Want to earn income from options but don’t have thousands to buy 100 shares? A Poor Man’s Covered Call might be your answer.

This strategy lets you collect regular premiums just like traditional covered calls, but with a fraction of the capital. Instead of buying expensive stock, you use a long-term call option as a substitute.

Then you sell shorter calls against it to generate cash flow. The result? Similar income potential with defined risk and lower upfront cost.

In this guide, you’ll learn exactly how this strategy works, when to use it, and how to set it up step by step.

We’ll cover the mechanics, walk through real examples, and show you how to manage risk properly.

What is a Poor Man’s Covered Call?

A Poor Man’s Covered Call is an options strategy that lets you earn income without buying expensive stocks.

It works by combining two calls: a long-term deep in the money call (often called LEAPS) and a short-term out of the money call. Think of it as a diagonal spread.

The LEAPS act like owning the stock, but they cost much less. You then sell the short call against it to collect the premium. This setup mimics a traditional covered call but uses only a fraction of the capital.

That’s why traders call it the “poor man’s” version. You get similar benefits without the heavy upfront cost.

Purpose and Core Idea

- Generate Premium Income: The main goal is to collect steady cash from selling short calls while keeping your risk clearly limited and controlled.

- Maintain Bullish Exposure: You stay bullish on the stock without spending thousands of dollars to buy 100 shares outright.

- Suits Capital-Limited Traders: This strategy fits traders who want consistent income from options but lack the capital for traditional covered calls.

- Best for Flat to Moderate Growth: It works perfectly when you expect the stock to stay sideways or rise slowly over time.

- Collect Premiums with Protection: You earn a regular income while your long LEAPS call shields you from major downside losses beyond its cost.

How the Poor Man’s Covered Call Strategy Works

Now that you understand what a Poor Man’s Covered Call is and why traders use it, let’s break down exactly how this strategy operates. The setup involves two key parts working together to create income while limiting risk.

