Ever wondered how gold, crude oil, or coffee are traded on global markets? You’re not alone. Thousands of traders profit daily from price movements in these essential goods.

Commodity trading isn’t just for Wall Street professionals anymore. With the right knowledge and tools, anyone can start trading energy, metals, or agricultural products. The best part? You don’t need to store barrels of oil or bags of wheat in your garage.

This guide covers everything you need to know about commodity trading. You’ll learn what commodities are, how markets work, and how to place your first trade. We’ll also share proven strategies and common mistakes to avoid.

By the end, you’ll understand the fundamentals of commodity trading and feel confident taking your first steps into this exciting market.

What Are Commodities?

Commodities are basic goods used in commerce. They’re interchangeable with other goods of the same type. One barrel of crude oil is the same as another barrel from the same grade. One ounce of gold has the same value as any other ounce of gold.

These raw materials power our daily lives. From the fuel in your car to the coffee in your mug, commodities are everywhere. They form the backbone of global trade and manufacturing.

Main Categories of Commodities

| Category | Examples | Common Uses |

|---|---|---|

| Energy | Crude oil, natural gas, gasoline, heating oil | Transportation fuel, electricity generation, and home heating |

| Metals | Gold, silver, platinum, copper, aluminum | Jewelry, electronics, construction, industrial manufacturing |

| Agricultural | Corn, wheat, soybeans, sugar, coffee, cocoa | Food products, animal feed, beverages, cooking ingredients |

| Livestock | Cattle, hogs, poultry | Meat production, dairy products, and leather goods |

Why These Goods Matter?

Every commodity serves a specific purpose in the economy. Energy commodities keep factories running and cars moving. Metals build smartphones, homes, and medical equipment. Agricultural products feed billions of people worldwide. Livestock provides protein and other essential nutrients.

Without these raw materials, modern life would stop. Industries depend on steady supplies to function. When supply gets disrupted, prices change quickly. This creates opportunities for traders who understand market dynamics.

Commodities are standardized and traded in large quantities. Buyers know exactly what they’re getting, regardless of the seller.

Types of Commodity Markets

Commodity markets operate in different ways depending on when and how the transaction happens. Each market type serves different needs for traders and businesses. Here’s how they work:

| Market Type | What It Is | Real Example | Best For |

|---|---|---|---|

| Spot Market | Buy or sell commodities for immediate delivery at the current price | A farmer sells 1,000 bushels of wheat today at $6.50 per bushel | Producers and buyers who need physical goods right now |

| Futures Market | Contract to buy or sell at a set price on a future date | An investor buys a crude oil contract for delivery next month at $75 per barrel | Traders speculating on price movements or hedging risk |

| Options Market | Right (but not obligation) to buy or sell at a specific price | A trader buys the option to purchase silver at $25/ounce within 60 days | Those wanting limited risk with potential for profit |

| ETF Market | Trade funds that track commodity prices like stocks | A beginner buys shares of a gold ETF instead of physical gold bars | New traders who want simple exposure without storage hassles |

The spot market handles immediate transactions. Futures and options involve contracts for later dates. ETFs provide an easy entry point for beginners. Choose the market that matches your goals and experience level.

Key Terms Every Beginner Should Know

Understanding basic commodity trading terms helps you make smarter decisions. Here are the essential concepts:

- Futures Contract: An agreement to buy or sell a specific commodity at a predetermined price on a set future date.

- Margin & Leverage: Margin is the deposit required to open a trade, while leverage lets you control large positions with small capital (e.g., $1,000 can control $10,000 worth of crude oil).

- Hedging vs. Speculation: Hedging protects against price changes (a farmer locks in wheat prices), while speculation aims to profit from price movements (a trader bets oil will rise).

- Long vs. Short Position: Going long means buying a commodity expecting prices to rise (buying silver futures), while going short means selling, expecting prices to fall (shorting natural gas).

- Roll-Over & Settlement: Roll-over extends a futures position to the next contract month before expiry, while settlement occurs when the contract ends and either cash or physical delivery takes place.

