After one of the sharpest market downturns in recent memory, investors everywhere are asking the same question: Will crypto recover?

The 2025 crash erased nearly $1 trillion in market value, shaking confidence across Bitcoin, Ethereum, and altcoins alike.

Panic spread through trading floors and Reddit threads. Portfolios that looked healthy in spring now sit deep in the red. Yet history shows that crypto has always bounced back, stronger, leaner, and more mature.

From the 2018 winter to the 2022 meltdown, every crash has been followed by a rally. The question isn’t if crypto will recover, but when and how.

In this article, we’ll unpack why the crypto market crashed, what’s changing beneath the surface, and the key signals that could point to a recovery in 2025 and beyond.

The Current State of the Crypto Market

The crypto landscape in late 2025 looks bruised but not broken.

Bitcoin trades near $55,000. Ethereum hovers below $2,000. The total crypto market capitalization has slipped to around $1.8 trillion, nearly half its mid-2024 peak.

Investor sentiment is mixed. Fear dominates retail markets. But institutional investors are quietly reassessing entry points. ETF outflows have slowed. Trading volumes, though muted, show stabilization, a pattern typical before long-term reversals.

Market veterans recognize these conditions. They’ve seen bear markets turn into opportunity zones. The key difference now? Infrastructure is stronger, regulation is clearer, and adoption continues despite the downturn.

Crypto has seen this movie before: volatility, correction, consolidation, and then resurgence.

Why Did Crypto Crash? Key Reasons Behind the Meltdown

The 2025 crypto crash wasn’t caused by a single event. It was a chain reaction. Multiple forces from global economics to internal market mechanics collided at once. Understanding these triggers helps answer the big question: Will crypto recover? Let’s break down what went wrong.

1. Macro Triggers

Global markets set the stage for crypto’s downturn. The broader economy was already struggling, and risk assets like crypto felt the pressure first.

- Sticky inflation and delayed interest rate cuts tightened liquidity: Central banks kept rates high longer than expected, draining capital from speculative markets.

- A strong U.S. dollar index (DXY) pressured risk assets: As the dollar strengthened, investors moved toward bonds and cash instead of crypto.

- Concerns about global trade tensions and slow growth led to broad “risk-off” sentiment: Economic uncertainty pushed capital away from volatile assets like Bitcoin and Ethereum.

Simply put, crypto fell not because it failed but because global liquidity dried up. When money becomes scarce, speculative investments suffer first.

2. Crypto-Native Factors

Inside the ecosystem, several technical issues intensified the crash. These were problems unique to crypto, not borrowed from traditional finance.

- A $19 billion leveraged liquidation wiped out over 1.6 million traders in just 48 hours: Overleveraged positions triggered a cascade of forced sell-offs across major exchanges.

- Stablecoin USDe briefly depegged, exposing weak collateral systems: The break below $1 shattered confidence in algorithmic stablecoins and raised systemic risk concerns.

- Binance’s $400 million liquidity support plan highlighted stress across exchanges: Emergency measures signaled deeper liquidity problems threatening the entire trading infrastructure.

- Miners capitulated as energy costs soared, adding selling pressure to Bitcoin: Unprofitable mining operations sold their Bitcoin holdings to cover rising electricity expenses.

These internal shocks turned a market correction into a full-blown crisis.

3. Behavioral & Regulatory Pressures

Human behavior turned a correction into a crash. Fear spread faster than facts, and unclear rules made everything worse.

- Retail investors panicked and sold into fear as social media amplified every dip: Negative sentiment went viral, creating a self-fulfilling prophecy of declining prices.

- Regulatory uncertainty in the U.S., particularly around staking and stablecoins, cooled speculative activity: Without clear legal frameworks, both retail and institutional investors stayed away.

- Delays in ETF approvals frustrated institutional players who prefer clarity before re-entry: Major funds waited on the sidelines until regulatory conditions improved.

Each of these elements combined to form a “perfect storm.” It brought crypto markets to their knees but also cleared the path for healthier growth ahead.

Structural Reset: The October 2025 Leverage Flush

Every crypto cycle has a moment of capitulation, a painful but necessary reset. October 2025 was exactly that.

