Ever bought an option and watched it lose money even when the stock barely moved? That’s theta at work, the silent killer of option value.

Here’s the problem: most traders focus only on stock direction. They pick calls or puts based on whether they think the price will rise or fall. But they ignore time. And time costs money every single day you hold an option.

This guide will show you exactly how theta works, why it matters, and how you can use it to your advantage. You’ll learn when time decay hits hardest, how to protect yourself as a buyer, and how to profit from it as a seller.

Stop letting theta drain your account. Let’s turn time into your trading edge.

What is Theta in Options?

Theta tells you how much money your option loses each day. Think of it like watching ice melt; even if nothing else changes, your option’s value slowly drips away.

Example: If your option has a theta of –0.05, you’re losing about $5 per day per contract.

That happens because options have expiration dates. The closer you get to expiry, the less time there is for the stock to move in your favor.

Here’s the interesting part:

- Theta works against you if you buy options.

- Theta works for you if you sell them.

Buyers watch their option value shrink daily. Sellers collect that same decay as profit. In options trading, time literally is money.

How Theta Works: The Concept of Time Decay

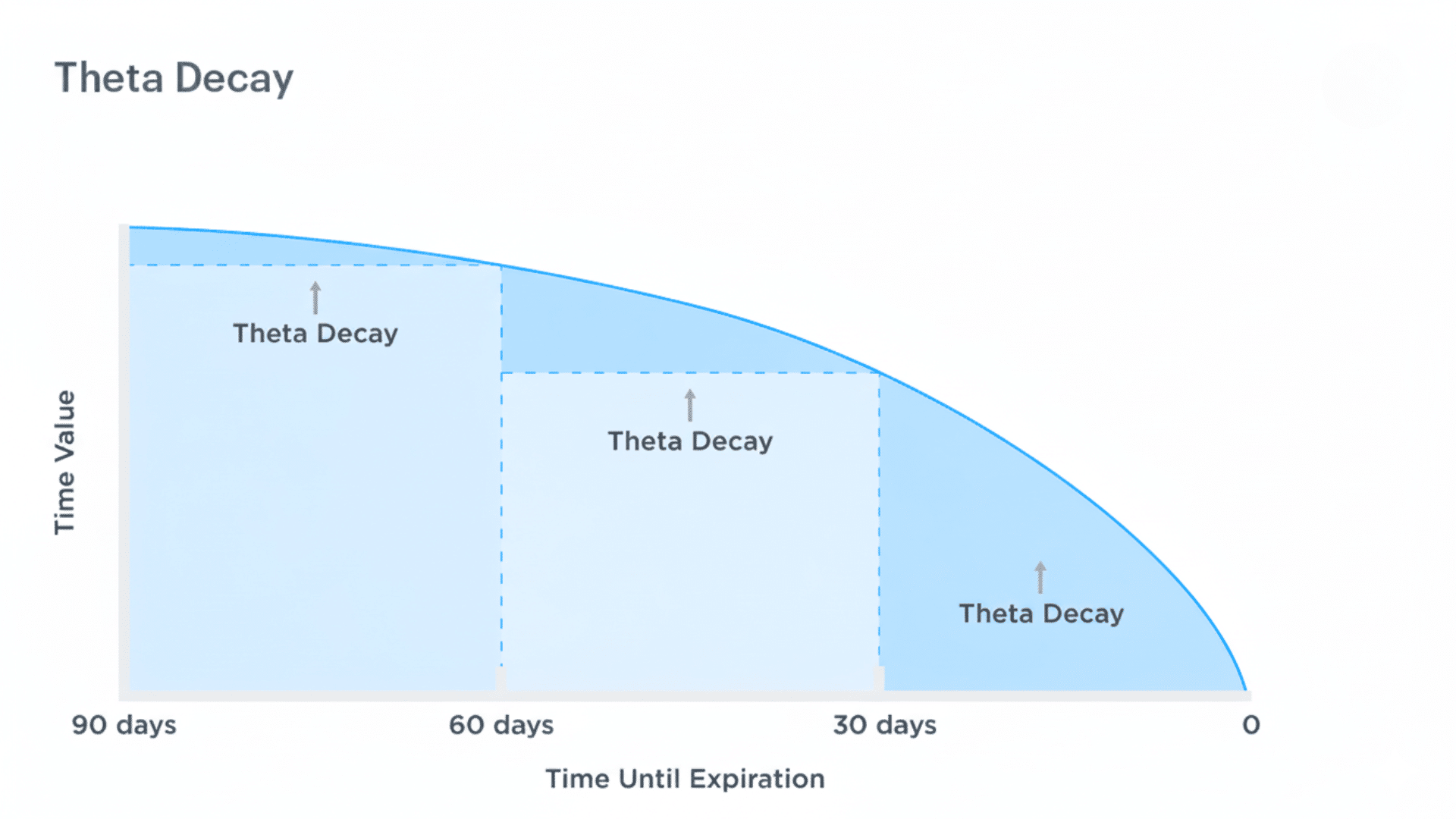

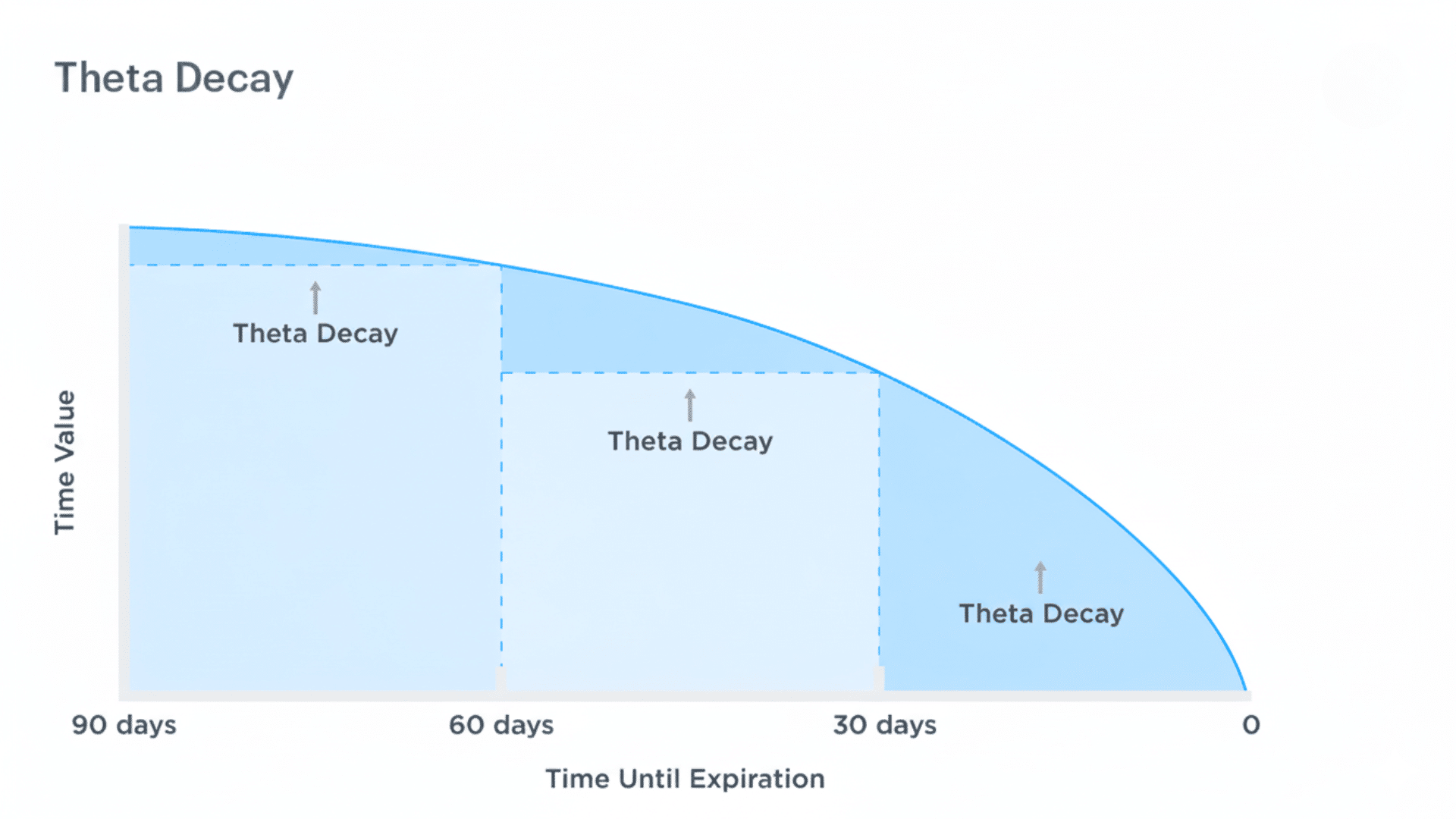

Every option’s price has two parts:

- Intrinsic value: What it’s worth if exercised today.

- Time value: The extra premium traders pay for the possibility of future movement.

Theta eats away at that time value.

When you have 60 days left, anything could happen. The stock might surge or crash. There’s a possibility. But as expiration nears, those possibilities fade. That shrinking window causes time value to melt like ice cream in the sun.

By expiration day, if the option isn’t already profitable, that time value is gone. Zero. This slow erosion is time decay, and theta measures how fast it happens.

Quick Formula and Math Corner

In pricing models like Black-Scholes, theta measures the rate of change in option price over time. You don’t need to crunch the math; trading platforms display theta automatically.

Just remember:

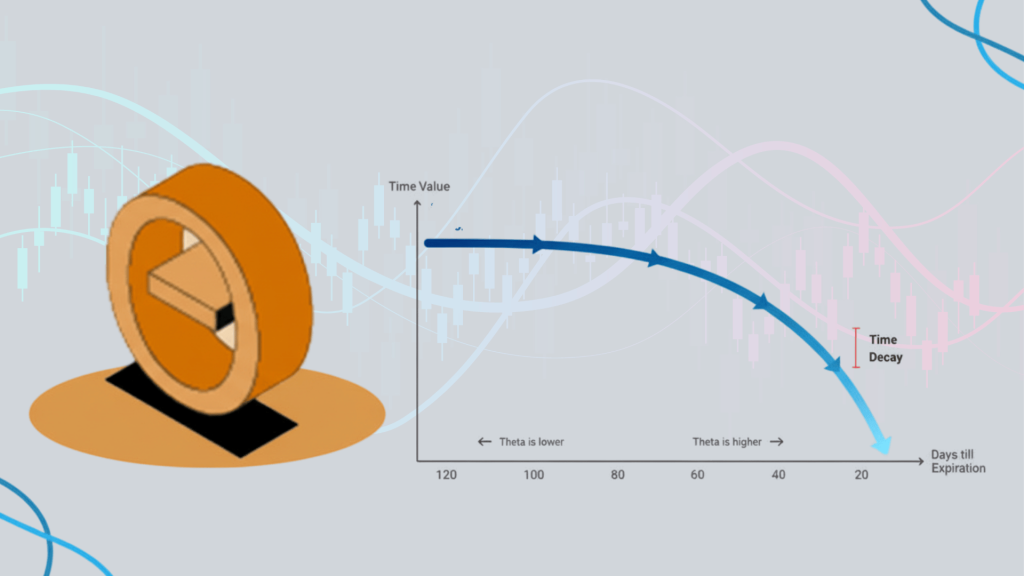

- Theta speeds up as expiration approaches.

- Long-term options lose pennies per day.

- Near-expiry options can lose dollars daily, like a snowball rolling downhill faster and faster.