Pro Tip: Master these five terms before placing your first commodity trade. They form the foundation of all trading strategies.

Why Trade Commodities?

Commodities offer unique benefits that stocks and bonds can’t match. Here’s why traders add them to their portfolios:

- Portfolio Diversification: Commodities often move independently from stocks and bonds. When stock markets crash, gold prices usually climb. This balance protects your overall investment portfolio.

- Inflation Hedge: As living costs rise, commodity prices typically increase too. Gold and silver historically maintain value when currency loses purchasing power. If inflation hits 5%, oil and agricultural products often rise in tandem.

- Global Macro Exposure: Commodities reflect worldwide economic trends. China’s manufacturing boom drives copper demand higher. Bad weather in Brazil sends coffee prices soaring. You can profit from global events without investing directly in foreign markets.

- Liquidity and 24-Hour Trading: Major commodities like crude oil and gold trade almost non-stop across global exchanges. You can enter or exit positions quickly, even during market emergencies. Unlike real estate, you won’t wait weeks to sell.

These advantages make commodities attractive for both new and experienced traders looking to expand beyond traditional investments.

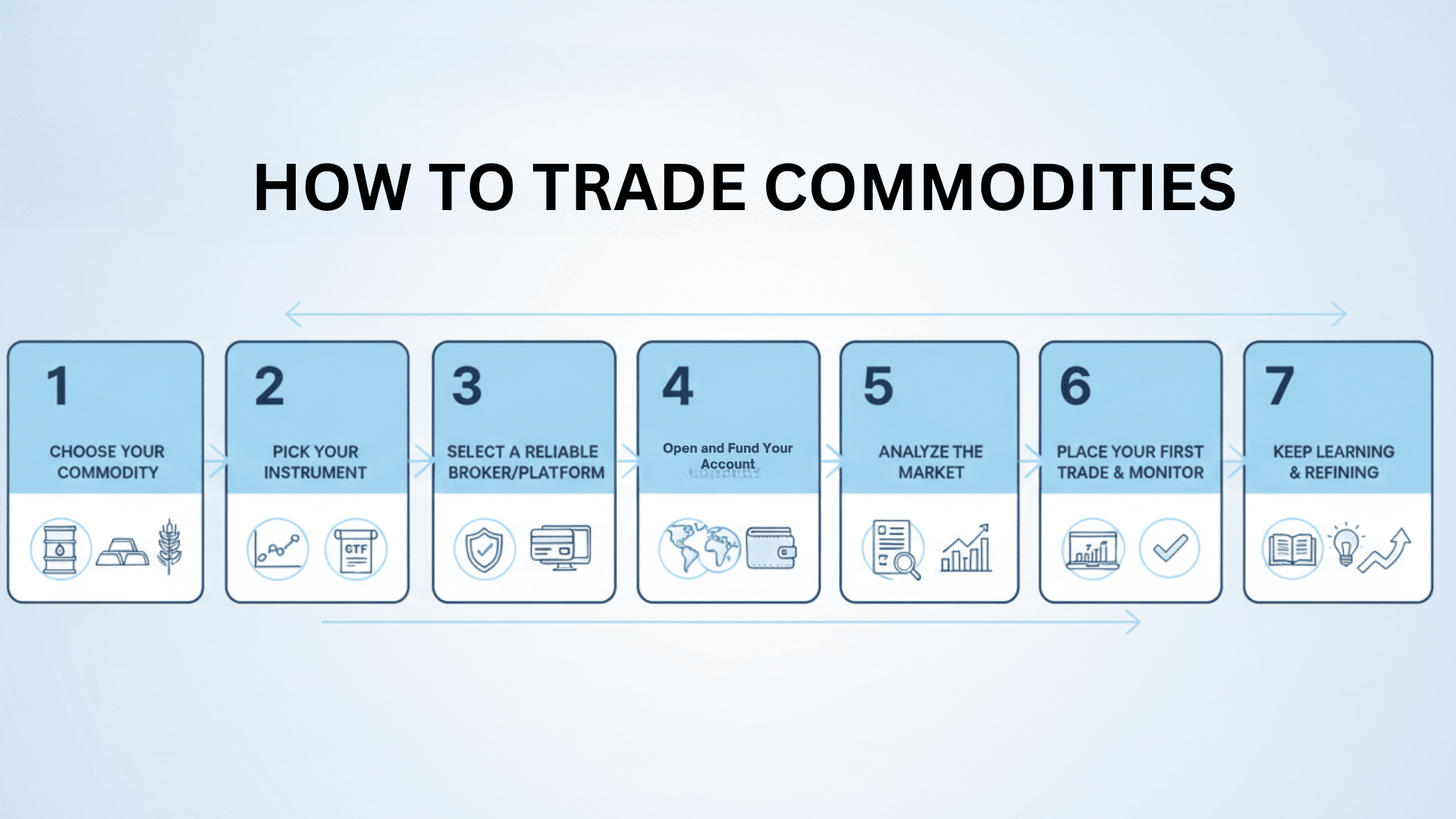

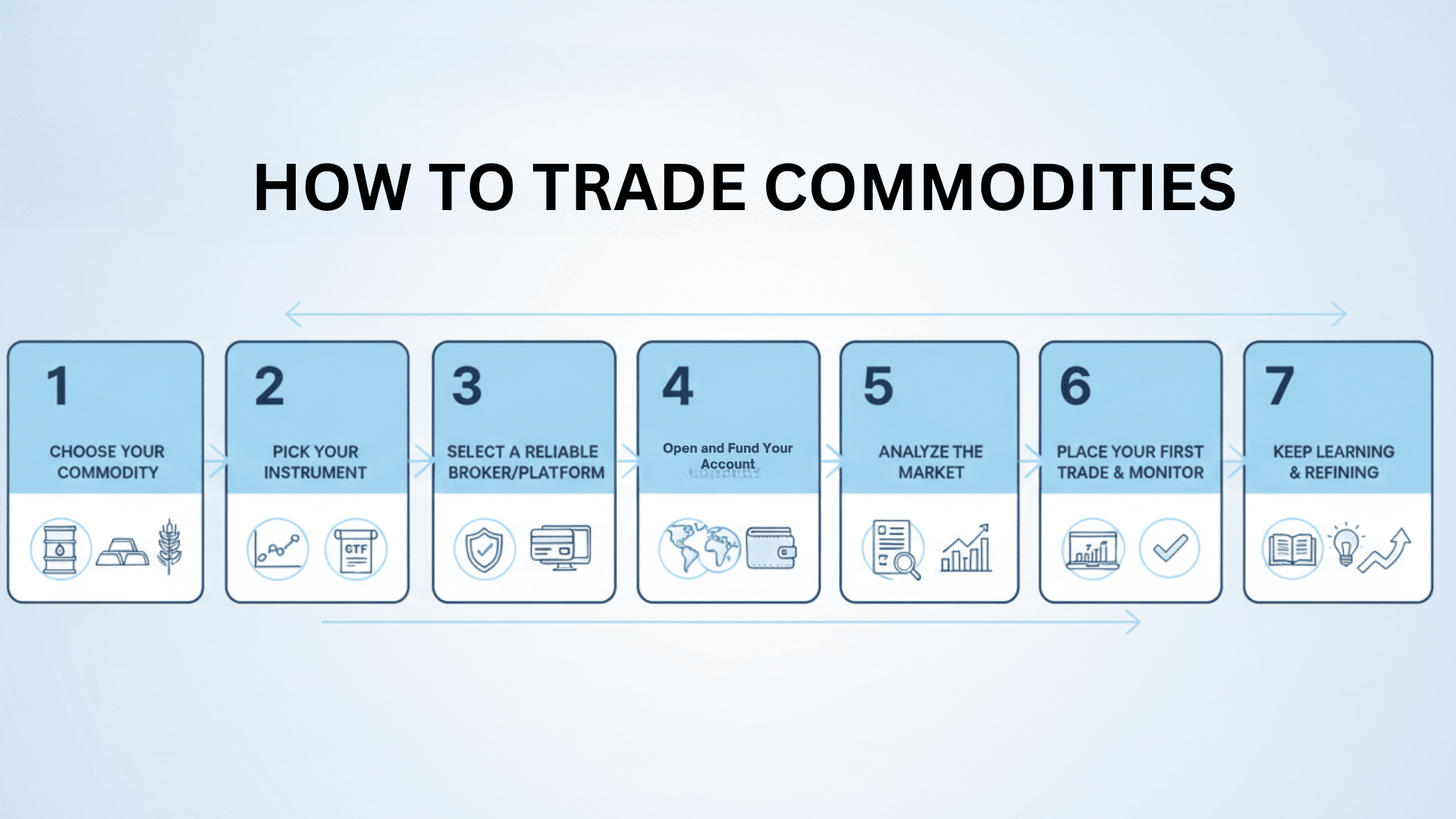

How to Trade Commodities: Step-by-Step Guide

Ready to start trading commodities? Follow these seven steps to build a solid foundation and make your first trade.

Step 1: Choose Your Commodity

