Options trading can feel overwhelming. Greeks, strikes, premiums, it’s a lot to track. But here’s the truth: if you understand Delta, you’re already ahead of most traders.

Delta tells you how much your option’s price moves when the stock moves by $1. It’s that simple. Yet this one number helps you predict profits, manage risk, and build smarter hedges.

Delta is part of the Options Greeks, a set of metrics that measure different risks. While Theta tracks time decay and Vega measures volatility, Delta focuses on price sensitivity and directional exposure.

In this guide, you’ll learn what Delta means, how to read Delta values, and how professional and retail traders use it every day. By the end, you’ll know exactly how Delta impacts your trades and your bottom line.

What Is Delta in Options Trading?

Delta tells you how much an option’s price will change when the stock moves by $1. Think of it as a sensitivity meter. If you own a call option with a Delta of 0.60, and the stock goes up by $1, your option gains about $0.60 in value.

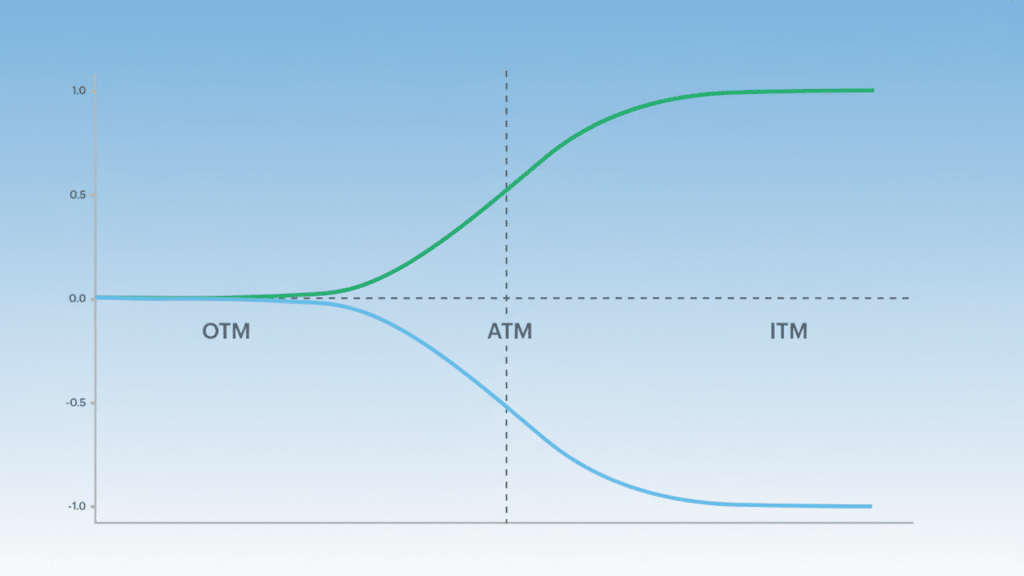

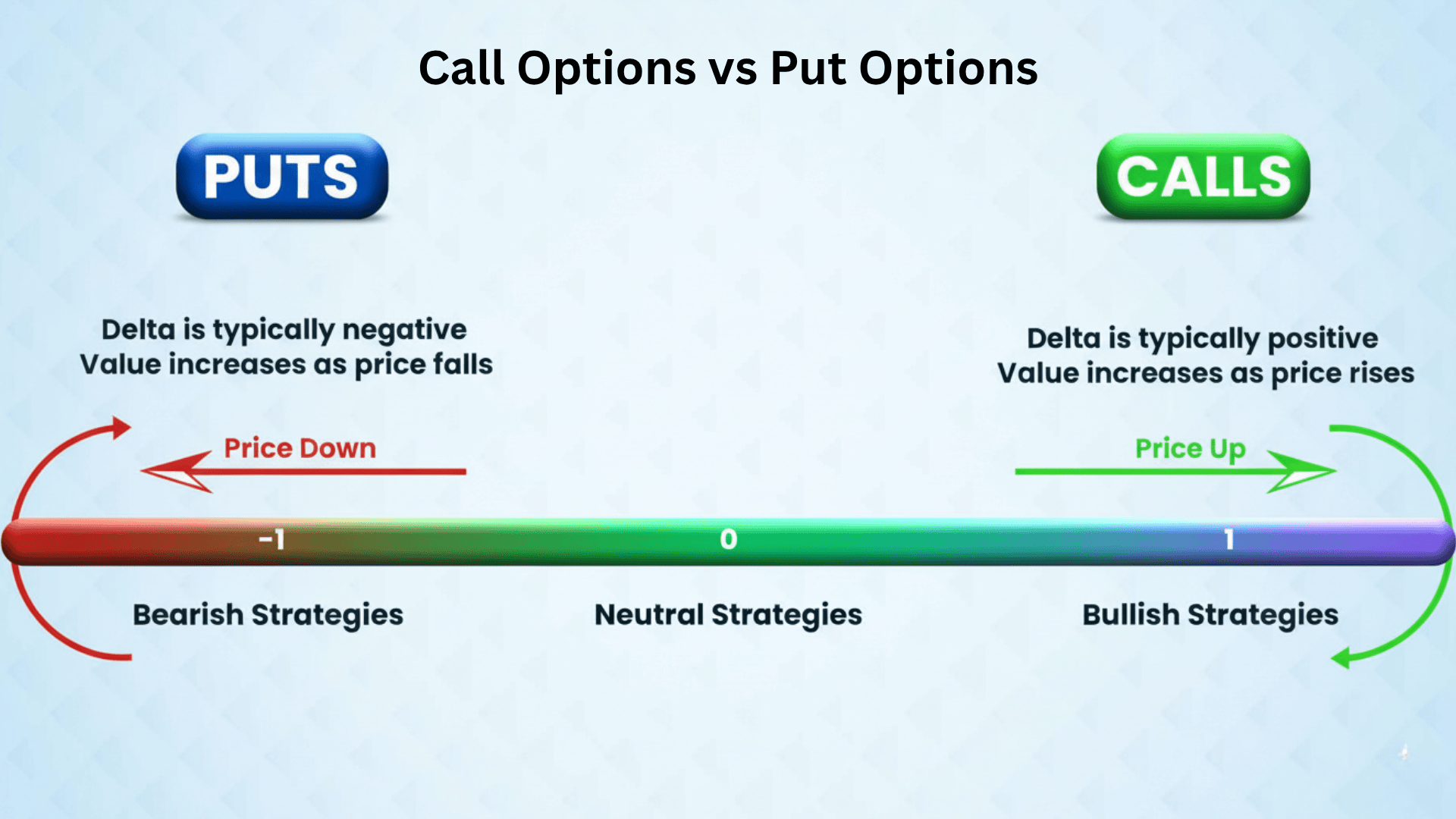

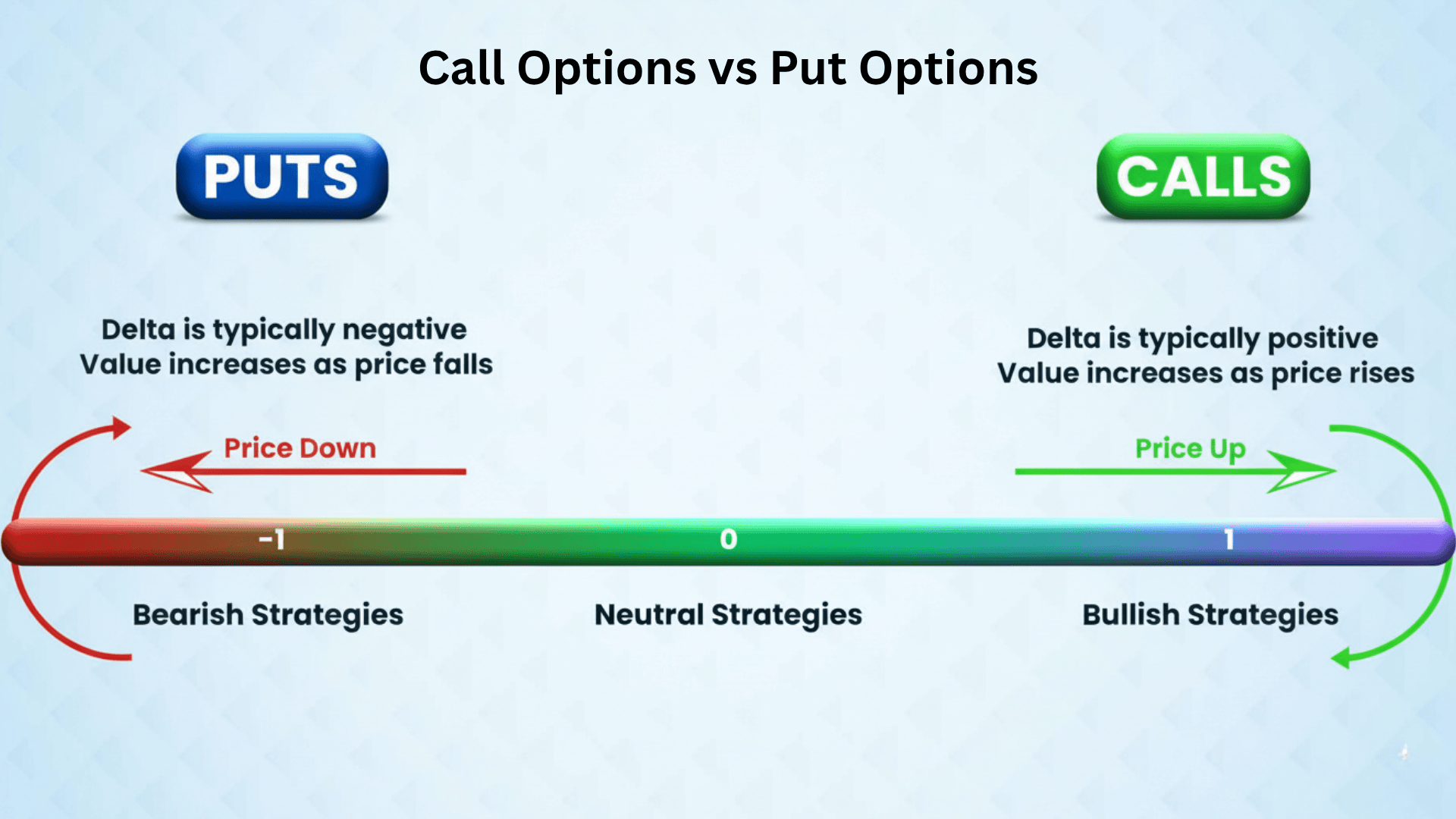

Delta ranges from -1.0 to +1.0, depending on whether you’re trading calls or puts. It’s one of the most practical tools for understanding how your position reacts to price movement.

Delta for Call Options vs Put Options

| Option Type | Delta Range | What It Means |

|---|---|---|

| Call Options | 0 to +1.0 | Positive Delta. The option price rises when the stock price goes up. A Delta of +0.70 means the call gains $0.70 for every $1 increase in stock price. |

| Put Options | 0 to -1.0 | Negative Delta. The option price rises when the stock price falls. A Delta of -0.50 means the put gains $0.50 for every $1 drop in stock price. |

Key Takeaway: Calls move with the stock. Puts move against it. Delta shows you exactly how much.

The Formula and Calculation of Delta

Delta is calculated using the Black-Scholes model, a mathematical formula that considers the stock price, strike price, time to expiration, volatility, and interest rates.

You don’t need to do the math yourself. Most trading platforms show Delta automatically. The concept is simple: Delta measures the rate of change between the option price and the stock price.

For example, if a call option has a Delta of 0.6, a $1 increase in the stock price raises the option’s value by $0.60. If the stock drops by $1, the option loses $0.60. Delta acts like a prediction tool, helping you estimate gains or losses before they happen.

