Understanding your company’s cash position is more important than knowing your profit.

A business can show profit on paper but still run out of money to pay bills. That’s where operating cash flow comes in.

Operating cash flow (OCF) measures the actual cash your business generates from daily operations.

It tells you if your company can sustain itself without borrowing money or selling assets. Unlike net income, which includes non-cash items, OCF shows real money flowing in and out.

This guide will teach you the operating cash flow formula, show you how to calculate it using two different methods, and walk you through a complete example.

You’ll also learn how to interpret OCF results and avoid common calculation mistakes. Let’s get started.

What is Operating Cash Flow?

Operating Cash Flow (OCF) is the cash a company generates from its main business operations. It appears on the cash flow statement and shows the actual money that flows in from selling products or services.

Unlike investing cash flow, which tracks money spent on assets, or financing cash flow, which covers loans and equity, OCF focuses solely on daily business activities.

Investors and analysts watch OCF closely because it reveals whether a company can sustain itself without relying on external funding.

A strong OCF means the business is healthy and can pay bills, invest in growth, and reward shareholders. It’s one of the most honest measures of financial strength.

Importance of Operating Cash Flow

Numbers tell part of the story, but operating cash flow reveals the truth about a company’s financial pulse. Let’s see why it matters so much.

- Why OCF is a key indicator of financial health and sustainability: OCF shows whether a company can generate enough cash to survive and grow without borrowing or selling assets.

- How positive OCF supports growth, dividend payments, and debt repayment: Positive OCF provides the cash needed to expand operations, pay dividends to shareholders, and clear outstanding loans.

- What consistently negative OCF can indicate: Negative OCF signals that the company is burning cash and may struggle to stay afloat without outside help.

- Real-world relevance: how companies use OCF in performance evaluation: Companies track OCF to measure operational efficiency and make informed decisions about budgets, hiring, and future investments.