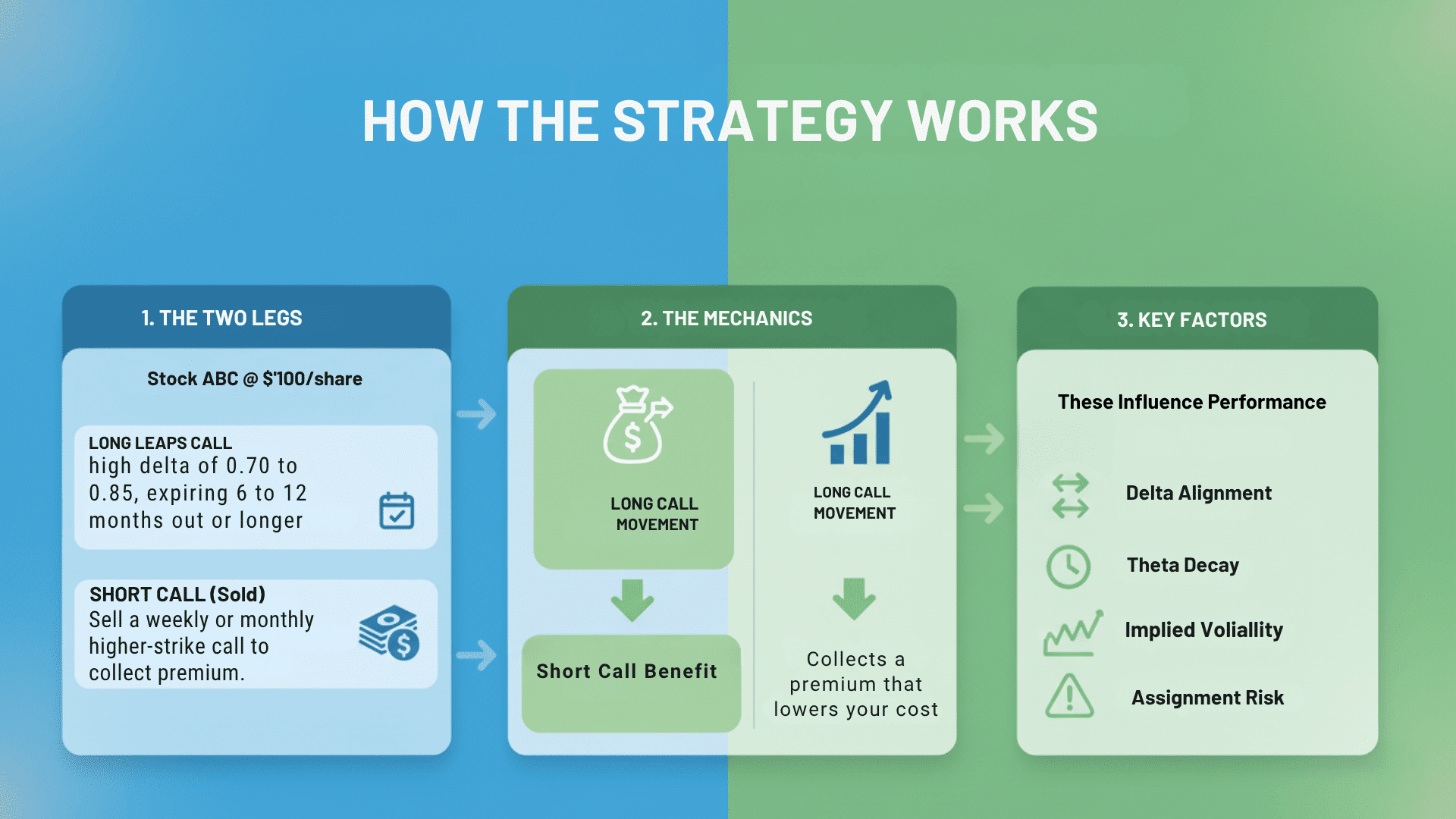

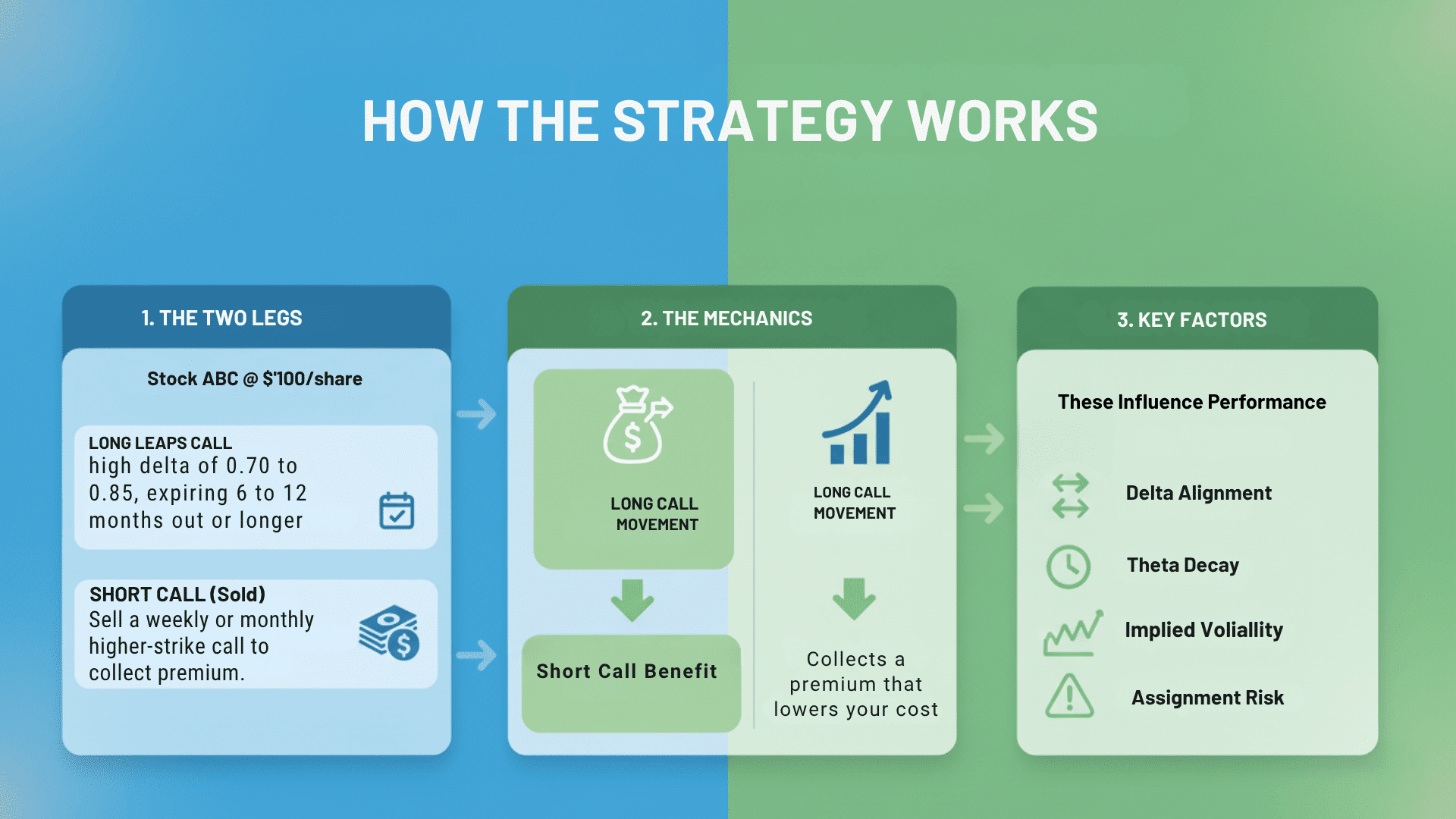

1. The Two Legs of the Strategy

- Long LEAPS Call: This replaces stock ownership and moves almost like the actual stock with a high delta of 0.70 to 0.85, expiring 6 to 12 months out or longer.

- Short Call: You sell this weekly or monthly at a higher strike to collect instant premium that offsets your LEAPS cost.

