You’ve probably heard about NFTs. Maybe you even wondered if they still matter.

The hype was huge back in 2021 and 2022. Digital art sold for millions. Everyone talked about NFTs. Then things quieted down.

So are NFTs still a thing? Or did they fade into history?

Here’s the truth: NFTs are still around, but they’ve changed. The wild speculation is mostly gone. What remains is different and more focused.

This article will show you what NFTs are today, why the hype cooled, where they’re still growing, and what the future might hold. Whether you’re a creator, collector, or just curious, you’ll get a clear picture of NFTs.

Let’s get started.

What Are NFTs?

NFT stands for non-fungible token. It’s a unique digital asset on a blockchain. This asset represents ownership of something distinct. That “something” could be artwork, a video, an in-game item, or more.

Non-fungible means it cannot be exchanged one-for-one with another identical item. Think of it like this: you can’t swap one painting for another and call them equal. But you can swap one dollar bill for another dollar bill. Bitcoin works like a dollar. NFTs don’t.

Here are the core features that make NFTs what they are:

- Uniqueness and scarcity: Each NFT is one of a kind or part of a limited set.

- Proof of ownership: The blockchain records who owns it. No one can fake that.

- Transferability: You can sell it, trade it, or gift it to someone else.

- Digital or phygital form: Most NFTs are purely digital. But some link to physical items too.

These features set NFTs apart from regular digital files. Anyone can screenshot an image. But only one person can own the actual NFT.

Why Did People Care About NFTs?

So why did NFTs gain so much attention? For artists and digital creators, NFTs opened a new door. They could sell their work directly.

No middleman needed. Plus, they could earn royalties each time their NFT was resold. That was a big deal. For collectors, the appeal was different. Owning an NFT gave them status. It showed they were early adopters. Some also saw it as an investment. They hoped to resell for profit later.

Brands and tech companies saw an opportunity, too. NFTs let them engage audiences in fresh ways. They could build communities around exclusive drops. They could reward loyal customers with special access or perks.

But perhaps the biggest reason? The idea of digital ownership itself. For the first time, people could truly own an original digital asset. Not just a copy. The original. That concept captured imaginations everywhere.

Is an NFT Different From Cryptocurrency?

Before diving deeper into the NFT world, it’s important to clear up one big confusion: how NFTs actually differ from cryptocurrencies.

| Aspect | NFT | Cryptocurrency |

|---|---|---|

| Nature | Unique digital asset | Digital currency |

| Fungibility | Non-fungible (one-of-a-kind) | Fungible (interchangeable) |

| Use | Represents ownership of digital items | Used for transactions or payments |

| Divisibility | Indivisible | Divisible into smaller units |

| Value Basis | Rarity, utility, creator value | Market supply and demand |

The Rise and Peak of the NFT Boom

To understand “are NFTs still a thing?”, we need to look at where they’ve been.

The biggest NFT hype wave hit around 2021 to 2022. High-profile sales grabbed headlines everywhere. Premium digital artworks sold for millions of dollars. Celebrities joined in. News outlets couldn’t stop talking about it.

During this time, newcomers flooded the market. Artists saw a chance to finally make money from digital work. Speculators wanted quick profits. Collectors rushed in, hoping to grab the next big thing. Everyone was driven by the promise of fast gains.

Marketplaces grew at lightning speed. Platforms expanded their offerings. Nearly everything digital got an “NFT drop” attached to it. Tweets, memes, virtual land, music clips, you name it, someone turned it into an NFT.

But with all that growth came serious challenges:

- Oversupply: Too many NFTs hit the market at once. Most had little to no value.

- Quality questions: Many projects lacked substance or creativity. They were just cash grabs.

- Speculative risk: Prices were driven by hype, not real worth. When hype faded, values crashed.

- Regulatory questions: Governments started asking tough questions. Were NFTs securities? How should they be taxed? No one had clear answers.

The boom was real. But so were the problems that came with it.