A historic leverage flush wiped out excessive margin positions. It brought open interest in Bitcoin futures to its lowest level since 2021. This “cleansing event” removed speculative froth. It paved the way for a healthier market structure.

Analysts call this a structural reset. Funding rates normalized. Volatility dropped. The market began showing the kind of calm that often precedes recovery.

Insight: In past cycles, similar leverage flushes (like March 2020 and May 2021) were followed by strong rebounds within 6–12 months.

Historical Context: How Crypto Recovers After Every Crash

History doesn’t repeat, but it often rhymes. Crypto has survived multiple brutal downturns, and each time, it has come back stronger. The pattern is clear: crash, rebuild, recover, and surge.

Every major crash, from 2018’s winter to 2022’s meltdown, has been followed by a new bull cycle. The 2025 crash fits this pattern. Understanding past recoveries helps us see where the market might head next.

Typical Recovery Phases:

-

Panic, Massive sell-offs, and liquidations: Fear dominates. Prices drop fast. Weak hands exit. Overleveraged positions get wiped out. This phase feels endless, but usually lasts weeks, not months.

-

Base Building, Prices stabilize at strong support levels: Volatility decreases. Prices move sideways. The market finds a floor. Long-term holders stop selling. This quiet phase can last several months.

-

Accumulation, Smart money re-enters quietly: Institutional investors and experienced traders start buying again. Volume stays low. Prices inch up slowly. The public doesn’t notice yet.

-

Breakout, Retail momentum returns, sparking a bull run: Positive news triggers a surge. FOMO kicks in. Retail investors flood back. Prices break resistance levels. The next cycle begins.

Bitcoin’s halving cycles have historically aligned with recovery. The halving reduces the new Bitcoin supply by 50%, creating scarcity. With the next halving expected in mid-2026, many analysts believe the foundation for the next surge could form throughout 2025.

Will crypto recover? History says yes, with patience and timing. Every previous crash ended in recovery. The 2025 downturn likely won’t be different. The question isn’t if, but when.

Early Signs of Recovery of Crypto to Watch in 2025

There are already subtle but important signs the market may be turning a corner:

- ETF Flows Turning Positive: After months of outflows, Bitcoin spot ETFs have started seeing net inflows, an early indicator of renewed institutional trust.

- On-Chain Accumulation: Long-term holders (“whales”) are quietly accumulating Bitcoin at current price levels.

- Exchange Reserves Declining: Fewer coins sitting on exchanges suggest investors are moving assets into cold storage, a bullish sign.

- Volatility Compression: Narrowing price ranges often precedes big directional moves.

- AI Sentiment Models: Machine learning analysis of crypto-related news and tweets shows improving optimism.

Individually, these may seem minor. Together, they form a crypto recovery narrative.

Crypto Market Predictions: What Experts Expect Next

Experts remain cautiously optimistic about the year ahead.

| Asset | 2025 Base Case | Bullish Case | Key Drivers |

|---|---|---|---|

| Bitcoin (BTC) | $70,000–$90,000 | $120,000+ | ETF inflows, halving anticipation |

| Ethereum (ETH) | $2,500–$3,000 | $4,000+ | L2 adoption, institutional DeFi |

| Solana (SOL) | $120–$180 | $250 | Developer ecosystem growth |

| XRP | $0.75–$1.20 | $1.50+ | Legal clarity, cross-border partnerships |

Analysts from firms like Glassnode and CoinMetrics agree that the hardest part of the downturn is over. The next phase will likely be slow rebuilding, not explosive growth, but steady, fundamental-driven recovery.

Bitcoin forecast 2025 looks promising once liquidity returns.