2. The Mechanics Explained

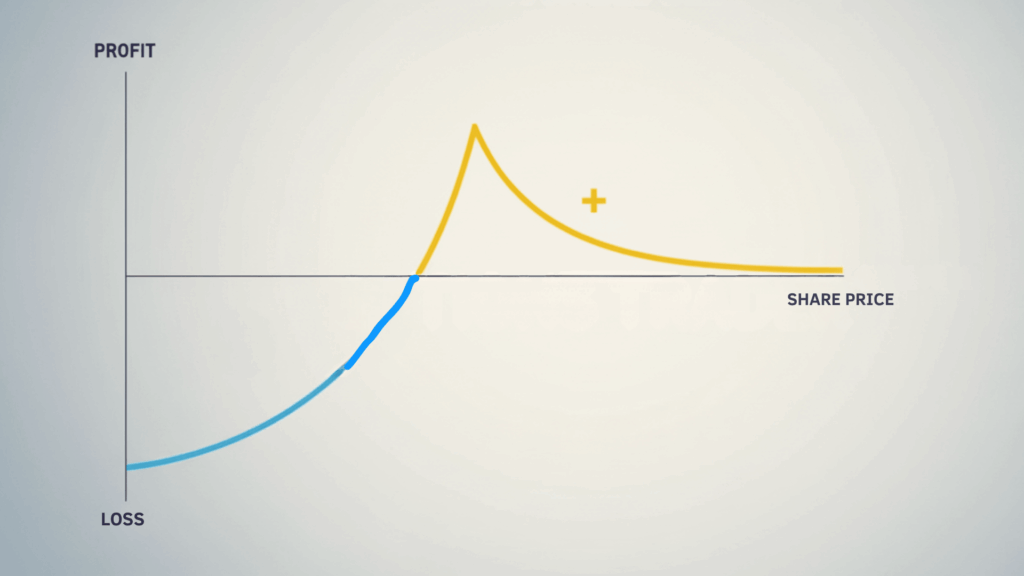

- Long Call Movement: Your LEAPS tracks the stock closely, giving you upside exposure while capping your loss at the premium paid.

- Short Call Benefit: Each sale collects a premium that lowers your cost basis and creates regular cash flow.

3. Key Factors That Influence Performance

- Delta Alignment: High LEAPS delta (around 0.80) mimics stock movement, while lower short call delta (around 0.30) balances income with protection.

- Theta Decay: Time decay helps your short call but hurts your LEAPS, as both lose value over time.

- Implied Volatility: Rising volatility boosts your LEAPS value but makes short calls costlier to buy back.

- Assignment Risk: If the stock rises past your short call strike at expiration, you’ll need to close or roll your position.

How to Use a Poor Man’s Covered Call

Ready to put this strategy into action? Here’s a step-by-step process to set up your Poor Man’s Covered Call from start to finish.

Step 1: Select a Liquid Stock or ETF with Steady Price Movement

Start by choosing a stock or ETF that trades with high volume and tight bid-ask spreads. Look for something that moves steadily without wild swings. Liquid options make it easier to enter and exit trades at fair prices.

Step 2: Buy a Deep ITM LEAPS Call (6 to 12 Months Out, Delta Around 0.8)

Purchase a long-term call option that’s deep in the money with at least 6 months until expiration. Aim for a delta of 0.70 to 0.85 so it moves closely with the stock. This LEAPS will act as your synthetic stock position.

Step 3: Sell a Short Term OTM Call (30 to 45 Days) to Generate Income

Once you own the LEAPS, sell a call option that expires in 30 to 45 days at a strike price above the current stock price. This generates immediate premium income. The goal is to collect this premium while giving the stock some room to rise.

Step 4: Monitor Price Movement and Option Decay

Keep an eye on how the stock price moves and how your options lose value over time. Watch your short call, especially as it approaches expiration. If the stock rallies too much, you may need to adjust your position.

Step 5: Roll or Close the Short Call Before Expiration to Avoid Assignment

Before your short call expires, decide whether to let it expire worthless, buy it back, or roll it to the next month. Rolling means buying back the current call and selling a new one further out in time. This keeps your income flowing and prevents you from being assigned to the short call.

Example: Poor Man’s Covered Call in Action

Theory is helpful, but nothing beats seeing how this strategy plays out in real numbers. Let’s walk through a practical example so you can see exactly how the Poor Man’s Covered Call works.

