Ever wondered how companies decide whether to borrow or use their own funds to grow? That choice can make or break a business.

The debt-to-capital ratio shows how much a company depends on loans relative to its own capital. This number tells investors if a stock is risky, helps lenders approve credit, and shows business owners if they’re heading toward trouble or stability.

Understanding this ratio isn’t just for Wall Street experts. If you invest in stocks, run a business, or want to make smarter money decisions, knowing how to read financial leverage matters.

This guide breaks down the debt-to-capital ratio, shows real examples from Apple and Tesla, and explains how it differs from the debt-to-asset ratio. You’ll learn what the numbers mean and how to use them.

What Is the Debt-to-Capital Ratio?

The debt-to-capital ratio shows how much a company relies on borrowed money versus its own funds. It tells you the portion of a company’s financing that comes from debt relative to total capital. This ratio helps investors and lenders understand if a business is taking on too much risk or playing it safe.

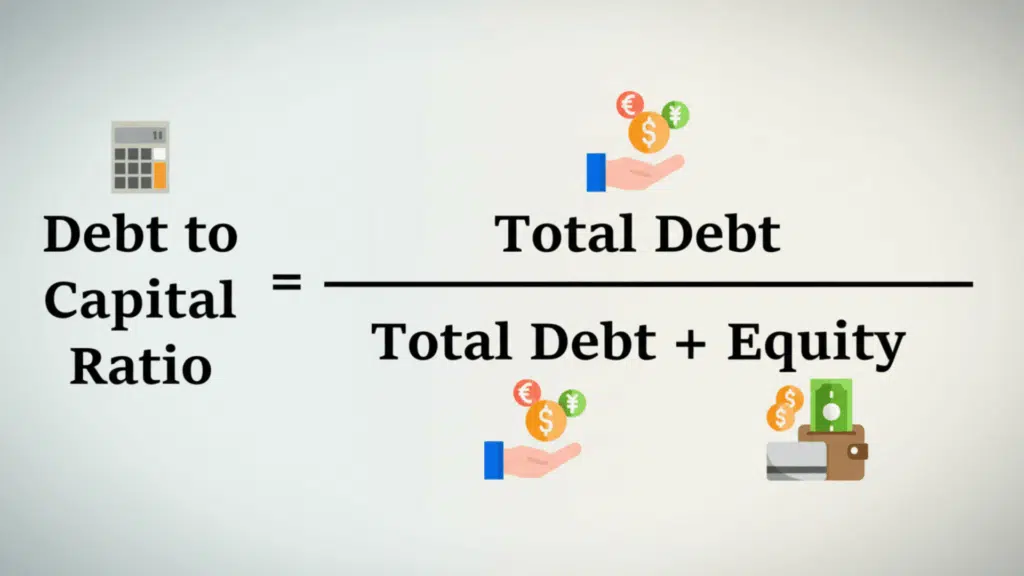

Formula:

Debt-to-Capital Ratio = Total Debt ÷ (Total Debt + Shareholders’ Equity)

Total debt includes both short-term and long-term loans a company owes. Shareholders’ equity represents the money owners have invested plus retained earnings.

Together, these two make up the company’s capital structure, which is how a business funds its operations and growth.

What Do the Numbers Mean?

A ratio between 0.3 and 0.6 (or 30% to 60%) is typically considered healthy for most industries.

-

High ratio (above 0.6): The company uses more debt than equity. This means higher financial risk but potentially better returns if things go well.

-

Low ratio (below 0.3): The company relies more on its own money. This signals lower risk but may mean the company isn’t fully leveraging growth opportunities.

The ideal range varies by industry. Capital-heavy sectors like utilities often carry higher ratios, while tech companies usually keep theirs lower.

Why the Debt-to-Capital Ratio Matters?

Understanding why this ratio is important can help you make smarter financial decisions. Here’s why investors, lenders, and business owners pay close attention to it.

- Evaluating Financial Leverage: This ratio shows exactly how much a company depends on borrowed money to run its business and fund growth.

- Impact on Risk, Cost of Capital, and Investor Confidence: A higher ratio indicates greater risk, which leads to higher loan interest rates and makes investors nervous about investing their money.

- Importance for Credit Rating and Borrowing Capacity: Credit rating agencies use this ratio to determine whether a company deserves a good credit rating, and lenders check it before approving new loans.

- How It Helps in Capital Structure Optimization: Companies use this ratio to find the optimal balance between debt and equity that minimizes costs while maximizing shareholder value.