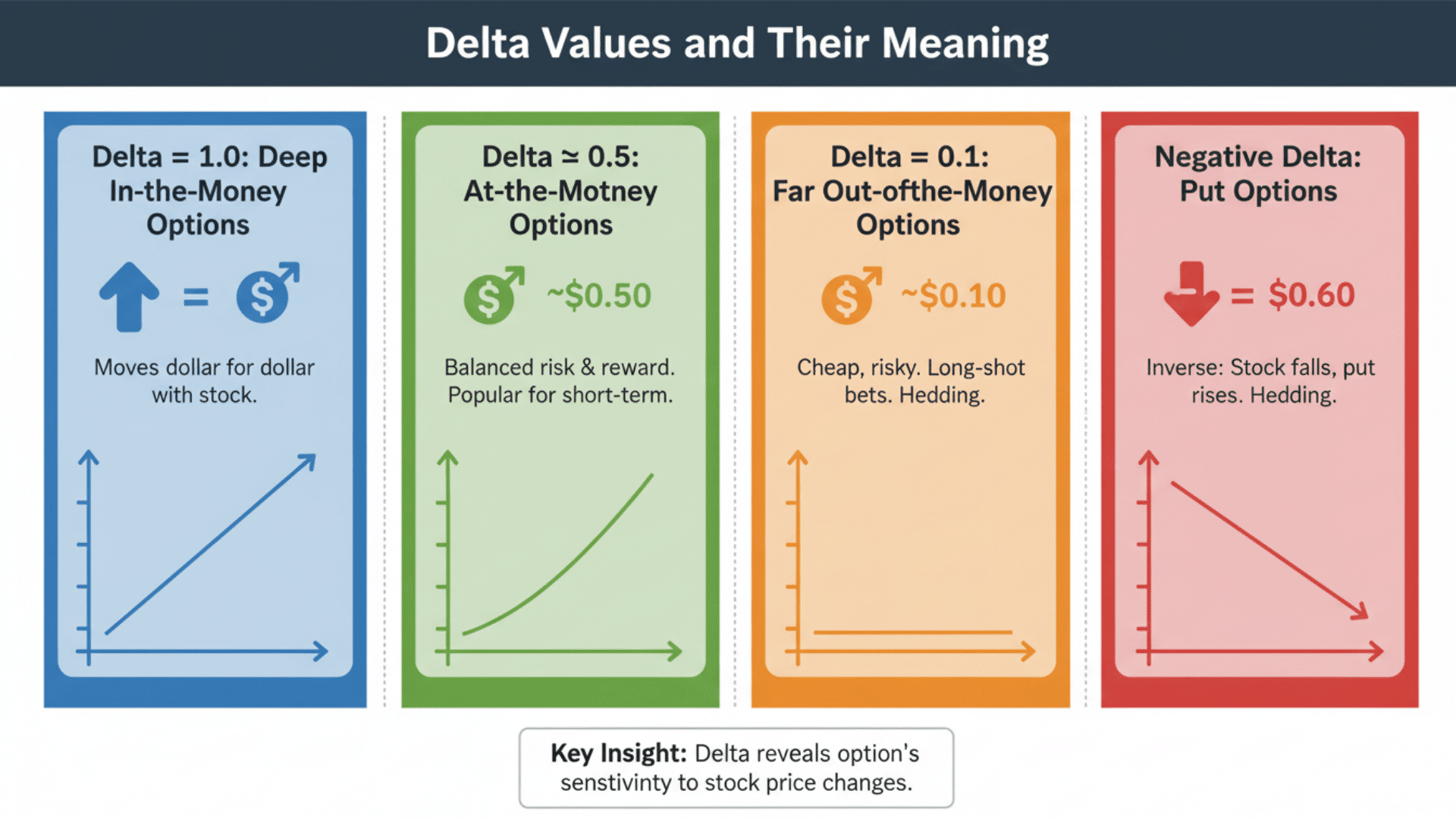

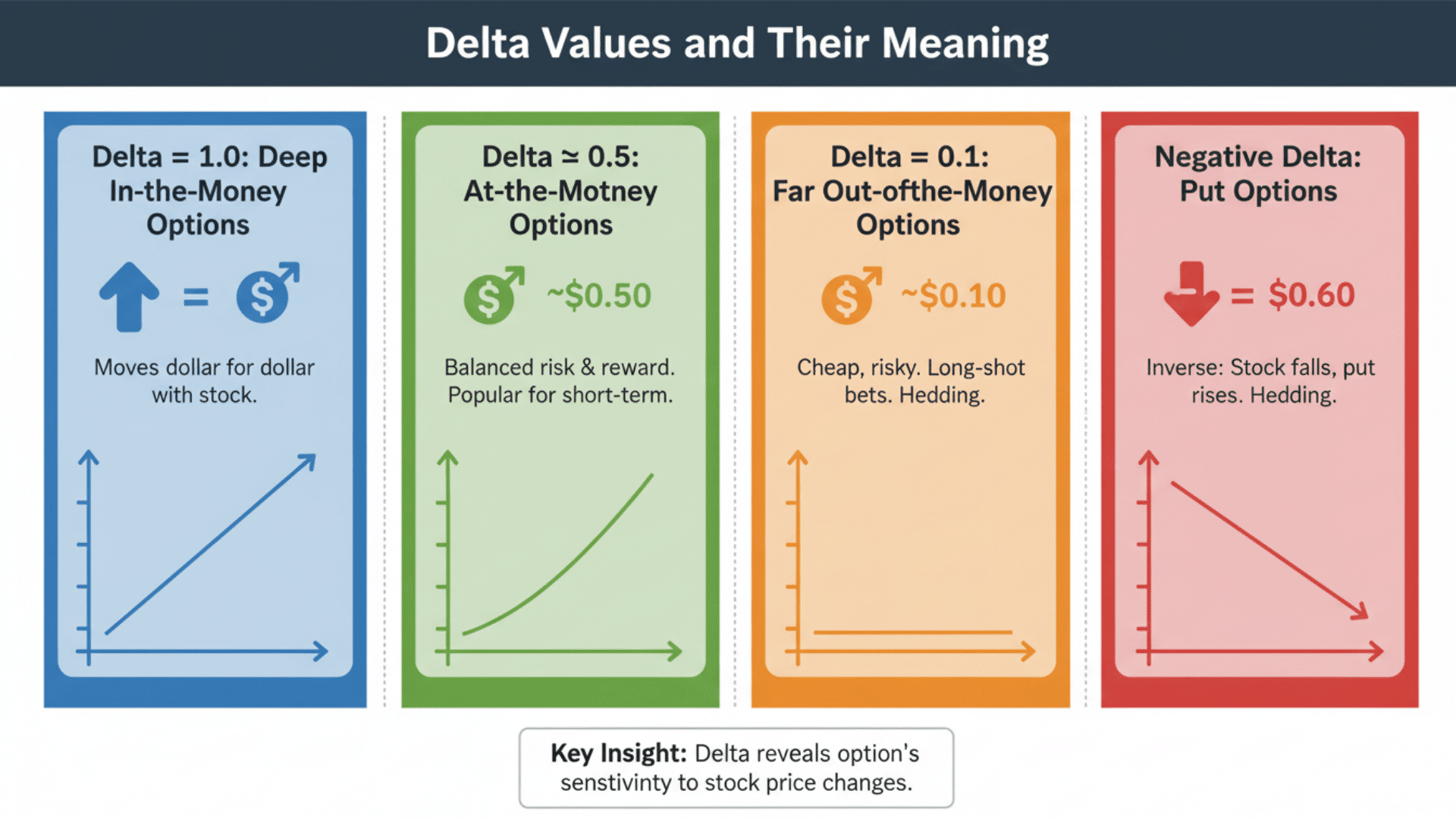

Delta Values and Their Meaning

Now that you understand how Delta is calculated, let’s explore what those values actually mean, and how they reveal the option’s sensitivity and behavior in real market conditions.

1. Delta = 1.0: Deep In-the-Money Options

A Delta of 1.0 means the option moves dollar for dollar with the stock. These are deep in-the-money calls that behave almost like owning the stock itself. For every $1 the stock rises, your option gains $1. These options have high premium costs but offer strong price tracking.

2. Delta ≈ 0.5: At-the-Money Options

When Delta is around 0.5, the option’s strike price is close to the current stock price. These are at-the-money options. They offer balanced risk and reward. A $1 stock move changes the option value by about $0.50, making them popular for short-term trades.

3. Delta ≈ 0.1: Far Out-of-the-Money Options

A Delta near 0.1 signals a long shot. These options are far out-of-the-money with strike prices distant from the current stock price. They’re cheap but risky. A $1 stock move only changes the option by $0.10. Traders use these for speculative bets or lottery-style plays.