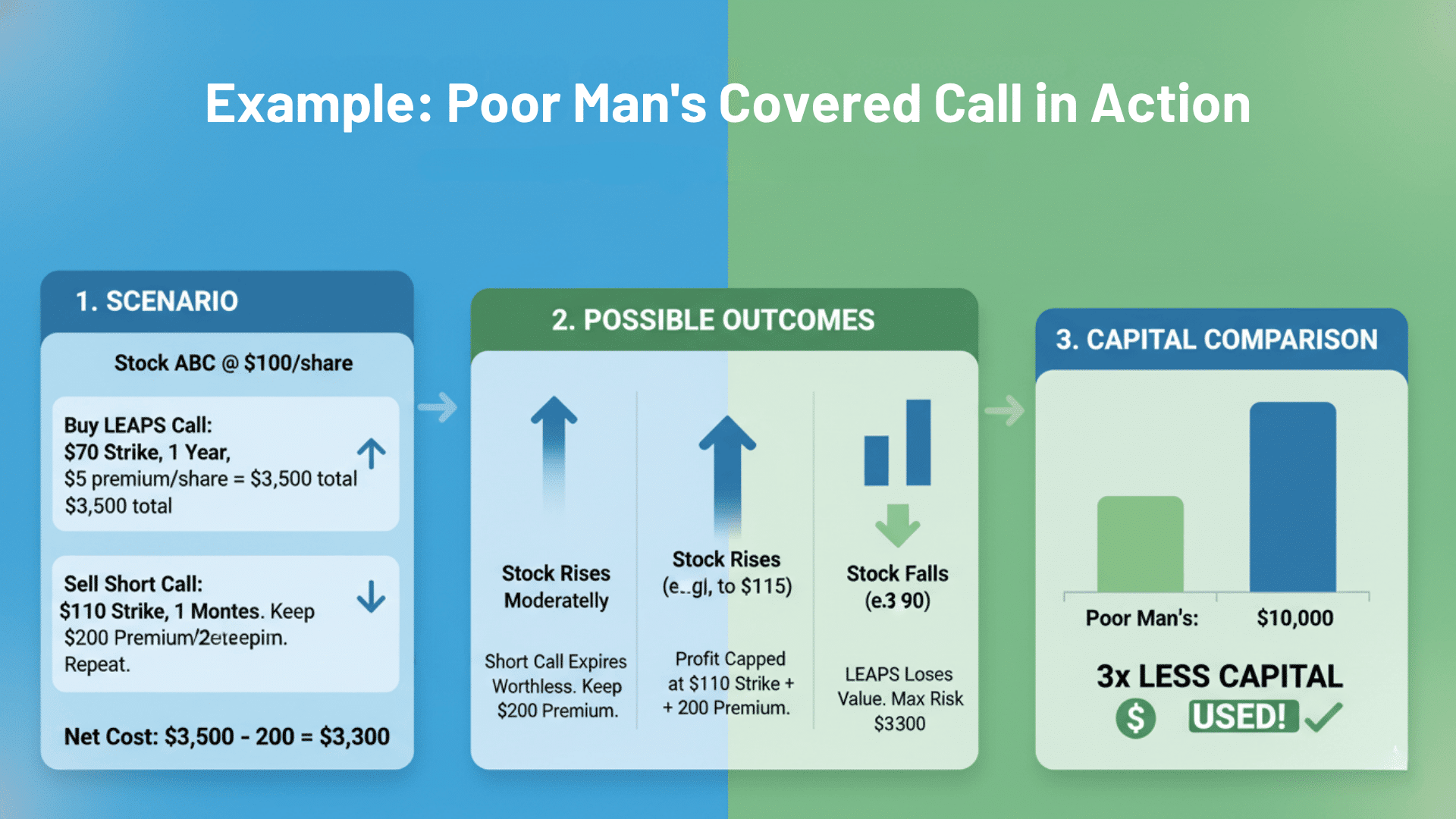

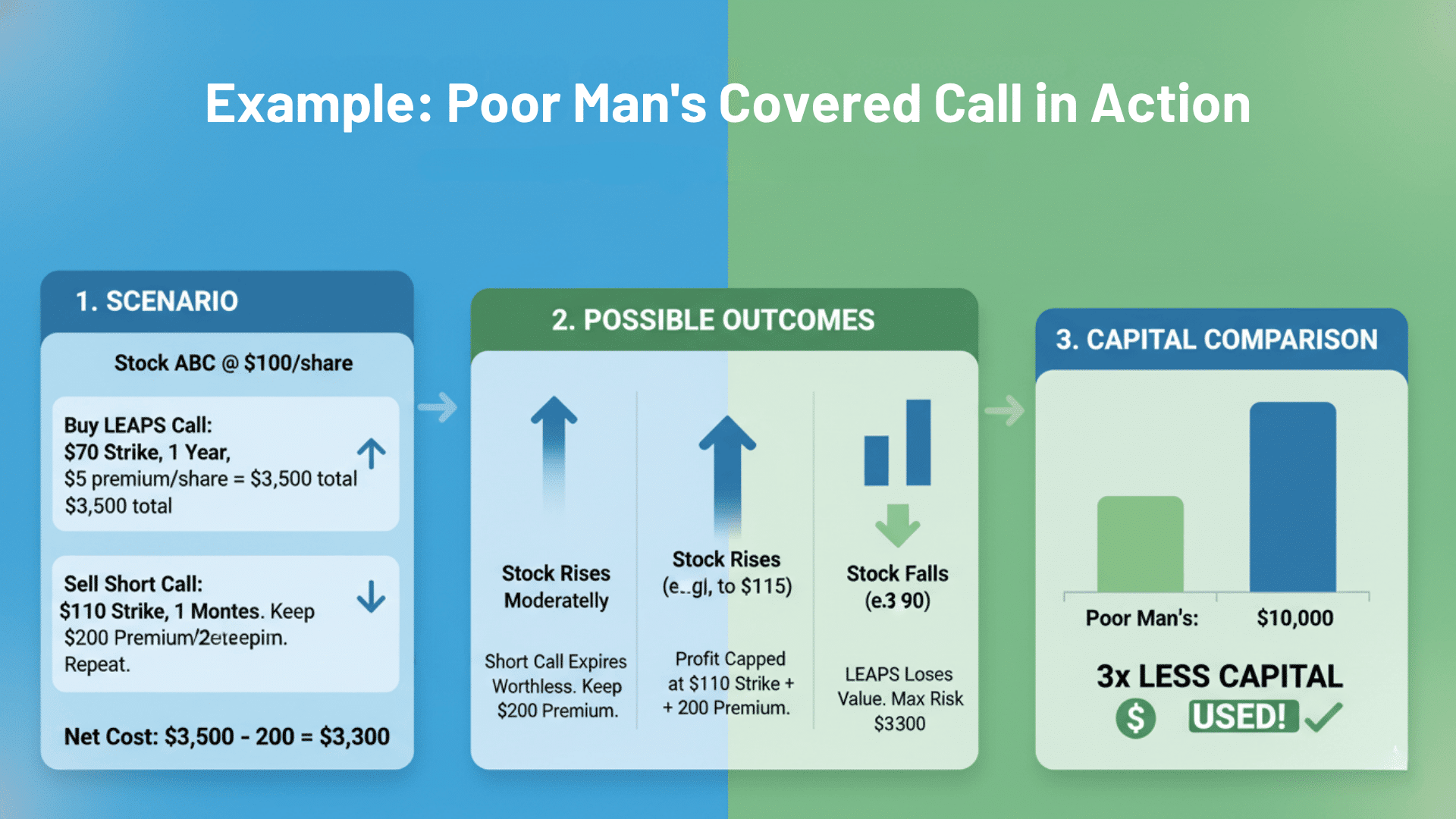

1. Scenario

Let’s say Stock ABC is trading at $100 per share. Instead of buying 100 shares for $10,000, you take a different approach.

You buy a LEAPS call with a $70 strike price expiring in 1 year for $35 per share, which costs you $3,500 total.