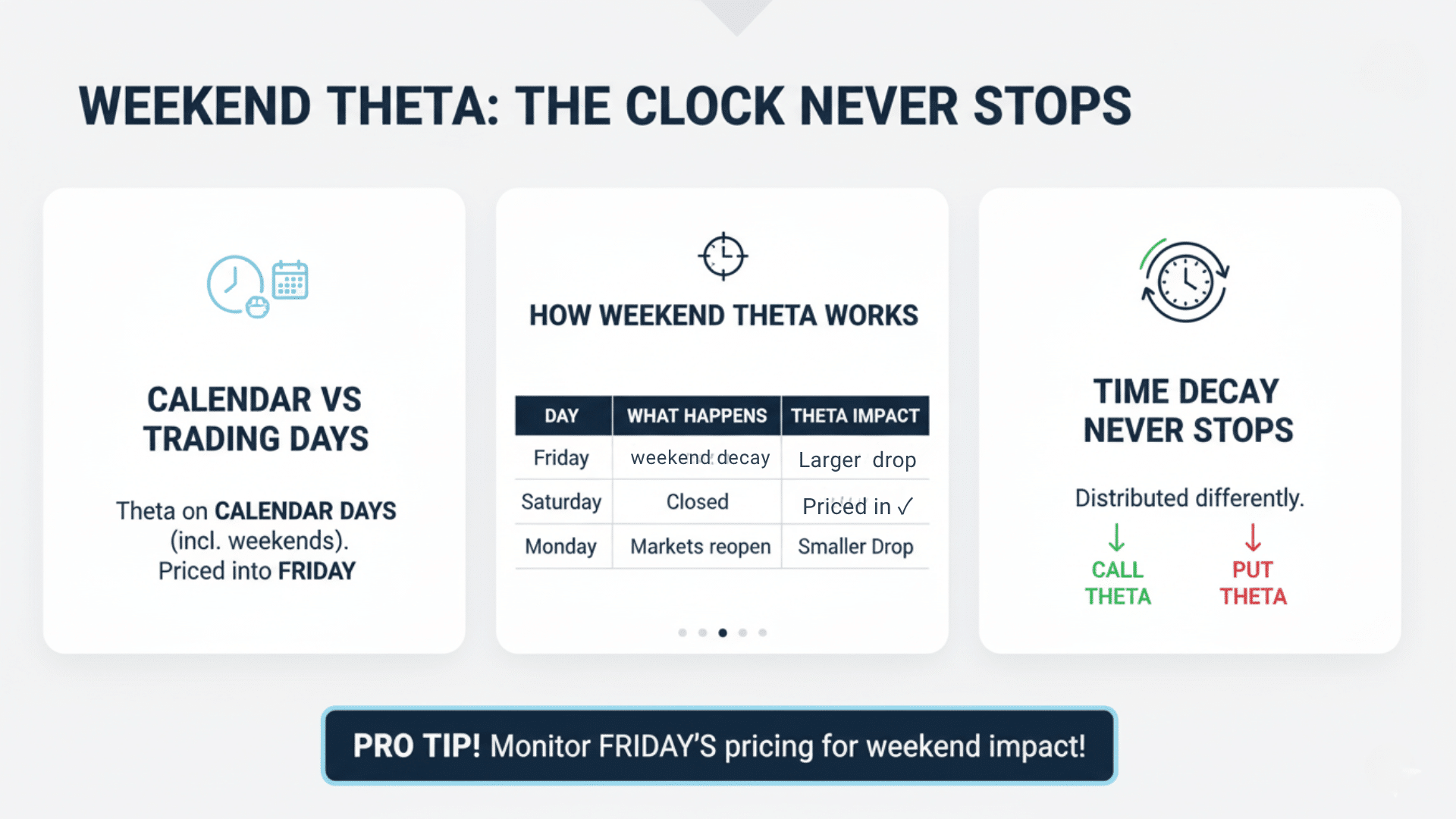

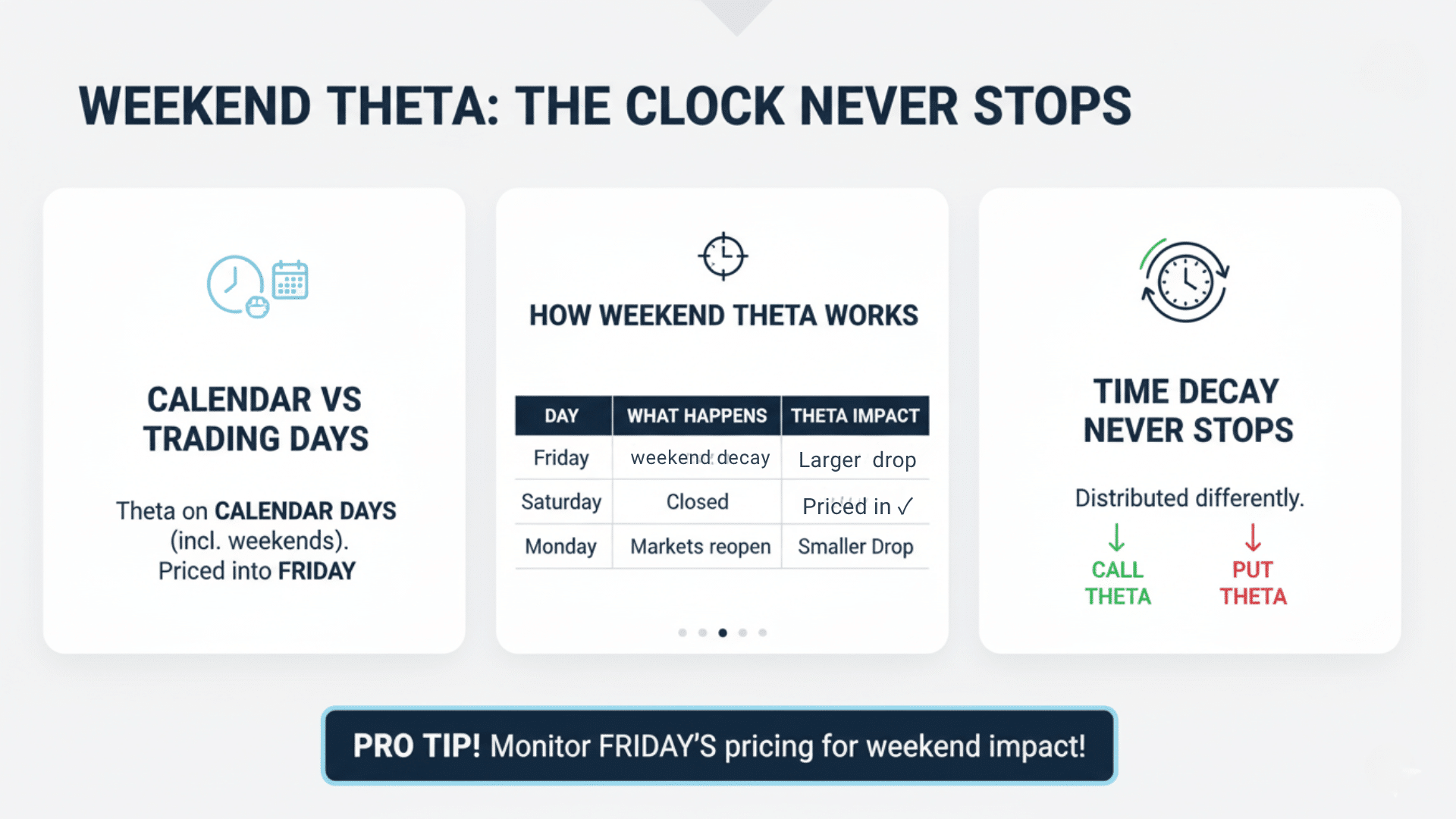

Calendar vs. Trading Days: Does Theta Decay on Weekends?

Here’s something that confuses many traders: Does your option lose value on Saturday and Sunday when markets are closed? The answer is yes and no.

Most brokers calculate theta based on calendar days, which includes weekends. But here’s the twist: the weekend decay usually gets baked into Friday’s pricing.

So when Monday rolls around, your option doesn’t suddenly drop by three full days of theta. Market makers are smart. They adjust prices on Friday to account for the upcoming weekend.

They factor in volatility shifts and adjust their bid-ask spreads, too. This can make the weekend impact appear smaller or even disappear from your account.

How Weekend Theta Actually Works:

| Day | What Happens | Theta Impact |

|---|---|---|

| Friday | Markets price in weekend decay | Larger than normal drop |

| Saturday | Markets closed | Decay already priced in |

| Sunday | Markets closed | Decay already priced in |

| Monday | Markets reopen | Smaller drop than expected |

Time decay never stops. It just gets distributed differently than you might expect. The clock keeps ticking, even when trading doesn’t.

Where Theta Hits Hardest

Theta doesn’t hit all options equally. Some positions decay faster, depending on three key factors.

1. Moneyness Matters Most

At-the-money options have the highest time value and, therefore, the biggest theta loss. In-the-money and out-of-the-money options decay more slowly because they have less time value to lose.

2. Time to Expiration Changes Everything

Options with months left decay slowly. Once you enter the final 30 days, theta accelerates. The final two weeks are brutal. This “theta curve” looks like a hockey stick lying on its side: slow at first, then sharply steep near the end.