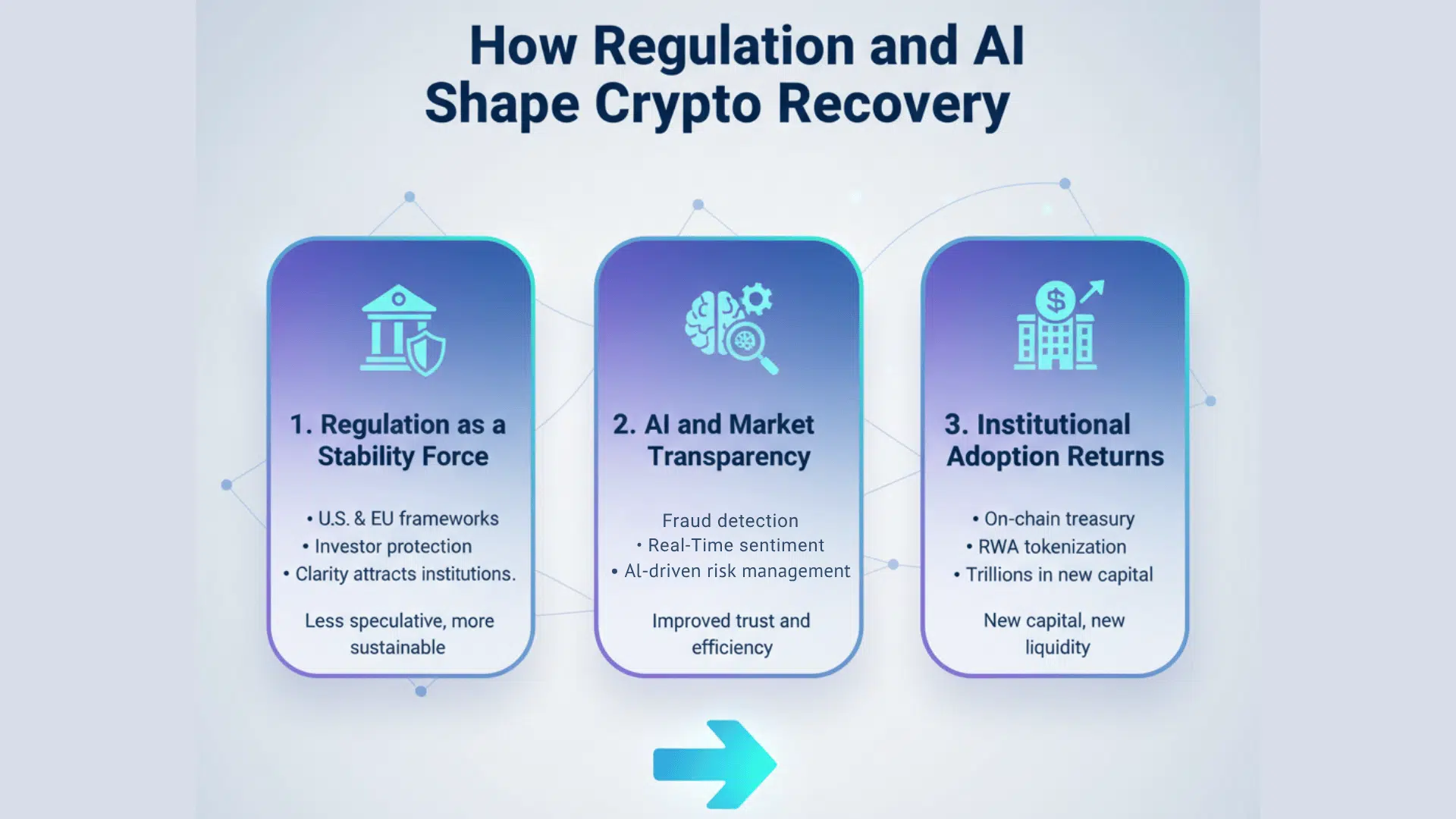

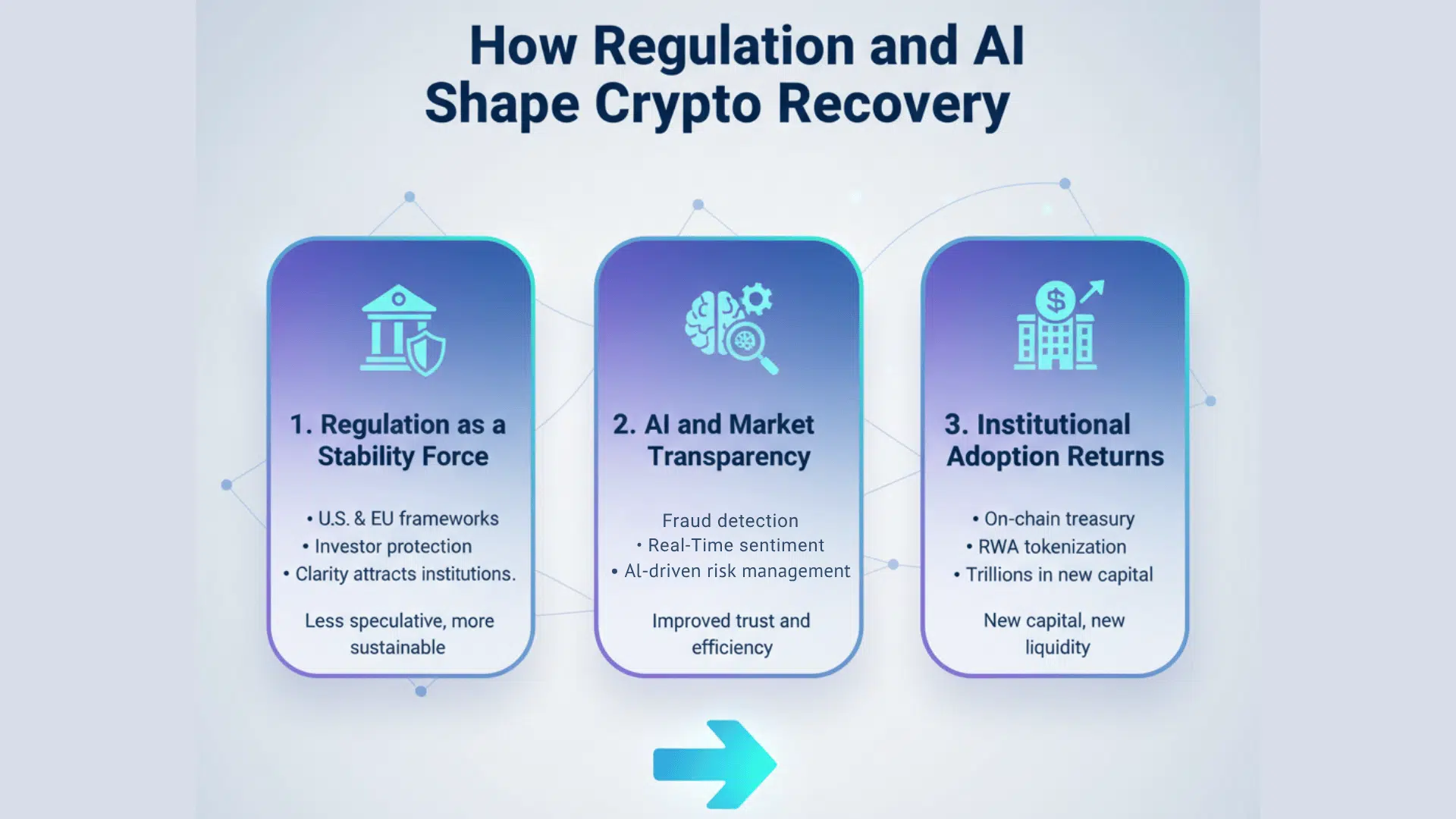

How Regulation and AI Shape Crypto Recovery

Regulation and technology are now the twin engines of crypto’s next era. These forces are reshaping how markets operate, who participates, and how quickly crypto recovery can happen.

1. Regulation as a Stability Force

U.S. and EU regulators are finally defining clear frameworks for stablecoins and digital assets. After years of uncertainty, governments are creating rules that protect investors without stifling innovation.

Clarity attracts institutions. It makes future cycles less speculative and more sustainable.

2. AI and Market Transparency

Artificial intelligence is improving market monitoring, fraud detection, and real-time sentiment tracking. AI tools now scan millions of transactions, flagging suspicious activity before it spreads.

AI-driven portfolio tools help investors manage risk more intelligently through automated rebalancing and predictive analytics.

3. Institutional Adoption Returns

Post-crash, major funds and corporations are exploring on-chain treasury management again. Companies like MicroStrategy never stopped accumulating Bitcoin.