Then you immediately sell a 1-month call with a $110 strike for $2 per share, collecting $200 in premium right away.

2. Possible Outcomes

- Stock Rises Moderately: If ABC climbs to $105 by expiration, your short call expires worthless and you keep the $200 premium. Your LEAPS also gains value as the stock rises. You can sell another call next month and repeat the process.

- Stock Rises Sharply: If ABC jumps to $115, your profit gets capped at the $110 strike of your short call. You still make money on the LEAPS appreciation up to $110, plus the premium collected. But any gains above $110 are lost because of the short call.

- Stock Falls: If ABC drops to $90, your LEAPS loses value, but your loss is limited. You paid $3,500 for the LEAPS but collected $200 from the short call. Your maximum risk is $3,300, not the full $10,000 you’d lose owning shares.

3. Capital Comparison

This strategy uses only about one-third of the capital compared to a traditional covered call. Owning 100 shares at $100 costs $10,000.

Your Poor Man’s Covered Call costs just $3,500 for the LEAPS. You achieve similar income potential with far less money tied up in the trade.

Pros and Cons of a Poor Man’s Covered Call

Like any trading strategy, the Poor Man’s Covered Call comes with its own set of benefits and drawbacks. Here’s what you need to weigh before jumping in.

| Advantages | Disadvantages |

|---|---|

| Low Capital & Defined Risk: Costs far less than buying shares, and your loss is capped at the LEAPS premium paid. | Time Decay Hurts LEAPS: Your long call loses value over time, eating into profits even when the stock holds steady. |

| Regular Premium Income: Selling short calls monthly or weekly generates consistent cash flow. | No Dividends: You don’t own the stock, so you miss dividend payments. |

| Better Diversification: Lower cost per trade lets you spread capital across multiple positions. | Assignment Risk: Short calls can get assigned if the stock rallies past your strike price. |

| Leverage Without Margin: You get stock exposure without borrowing money or paying margin interest. |

Needs Active Monitoring: Requires regular attention to manage risk and roll positions properly. |

How to Select Underlyings & Set Up the Trade

Success with this strategy starts before you even place a trade. Choosing the right stock and setting up your positions correctly makes all the difference in your results.