3. Volatility Can Soften the Blow

High implied volatility inflates option prices, giving theta more cushion to burn through. When IV is low, decay feels harsher because there’s less time value to lose.

Theta Impact by Time Frame:

| Option Type | Days to Expiration | Theta Impact (per day) |

|---|---|---|

| Long-term | 90+ days | Slow decay: –0.01 to –0.03 |

| Medium-term | 30–60 days | Moderate decay: –0.04 to –0.06 |

| Near-expiry | Rapid decay: –0.07 to –0.12 |

The closer you get to expiration, the faster your option loses value. This acceleration is sharp, sudden, and unforgiving. That’s why short-term options can feel like they’re on fire in those final days.

Positive vs. Negative Theta: Who Benefits and Who Loses

Theta creates winners and losers in options trading, and which side you’re on depends entirely on whether you’re buying or selling. It’s a zero-sum game where one trader’s loss becomes another’s gain.

- Buyers: You’re paying for time, so the concept of theta works against you from day one. You must be right not only about direction but also timing, and quickly.

- Sellers: You’re selling time to others. Each passing day brings profit, provided the option expires worthless. That’s why experienced traders often say, “Sell time, don’t buy it.”

Who Wins and Who Loses:

| Position Type | Theta Sign | Effect of Time | What It Means |

|---|---|---|---|

| Long Call / Long Put | Negative (–) | Time erodes value | Buyer loses value daily |

| Short Call / Short Put | Positive (+) | Time benefits the seller | The seller collects decay as income |

The math is simple. Option buyers pay for time, and each day incurs a cost. Option sellers sell time, and every day can bring profit if the option expires worthless. Choose your side wisely.