Start with one commodity category that interests you. Energy traders might focus on crude oil or natural gas. Metal enthusiasts often begin with gold or silver.

Agricultural traders look at corn, wheat, or coffee. Pick a commodity you understand or can research easily. Don’t try to trade everything at once.

Step 2: Pick Your Trading Instrument

Decide how you want to trade your chosen commodity. Futures contracts offer direct exposure but require more capital and knowledge.

CFDs provide flexibility with lower entry costs. ETFs are simplest for beginners and trade like regular stocks. Your choice depends on your experience level, capital, and risk tolerance.

Step 3: Select a Reliable Broker/Platform

Choose a broker regulated by recognized authorities like the SEC, FCA, or CFTC. Check if they offer access to your preferred commodities and instruments.

Compare trading fees, platform usability, and customer support quality. Never trade with unregulated brokers, no matter how attractive their offers seem.

Step 4: Open and Fund Your Account

Complete the broker’s registration process with the required identification documents. Verify your account through email or phone confirmation.

Deposit funds using secure payment methods like bank transfer or credit card. Start with an amount you can afford to lose while learning.

Step 5: Analyze the Market

Fundamental Analysis: Study supply and demand factors affecting your commodity. Monitor weather patterns for agricultural products. Track geopolitical tensions for energy commodities. Watch industrial demand trends for metals like copper and aluminum.