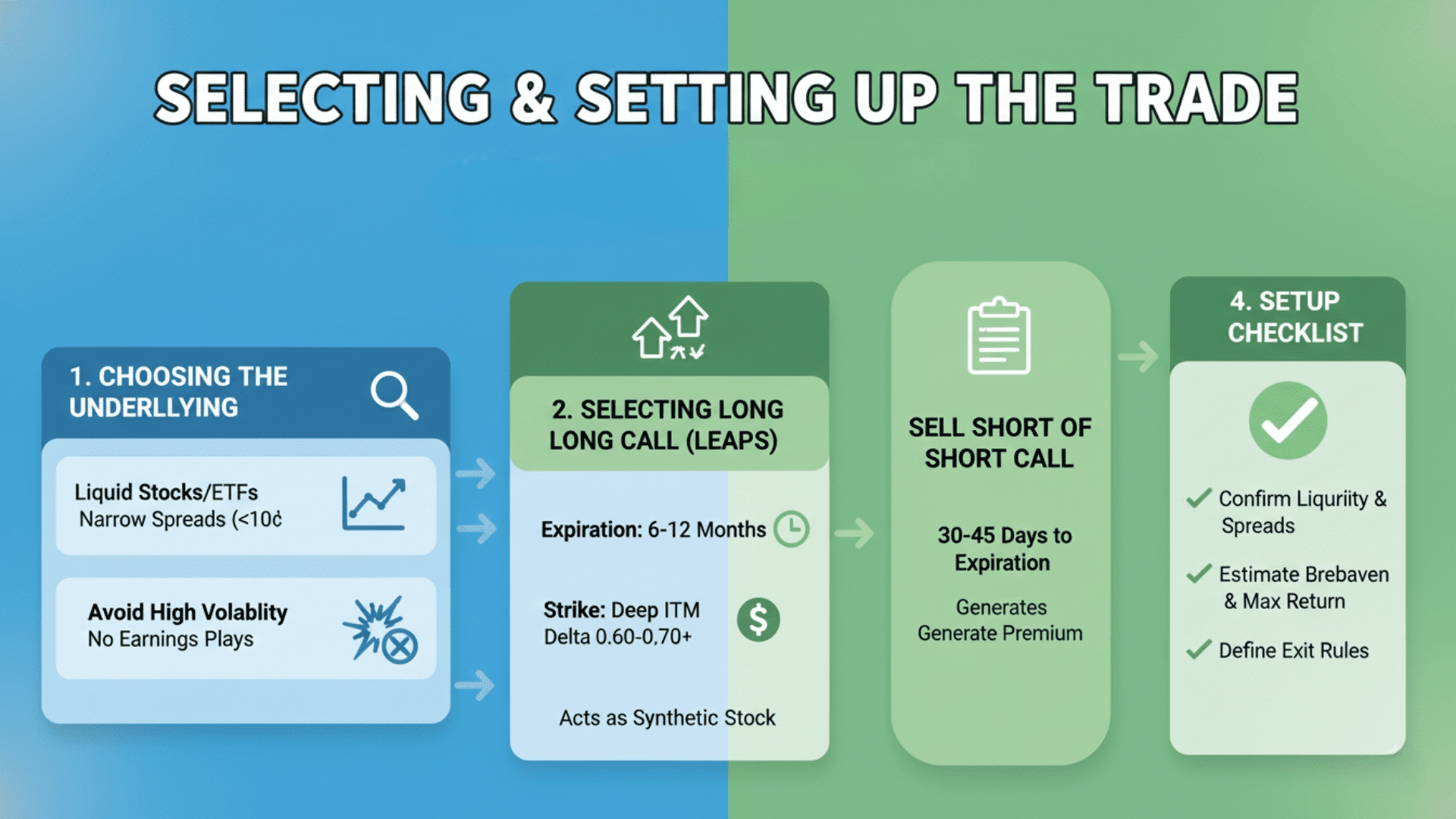

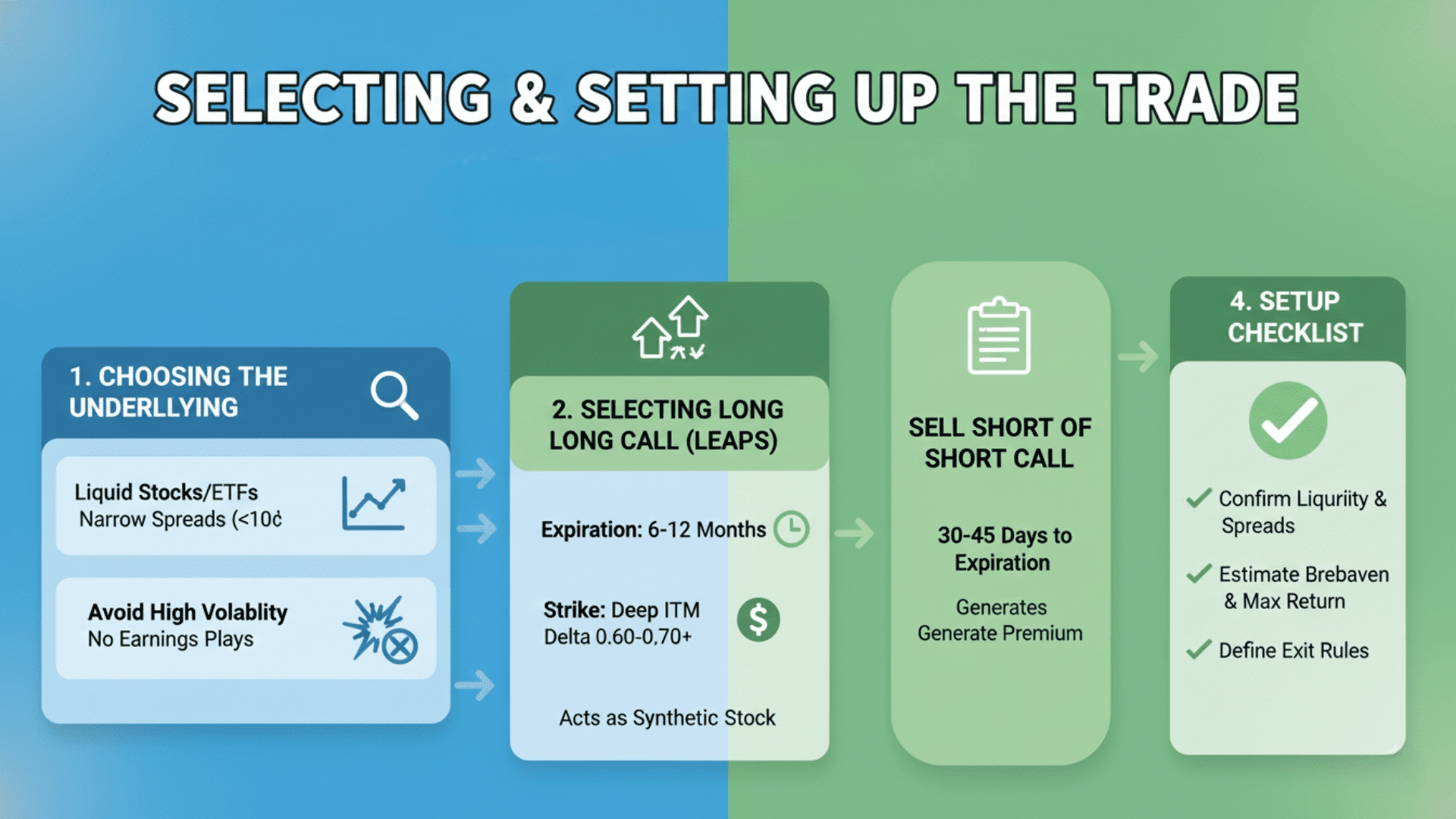

1. Choosing the Underlying

- Prefer Liquid Stocks or ETFs: Stick with highly traded stocks or ETFs that have narrow bid-ask spreads, usually under 5 to 10 cents. High liquidity means you can enter and exit positions easily without losing money to wide spreads.

- Avoid High Volatility or Earnings Plays: Stay away from stocks with wild price swings or those reporting earnings soon. These can move unpredictably and blow up your position overnight.

2. Selecting the Long Call (LEAPS)

- Expiration 6 to 12 Months or Longer: Choose a LEAPS with at least half a year until expiration, though longer is often better. This gives you plenty of time to sell multiple short calls against it.

- Strike Deep in the Money (60 to 70 Delta Minimum): Look for a strike price well below the current stock price with a delta of at least 0.60 to 0.70. The higher the delta, the more your LEAPS behaves like owning the actual stock.

- Acts as the Synthetic Stock: This LEAPS replaces the need to buy 100 shares. It tracks the stock movement closely while limiting your downside risk.

3. Choosing the Short Call

- 30 to 45 Days to Expiration: Sell calls that expire in about a month to capture decent premium from time decay. This timeframe balances income collection with flexibility.

- Slightly Out of the Money: Pick a strike price above the current stock price to generate premium while leaving room for the stock to rise. This preserves some upside potential if the stock rallies.