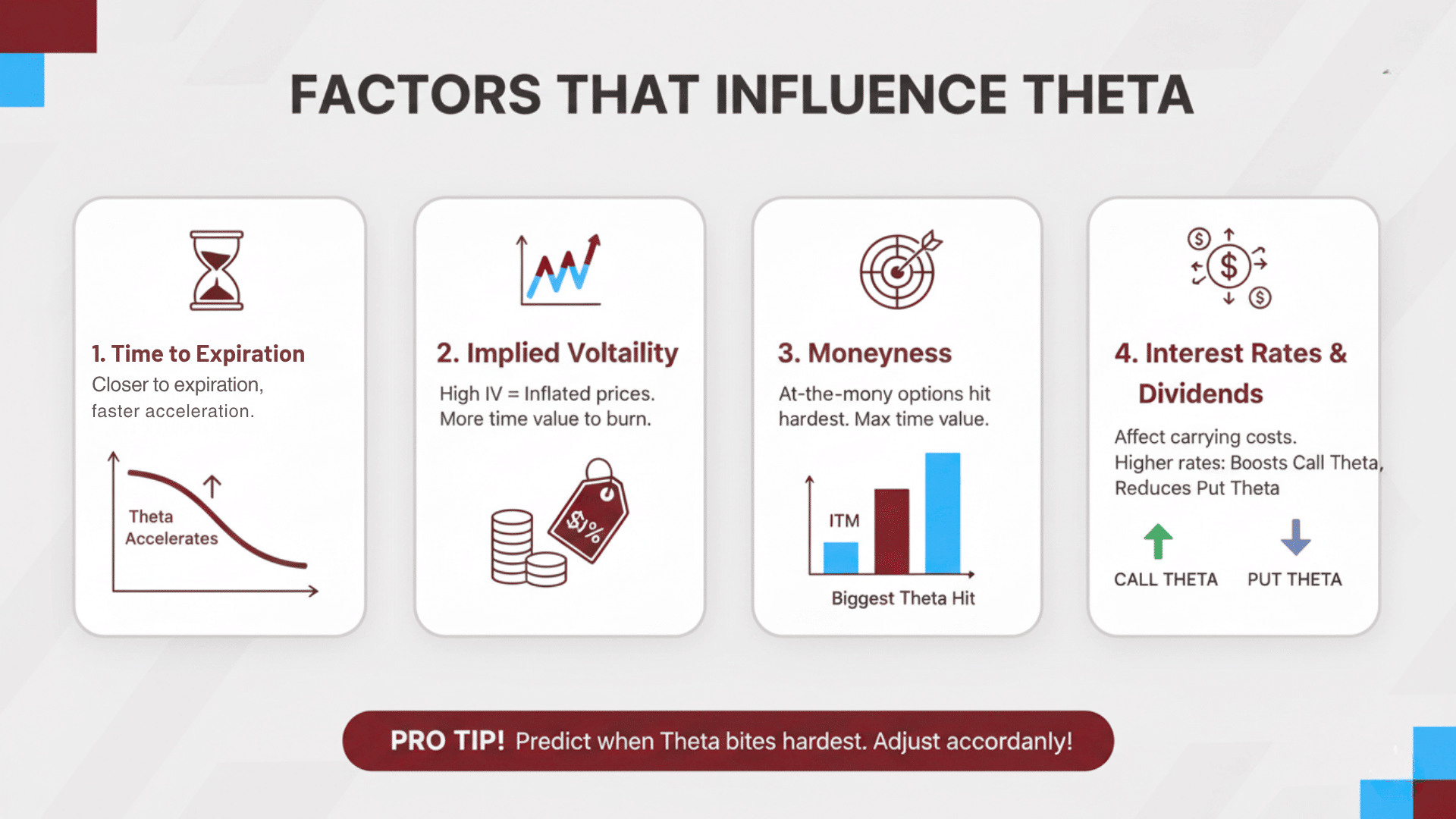

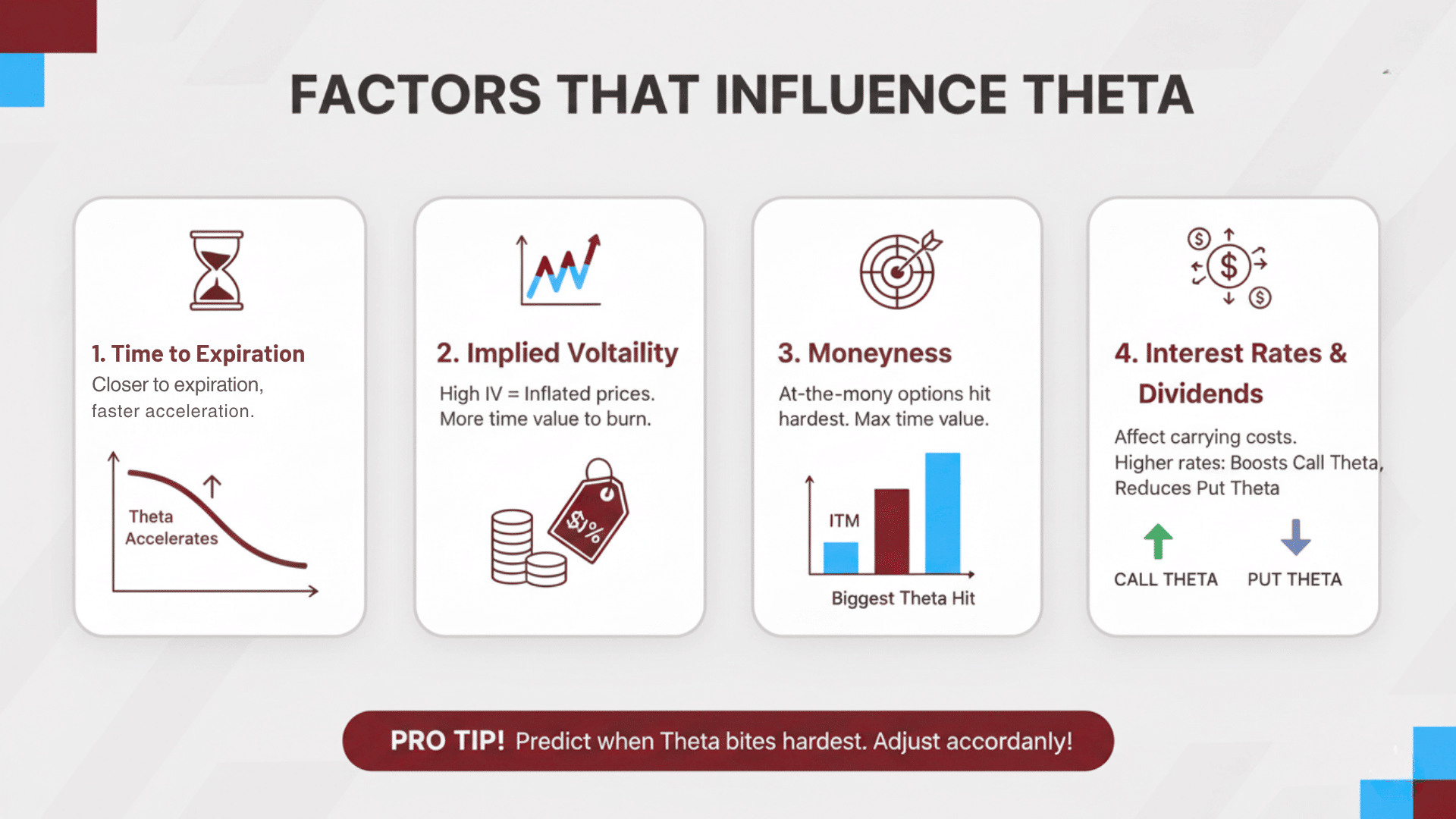

Factors That Influence Theta

Theta doesn’t operate in a vacuum. Several factors control how fast your option loses value, and understanding them helps you predict what’s coming next.