Blockchain-based payments and tokenization of real-world assets (RWA) are regaining traction, bringing trillions in traditional assets onto blockchain rails.

All these developments are rebuilding trust, the most important ingredient for recovery. Trust brings capital. Capital brings liquidity. Liquidity fuels the next bull cycle.

How to Invest in a Recovering Crypto Market?

Wondering what to do while waiting for crypto to recover? Here’s a practical, no-hype roadmap. These strategies help you survive the downturn and position yourself for the upswing.

1. Focus on Risk Management

Risk management separates survivors from casualties in crypto markets. Over-leveraging killed portfolios during the crash. Don’t repeat those mistakes.

- Avoid leverage until volatility stabilizes: Margin trading amplifies losses during uncertain times; wait for clearer trends before using borrowed capital.

- Keep a diversified portfolio: 60% major coins (BTC/ETH), 20% quality altcoins, 20% cash/stables: Diversification protects against single-asset collapses while keeping you ready to buy dips.

2. Use Dollar-Cost Averaging (DCA)

Invest small, fixed amounts at regular intervals. It smooths volatility. It builds exposure without emotion-driven timing.

DCA removes the pressure of “buying the bottom.” You buy high, you buy low, and over time, your average cost evens out. This strategy works especially well during uncertain markets like 2025.

3. Track These Key Indicators

Data beats guesswork every time. Watch these metrics to gauge when crypto recovery is truly underway.

- ETF Net Flows: Positive = institutional re-entry – When Bitcoin ETFs show consistent inflows, it signals big money is returning with confidence.

- Exchange Reserves: Falling = accumulation – Fewer coins on exchanges mean investors are moving assets to cold storage for long-term holding.

- Funding Rates: Neutral or slightly positive = healthy market – Extreme funding rates signal overleveraged positions; neutral rates show balanced sentiment.

4. Avoid Emotional Trading

FOMO and panic-selling destroy portfolios. Stick to data, not headlines. Markets reward patience and punish emotion.

When prices surge, resist the urge to chase pumps. When they crash, avoid selling in panic. Have a plan. Follow it. Adjust based on data, not fear or greed.

Pro Tip: Create a watchlist of 5–7 projects with strong fundamentals not hype tokens. Follow development progress, not just price. Real builders keep building through bear markets. Those are the projects that survive and thrive in the next cycle.