4. Setup Checklist

- Confirm Liquidity and Spreads: Ensure that both the LEAPS and short calls exhibit strong open interest and volume, with tight bid-ask spreads. Poor liquidity can cost you money on every trade.

- Estimate Breakeven and Maximum Return: Calculate your breakeven point by subtracting premiums collected from your LEAPS cost. Know your maximum profit if the stock hits your short call strike.

- Define Exit Rules: Decide in advance when you’ll roll the short call, close the entire position, or take profits. Having a plan prevents emotional decisions when the market moves against you.

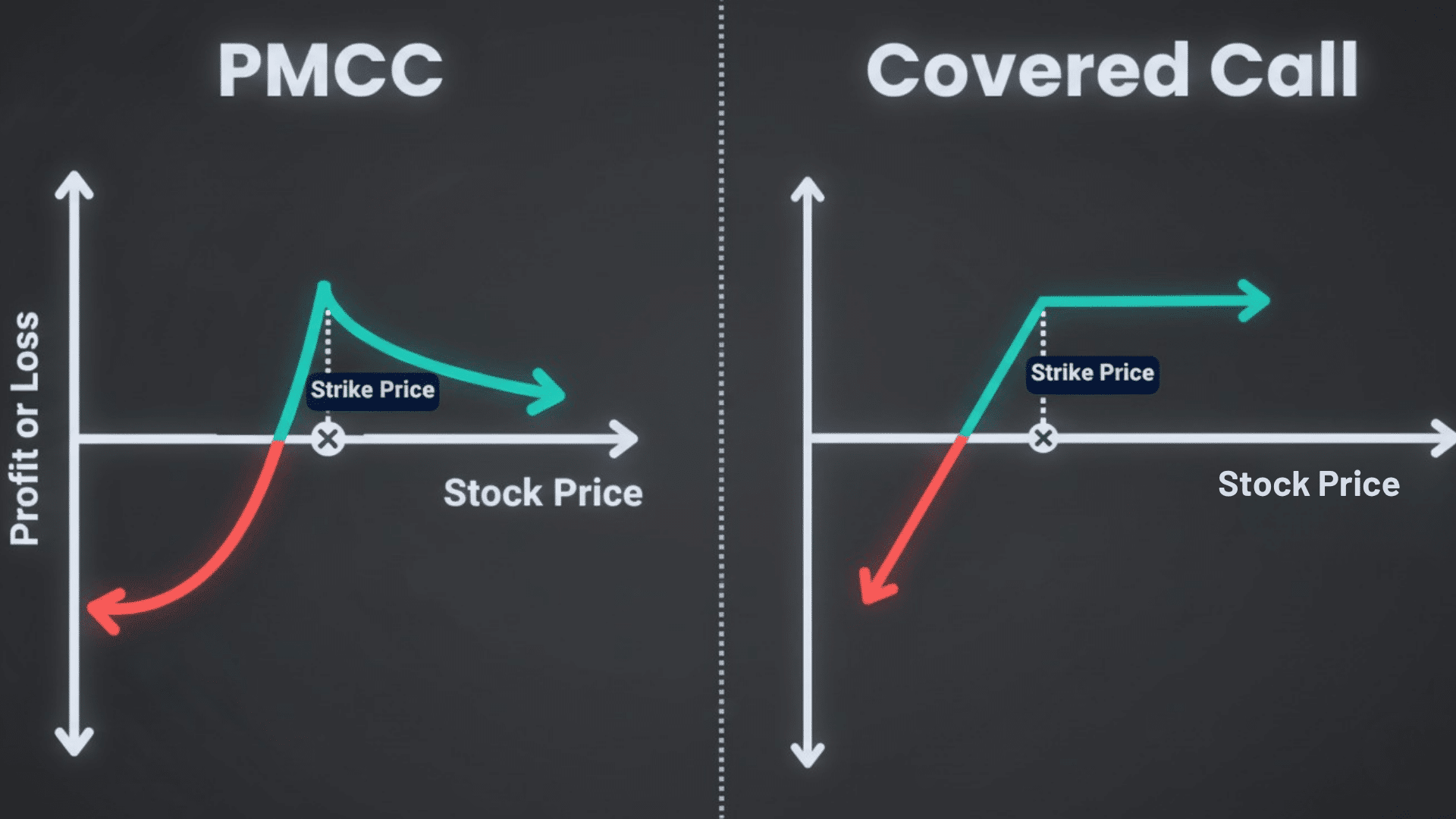

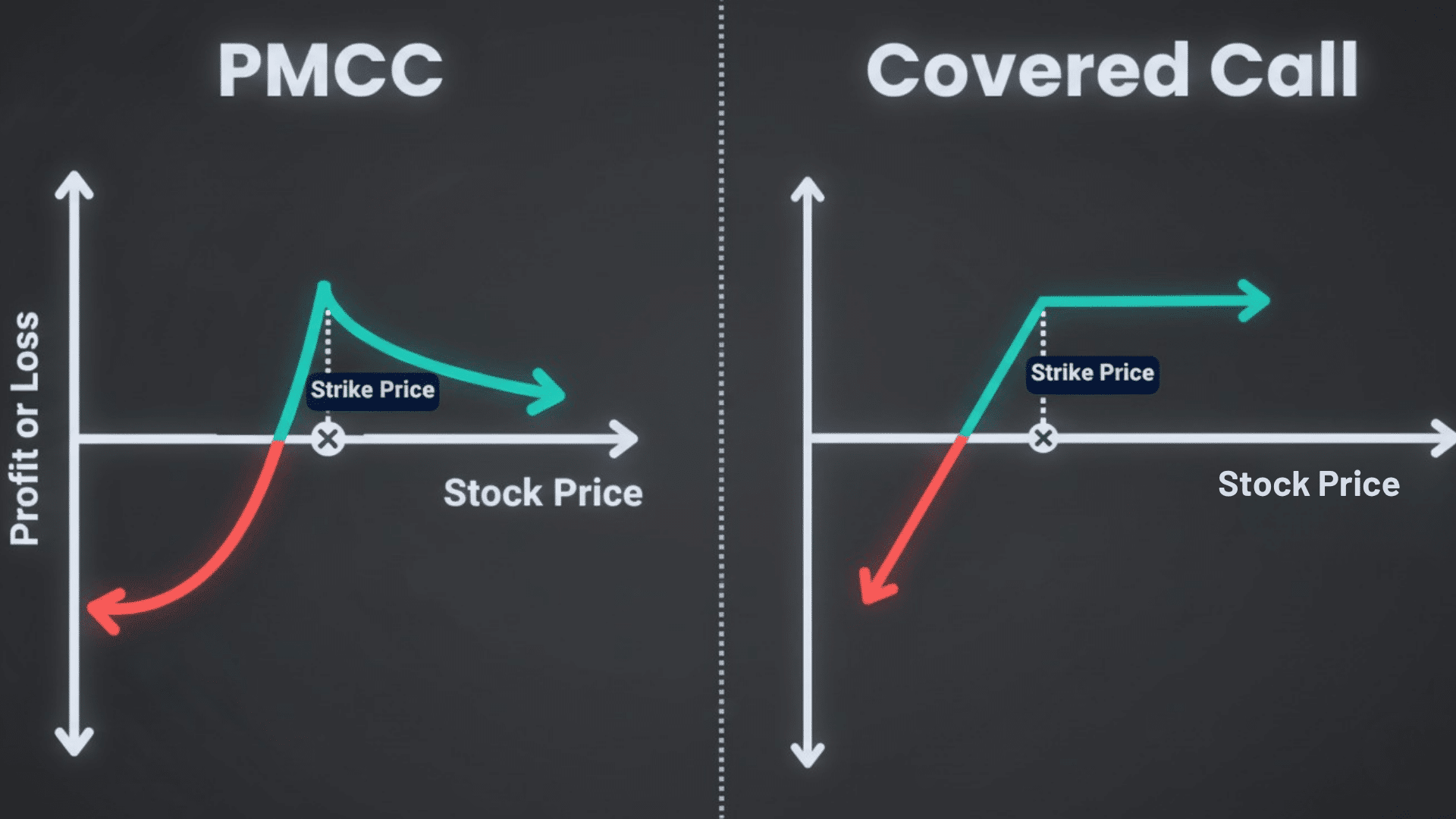

Covered Call vs Poor Man’s Covered Call

You might be wondering how this strategy stacks up against the traditional covered call. Let’s compare them side by side so you can see which one fits your trading style and capital situation.

| Feature | Covered Call | Poor Man’s Covered Call |

|---|---|---|

| Capital Needed | High (must buy 100 shares) | Low (only LEAPS premium) |

| Risk Exposure | Full stock downside | Limited to LEAPS cost |

| Dividends | Yes (you own the stock) | No (only own options) |

| Complexity | Low (simple to execute) | Moderate (requires options knowledge) |

| Leverage | None | Built in through options |

| Ideal User | Long-term investors | Active options traders |

Managing Risks in a Poor Man’s Covered Call

Every options strategy carries risk, and this one is no exception. Here’s what you need to watch out for and how to protect your capital effectively.

- Theta Decay Impact: Time decay hurts your LEAPS position as it loses value daily, especially in the final 60 days before expiration, which can offset the premium income you collect from short calls.

- Implied Volatility Impact: Rising volatility increases your LEAPS value but also makes your short calls more expensive to buy back, while falling volatility does the opposite and can reduce your overall position value.

- Assignment Handling: If your short call gets assigned, you’ll need to either sell your LEAPS to cover the obligation or close the position before expiration to avoid complications with your broker.