4. Negative Delta: Put Options Move Inversely

Put options carry negative Delta values between 0 and -1.0. When the stock drops, put values rise. A Delta of -0.60 means the put gains $0.60 for every $1 the stock falls. This inverse relationship makes puts useful for hedging or betting on downturns.

Delta Values Comparison Table

| Delta Value | Option Status | Price Sensitivity | Typical Use |

|---|---|---|---|

| +1.0 | Deep in-the-money call | Moves $1 for every $1 stock increase | Stock replacement, high confidence trades |

| +0.5 | At-the-money call | Moves $0.50 for every $1 stock increase | Balanced trades, moderate risk |

| +0.1 | Far out-of-the-money call | Moves $0.10 for every $1 stock increase | Speculative bets, low-cost entries |

| -0.5 | At-the-money put | Moves $0.50 for every $1 stock decrease | Hedging, bearish trades |

| -1.0 | Deep in-the-money put | Moves $1 for every $1 stock decrease | Strong downside protection |

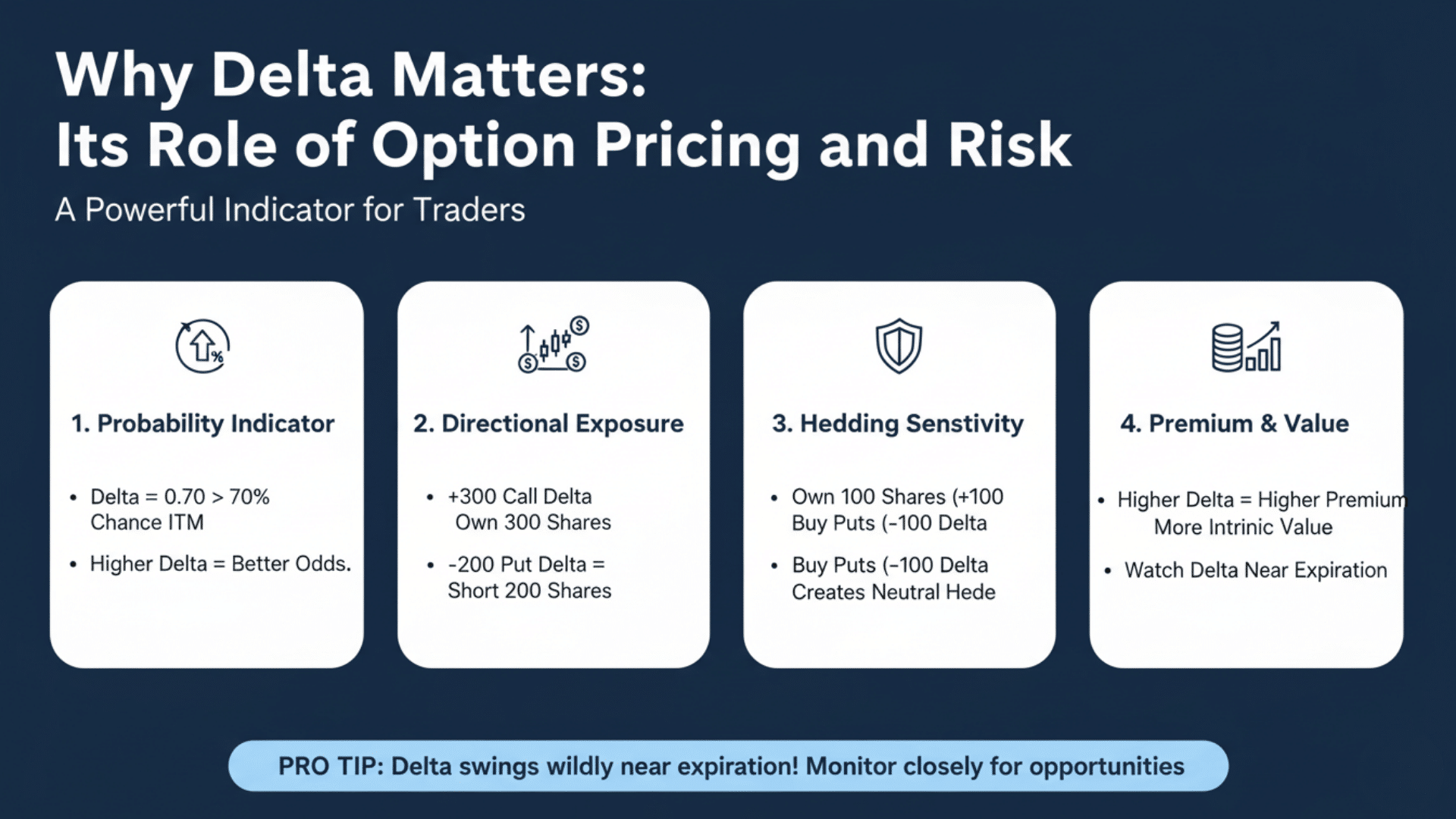

Why Delta Matters: Its Role in Option Pricing and Risk

Delta isn’t just a number; it’s a powerful indicator that shapes how options are priced and how traders manage their risk exposure.

