Want to jump on a stock move the moment earnings drop at 5 p.m.? Too bad your options can’t.

Here’s the problem: stocks trade after hours, but options don’t. That gap leaves traders stuck watching their positions shift overnight with no way to act.

Here’s what you’ll learn: We’ll cover standard option trading hours, how after-hours stock moves affect your positions, and why most options stay locked until 9:30 a.m.

You’ll see real examples of earnings gaps, compare regular vs. extended sessions, and get practical tips for managing risk overnight.

By the end, you’ll know exactly when you can trade options and how to prepare for market moves that happen when exchanges are closed.

Can You Trade Options After Hours?

No, most options cannot be traded after regular market hours. The options market closes at 4:00 p.m. ET along with standard trading sessions.

1. Why the restriction?

Options depend on real-time stock prices and volatility data to determine their value. Without active trading in the underlying stock, there’s no reliable way to price the option fairly.

The Greeks that measure risk and potential profit need constant market updates to stay accurate.

2. Are there any exceptions?

Yes, but they’re limited. Some ETF options and index options have extended trading hours on select exchanges. For example, certain S&P 500 index options can trade until 4:15 p.m. ET.

Index futures also trade nearly 24 hours a day, giving traders alternative ways to hedge positions overnight.

3. What about broker restrictions?

Most brokers don’t support after-hours options trading because the exchanges don’t offer it. If you place an order after hours, it sits in the queue until the market opens the next day.

Your order will execute at the next available price during regular option trading hours, which could be very different from what you expected.

What Are Standard Option Trading Hours?