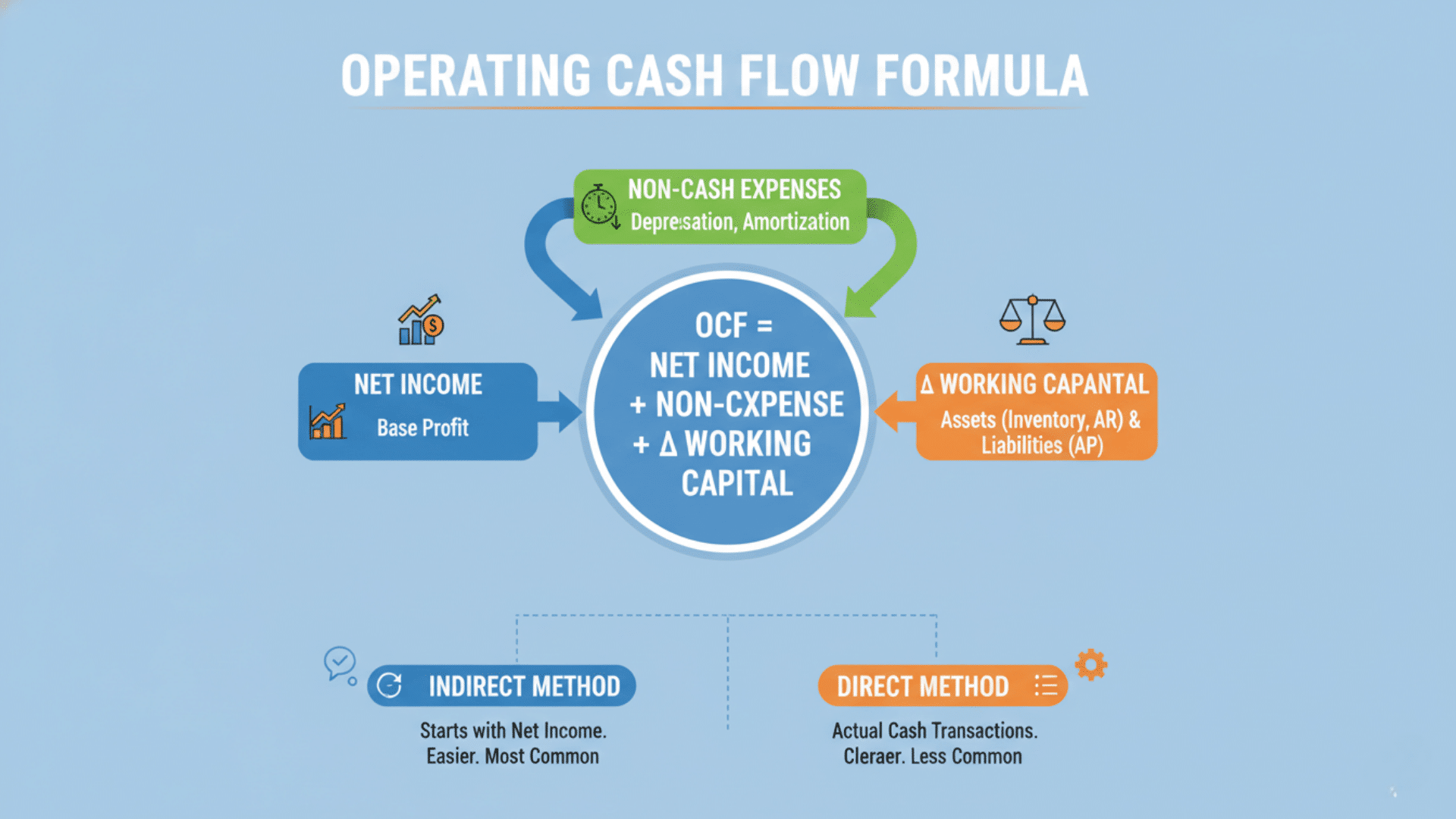

The Operating Cash Flow Formula

With a clear grasp of the importance of operating cash flow, it’s time to break down the formula that helps businesses and investors measure it accurately.

Basic Formula

Operating Cash Flow = Net Income + Non-Cash Expenses + Changes in Working Capital

This formula helps you calculate the actual cash generated from business operations.

Breaking down the elements:

- Net Income: This is the base profit shown on the income statement after all expenses and taxes.

- Non-Cash Expenses: These are costs like depreciation and amortization that reduce profit but don’t involve actual cash leaving the company.

- Changes in Working Capital: This adjustment accounts for changes in current assets like inventory and receivables, and current liabilities like payables.

Alternative Calculation Methods

1. Indirect Method

The indirect method starts with net income and adjusts it by adding back non-cash expenses and accounting for working capital changes.

This is the most widely used approach in financial reporting because it’s easier to prepare from existing financial statements. Most companies prefer this method for their cash flow statements.

2. Direct Method

The direct method lists actual cash transactions, showing cash received from customers and cash paid to suppliers and employees. It offers clearer visibility into where cash comes from and where it goes.

However, fewer companies use it because it requires more detailed record keeping and takes longer to prepare.