Technical Analysis: Learn to read price charts and identify trends. Use indicators like moving averages, RSI, and support/resistance levels. Look for patterns that signal potential entry or exit points. Combine both analysis types for better trading decisions.

Step 6: Place Your First Trade and Monitor Performance

Start with a demo account to practice without risking real money. When ready, place small trades to test your strategy. Set stop-loss orders to limit potential losses.

Monitor your positions regularly, but avoid obsessive checking. Keep a trading journal to track what works and what doesn’t.

Step 7: Keep Learning and Refining Your Strategy

Review your trades weekly to identify patterns in wins and losses. Read commodity market news and analysis from trusted sources.

Adjust position sizes based on your growing experience. Never stop learning because commodity markets constantly change with global events.

Pro Tip: Paper trade for at least 30 days before risking real money. This builds confidence and reveals flaws in your strategy.

Risks Involved in Commodity Trading

Commodity trading offers opportunities but comes with serious risks. Understanding these dangers helps you protect your capital.

- Market Volatility: Commodity prices can swing wildly in minutes due to supply shocks, demand changes, or economic reports (oil dropped 25% in March 2020 during the pandemic).

- Geopolitical Events and Natural Disasters: Wars, sanctions, hurricanes, and droughts dramatically impact prices (Russia-Ukraine conflict sent wheat prices soaring by 40% overnight).