1. Delta as a Probability Indicator

Delta gives you a quick estimate of the option’s chances of expiring in the money. An option with a Delta of 0.70 has roughly a 70% probability of finishing profitable at expiration.

This isn’t a perfect prediction, but it’s a useful rule of thumb. Higher Delta means better odds. Lower Delta means you’re taking a bigger gamble.

2. Measuring Directional Exposure

Delta shows your directional risk in the market. If you hold calls with a total Delta of +300, your position behaves like owning 300 shares of stock. When the stock climbs $1, you gain about $300.

If you hold puts with a Delta of -200, you profit when the stock falls, as if you’re short 200 shares. Traders use Delta to understand how much their portfolio moves with market swings.

3. Delta and Hedging Sensitivity

Delta helps you build hedges that protect your positions. If you own 100 shares of stock (Delta = +100), you can buy puts with a Delta of -100 to create a neutral position.

This balance shields you from sudden price drops. Professional traders constantly monitor Delta to adjust their hedges and control risk exposure.

4. Delta’s Link to Option Premium and Intrinsic Value

Delta directly affects how much premium you pay or collect. Higher Delta options cost more because they move more with the stock and have greater intrinsic value.

A deep in-the-money call with a Delta of 0.90 carries a hefty premium since it acts almost like the stock. Low Delta options are cheaper but offer less price movement. As Delta increases, more of the option’s value comes from intrinsic worth rather than time value.

Pro Tip: Watch Delta changes as expiration approaches. Options near the strike price can swing from 0.50 Delta to 1.0 or 0 very quickly, creating opportunities and risks.

Factors That Influence Delta

- Time to Expiration (Theta Impact): As expiration approaches, Delta becomes more extreme for at-the-money options, either moving toward 1.0 if in-the-money or dropping to 0 if out-of-the-money, because there’s less time for the stock to change direction.

- Volatility (Vega’s Indirect Effect): Higher volatility flattens Delta curves, making out-of-the-money options gain Delta faster because bigger price swings increase the chance they’ll finish in-the-money.

- Movement of the Underlying Asset: When the stock price moves, Delta changes immediately, calls gain Delta as the stock rises and lose Delta as it falls, while puts do the opposite.

- How Delta Changes Dynamically as Market Conditions Shift: Delta isn’t fixed; it adjusts constantly based on price movement, time decay, and volatility shifts, which is why traders must monitor positions regularly and rebalance hedges to maintain desired exposure.

Pro Tip: Gamma measures how fast Delta changes, so high Gamma means your Delta can swing dramatically with small stock moves, especially near expiration.

Difference Between Delta and Other Greeks in Options

We’ve explored the various factors that can influence Delta, but Delta doesn’t operate in isolation. To truly master options trading, you need to see how Delta interacts with the other Greeks, each measuring a different aspect of an option’s behavior and risk.

| Greek | What It Measures | Range/Value | Impact on Option Price | Key Use |

|---|---|---|---|---|

| Delta | Price sensitivity to $1 stock move | -1.0 to +1.0 | Shows how much the option price changes when stock moves | Directional exposure and hedging |

| Gamma | Rate of change of Delta | 0 to ~1.0 (highest at-the-money) | Shows how fast Delta changes with stock movement | Managing Delta risk, especially near expiration |

| Theta | Time decay per day | Negative for long options | Shows the daily loss in option value as time passes | Timing entries and exits, selling premium strategies |

| Vega | Sensitivity to 1% volatility change | Positive for long options | Shows how much the option price changes with volatility shifts | Volatility trading, earnings plays |

| Rho | Sensitivity to 1% interest rate change | Small, often ignored | Shows the impact of interest rate changes on the option price | Long-term options, LEAPS strategies |

How Delta Interacts with Gamma

Gamma is the speedometer for Delta. It measures how quickly Delta changes when the stock moves.

If you own a call with a Delta of 0.50 and a Gamma of 0.10, a $1 stock increase pushes the Delta up to 0.60. High Gamma means Delta is unstable and can shift rapidly.

Options at the money near expiration have the highest Gamma, making Delta swing wildly. Traders watch Gamma closely because it shows whether their Delta hedge will hold or need constant adjustment.

Practical Examples: Reading Delta in Real Scenarios

Let’s look at a few practical examples to understand how Delta behaves when prices move, and how traders interpret those shifts to make smarter decisions.