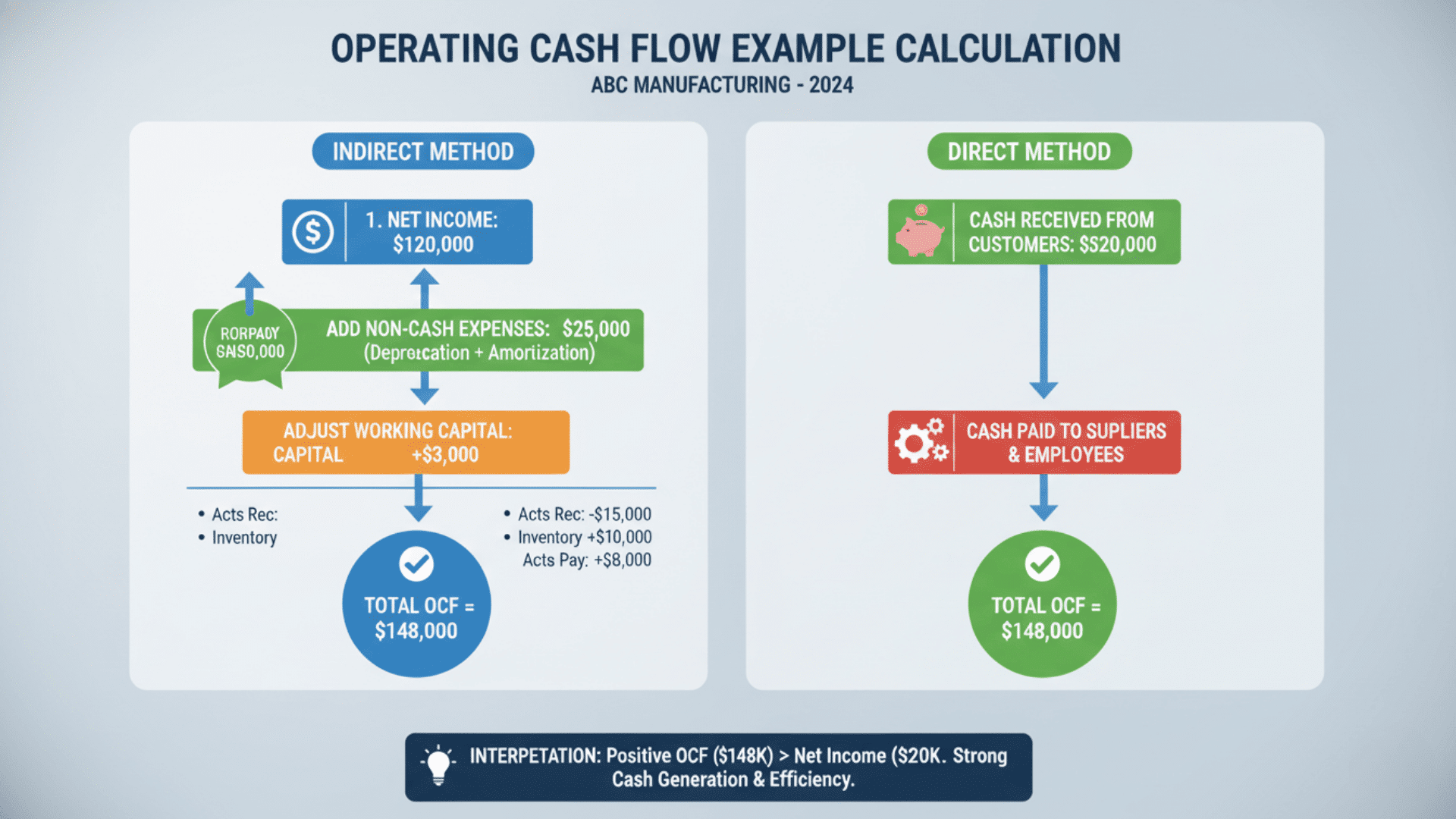

Operating Cash Flow Example: Step-by-Step Calculation

Theory is helpful, but nothing beats a real-world example. Let’s work through an actual operating cash flow calculation so you can see exactly how the formula comes together. We’ll use both the indirect and direct methods to show you how they work in practice.

Imagine ABC Manufacturing has just closed its books for 2024. The finance team has gathered all the necessary data to prepare the cash flow statement. Here are the key financial figures from their annual reports:

| Item | Amount (USD) |

|---|---|

| Net Income | 120,000 |

| Depreciation | 20,000 |

| Amortization | 5,000 |

| Increase in Receivables | 15,000 |

| Decrease in Inventory | 10,000 |

| Increase in Payables | 8,000 |

Now we’ll use these numbers to calculate the operating cash flow using two different methods.

A. Calculation Using the Indirect Method

The indirect method is the most popular approach in corporate finance and accounting. This method starts with net income from the income statement and then adjusts it to reflect actual cash movements.

Formula:

OCF = Net Income + Non-Cash Expenses + Changes in Working Capital

Think of it like this: you’re taking the profit number and converting it into a cash number by removing things that didn’t involve cash and adjusting for timing differences.

Step 1: Start with Net Income

Net income is your starting point. This is the bottom line profit ABC Manufacturing reported on its income statement after deducting all expenses, interest, and taxes.

Net Income = $120,000

However, net income includes several non-cash items and doesn’t account for changes in working capital.

Step 2: Add Back Non-Cash Expenses

Not all expenses on the income statement actually require cash to leave the company. Depreciation and amortization are perfect examples.

For instance, if ABC bought a machine for $100,000 with a 5-year life, they record $20,000 in depreciation each year. This reduces net income, but no cash actually left the bank in year two, three, or four.

Here’s what ABC Manufacturing recorded:

- Depreciation = $20,000 (wear and tear on equipment and buildings)

- Amortization = $5,000 (spreading the cost of intangible assets like patents)

Total Non-Cash Expenses = $20,000 + $5,000 = $25,000

Step 3: Adjust for Changes in Working Capital

Working capital represents the cash tied up in day-to-day operations. Changes in current assets and liabilities directly affect how much cash is available.

