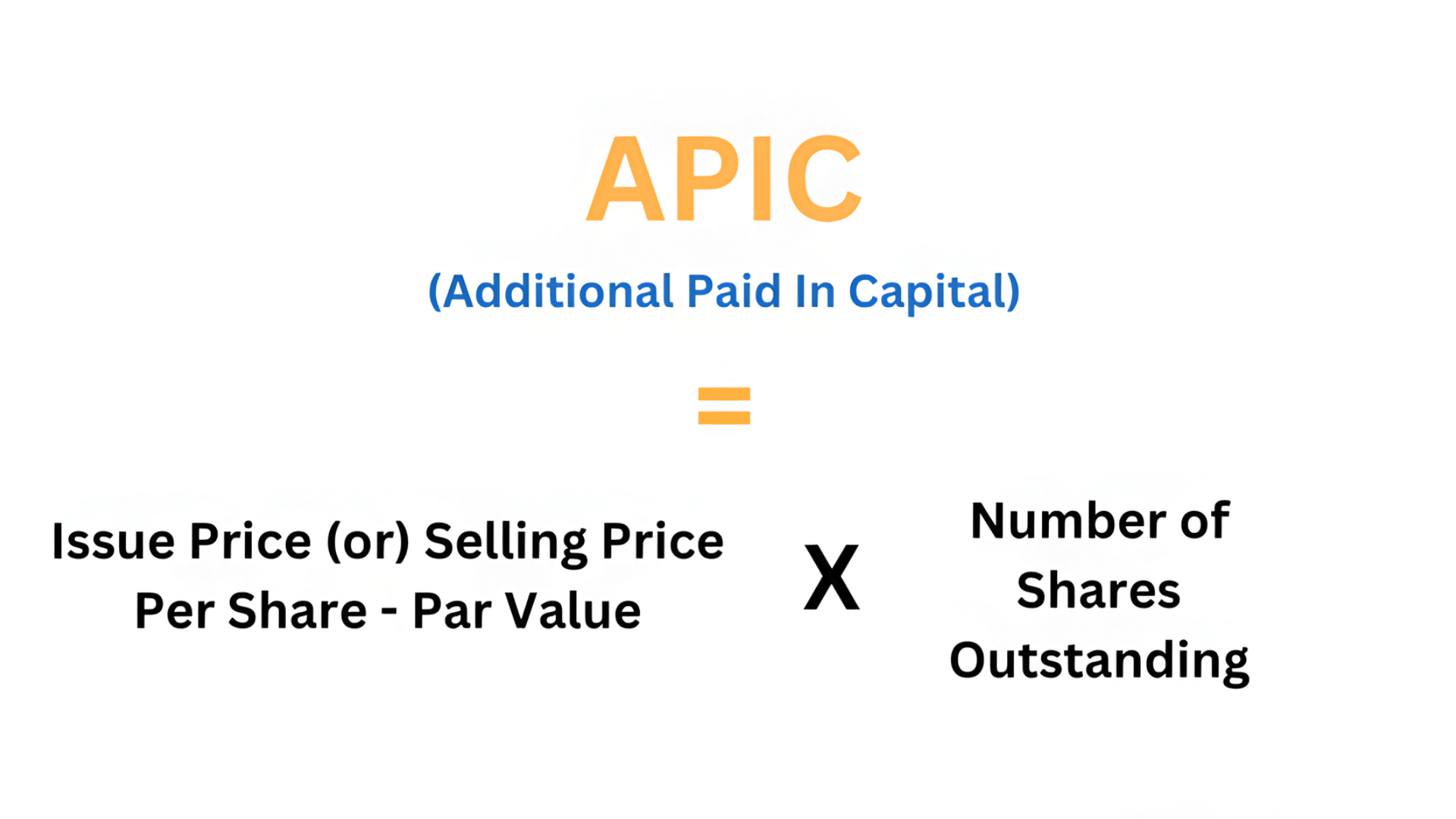

You can calculate APIC with this formula:

APIC = (Issue Price – Par Value) × Number of Shares

Here’s what each part means:

- Issue Price: The price investors pay per share.

- Par Value: The base or face value of each share.

- Number of Shares: The total shares sold.

Example: If a company issues 1,000 shares at $12 each and the par value is $1:

= (12 – 1) × 1,000 = $11,000

That $11,000 becomes additional paid-in capital.

If the company pays fees or commissions to issue shares, those costs are subtracted from APIC because they reduce the total amount raised.

How APIC Appears on Financial Statements

You’ll find APIC under shareholders’ equity on the balance sheet, usually listed below “Common Stock” or “Preferred Stock.”

On the cash flow statement, stock sales appear under financing activities, while APIC itself remains part of the equity section.

APIC doesn’t show up on the income statement because it’s not revenue. It’s part of the money investors contribute, not income from business operations.