Current State of the Market: Are NFTs Still a Thing?

Short answer: Yes, but in a different shape than the 2021 boom.

The NFT space hasn’t disappeared. It has changed. The wild speculation is mostly gone. What remains is a more focused, practical market.

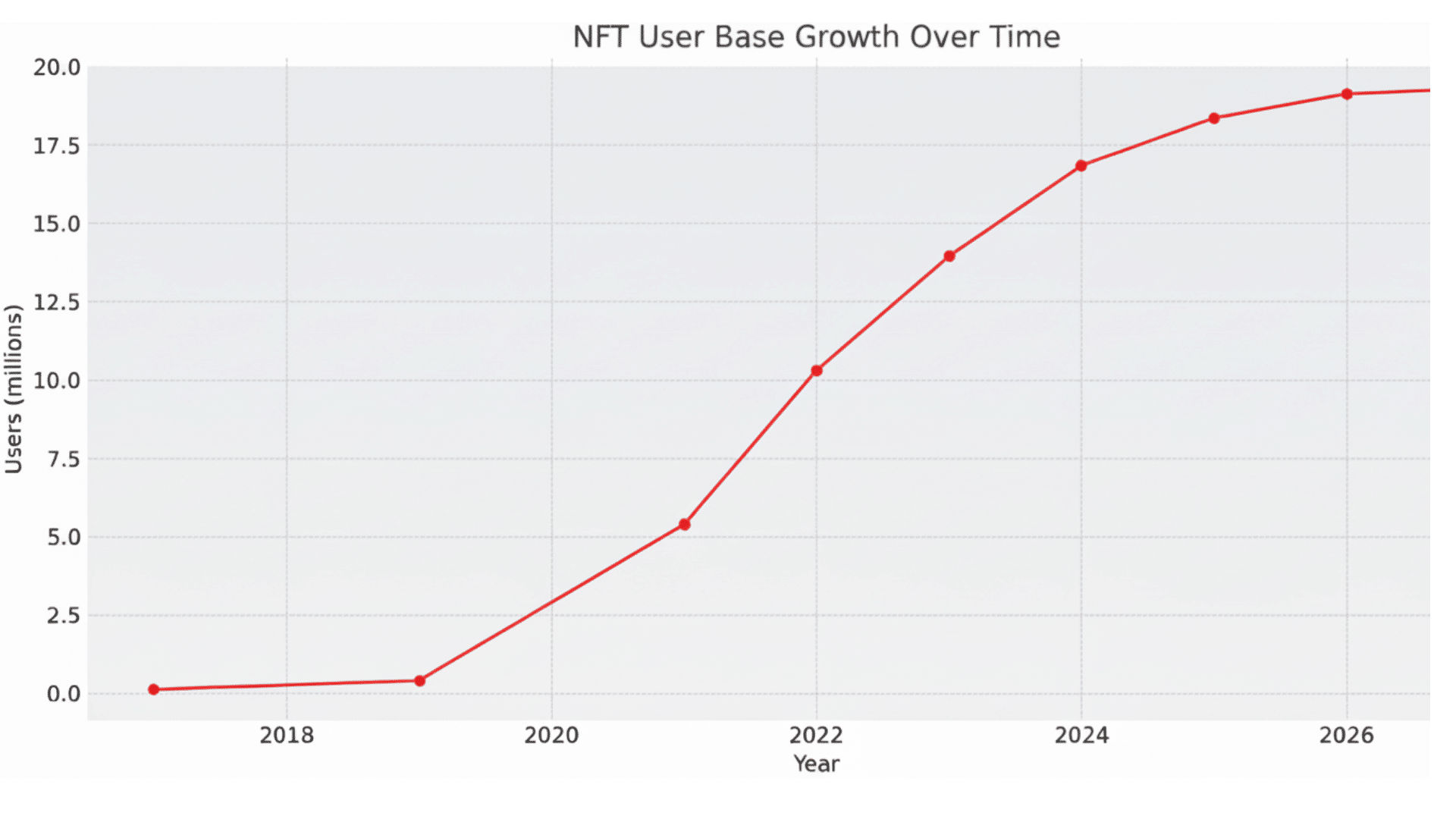

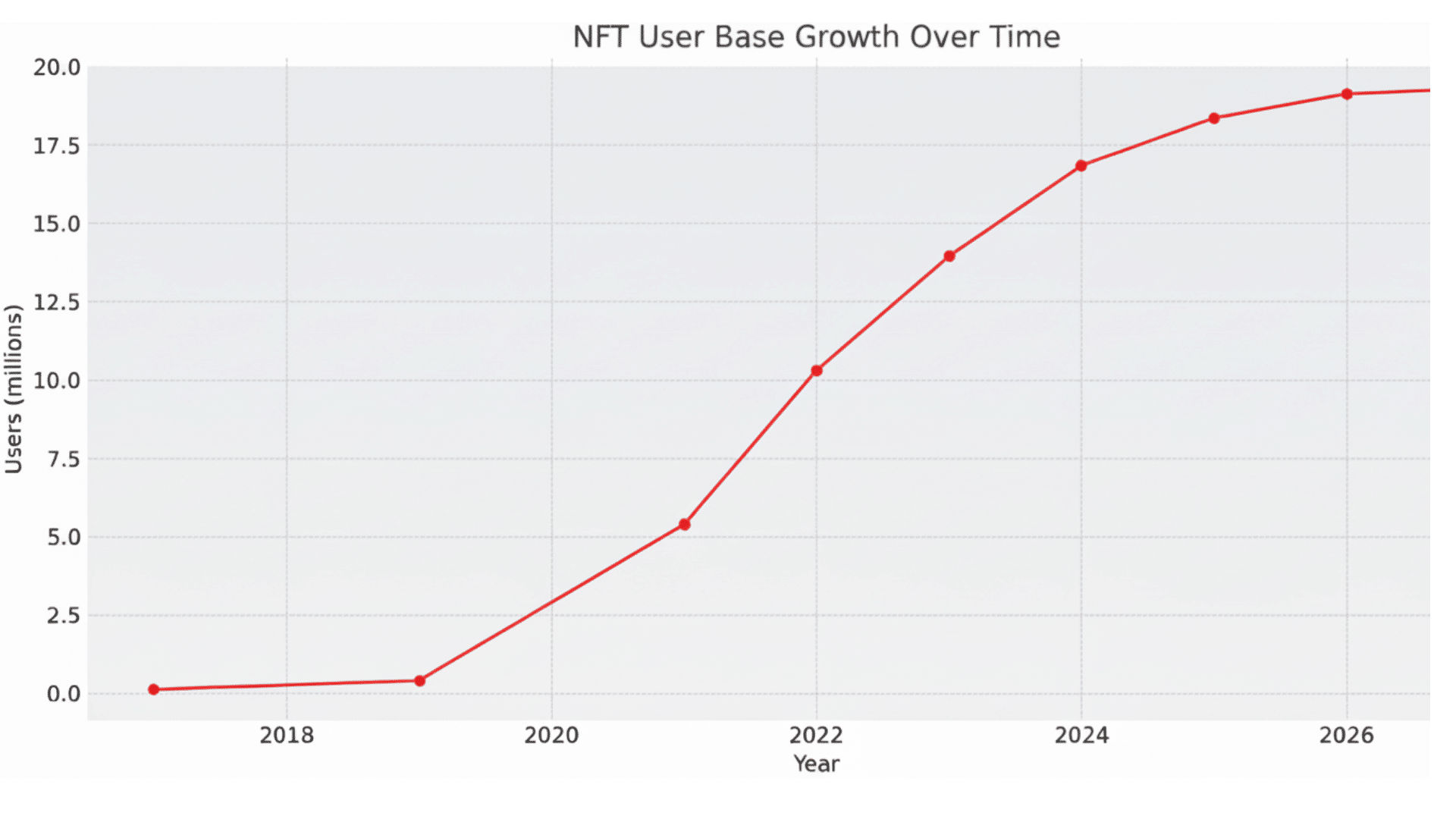

Market Snapshot (2025 Data)