1. Time to Expiration

The closer you get to expiration, the faster theta accelerates. An option with 90 days left might lose $3 per day. With 10 days left, that same option could lose $10 or more per day. Short-term options are theta’s favorite target because there’s less time cushion to absorb the decay.

2. Implied Volatility

When implied volatility spikes, option prices inflate because traders expect bigger moves. This extra premium gives your option more time value to burn through. Higher IV doesn’t stop theta, but it can make daily losses feel smaller.

3. Moneyness

At-the-money options take the biggest theta hit. They have maximum time value and minimum intrinsic value, which means decay has the most room to work.

In-the-money options have built-in real value that somewhat protects them. Out-of-the-money options already have little value, so there’s less to lose in absolute dollars, though the percentage loss can still sting.

4. Interest Rates and Dividends

Interest rates affect the cost of carrying positions, which impacts how calls and puts are priced.

Dividends matter too because they influence when it makes sense to exercise early. Higher rates generally boost call theta slightly while reducing put theta.

Understanding how these factors interact gives you an edge. You can predict when theta will bite hardest and adjust your trades accordingly.

Theta and the Other Greeks

Theta never operates in isolation. It’s constantly interacting with the other Greeks, and understanding these relationships is key to managing risk and maximizing profit.

- Vega vs. Theta: Vega measures sensitivity to changes in volatility. Rising volatility can boost option value faster than theta decays it. Falling volatility can make theta hit harder.

- Gamma vs. Theta: Gamma shows how fast your delta changes as the price moves. Near expiration, ATM options have both high gamma and high theta, creating fast gains or losses and intense time decay.

Balancing the Greeks

Skilled traders use delta-neutral or gamma-neutral strategies to isolate theta and earn from time decay directly. Examples include iron condors, calendars, and butterfly spreads.

How the Greeks Interact:

| Greek | What It Measures | How It Affects Theta |

|---|---|---|

| Vega | Volatility sensitivity | Can offset or amplify theta decay |

| Gamma | Delta change rate | Affects how theta impacts overall position |

| Delta | Directional exposure | Neutral delta lets theta work cleanly |

The best traders don’t just watch theta. They observe how all the Greeks work together to shape the behavior of their positions over time.

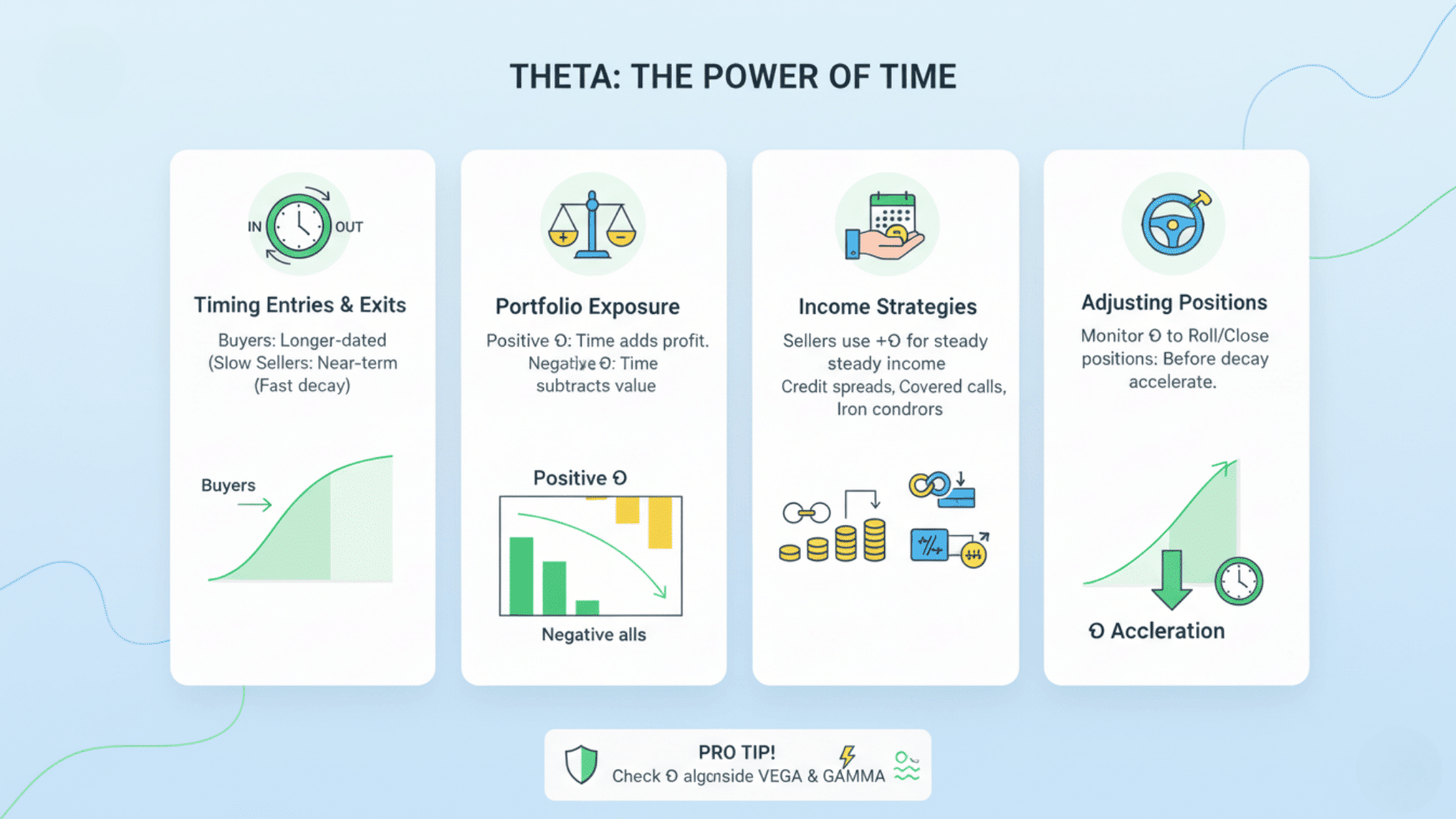

How Are the Theta Greeks Used?