Journal Entries for Additional Paid-In Capital

When a company issues stock above par value, the journal entry separates the par value and APIC.

Example:

| Account | Debit | Credit |

|---|---|---|

| Cash | $10,000 | |

| Common Stock ($1 par × 1,000 shares) | $1,000 | |

| Additional Paid-In Capital | $9,000 |

If the company pays issuance costs, they’re deducted from APIC.

Preferred stock follows the same rule: any amount received above par goes to Additional Paid-In Capital – Preferred.

Components of Paid-In Capital

Paid-in capital has two main parts:

- Par Value (Share Capital): The legal face value of issued shares.

- Additional Paid-In Capital: The extra amount paid above par.

Example: If 2,000 shares are sold at $8 each with a $1 par value:

- Common Stock = $2,000

- APIC = $14,000

- Total Paid-In Capital = $16,000

This shows how total capital is split between par value and investor premiums.

APIC vs. Other Equity Accounts

It’s easy to mix up additional paid-in capital with other equity accounts since they all sit in the same section of the balance sheet. Here’s a simple comparison to help you see the difference clearly:

| Comparison | Description |

|---|---|

| APIC vs. Par Value | Par value is the minimum legal value per share. APIC is the extra amount investors pay above that value. |

| APIC vs. Retained Earnings | APIC comes from money that investors contribute. Retained earnings come from company profits that stay in the business. |

| APIC vs. Contributed Capital | Contributed capital is the total amount shareholders have invested, which includes both par value and APIC. |

| APIC vs. Share Premium | In many countries outside the U.S., APIC is called “share premium.” Both terms mean the same thing: money paid above par value. |

By separating these accounts, you can better understand how each one contributes to a company’s overall equity.

It also helps you read financial statements with more confidence, knowing where each source of capital comes from.

Factors That Increase or Decrease APIC

A company’s additional paid-in capital doesn’t stay the same forever. It changes when the company issues, repurchases, or adjusts its shares.

These movements reflect how investors interact with the company through equity transactions rather than day-to-day business activities.

APIC Increases When

- The company issues new shares above par value

- Employees exercise stock options or warrants

- Bonds or preferred shares convert to common stock

APIC Decreases When

- The company buys back its shares

- Stock issuance costs are recorded

- Certain restructuring entries adjust equity

Overall, APIC only changes through equity-related actions. It’s not affected by operating profits, losses, or normal business expenses; only by events tied to ownership and capital structure.

Examples of Additional Paid-In Capital

To understand how additional paid-in capital (APIC) works, it helps to look at real-world situations. Each example below shows how APIC increases when shares are issued for more than their par value.

1. IPO Example

When a company goes public, it sells stock to investors for the first time. If the stock price is $25 per share and the par value is $0.01, the extra $24.99 per share becomes APIC.

This amount shows investor confidence in the company’s value and future potential.

2. Private Investment

Private investors can also add to APIC. If they buy shares at $5 each with a $1 par value, the extra $4 per share is recorded as additional paid-in capital.

This type of investment strengthens the company’s balance sheet without adding debt.

3. Employee Stock Options

When employees exercise stock options, they buy shares directly from the company, often at a set price. If the exercise price is higher than par value, that difference adds to APIC.

It benefits both the employees and the company by boosting ownership and equity.

Each of these cases increases shareholders’ equity without affecting the company’s net income. APIC grows through investment activity, not from day-to-day operations.

Why Additional Paid-In Capital Matters?

APIC shows how much confidence investors have in a company. When investors pay more than the par value, it means they believe the company is worth more than its base share price.

A strong APIC balance strengthens equity, helps the company attract future investors, and shows lenders that shareholders have invested real money into the business.

Common Mistakes and Misunderstandings to Avoid

Even experienced bookkeepers can make small errors when recording additional paid-in capital.

These mistakes can change how equity looks on the balance sheet, so it’s important to handle them carefully. Here are the most common ones to watch for:

- Recording all proceeds under common stock: Always separate the par value from APIC. Only the par value portion belongs under “common stock.”

- Forgetting to deduct issuance costs: Expenses like legal or underwriting fees should be subtracted from APIC, not ignored or recorded as regular expenses.

- Treating APIC as income: APIC comes from investors, not business operations. It should never appear on the income statement.

Keeping these entries correct helps your financial statements stay accurate and compliant with accounting standards. It also gives a clearer picture of where your company’s equity truly comes from.

Summing Up

Now that you know what is additional paid in capital, you can look at a company’s financial statements with more clarity. You’ve learned what it means, how to calculate it, and why it plays a key role in understanding a company’s equity.

I see APIC as a simple reflection of trust; it shows how much investors are willing to support a business beyond its basic share value.

Keep this idea in mind the next time you review a balance sheet. And if you’d like to keep learning, check out more of my blogs for clear, practical explanations on finance topics.