Let’s look at the numbers to see where things stand today:

| Metric | Latest Insight |

|---|---|

| Global NFT market size | Estimated at around $36 billion in 2024 and projected at around $49 billion in 2025. |

| Sales and usage trends | Q1 2025: over $8.2 billion in sales, according to some reports. |

| Volume cooling | Some data shows the trend of “boom then drop.” Fewer speculative projects exist now. Lower visibility for many drops. |

| Shift in focus | Utility-driven use cases are gaining attention. Think gaming assets, brand drops, and real-world linkage. |

What does this mean?

The NFT market is still active. New projects are being launched. Drops still happen. Use cases are being explored. It’s not dead.

But the hype driven speculative explosion of the early years has largely faded. Many generic NFT drops have little traction now. People aren’t rushing to buy just anything anymore.

The market is maturing. There’s more focus on delivering real utility. Building communities matters. Creating actual value matters. The “mint and flip” mentality is dying out.

Overall: NFTs remain a “thing.” But the question is what kind of thing? They’re no longer just collectibles for speculation. They’re becoming tools, memberships, and assets with purpose.

Why the Public Perception Shifted

It’s useful to understand why many people now ask, “Are NFTs still a thing?” with doubt.

- Oversupply of low-quality projects: Many NFT collections were launched without clear value or follow-through, and most flopped or were never traded.

- Speculative returns cooled: After the big wins of the early days, many buyers saw little or no return, which created doubt about the whole space.

- Media and attention shifted: As other crypto and trend stories emerged, NFTs received less mainstream buzz and coverage.

- Regulatory, legal, and technical issues: Questions about intellectual property rights, metadata, storage, and regulatory status have grown without clear answers.

- Changing investor and collector mentality: Instead of “get rich quick” thinking, many now demand clearer roadmaps, real utility, and strong communities.

Because of those factors, while NFTs haven’t disappeared, they’re no longer in the “wild west” hype stage they once were. Many casual observers believe they are “over.” But that’s not the full story.

Where NFTs Are Still Valid & Growing?

If you’re a creator, collector, or investor wondering what kind of NFTs might still matter, here are the use cases with promise.

1. Gaming & Virtual Assets

In-game items, avatars, skins, and digital land in metaverse worlds are using NFTs to represent ownership. Players can own and trade items freely. Developers can reward users with NFTs. The value is more tied to game usage than speculation.

2. Brand & Licensed Collectibles

Big brands are using NFTs to engage fans in new ways. They offer membership perks, access to events, or physical plus digital “phygital” goods. These projects tend to be selected carefully, with brand backing and, therefore, greater trust from buyers.

3. Real World Asset Tokenization and Utility NFTs

NFTs are being used to represent real-world assets like art, real estate fractions, and licenses. They also provide utilities such as access rights and memberships. This shift puts more focus on utility over pure scarcity or speculation.

4. Community & Membership Driven Models

Owning an NFT may now be less about flipping for profit. Instead, it’s more about being part of a community, club, or culture. The value lies in experiences, network effects, and long-term engagement with others.

Common NFT Scams

Before diving into what’s next for NFTs, it’s crucial to understand the darker side of the space: the scams that have cost investors millions.

| Type of Scam | Description |

|---|---|

| Phishing Links | Fake websites or direct messages trick you into giving away your wallet access or private keys. |

| Rug Pulls | Project founders vanish after raising funds, leaving investors with worthless NFTs. |

| Fake Marketplaces | Scammers clone popular NFT sites to steal your assets when you connect your wallet. |

| Impersonator Drops | Fraudsters pose as famous artists or brands to sell fake NFTs and steal your money. |

Key Challenges & Risks Going Forward

It’s not all smooth sailing. Here is what you need to watch.