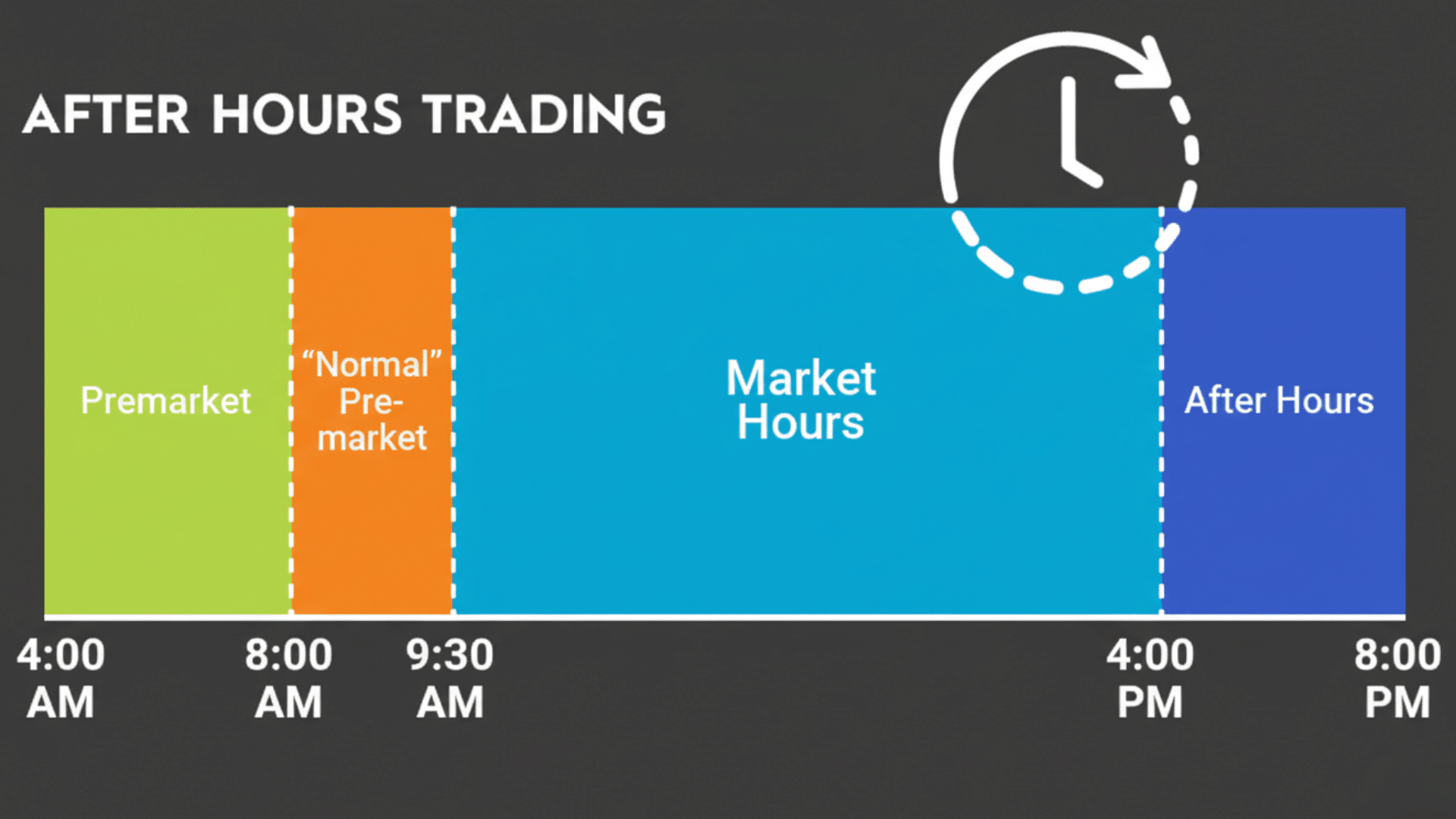

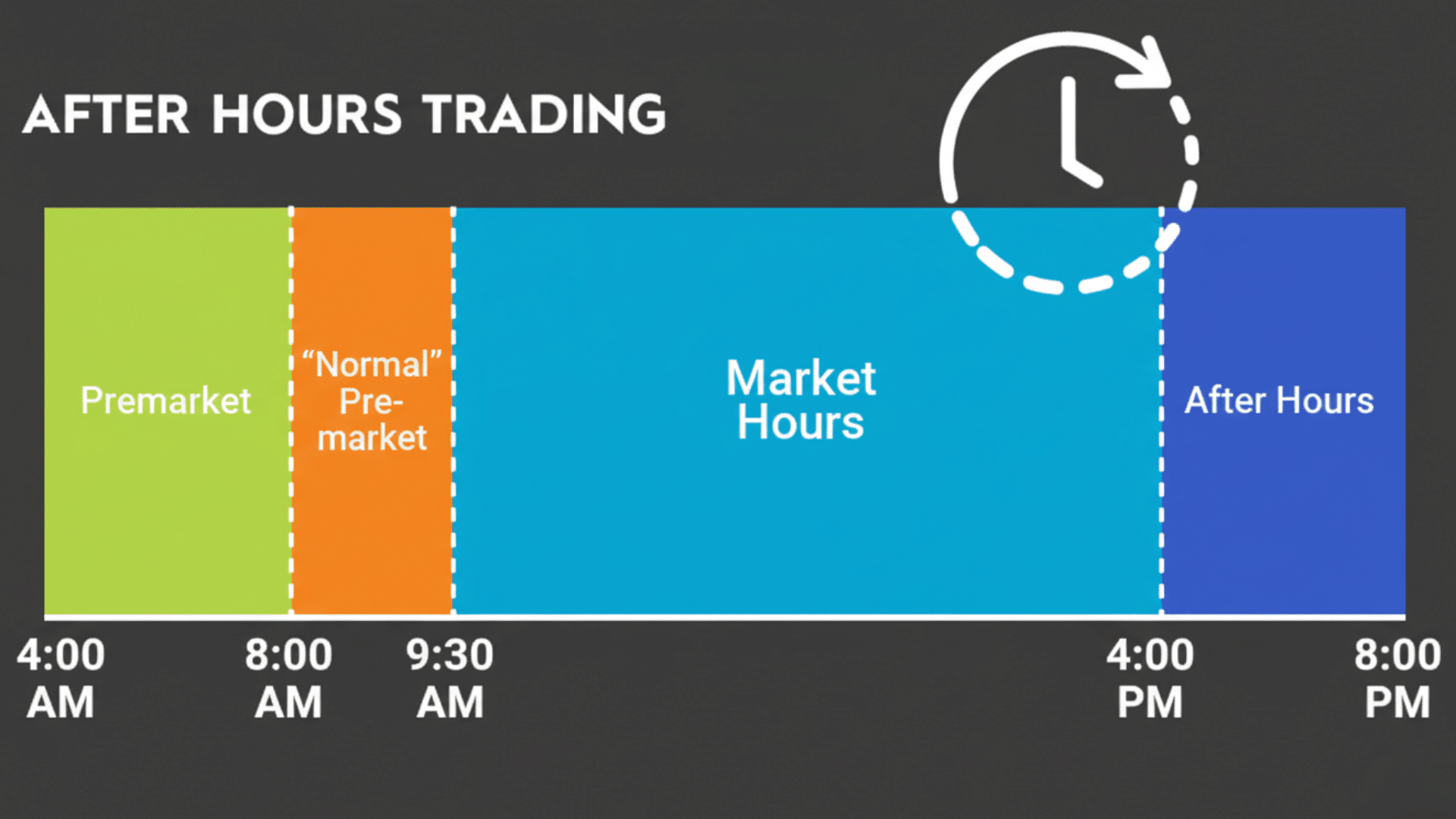

Option trading hours run from 9:30 a.m. to 4:00 p.m. Eastern Time, Monday through Friday.

This matches the regular stock market session because options get their value from the stocks they represent. When a stock trades, its option can trade too.

Major exchanges like the Chicago Board Options Exchange (CBOE) and NASDAQ follow these same hours.

The connection is simple: no active stock trading means no live option pricing. That’s why both markets open and close together during standard sessions.

How After-Hours Trading Works in Options?

After-hours trading lets investors buy and sell stocks outside regular market hours. The pre-market session runs from 4:00 a.m. to 9:30 a.m. ET.

The after-hours session goes from 4:00 p.m. to 8:00 p.m. ET. These extended sessions use electronic communication networks (ECNs) to match buyers with sellers.

Who trades during these hours? Institutional investors often make big moves based on news. Retail traders can also participate through their brokers. Market makers help fill orders, but there are far fewer of them compared to regular hours.

Here’s what makes after-hours different:

- Lower liquidity means fewer buyers and sellers

- Wider bid-ask spreads can cost you more per trade

- Price gaps happen more often due to limited activity

- Order types are usually restricted to limit orders only

Price transparency suffers, too. You might see a stock quote, but that price could be from minutes ago. The lack of constant trading makes it harder to know the true current value.