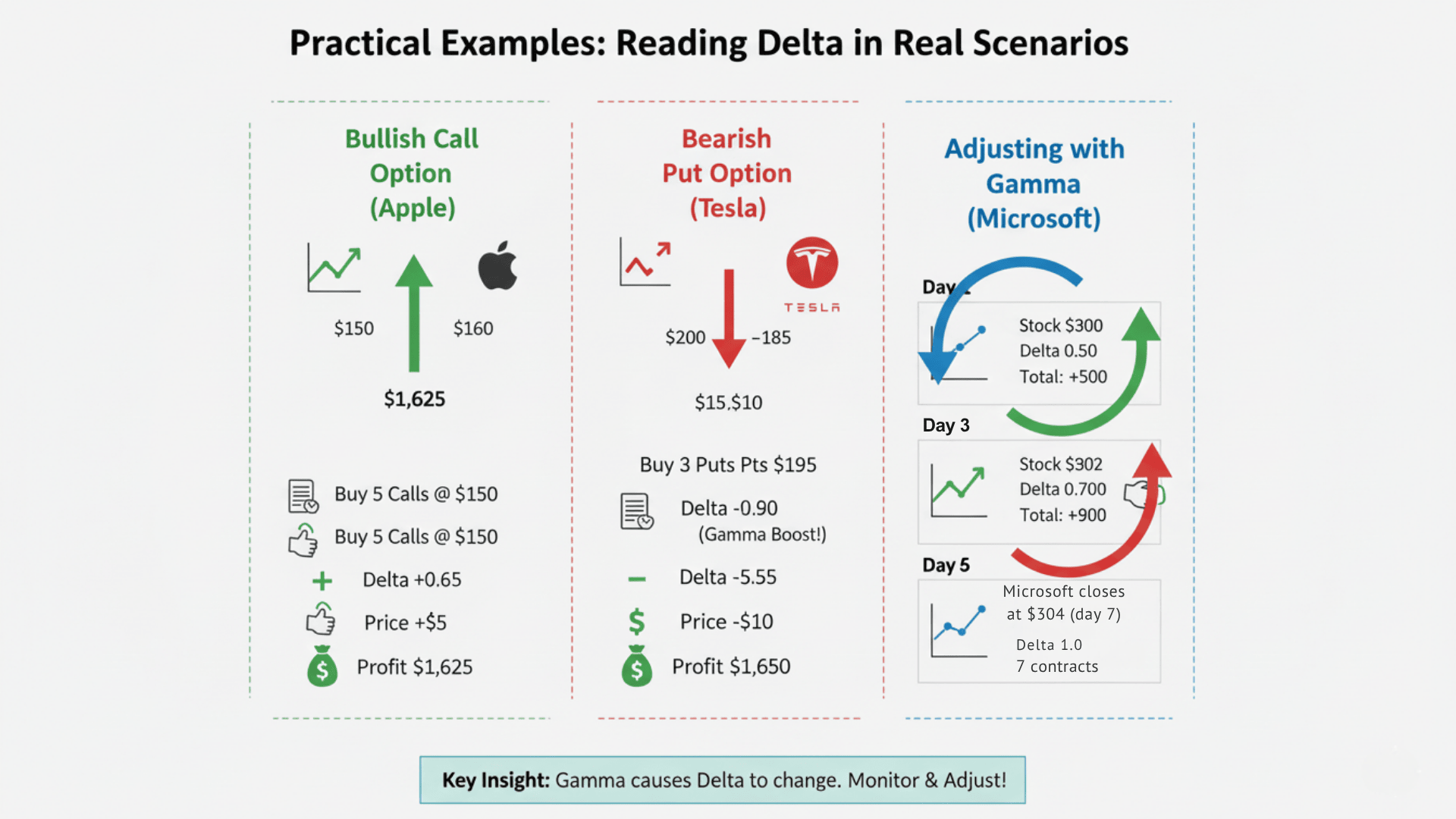

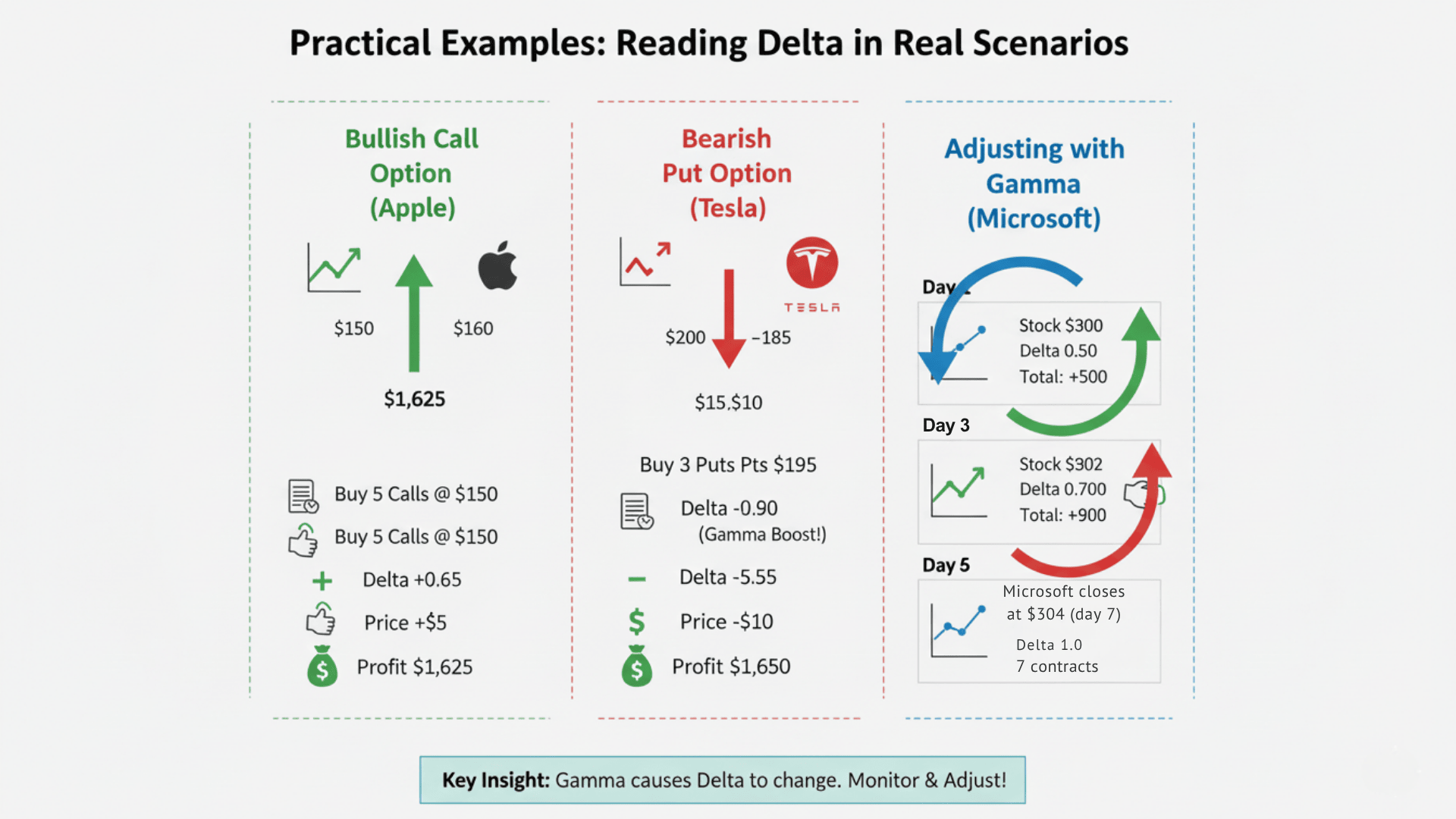

Example 1: Delta in a Bullish Call Option

- Scenario: You believe Apple stock will rise from $150 to $160 in the next month.