- Accounts Receivable (Increase of $15,000): When receivables increase, it means customers owe ABC more money at year end. Sales were made, and net income includes them, but the cash hasn’t been collected yet.

- Impact: -$15,000 (cash is reduced because it’s stuck in receivables)

- Inventory (Decrease of $10,000): ABC reduced its inventory levels during the year. Less money is sitting on shelves as unsold products.

- Impact: +$10,000 (cash is increased because inventory was converted to sales)

- Accounts Payable (Increase of $8,000): When payables increase, ABC owes suppliers more money at year end. This allows ABC to keep that cash longer.

- Impact: +$8,000 (cash is retained because payment is delayed)

Total Working Capital Change = -$15,000 + $10,000 + $8,000 = $3,000

Step 4: Calculate Total OCF

Now we bring everything together. Take the net income, add back the non-cash expenses, and adjust for working capital changes.

OCF = $120,000 + $25,000 + $3,000

Operating Cash Flow = $148,000

B. Calculation Using the Direct Method

The direct method takes a completely different approach. Instead of starting with net income and adjusting it, you track actual cash transactions directly.

This method is more transparent because it shows exactly where cash came from and where it went. However, fewer companies use it because it requires more detailed record keeping.

- Cash received from customers = $520,000

- Cash paid to suppliers and employees = $372,000

Now apply the formula:

OCF = Cash Received – Cash Paid

OCF = $520,000 – $372,000 = $148,000

Result: Both methods give the same result of $148,000.

Notice something important here: both methods produced the exact same result of $148,000. When done correctly, both approaches must arrive at the same operating cash flow figure.

Interpretation of the Result

What does this $148,000 figure tell us?

- Positive OCF means strong operational efficiency: ABC Manufacturing is generating real cash from its core business activities.

- OCF higher than net income shows good cash conversion: The company effectively turns its profits into actual cash, not just paper earnings.

- The company can cover expenses, reinvest, and service debt comfortably: With $148,000 in operating cash flow, ABC has the financial flexibility to grow, pay loans, and keep operations running smoothly.

This is exactly what investors and lenders want to see in a healthy business.

How to Interpret Operating Cash Flow Results

Understanding your OCF numbers is just as important as calculating them. Here’s how to read and analyze operating cash flow effectively.