Now here’s the key point for options traders: stocks can trade after hours, but options cannot. Why? Options need real-time data from the underlying stock to calculate fair prices.

Without active market pricing, Greeks like delta and implied volatility can’t update properly. The options market stays closed when regular hours end, even if the stock keeps moving.

Pros & Cons of After-Hours Options Trading

Like any trading opportunity, after-hours options trading has its upsides and downsides. Let’s look at both

| Pros | Cons |

|---|---|

| React to breaking news – Respond quickly to earnings releases or global events that move markets. | Low trading volume – The limited number of buyers and sellers makes it hard to execute orders at fair prices. |

| Early market signals – Access price movements and trends before the next regular session starts. | Unpredictable pricing – Thin liquidity creates wild swings and unreliable quotes. |

| Position for gaps – Set up trades early to catch price jumps when the market reopens. | No updated Greeks – Delta, theta, and vega don’t refresh without live market data. |

| Less competition – Fewer active traders can sometimes mean better entry or exit opportunities. | High costs – Wider bid-ask spreads increase transaction costs and slippage. |

| Global flexibility – Traders in different time zones can participate without waiting for U.S. hours. | Limited support – Most brokers and exchanges don’t offer extended options trading or restrict order types. |

The risks often outweigh the benefits. Even when after-hours options trading is available, the lack of liquidity and accurate pricing makes it challenging for most traders.