- Action: You buy 5 call options with a strike price of $150 and a Delta of 0.65.

- Delta Calculation: Total Delta = 5 contracts × 100 shares × 0.65 = +325

- Outcome: Apple rises to $155 (a $5 increase). Your options gain approximately $5 × 0.65 = $3.25 per share, or $325 per contract. With 5 contracts, you profit about $1,625 before accounting for time decay.

- Lesson: Higher Delta means stronger profit potential when you’re right about direction, but also bigger losses if the stock moves against you.

Example 2: Delta in a Bearish Put Option

- Scenario: You expect Tesla to drop from $200 to $185 due to weak earnings.

- Action: You buy 3 put options with a strike price of $195 and a Delta of -0.55.

- Delta Calculation: Total Delta = 3 contracts × 100 shares × (-0.55) = -165

- Outcome: Tesla falls to $190 (a $10 drop). You gain approximately $10 × 0.55 = $5.50 per share, or $550 per contract. With 3 contracts, you profit about $1,650.

- Lesson: Negative Delta works in your favor when the stock falls. The larger the negative Delta, the more you profit from downward movement.

Example 3: Adjusting Position as Delta Changes (Gamma Effect)

Case Study: Managing Delta Through Expiration Week

- Day 1: You own 10 at-the-money call options on Microsoft at $300 strike. The stock is at $300. Delta = 0.50, Gamma = 0.08. Total Delta = +500.

- Day 3: Microsoft rallies to $305. Your Delta increases due to Gamma. New Delta = 0.50 + ($5 × 0.08) = 0.90. Total Delta = +900. Your position now behaves like owning 900 shares instead of 500.

- Day 5: Microsoft pulls back to $302. Delta drops to 0.70. Total Delta = +700. You decide to sell 3 contracts to reduce exposure and lock in gains.

- Day 7 (Expiration): Microsoft closes at $304. Your remaining 7 contracts finish in the money with Delta = 1.0. You either exercise or sell for maximum intrinsic value.

Key Insight: Gamma caused your Delta to swing from 0.50 to 0.90 and back to 0.70 within days. Without monitoring and adjusting, you could have faced unexpected risk or missed profit-taking opportunities.

Common Mistakes Traders Make About Delta

Even experienced investors can misinterpret Delta’s signals or overlook how quickly it changes, mistakes that can lead to poor risk management or missed opportunities.

| Mistake | The Problem | How to Fix It |

|---|---|---|

| Confusing Delta with Probability | A delta of 0.70 doesn’t guarantee a 70% profit. It shows odds of expiring in the money, not actual gains after premium costs. | Use Delta as a guide only. Always calculate your breakeven price, including the premium paid. |

| Ignoring Delta Changes (Gamma Risk) | Delta isn’t fixed. High Gamma can quickly swing Delta from 0.50 to 1.0, especially near expiration. | Check Gamma regularly. Adjust positions when Delta moves beyond your risk level. |

| Over-Hedging Positions | Hedging everything to zero Delta kills profits. You pay commissions while gains and losses cancel out. | Hedge only when needed. Keep some directional exposure if you have a strong conviction. |

| Under-Hedging Positions | Ignoring high Delta exposure leads to big losses in sudden market drops. | Set Delta limits based on your risk tolerance. Hedge when you exceed those limits. |

