Buying a home might seem out of reach when you think about saving up. I get it; the numbers can look big at first. But once you learn how to save for a down payment step by step, it feels much easier.

You don’t need 20% down or years of sacrifice. What you do need is a clear plan, small habits, and a few smart money moves that actually work.

In this guide, I’ll walk you through practical strategies, creative ideas, and real examples to help you reach your goal faster and with less stress.

Why Saving for a Down Payment Feels So Hard?

Saving for a down payment can feel overwhelming, especially when prices and rent are rising faster than your paycheck.

But the good news is, you don’t need to save all at once or make massive sacrifices. The trick is breaking your goal into smaller, manageable steps and choosing methods that fit your lifestyle.

Once you understand what you’re saving for and how much you need, the process becomes simpler and more motivating. You’ll see that every small change can bring you closer to your new home.

How to Save for a Down Payment: Start with a Clear Goal

Before you start saving, you need to understand how much to save for your down payment. Knowing your exact number gives you a clear target and helps you plan smarter.

Here’s what most loan programs require:

- Conventional loans: As low as 3% to 5% down

- FHA loans: 3.5% down

- VA or USDA loans: 0% down for qualified buyers

You’ll also want to factor in closing costs, which typically range from 2% to 6% of the home’s price.

For example, if you plan to buy a $350,000 home and put down 5%, that’s $17,500. Add another $10,000 for closing costs, and your total target becomes roughly $27,500.

Having a clear number gives you focus and makes your goal feel more achievable.

Practical Ways to Save for a Down Payment

These are simple, real-world steps that help you build savings without drastically changing your lifestyle. Each one helps you make consistent progress while keeping your plan realistic.

1. Set a Clear Savings Goal

Start by deciding your target home price and down payment percentage. Add closing costs and a small cushion for moving expenses. Once you know the total, divide it into monthly targets.

For example, saving $24,000 in two years means putting aside about $1,000 a month. Seeing smaller goals keeps you motivated and makes saving feel possible instead of overwhelming.

2. Open a Dedicated High-Yield Savings Account

Keep your down payment fund in a separate high-yield savings account (HYSA). It helps you avoid spending that money while earning higher interest, often 4% or more in 2025.

Pick an account with no fees and automatic transfer options. Label it “Down Payment Fund” so you remember what it’s for and resist dipping into it.

3. Automate Your Savings

Automation takes the pressure off saving. Set a direct deposit or scheduled transfer to your HYSA on payday, so you save before spending.

Even $100 a week adds up to over $5,000 a year. You can also use round-up apps that move small change from purchases into savings automatically. Small, steady habits make the biggest difference.

4. Cut Back on Major Expenses

You don’t need to give up everything you enjoy, just target big areas.

- Housing: Get a roommate or rent a smaller place short-term.

- Transportation: Use public transit, carpool, or walk more often.

- Food: Cook at home and limit takeout. Cutting $400 a month adds nearly $5,000 a year, a big step toward your goal.

5. Reassess Debt and Payments

High-interest debt can slow your progress. Pay off credit cards first or look into refinancing to lower your monthly bills.

If you have student loans, explore temporary relief or consolidation. Every dollar you save on payments can go directly toward your down payment fund.

6. Stay Consistent and Review Monthly

Consistency builds results. Check your progress each month, adjust if needed, and increase contributions when your income grows.

Celebrate milestones like your first $5,000, small wins keep you motivated. Saving for a home takes time, but steady progress adds up faster than you think.

Creative Methods to Save for a Down Payment Faster

These ideas go beyond basic budgeting, perfect if you want quicker progress or more flexibility. They focus on creative, real-world ways to grow your savings faster.

7. Use Windfalls and Bonuses Wisely

When you get extra money, a tax refund, bonus, or gift, put it straight into your down payment fund. Treat these as fast-track contributions, not spending money.

Even a $2,000 refund each year adds $6,000 in three years. Setting an automatic transfer for windfalls ensures you save before you’re tempted to spend.

8. Take Advantage of Down Payment Assistance (DPA)

Many cities and states offer grants or forgivable loans for first-time buyers. These can cover part of your down payment or closing costs, reducing what you need to save.

Check your local housing agency or lender for current programs. A $5,000 or $10,000 grant can make a big difference in reaching your goal.

9. Earn Extra Income Short-Term

Add a small, short-term income stream to boost savings. Freelance, pet-sit, sell unused items, or drive for delivery apps.

Earning even $250 a month adds $3,000 in a year. Send that money straight to your savings account, and you’ll reach your target months sooner.

10. Try Round-Up or Cashback Apps

Apps like Acorns, Chime, or Rakuten make saving effortless. They round up purchases or give cashback for shopping and gas.

Those small amounts add up over time, even $15 a week equals nearly $800 a year — all without changing your habits.

11. Check for Employer Homebuyer Benefits

Some employers partner with lenders to offer down payment help or reduced closing costs. Ask your HR department if such programs exist.

Even smaller companies sometimes work with credit unions or banks to assist first-time buyers. It’s an often-overlooked perk that can save you thousands.