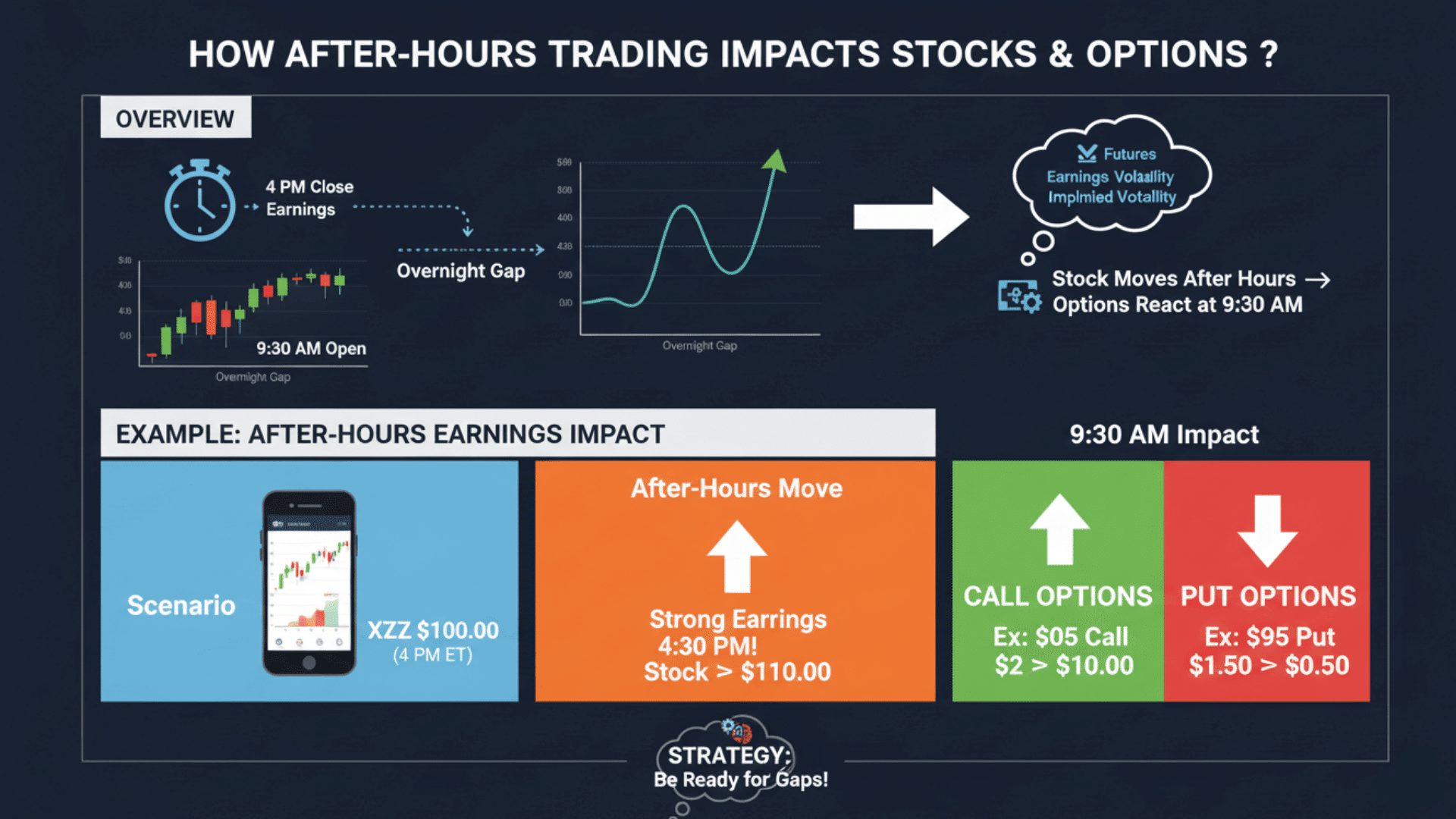

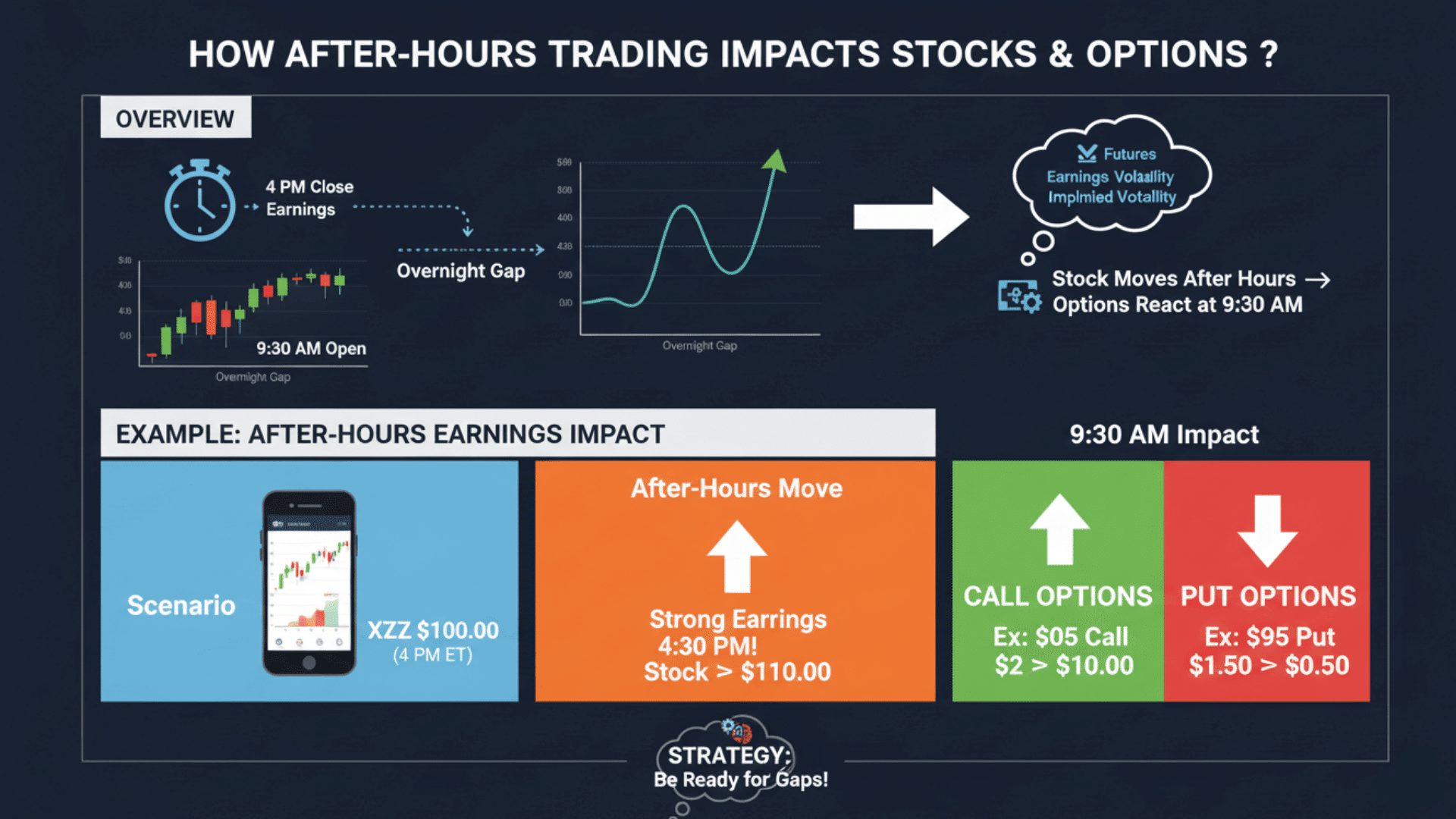

How After-Hours Trading Impacts Stocks & Options?

Even though you can’t trade options after hours, after-hours stock movements directly impact your option values the moment the market reopens.

When a stock jumps or drops overnight, your calls and puts adjust instantly at 9:30 a.m. ET. Overnight gaps happen when stocks close at one price and open much higher or lower the next day.

Futures market trends give clues about where stocks might open. Earnings volatility is the biggest driver; companies report after the bell, and stocks can swing 10% or more before morning.

These moves change implied volatility and option premiums dramatically. If you hold options through earnings, you might wake up to very different values than you expected.

Example: After-Hours Earnings Impact

- Scenario: Tech company XYZ closes at $100 per share at 4:00 p.m. ET.

- After-Hours Move: Company reports strong earnings at 4:30 p.m. Stock surges to $110 in after-hours trading.

- Impact on Call Options: Your $105 call option, which was out of the money and worth $2, becomes in the money. When the market opens, it could be worth $6 or more due to the $10 stock gain.