- Liquidity risk: Many NFTs have little secondary market activity, so owning something doesn’t guarantee it will be easily sold later.

- Valuation ambiguity: Unique assets are harder to price, and what’s “valuable” may depend more on sentiment, community, or brand rather than objective benchmarks.

- Technical and metadata risks: Some NFTs rely on centralized metadata storage or off-chain assets, which raises the risk of loss or devaluation.

- Regulatory and legal uncertainty: Ownership rights, IP rights, and what you actually own when you buy an NFT still have ambiguity and risk.

- Public sentiment and hype cycles: The market is sensitive to sentiment, hype, and storytelling, and when these fade, many projects lose steam.

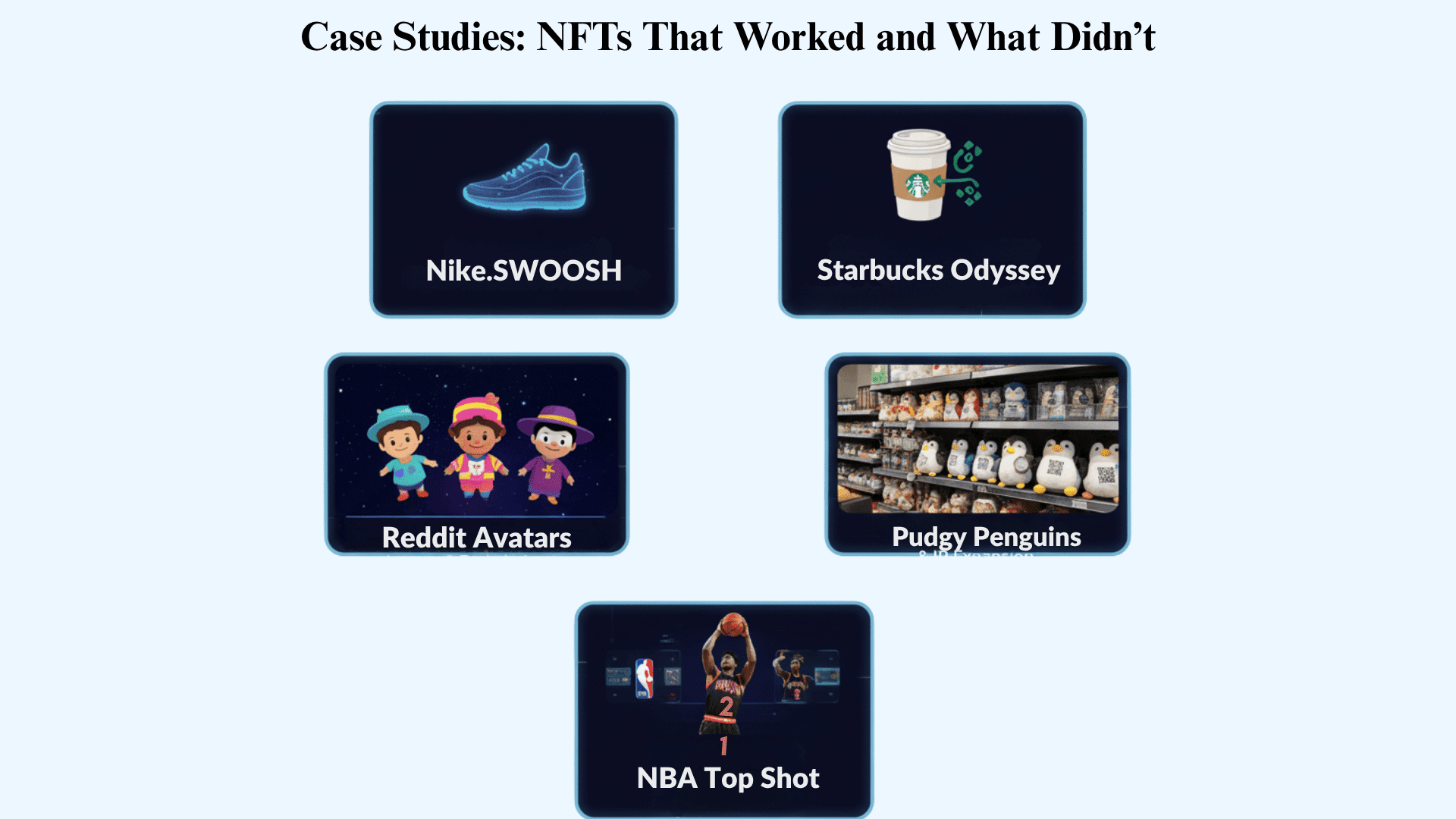

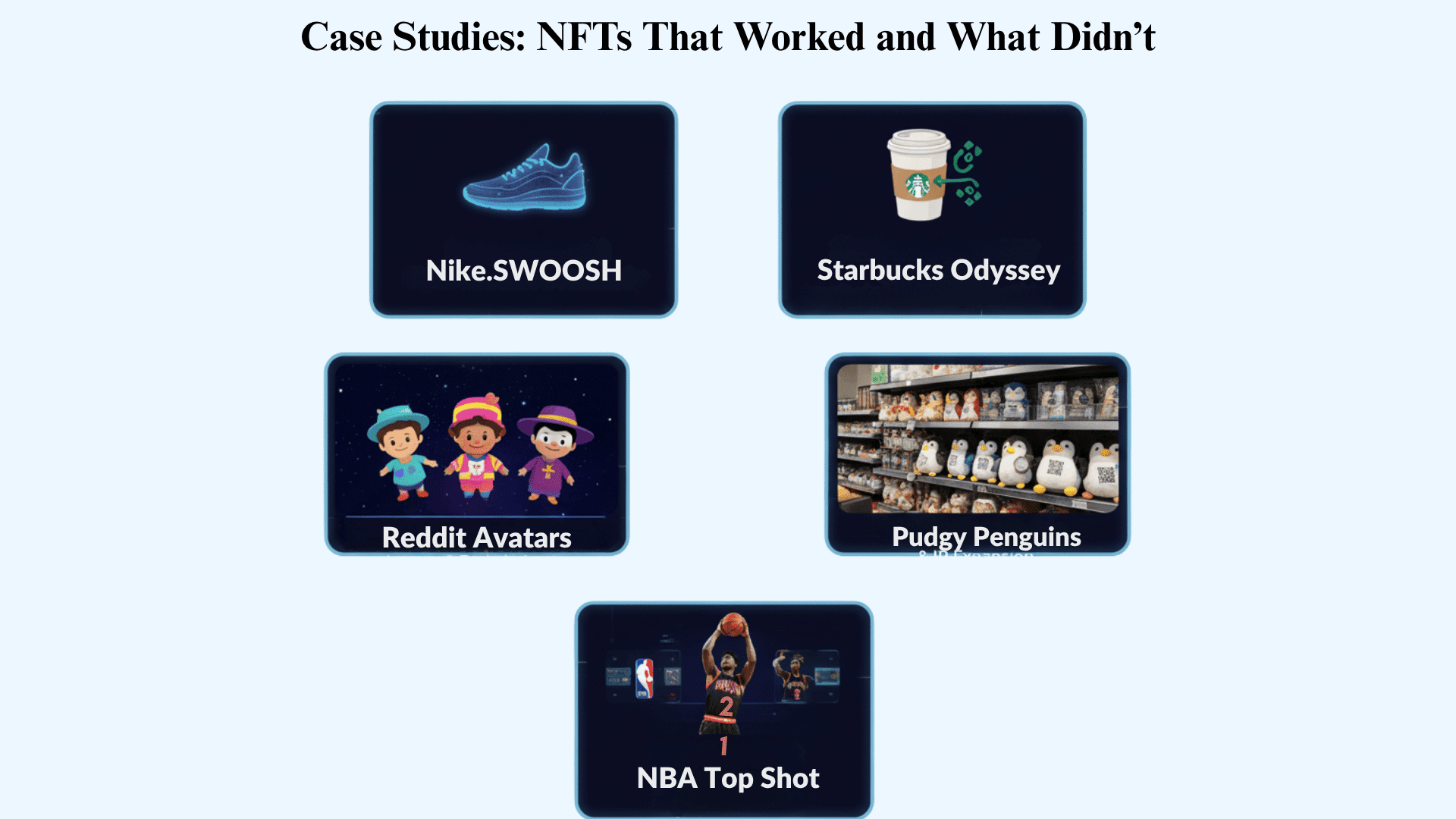

Case Studies: NFTs That Worked (and What Didn’t)

Here are real examples showing what succeeded and what struggled in the NFT space.

1. Nike.SWOOSH: Community Co-Creation Success

Nike launched.SWOOSH is a platform for digital sneakers and community-driven design. Members can collect, co-create, and even earn rewards through engagement. It focuses on long-term community building rather than quick sales.

2. Starbucks Odyssey: Cautionary UX Lesson

Starbucks tried to blend loyalty rewards with NFTs through its Odyssey program. But the user experience was confusing for everyday customers. The program eventually shut down, showing that complexity can kill adoption even with a strong brand.