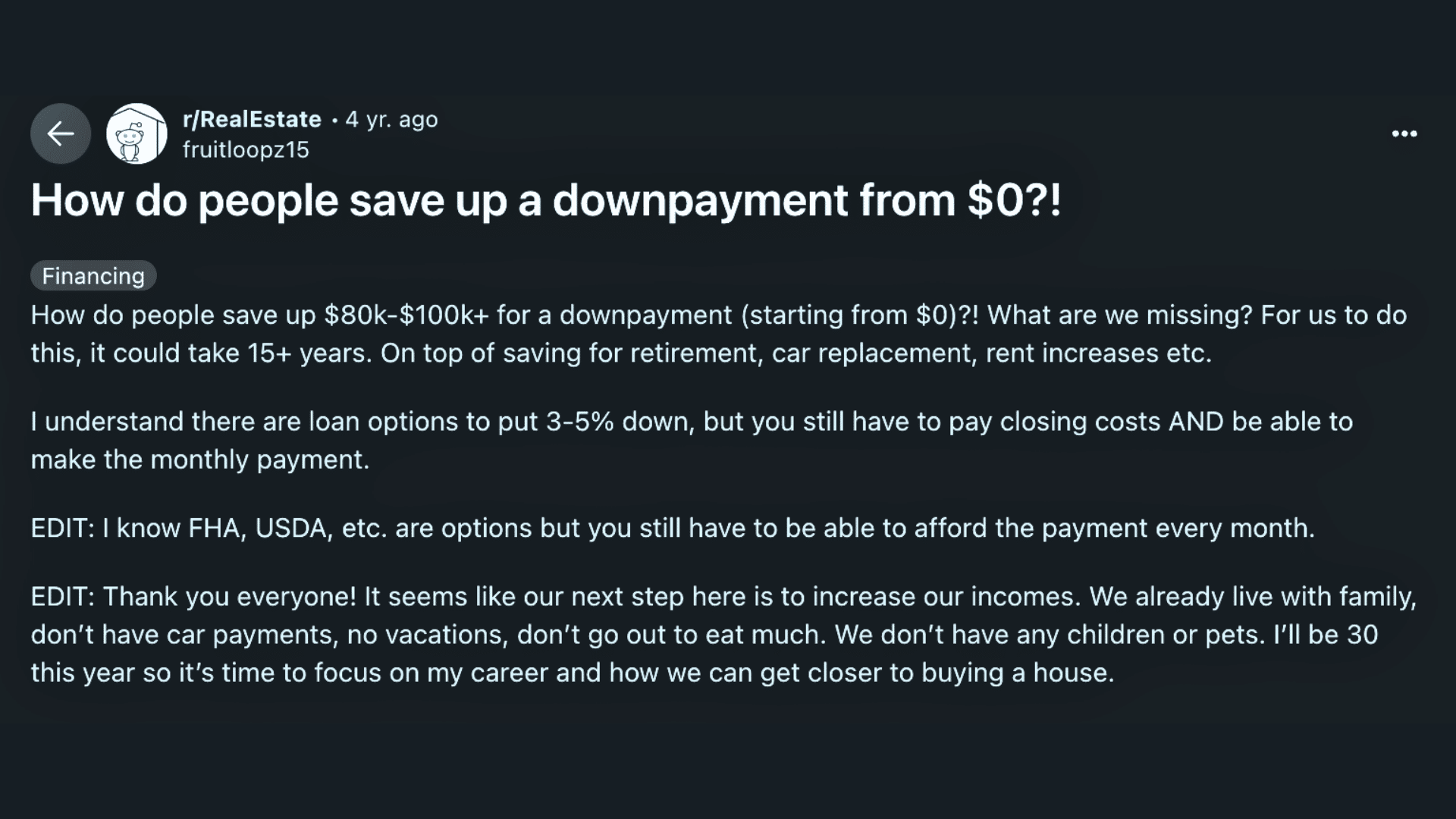

Real-World Stories from Homebuyers

Many people wonder how you actually go from $0 to a down payment, it’s one thing to see numbers, another to read real experiences.

On Reddit, a thread titled “How do people save up a downpayment from 0?” features first-hand accounts from homebuyers who started with nothing and built their savings over time.

You’ll find stories of roommates, side projects, sacrifice, and creative budgeting.

Check out the full discussion here: “How do people save up a downpayment from 0?” on Reddit

Tips to Save Money for a Down Payment

After using creative methods to grow your savings, these quick tips will help you stay steady and reach your goal faster:

- Keep your emergency fund separate: Don’t mix it with your down payment money. Unexpected costs can come up anytime, and you’ll want your home fund untouched.

- Avoid risky short-term investments: If you plan to buy soon, skip the stock market. Use a savings or money market account where your money stays safe.

- Revisit your budget often: Check your budget every few months and adjust if your income or bills change.

- Use simple tools to track progress: A spreadsheet or savings app helps you see your growth and stay motivated.

- Review assistance programs twice a year: Local or state programs may offer grants or help with closing costs. Checking twice a year keeps you informed.

Wrapping Up

Saving for a home can take time, but once you understand how to save for a down payment, it starts to feel manageable. Every dollar you set aside moves you closer to the life you want.

You’ve learned simple ways to budget smarter, build steady habits, and find creative options that make saving easier. It’s not about doing everything at once; it’s about doing what works for you.

Keep going, stay patient, and keep learning. If you found this guide helpful, check out more posts for ideas that can help you plan, save, and move forward with confidence!