- Rolling Short Calls Before Expiration: Buy back your short call a few days before expiration and immediately sell a new one further out in time at a similar or higher strike to keep collecting premium and avoid assignment risk.

- Position Sizing to Limit Exposure: Never put more than 5 to 10 percent of your trading capital into a single Poor Man’s Covered Call position, and avoid running too many positions at once to prevent overexposure if the market turns against you.

When Should You Use a Poor Man’s Covered Call?

This strategy works best in moderately bullish or sideways markets where you expect the stock to stay flat or rise slowly over time.

It’s ideal for traders who want a steady income from premium collection while keeping their risk clearly defined and limited.

You should have patience and be comfortable with managing active positions. Avoid using this strategy during earnings announcements or major news events that could cause sharp price swings.

Volatile periods can quickly move the stock past your short call strike or crush your LEAPS value. Stick to stable market conditions where you can predict price movement reasonably well and collect premiums consistently without surprises.

Final Thoughts

The Poor Man’s Covered Call offers a smart way to generate income without tying up large amounts of capital in stock ownership.

You get similar benefits to traditional covered calls, but with defined risk and better capital efficiency. By combining a long-term LEAPS call with short-term premium collection, you create a steady cash flow while maintaining bullish exposure.

Just remember that this strategy requires active management, regular monitoring, and discipline to roll positions before expiration.

It works best in stable or moderately rising markets, not during volatile periods. Start small, practice your setup process, and always stick to proper position sizing.

Ready to try it out? Consider paper trading first to build confidence before risking real money. Drop your questions or experiences in the comments below.