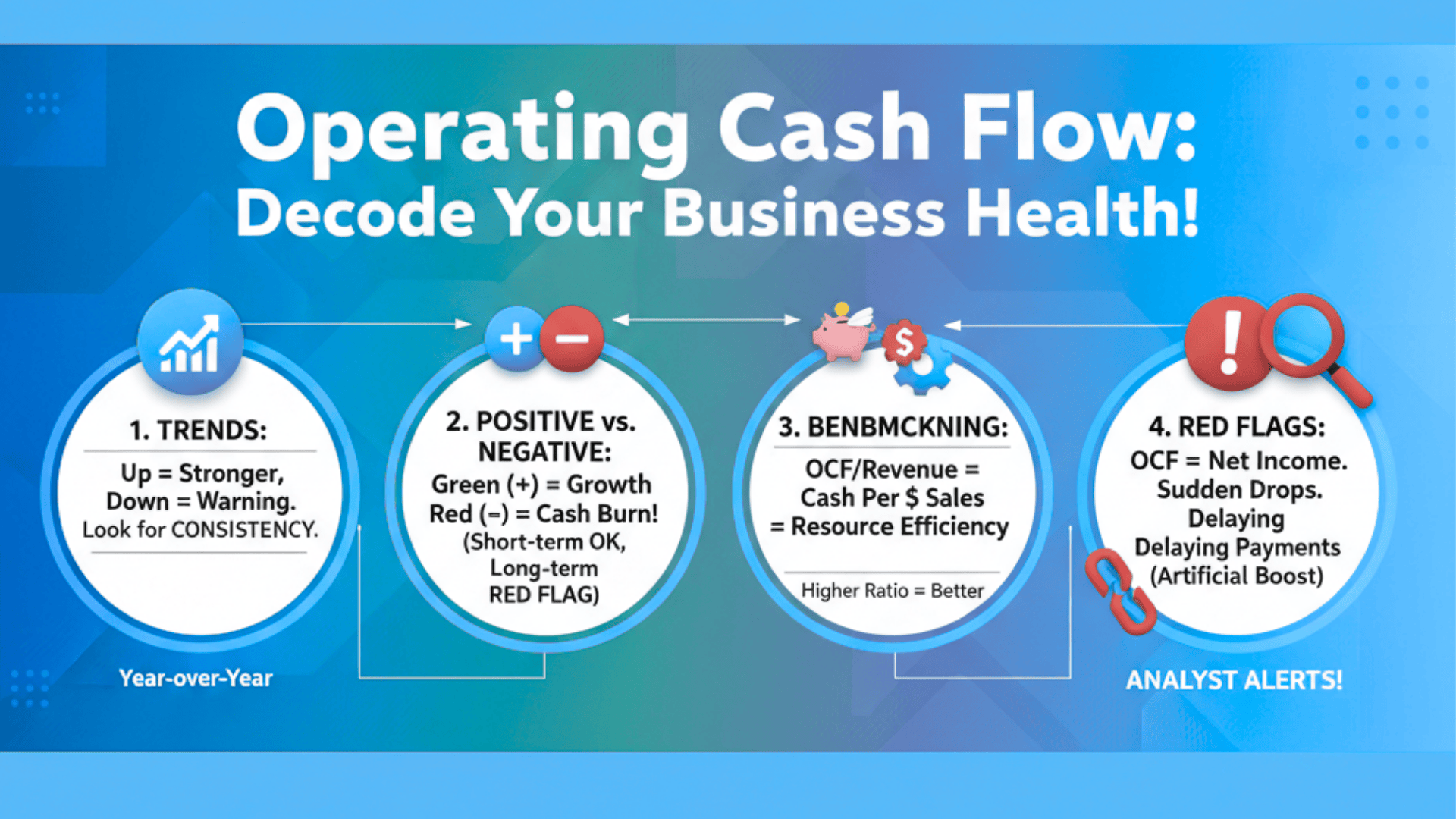

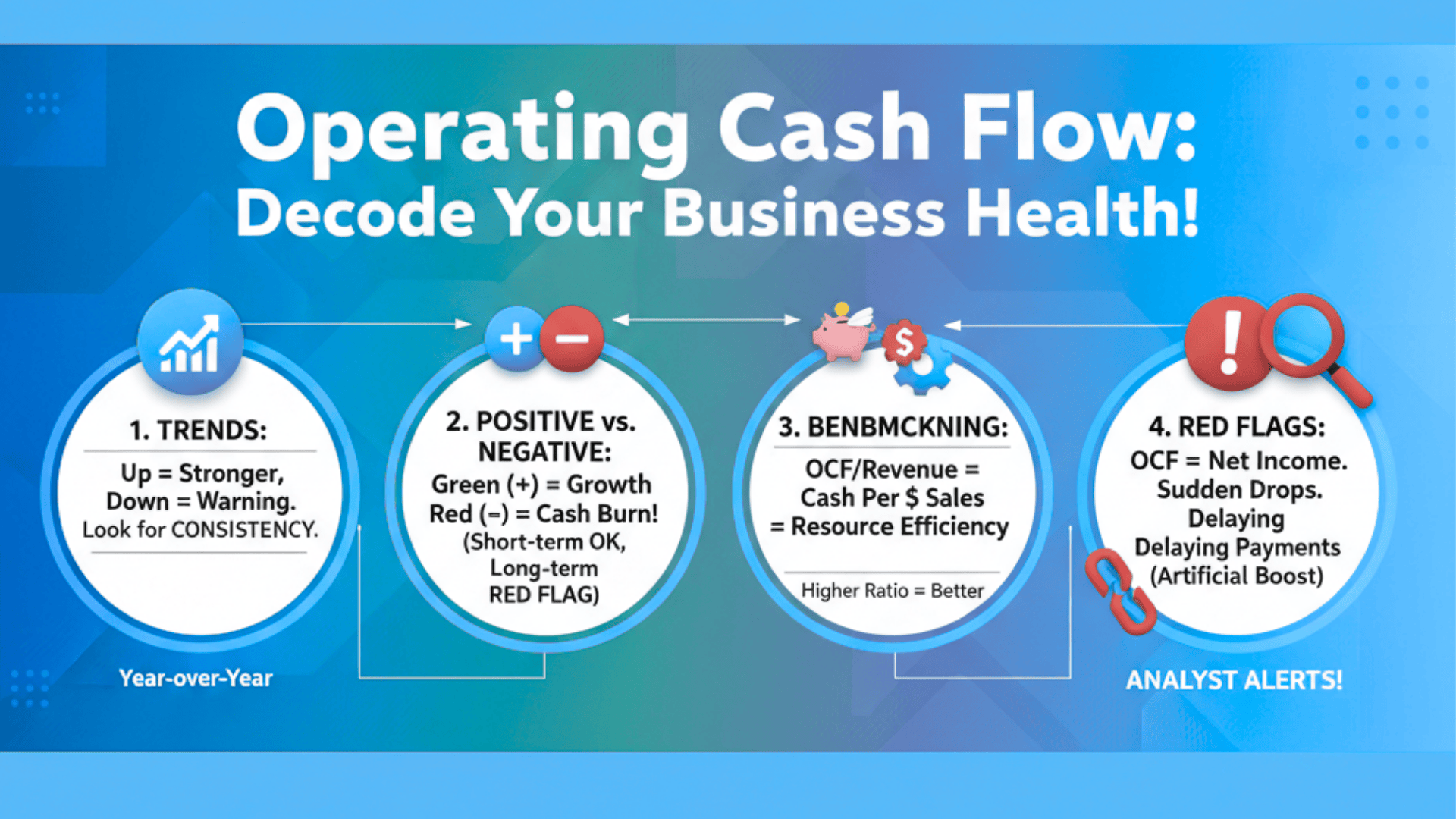

1. How to read trends in OCF year-over-year

Compare OCF across multiple years to spot patterns in cash generation.

A steady increase shows the business is growing stronger, while a decline in OCF may signal operational problems. Look for consistency rather than one-time spikes or drops.

2. What positive vs. negative OCF signals

Positive OCF means the company generates enough cash to fund operations and has money left over for growth.

Negative OCF suggests the business is spending more cash than it brings in, which can lead to financial trouble if it continues. A company can survive short periods of negative OCF, but prolonged negativity is a warning sign.

3. Benchmarking OCF against revenue or total assets

Divide OCF by revenue to get the OCF margin, which shows how much cash you generate per dollar of sales.

You can also compare OCF to total assets to measure how efficiently the company uses its resources. Higher ratios indicate better cash performance relative to business size.

4. Red flags in OCF trends that analysts look for

Watch for OCF that’s consistently lower than net income, which may indicate earnings quality issues.

Sudden drops in OCF without clear reasons can signal hidden problems like rising receivables or inventory buildup.

Analysts also worry when a company relies on reducing payables or delaying payments to boost OCF artificially.

Comparing Cash Flow Metrics: OCF vs FCF vs EBITDA

Operating cash flow is important, but it’s not the only metric that matters. Let’s compare OCF with two other popular financial measures.

| Metric | What It Measures | Formula | Includes Working Capital? | Best Used For |

|---|---|---|---|---|

| Operating Cash Flow (OCF) | Cash generated from core business operations | Net Income + Non-Cash Expenses + Working Capital Changes | Yes | Measuring operational cash health |

| Free Cash Flow (FCF) | Cash available after capital spending | OCF – Capital Expenditures | Yes | Evaluating investor returns and growth capacity |

| EBITDA | Operating profitability before financing decisions | Revenue – Operating Expenses (excluding interest, taxes, depreciation, amortization) | No | Quick profitability comparison across companies |

This table shows why OCF sits in the middle: more complete than EBITDA but broader than FCF.