3. Reddit Avatars: Mainstream Onboarding Example

Reddit introduced collectible avatars as NFTs without heavily marketing the blockchain aspect. Millions of users claimed them easily, many without even knowing they were NFTs. It proved that simplicity and familiarity can drive mass adoption.

4. Pudgy Penguins: IP Expansion Into Retail

Pudgy Penguins turned their NFT brand into physical toys sold in major retailers like Walmart and Target. They built a recognizable IP beyond just digital collectibles. This shows how NFTs can be a starting point for broader brand growth.

5. NBA Top Shot: From Hype to Sustainable Fan Platform

NBA Top Shot exploded during the NFT boom with viral highlight moment sales. After the hype cooled, the focus shifted to building a sustainable platform for basketball fans. It now serves a dedicated community rather than chasing speculators.

Future Outlook: Are NFTs Evolving or Becoming Obsolete?

Let’s look at possibilities for the next few years.

Possible Future Scenarios

- Utility-driven growth: NFTs become integral parts of digital ecosystems like gaming, the metaverse, identity systems, and loyalty programs.

- Selective consolidation: Many weak projects fade away, while stronger ones with real value endure and lead the space forward.

- New “killer apps”: A major adoption wave could occur if a widely used application of NFTs emerges, such as digital identity or real-world asset tokenization.

- Decline of generic collectibles: NFTs without utility, community, or brand might fade further into niche markets or vanish completely.

What to Watch

- Cross-chain and interoperability: The ability to use NFTs across many blockchains, not just one, will matter more.

- Real-world linkage: Phygital goods, event access, and brand tokens connecting digital and physical experiences will grow.

- Regulation and legal clarity: Clear rules and laws will make the space safer and help it go mainstream.

- Infrastructure improvements: Better minting experiences, cheaper transactions, and easier mobile access will bring in more users.

Summing It Up

So, are NFTs still a thing? Yes, but not in the same way they were at the peak.

The market is still active with billions in value and real use cases. But the hype driven speculative bubble has deflated. What’s left is a more mature, utility-based phase.

For creators, collectors, and investors, the message is clear: move beyond hype and focus on value. Assess quality. Look for utility. Join communities that matter.

NFTs are unique digital tokens representing ownership on a blockchain. Their relevance today lies in how well they’re used, not just how rare they appear.

The era of quick flips may be over. But the era of meaningful digital ownership and community-driven value is just beginning.

What’s your take on NFTs? Share your thoughts in the comments below.