Theta is more than a number. It’s a tool traders use to manage time risk and profit from it.

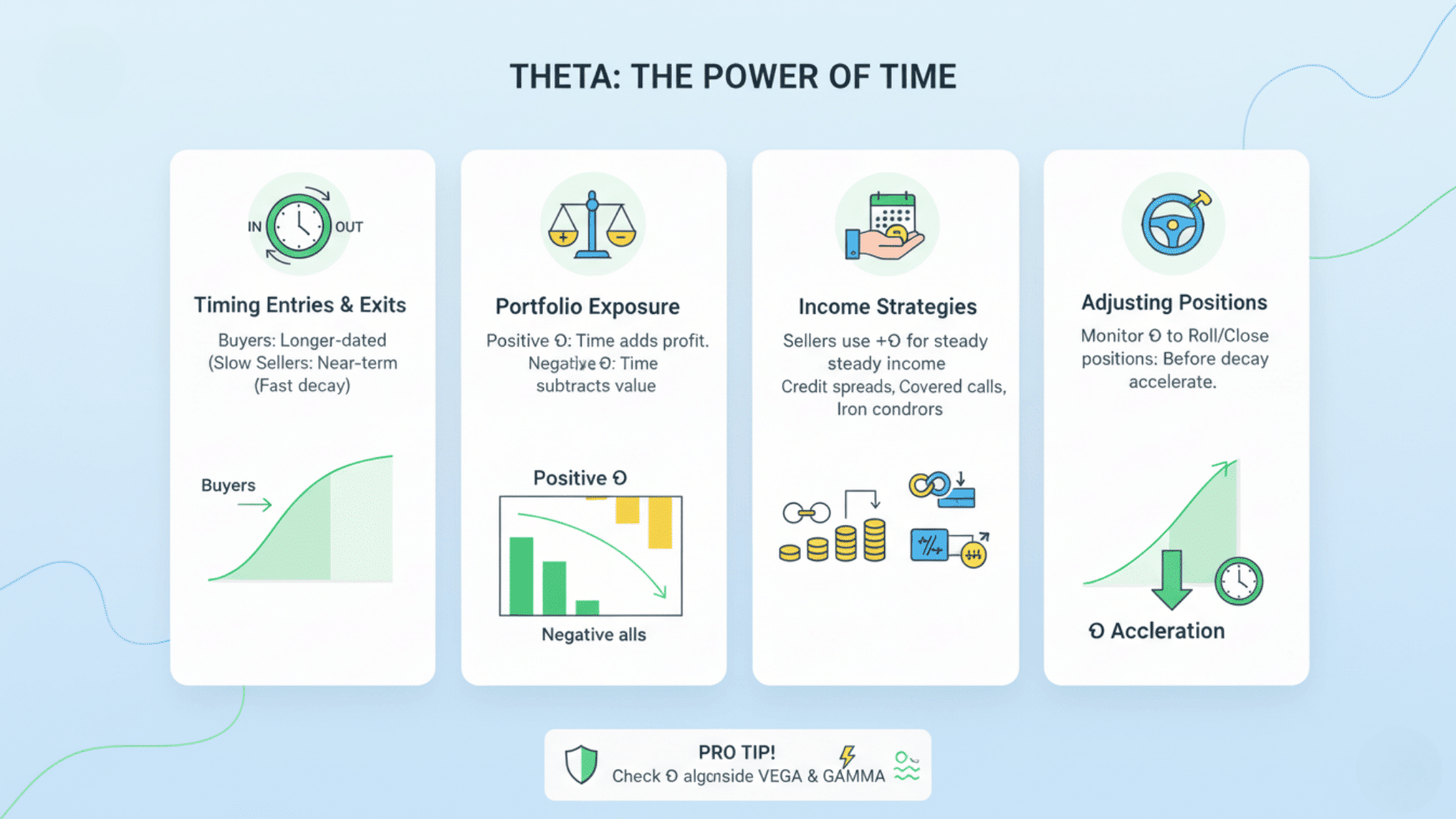

1. Timing Entries and Exits

Theta helps traders decide when to enter or exit. Buyers prefer longer-dated options with slower decay. Sellers target near-term expirations for faster decay.

2. Measuring Portfolio Exposure

Professional traders track net portfolio theta. Positive theta means time decay adds profit. Negative theta means time decay subtracts value.

3. Designing Income Strategies

Option sellers rely on positive theta to generate steady income from credit spreads, covered calls, or iron condors. They’re selling time itself and collecting premium as the clock ticks down.

4. Adjusting Positions

Monitoring theta helps traders know when to roll or close positions before decay accelerates sharply. It’s about timing your exit or adjustment before theta goes into overdrive.

Pro Tip: Always check theta alongside vega and gamma. A strong positive theta looks great — until volatility spikes or price moves fast.

Theta-Based Trading Strategies

If you’re tired of watching Theta drain your account, it’s time to flip the script. Instead of fighting time decay, make it work for you. Here are the strategies that let you collect money while the clock ticks.

Strategies That Profit from Theta

- Credit Spreads let you sell options with limited risk and earn daily theta decay. You win if the stock stays within your range or moves in your favor.

- Iron Condors are perfect for quiet, range-bound markets. You sell both a call spread and a put spread, creating a profit zone in the middle.

- Covered Calls give you theta income while holding stock you already own. You sell calls against your shares and collect a premium.