- Leverage Risks: Using borrowed money amplifies both gains and losses, meaning a small 5% price move against you can wipe out your entire account if over-leveraged.

How to Manage Risk Effectively?

- Stop-Loss Orders: Automatically exit trades when prices hit your predetermined loss limit (set a stop-loss 3% below your entry price on gold trades).

- Position Sizing: Never risk more than 1-2% of your total capital on a single trade (if you have $10,000, risk only $100-$200 per position).

- Diversification: Spread investments across different commodity types (combine energy, metals, and agriculture rather than putting everything in crude oil).

Pro Tip: Always use stop-loss orders on every trade. Even experienced traders get market direction wrong sometimes.

Commodity Trading Mistakes Beginners Must Avoid

New commodity traders often make similar errors that cost them money. Learn from these mistakes before they hurt your account.

| Mistake | Example | How to Avoid It |

|---|---|---|

| Ignoring Market Fundamentals | Trading crude oil without checking OPEC meetings or supply reports | Study weekly supply data, weather forecasts, and geopolitical news before trading |

| Over-Leveraging Trades | Using 10:1 leverage on volatile commodities like silver or crude oil | Risk only 1-2% per trade; use lower leverage until experienced |

| Trading Emotionally Without a Plan | Panic-selling gold during a dip or revenge-trading after losses | Write a trading plan with clear rules; follow it regardless of emotions |

| Neglecting News or External Events | Holding natural gas during pipeline disruptions or hurricanes | Check economic calendars daily; set price alerts for major announcements |

Key Takeaway: Most trading losses come from poor discipline, not bad markets. Avoid these mistakes and your success rate improves dramatically.

Top Commodity Trading Strategies for Beginners

Successful commodity trading requires a solid strategy. Here are five proven approaches that work for beginners and experienced traders alike.

1. Trend-Following Strategy

What It Is: Buy commodities when prices are rising and sell when they’re falling, riding the momentum until the trend reverses.

Example: Copper prices climb for three months due to construction demand. You enter long positions and hold them as the uptrend continues. Exit when prices start dropping consistently.

2. Breakout Strategy

What It Is: Trade when commodity prices break through key resistance or support levels, often triggering large price movements.

Example: Crude oil trades between $70 and $75 for weeks. After an OPEC meeting announces production cuts, oil breaks above $75. You buy immediately, expecting further gains.

3. Range Trading

What It Is: Buy at the bottom of a price range and sell at the top when commodities trade sideways within defined levels.

Example: Gold bounces between $1,900 and $1,950 for two months. You buy near $1,900 and sell near $1,950 repeatedly, profiting from predictable movements.

4. Seasonal Trading Approach

What It Is: Trade based on predictable seasonal patterns that affect supply and demand for certain commodities throughout the year.

Example: Natural gas prices typically rise before winter as heating demand increases. You buy natural gas futures in October and sell in January when demand peaks.

5. Hedging and Portfolio Balancing

What It Is: Use commodities to protect against losses in other investments or balance your overall portfolio risk exposure.

Example: Your stock portfolio drops during inflation fears. Gold positions rise simultaneously, offsetting losses and stabilizing your total account value.

Pro Tip: Master one strategy completely before trying others. Trend-following works well for beginners because it’s straightforward and easy to spot on charts.

Final Thoughts

Learning how to trade commodities opens doors to exciting market opportunities.

You now understand what commodities are, from gold and crude oil to coffee and natural gas. You know how different markets work and which trading instruments suit beginners best.

Start small and focus on one commodity type first. Master the basics before expanding your portfolio.

Use stop-loss orders, manage your position sizes, and never trade emotionally. Remember that successful traders learn continuously and adapt their strategies.

The commodity markets are waiting. Open a demo account today and practice these strategies risk-free. Test your analysis skills, refine your approach, and build confidence. When you’re ready, start with small real trades.

What commodity interests you most? Share your thoughts in the comments below, and let’s discuss your trading goals together.