- Impact on Put Options: Your $95 put option loses value fast. It was already out of the money and now sits even further from the current price. It might drop from $1.50 to $0.50 or less.

- Strategy Adjustment: If you planned to sell covered calls, you might need to roll them to higher strikes. If you bought protective puts, the overnight move just cost you money on that hedge.

After-Hours Trading vs. Standard Trading

To better understand how after-hours trading fits into the bigger picture, let’s compare it directly with standard trading sessions.

| Factor | Standard Trading | After-Hours Trading |

|---|---|---|

| Volume & Liquidity | High volume, easy execution | Low volume, slower fills |

| Bid-Ask Spreads | Tight spreads, better prices | Wide spreads, higher costs |

| Market Participants | All traders, market makers are active | Mostly institutions, fewer participants |

| Risk Levels | Lower risk, stable pricing | Higher risk, volatile moves |

| Options Trading | Fully available with live pricing | Not available for most options |

Standard hours offer better conditions. After-hours work for stocks, but not most options.

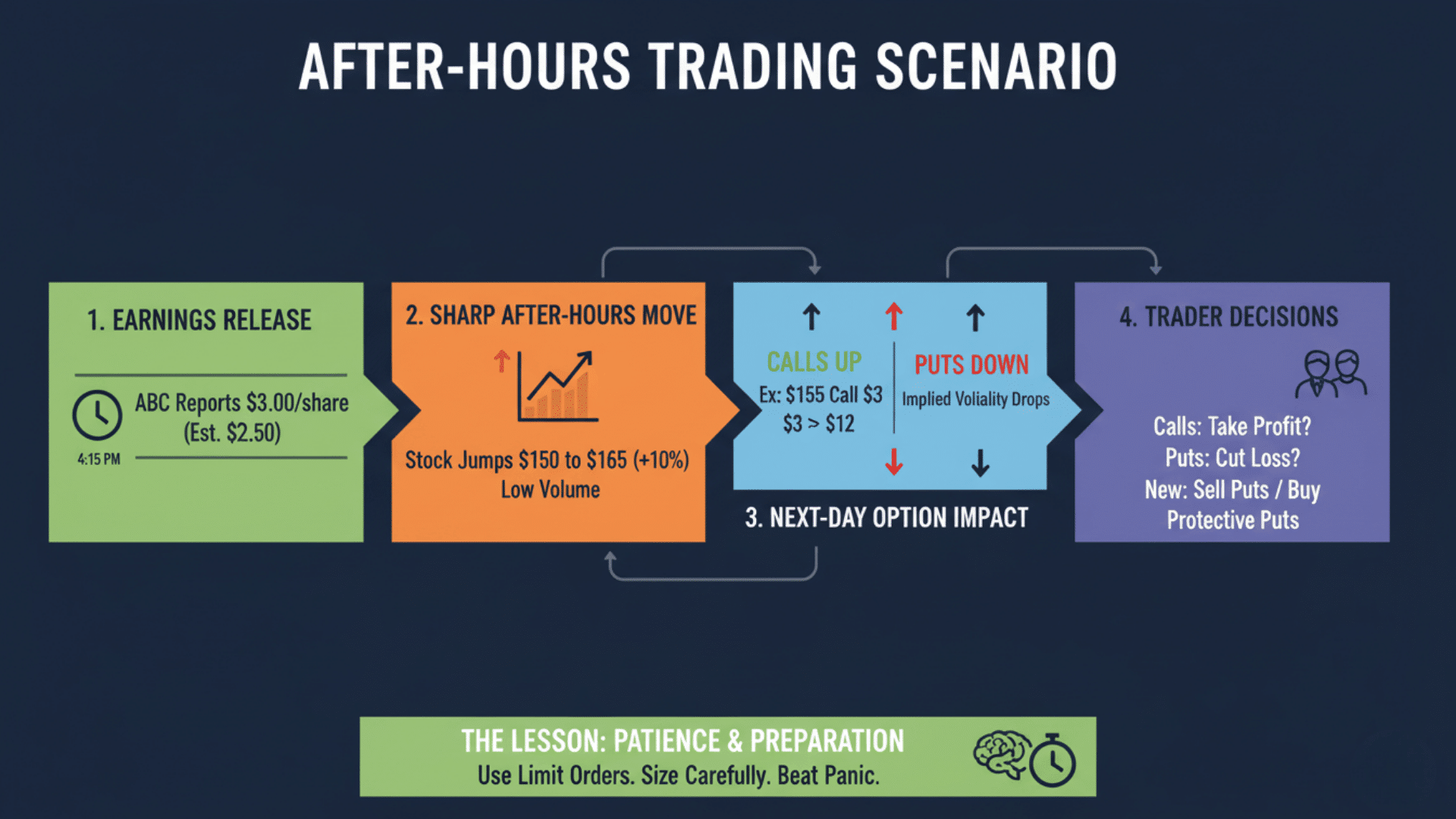

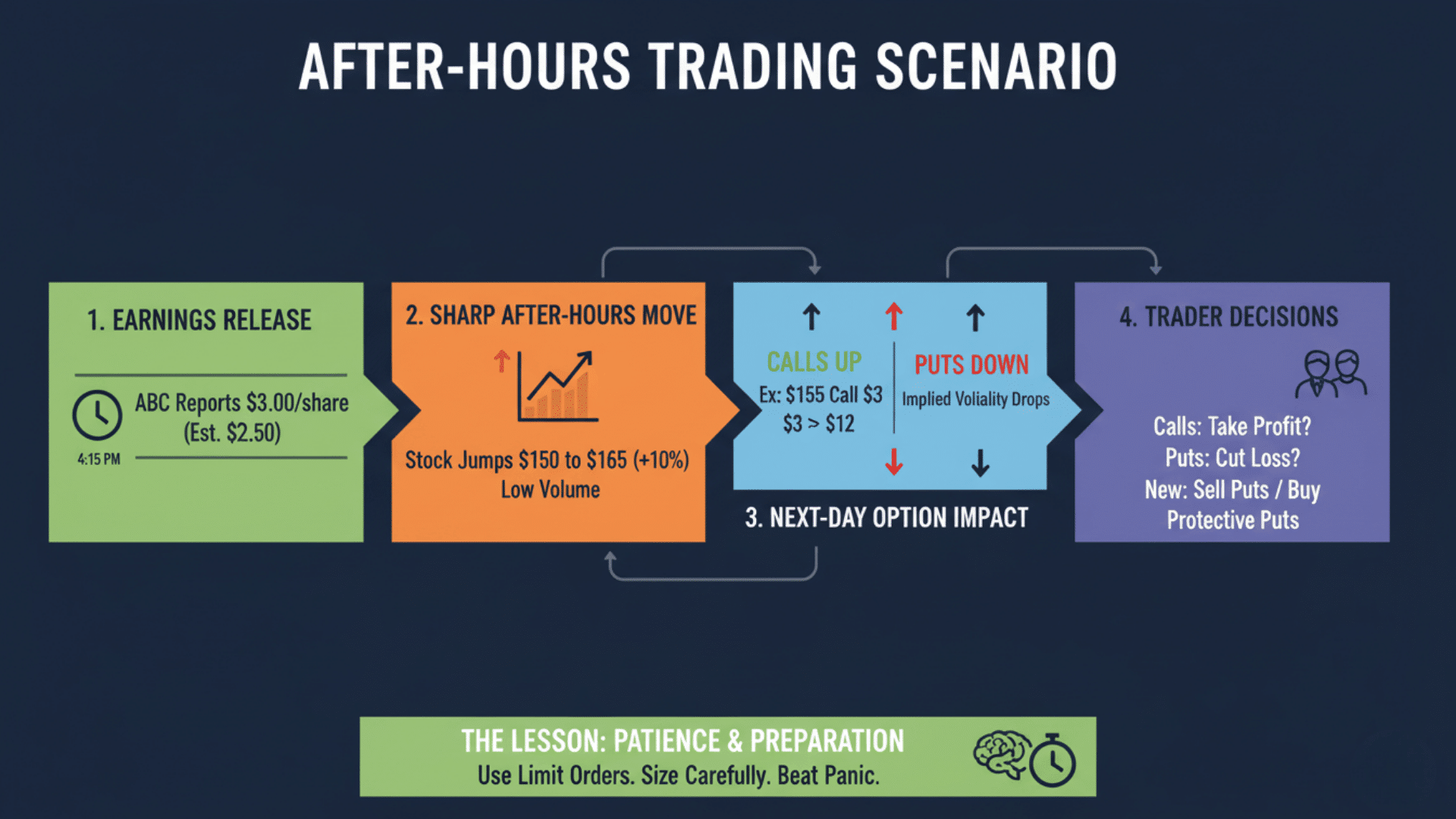

Example of After-Hours Trading Scenario

To put everything into perspective, let’s look at a real-world example of how after-hours trading plays out and how it can impact stock and option prices.