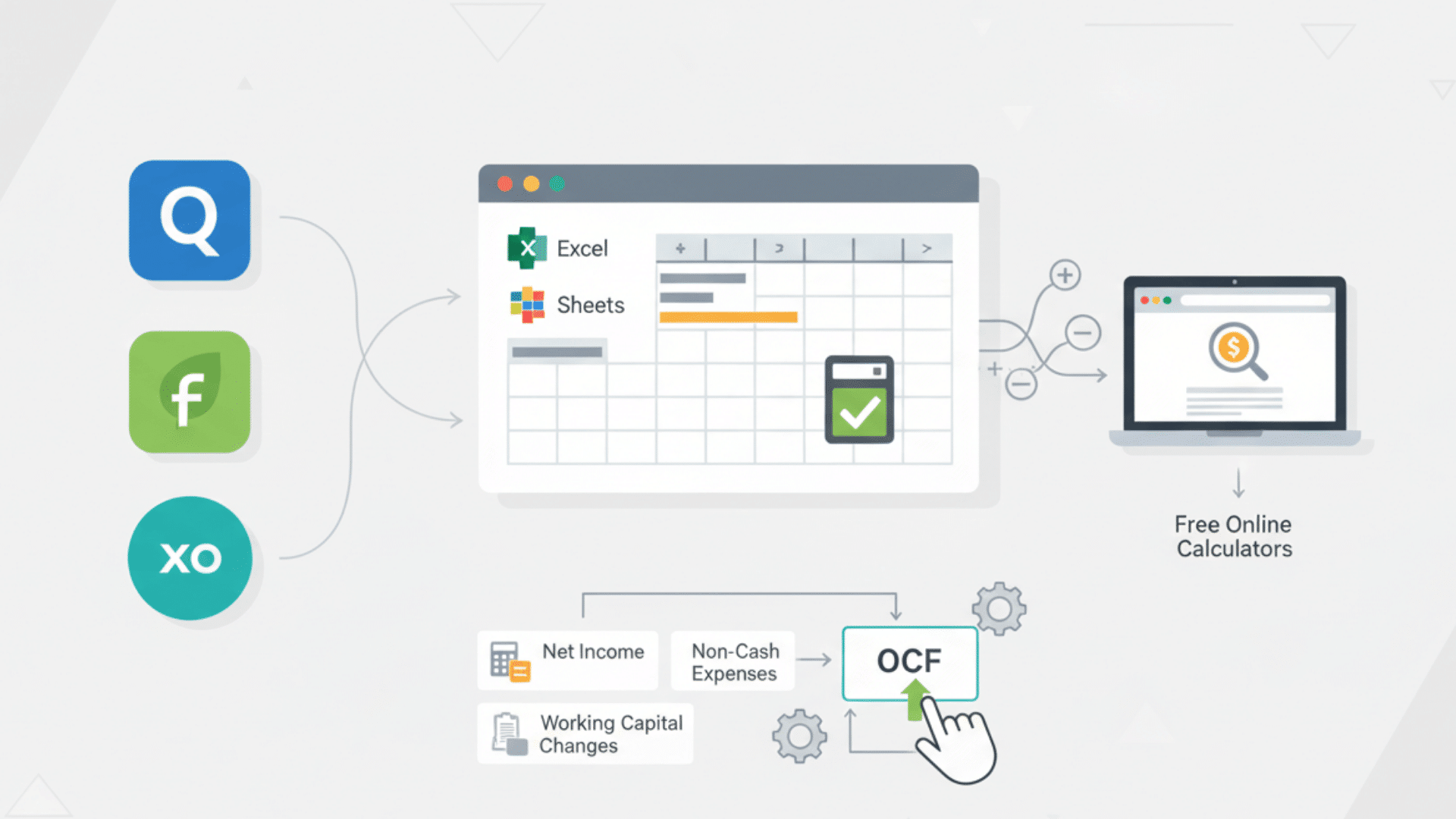

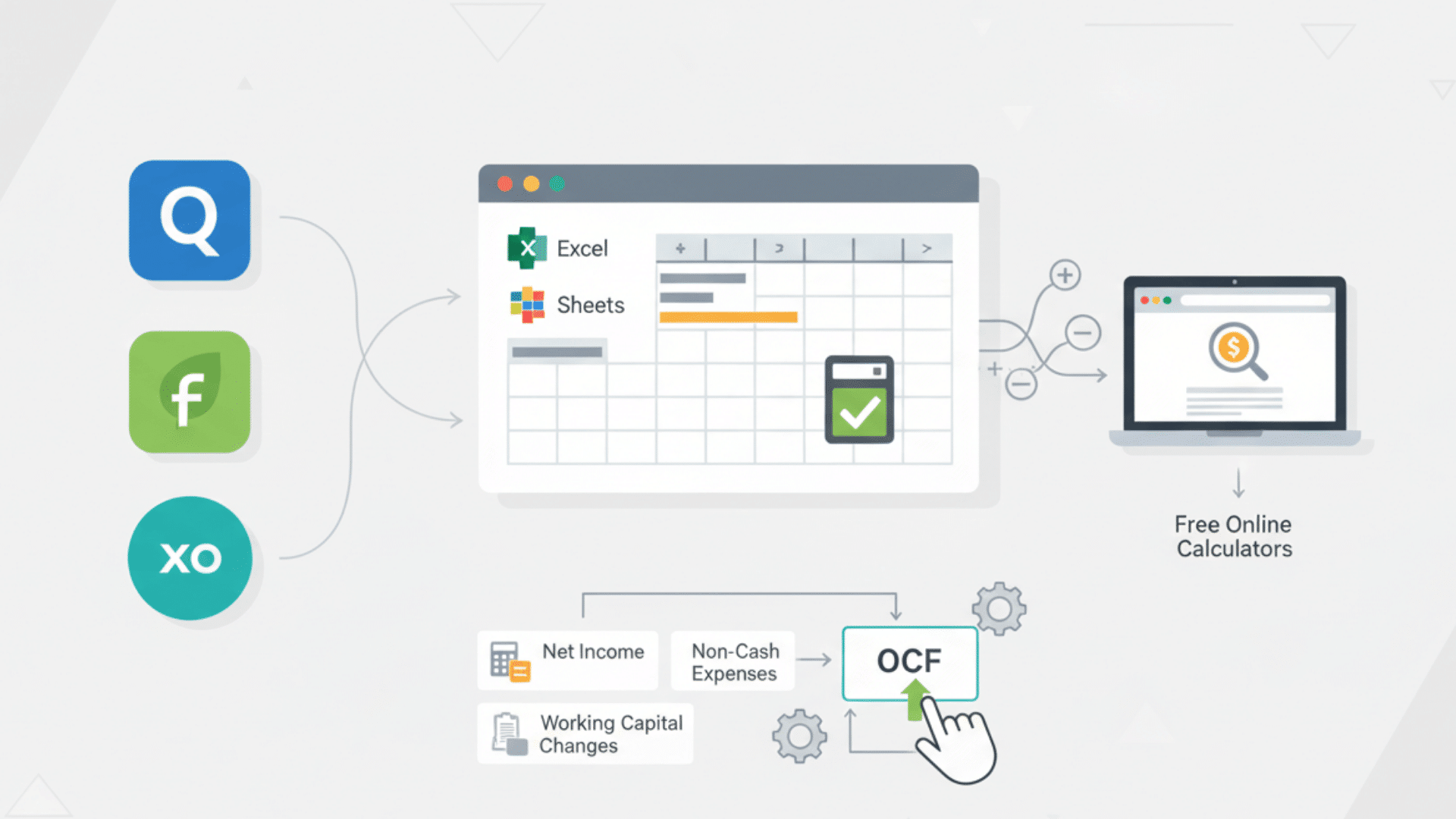

Tools & Templates for Calculating OCF

You don’t need to calculate operating cash flow manually every time.

Excel and Google Sheets offer ready-made templates with built-in formulas that automatically compute OCF when you input your numbers.

Accounting software like QuickBooks, FreshBooks, and Xero can generate cash flow statements instantly from your financial data.

You can also find free online operating cash flow calculators that do the math for you in seconds.

To automate OCF computation, set up a simple spreadsheet template where you enter net income, non-cash expenses, and working capital changes in designated cells, then use formulas to calculate the total automatically.

This saves time and reduces calculation errors significantly.

Common Mistakes When Calculating OCF

Even experienced finance professionals make errors when calculating operating cash flow. Here are the most common mistakes and how to avoid them.

| Mistake | Why It’s Wrong | How to Fix It |

|---|---|---|

| Forgetting non-cash adjustments | Makes OCF appear lower than reality | Always add back depreciation and amortization |

| Misclassifying transactions | Includes investing or financing items incorrectly | Keep only core operations in OCF |

| Ignoring working capital changes | Misses cash tied up in assets and liabilities | Track receivables, inventory, and payables carefully |

| Assuming profit equals cash | Treats earnings and cash as the same | Remember: profit is accounting, OCF is actual cash |

Pro Tip: Always reconcile your OCF calculation with the company’s financial statements. Cross-check your numbers against the official cash flow statement to catch errors early.

Conclusion

Operating cash flow is one of the most honest indicators of business health. While profit numbers can be misleading, OCF shows the real cash your company generates from operations.

You’ve learned the formula, explored both calculation methods, and seen a complete example in action.

Remember that positive OCF means your business can pay bills, invest in growth, and reward shareholders without external funding.

Track your OCF regularly and compare it year over year to spot trends early. Don’t confuse it with profit or EBITDA because changes in working capital matter.

Ready to calculate your own operating cash flow? Start applying this formula to your business finances today and see where you stand.

Need help understanding your results? Share your questions in the comments below, and we’ll guide you through it.