- Calendar and Diagonal Spreads combine long and short-term options to balance theta gain with protection.

If You’re Buying Options

Choose expirations 60 to 90 days out to slow theta’s impact. Roll positions early, before the final 30 days, when decay accelerates. Trade around earnings or volatility events where vega can offset theta.

In short, decide whether you want to pay rent or collect it.

Example: Theta in Action

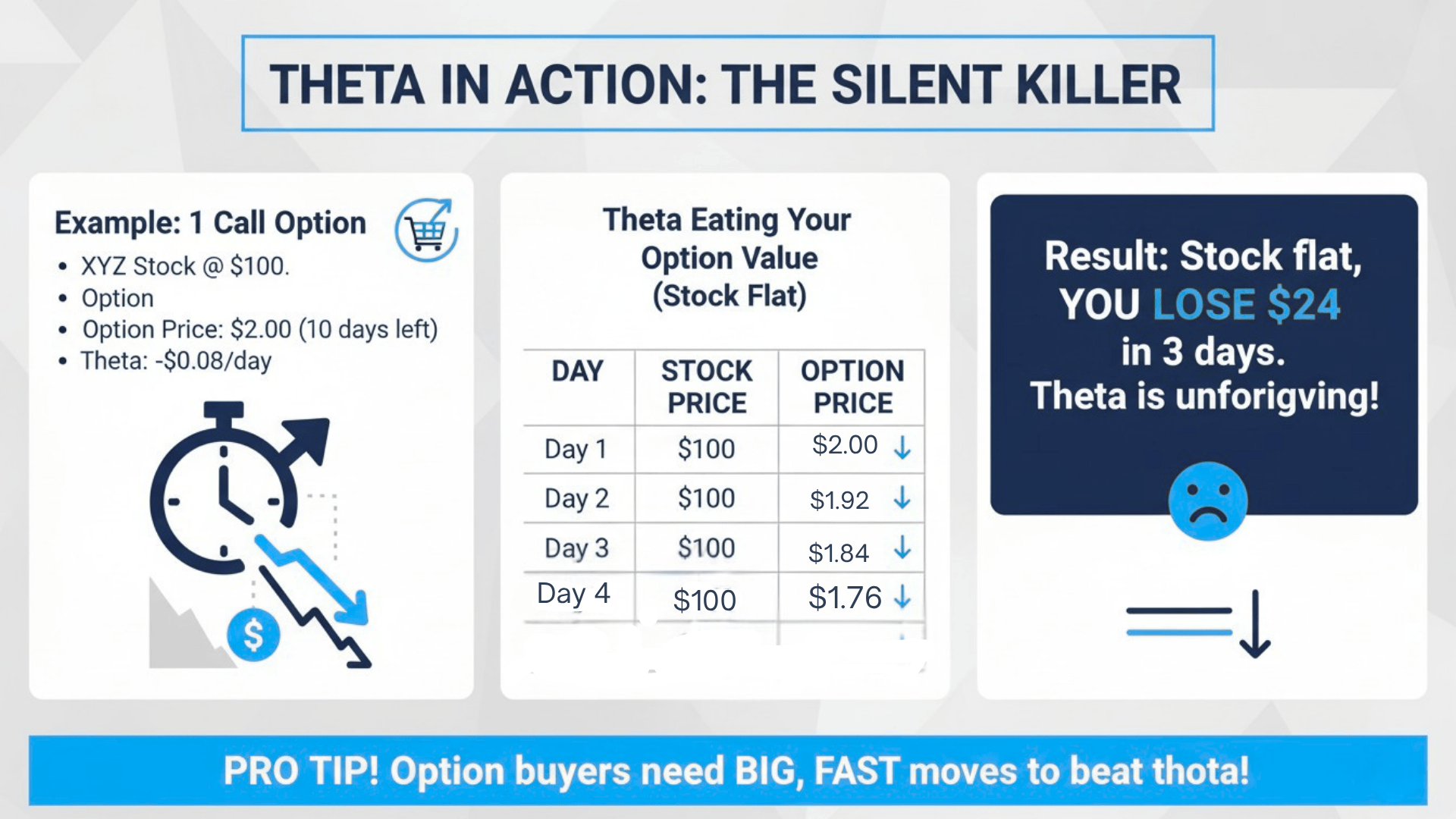

Imagine you buy a call option on XYZ stock for $2.00 per share (that’s $200 per contract). The option has 10 days until expiration, and its theta is –0.08.

The stock price is sitting at $100, and you’re hoping it climbs. But here’s what actually happens when the stock doesn’t move at all.

Theta Eating Your Option Value:

| Day | Stock Price | Option Price | Daily Theta Impact |

|---|---|---|---|

| Day 1 | $100 | $2.00 | – |

| Day 2 | $100 | $1.92 | –$0.08 ($8 loss) |

| Day 3 | $100 | $1.84 | –$0.08 ($8 loss) |

| Day 4 | $100 | $1.76 | –$0.08 ($8 loss) |

Notice the pattern? The stock price stays perfectly flat at $100. Nothing changed fundamentally. No news. No movement. Yet your option loses $8 per day like clockwork. That’s $0.08 per share times 100 shares per contract.

By day 4, you’re down $24 on a $200 investment, that’s a 12% loss in just three days, and the stock hasn’t budged an inch. This is theta in its purest form.

Time is literally money, and it’s bleeding out of your position every single day. If the stock had moved up, you might have offset this decay. But when it sits still, theta is unforgiving. This is why option buyers need strong, fast moves to win.

Summing It Up

Theta is the force you can’t ignore in options trading. It quietly drains value from buyers and quietly builds profit for sellers. Every day the clock ticks, theta is working, either for you or against you.

The key takeaway? Understand which side of theta you’re on. If you’re buying options, choose longer expirations and trade around volatility spikes. If you’re selling, use strategies like credit spreads and iron condors to collect that daily decay as income.

Time never stops. But now you know how to work with it instead of against it.

Ready to put theta to work? Start tracking it in your next trade. Watch how it moves. Test these strategies with small positions first. Share your theta wins or losses in the comments below!