Step 1: Earnings Release at 4:15 p.m. ET

Tech company ABC reports quarterly earnings 15 minutes after the market closes. Analysts expected $2.50 per share, but the company delivered $3.00 per share with strong guidance.

Step 2: Sharp After-Hours Stock Movement

The stock jumps from $150 to $165 in after-hours trading within 30 minutes. Volume is light, but the direction is clear. Buyers rush in while sellers back off, creating a 10% gain before most retail traders can react.

Step 3: Next-Day Impact on Option Pricing

When the market opens at 9:30 a.m., call options see massive gains. A $155 call that was worth $3 yesterday now trades at $12 because the stock is in the money.

Put options lose value fast as they move further out of the money. Implied volatility might actually drop after earnings, which can reduce option premiums even if the stock moves in your favor.

Step 4: Trader Decisions and Strategy Adjustments

Traders holding calls before earnings now face a choice: take profits immediately or hold for more gains.

Those with puts might cut losses quickly or wait for a potential pullback. New traders might look to sell cash-secured puts at lower strikes or buy protective puts if they think the rally will fade.

The Lesson: Patience and Preparation Win

Reacting emotionally to after-hours moves often backfires. Smart traders set up contingency plans before earnings.

They use limit orders ready to execute at specific prices. They also size positions carefully, knowing overnight gaps can work for or against them. Preparation beats panic every time.

Tips for Managing Option Positions After Hours

Now that you’ve seen how after-hours trading works, it’s important to know how to manage your option positions effectively when the market is closed.

- Set up alerts and limit orders for the next session. Configure price alerts on your broker platform to notify you when stocks hit key levels, and place limit orders that automatically execute at your target price when the market opens.

- Use Good-Til-Canceled (GTC) or stop-limit orders wisely. GTC orders stay active until filled or canceled, letting you secure profits or limit losses without watching the market constantly, while stop-limit orders protect against gap-down losses by triggering sells at predetermined prices.

- Hedge exposure using futures or related instruments. Trade index futures or related ETFs during extended hours to offset potential overnight losses in your option positions, giving you some protection when options markets are closed.

- Stay informed via broker platforms or real-time news feeds. Monitor after-hours price action, earnings reports, and breaking news through your broker’s mobile app or financial news services to anticipate how your positions might open the next day.

Future of After-Hours Options Trading

The options market might not stay limited to regular hours forever. Exchanges like the CBOE and ICE are actively exploring extended trading sessions for options contracts.

The push toward 24/5 trading in stocks and ETFs could eventually include options as investor demand grows. Global markets already trade around the clock, and U.S. exchanges want to stay competitive.

However, technological challenges remain significant, pricing models need constant real-time data, and systems must handle complex calculations instantly.

Regulatory hurdles also slow progress, as agencies like the SEC must ensure fair pricing and investor protection. Market makers worry about the costs of staffing overnight shifts.

While the future looks promising, widespread after-hours options trading is likely still years away.

Final Thoughts

So, can you trade options after hours? Not yet for most contracts. While stocks move freely in extended sessions, options remain tied to regular market hours from 9:30 a.m. to 4:00 p.m. ET.

The reason is simple: option trading hours depend on real-time stock data and volatility calculations that aren’t available overnight.

But here’s what matters: understanding after-hours stock movements gives you a real advantage. You can prepare for gaps, set smart limit orders, and adjust strategies before the opening bell.

Stay informed through alerts and news feeds. Use GTC orders wisely. And remember, patience beats panic when earnings hit after the close.

Want to stay ahead of market moves? Drop a comment below with your biggest options trading question.