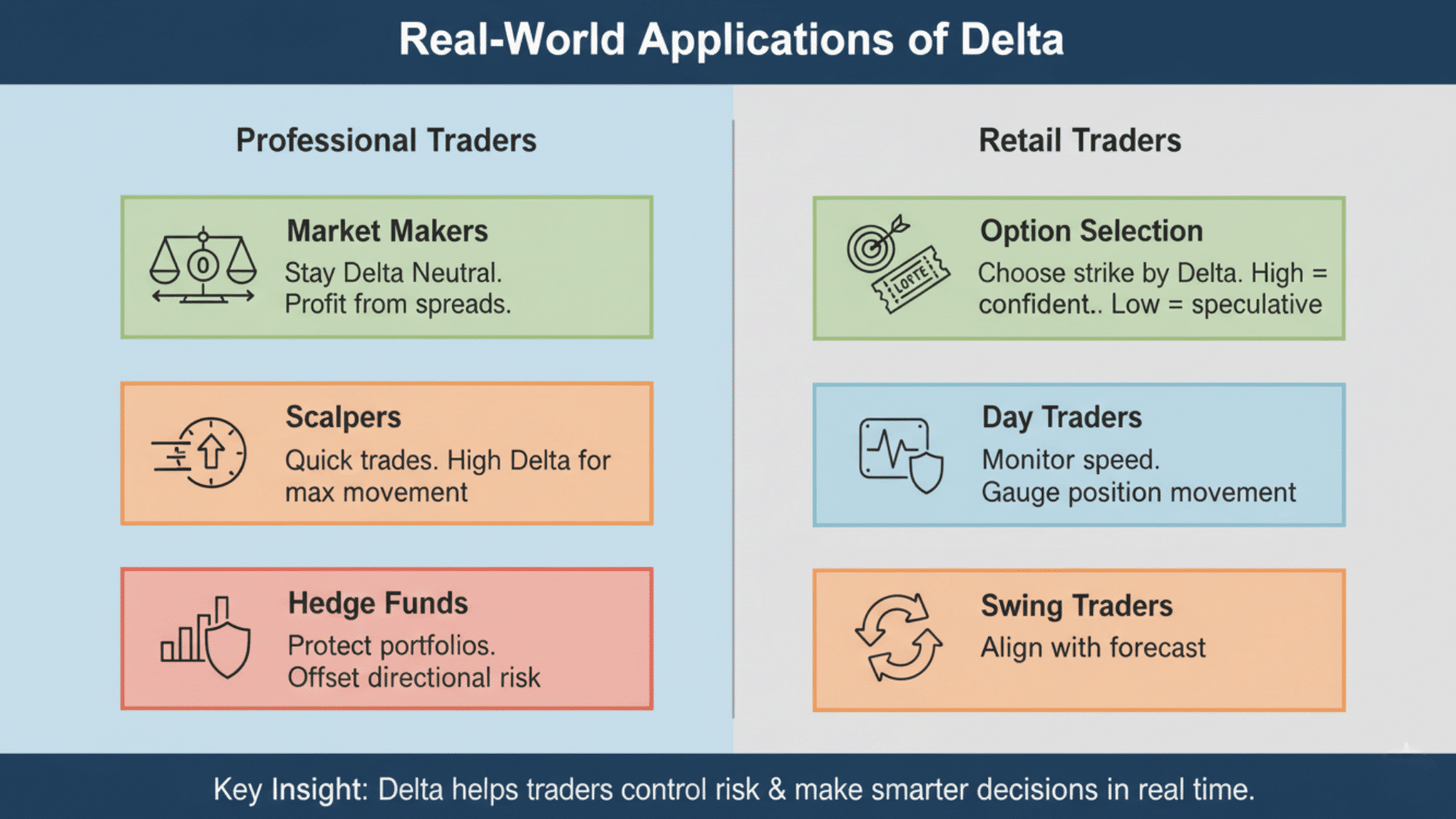

Real-World Applications of Delta

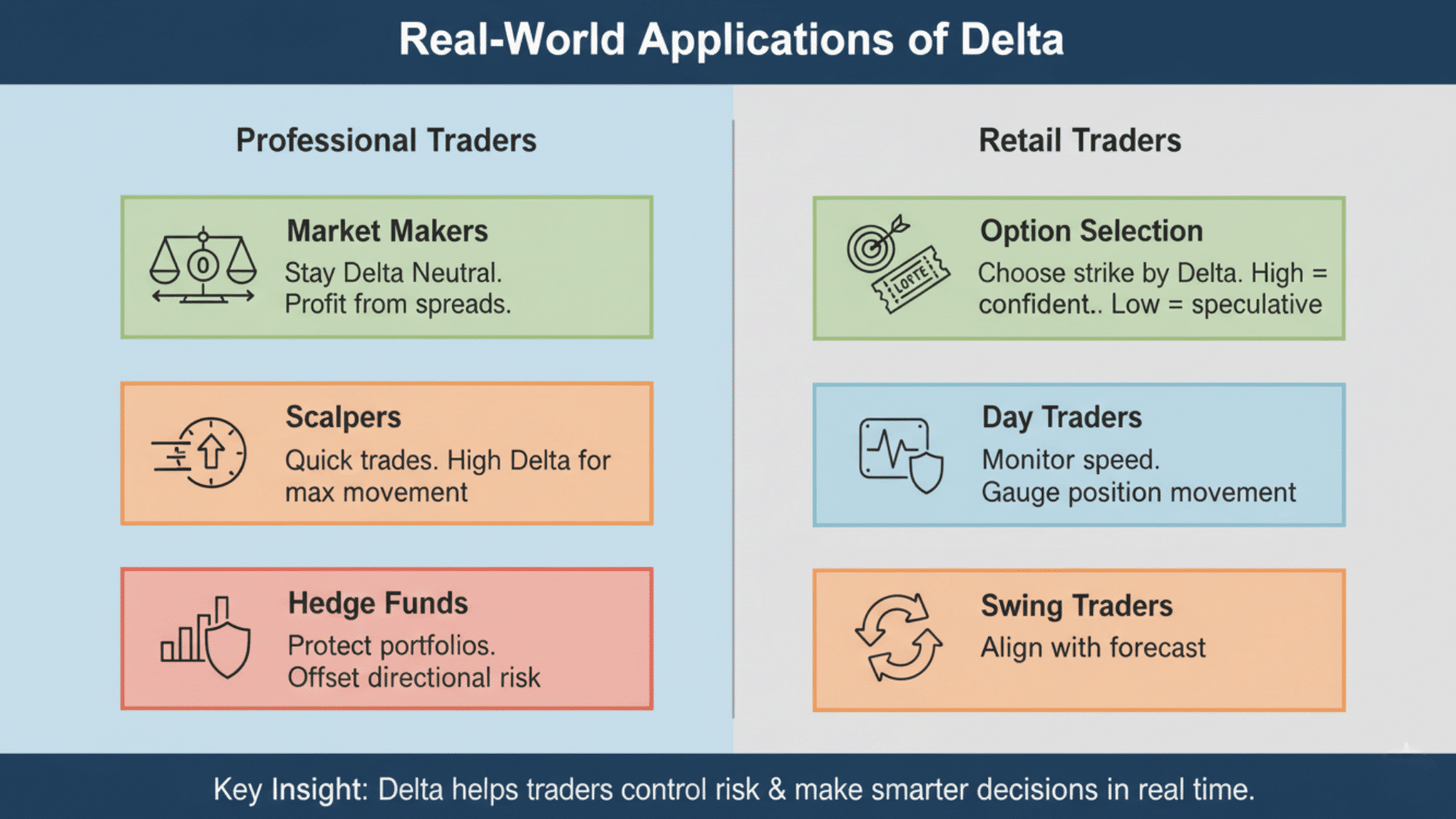

Professional traders rely on Delta every day for precision hedging, scalping, and market making.

Market makers use Delta to stay neutral while profiting from bid-ask spreads, constantly adjusting positions to maintain zero Delta exposure.

Hedge funds use Delta to protect large equity portfolios, buying puts or selling calls to offset directional risk during uncertain markets.

Retail traders use Delta differently but just as effectively. They compare Delta values to choose strike prices that match their risk appetite: high Delta for confident trades, low Delta for speculative bets.

Day traders monitor Delta to gauge how fast their positions will move with the market. Whether managing millions or a few thousand dollars, Delta helps traders control risk and make smarter decisions in real time.

Summing It Up

Delta is more than just a number. It’s your guide to understanding how options move with the stock. Whether you’re hedging a portfolio, choosing strike prices, or managing directional risk, Delta gives you clarity and control.

You now know how Delta works for calls and puts, how it changes with time and volatility, and how professionals use it for hedging and market making. You’ve seen real examples and learned the common mistakes to avoid.

The next step? Start tracking Delta in your own trades. Watch how it shifts as the market moves. Combine it with Gamma, Theta, and Vega for a complete view of your risk.

Want to go deeper? Check out our guide on Gamma and how it amplifies Delta changes, or explore Delta-neutral strategies for advanced hedging.

What’s your biggest question about Delta? Drop a comment below.