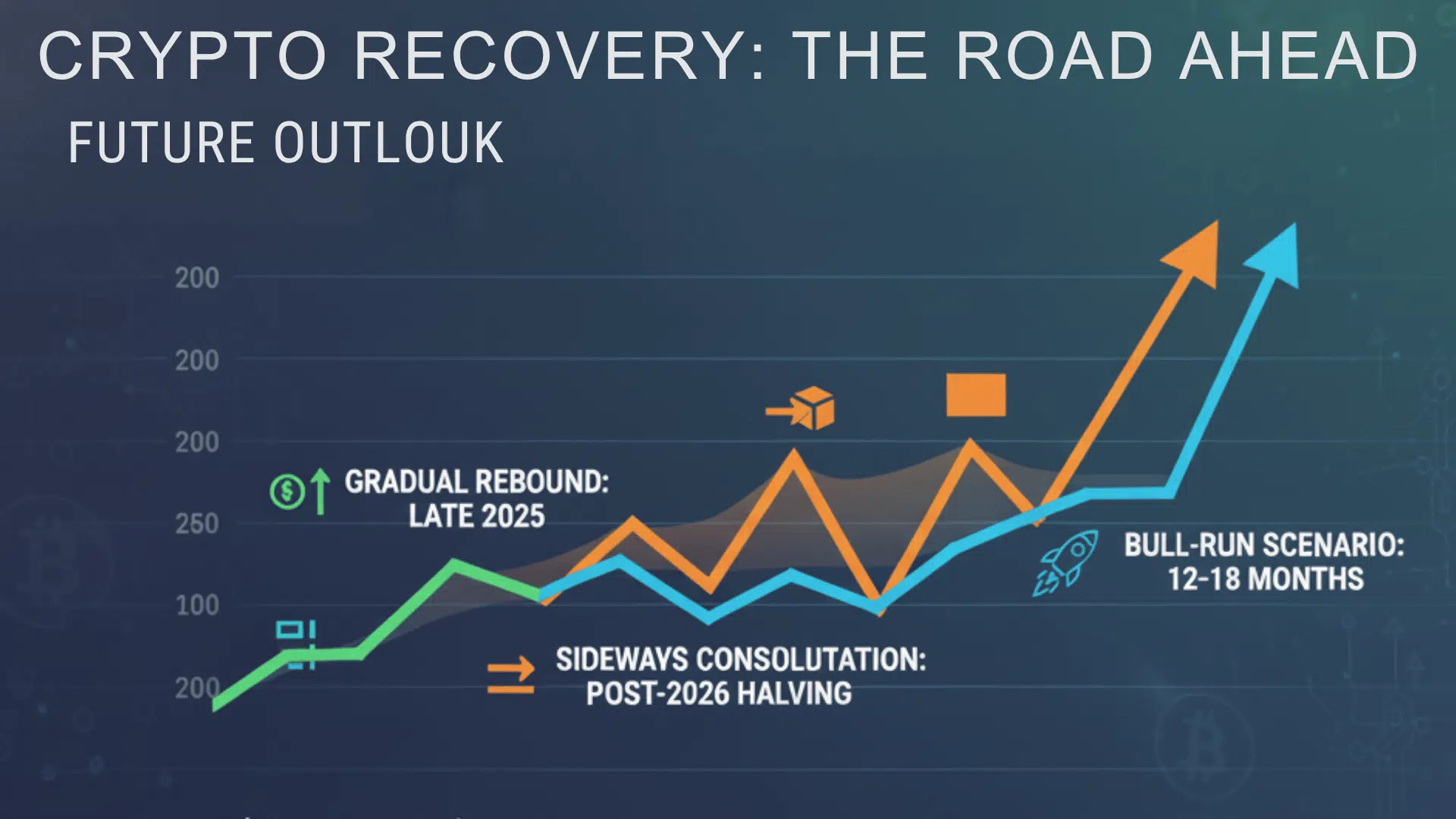

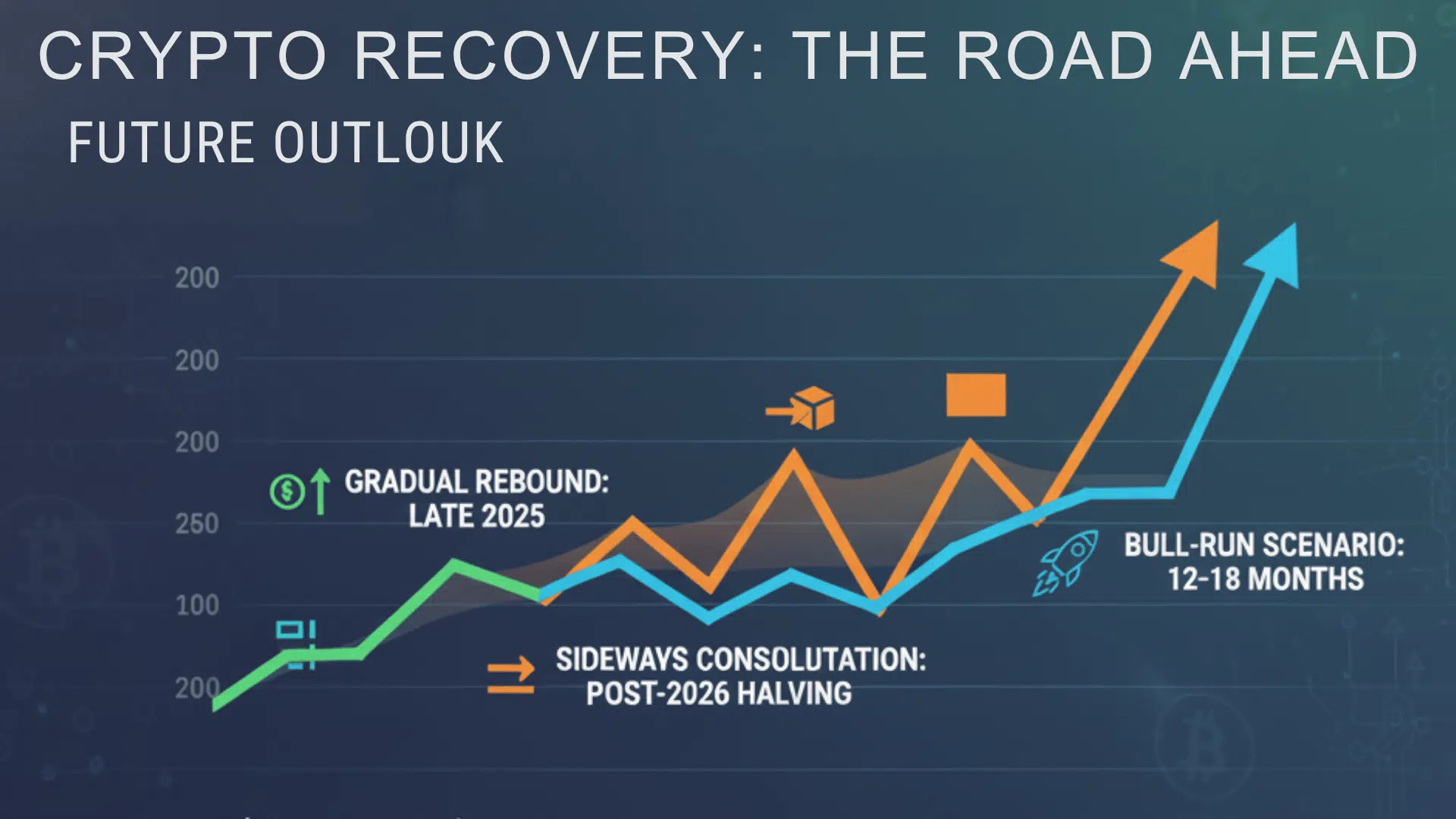

Future Outlook: When Could Crypto Fully Recover?

There’s no single date on the calendar for recovery. The timeline depends on macroeconomic conditions, regulatory developments, and market sentiment. But analysts outline three possible scenarios based on current trends.

- Gradual Rebound: Slow ETF inflows and mild macro improvement lead to recovery by late 2025. If inflation cools and central banks ease rates gradually, institutional money could return steadily, pushing prices higher step by step.

- Sideways Consolidation: Extended range trading continues until the 2026 halving triggers new inflows. Without major catalysts, the market might trade sideways through early 2026, building energy for a post-halving surge.

- Bull-Run Scenario: Rapid liquidity expansion plus regulatory clarity creates new highs within 12–18 months. If global liquidity improves quickly and U.S. crypto regulations become clearer, the market could rally faster than expected.

Recovery Timeline (Illustrative):

| Phase | Period | Market Behavior |

|---|---|---|

| Crash | Q3 2025 | Panic, liquidation |

| Base-Building | Q4 2025 | Stabilization, accumulation |

| Recovery | Q2–Q3 2026 | Gradual uptrend |

| Expansion | Late 2026 | Bull-run ignition |

The deeper the reset, the stronger the eventual rally. Markets that clear excess leverage and weak projects often see healthier, more sustainable growth cycles.

Crypto market outlook for 2026 is cautiously optimistic. The pieces are falling into place. Patience and positioning matter more than timing the exact bottom.

The Bottom Line

The question “will crypto recover?” isn’t about if, it’s about when.

2025’s crash was brutal but also cleansing. Excess leverage is gone. Regulation is improving. Fundamentals are quietly strengthening beneath the surface.

Crypto has reinvented itself after every storm, and this one will be no different. The crypto rebound is coming. It’s just a matter of timing, patience, and smart positioning.

Stay informed. Stay patient. Stay invested in knowledge.

What’s next for you? If you found this helpful, subscribe to our newsletter for weekly insights on crypto trends, market analysis, and upcoming recovery signals.

Share your thoughts in the comments below. Do you think we’ll see a full crypto recovery in 2025?