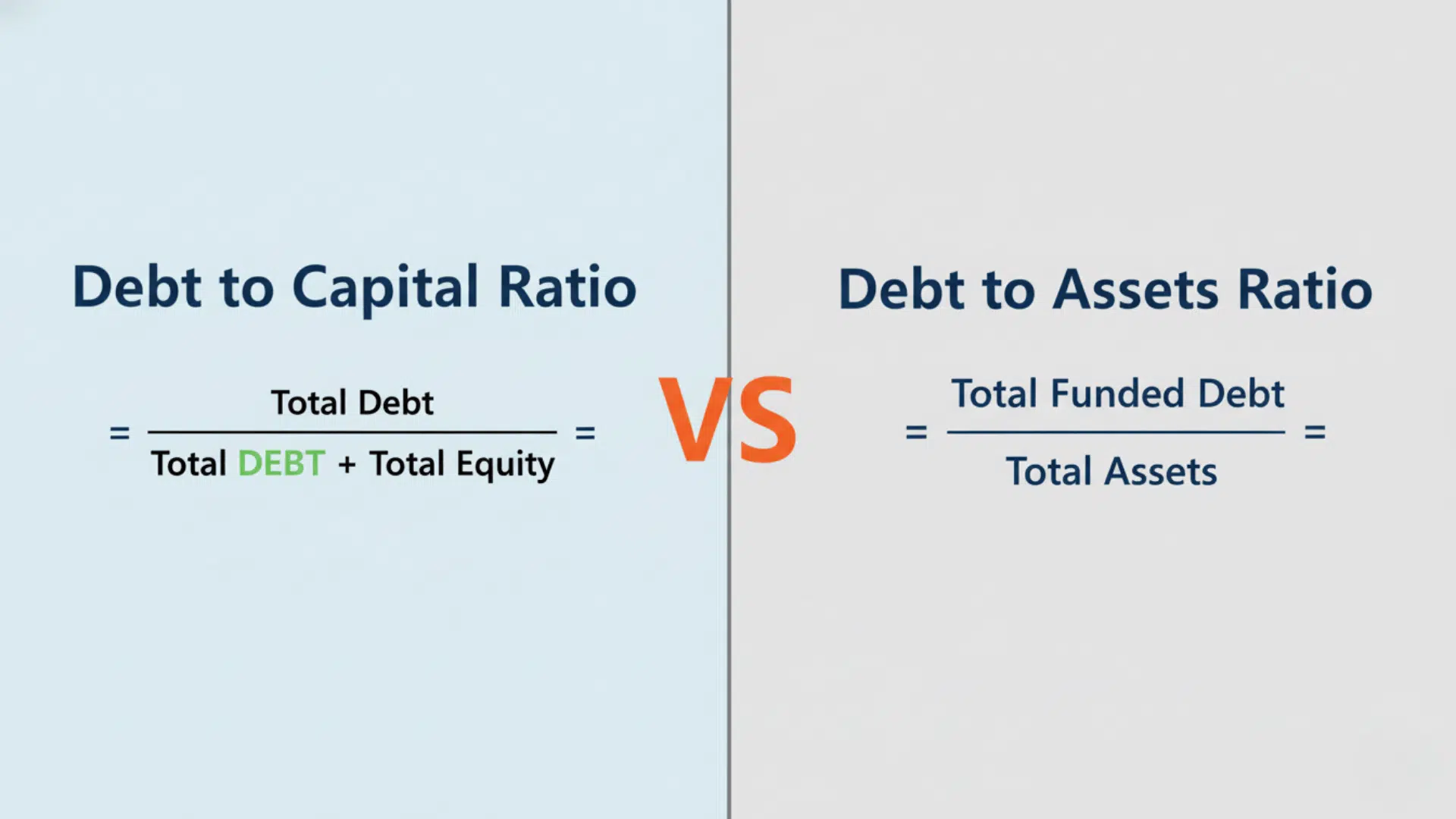

Debt-to-Capital Ratio vs. Debt-to-Asset Ratio

Many people confuse these two ratios, but they measure different things. Let’s clear up the confusion so you know which one to use and when.

What Is the Debt-to-Asset Ratio?

The debt-to-asset ratio measures how much of a company’s assets are financed through debt. It shows the percentage of a company’s assets that were bought with borrowed money.

Formula:

Debt-to-Asset Ratio = Total Debt ÷ Total Assets

This ratio helps you see if a company could pay off all its debts by selling its assets. A lower ratio means the company owns more than it owes.

Comparison:

| Feature | Debt-to-Capital Ratio | Debt-to-Asset Ratio |

|---|---|---|

| Formula | Total Debt ÷ (Total Debt + Equity) | Total Debt ÷ Total Assets |

| What It Measures | Financing structure and leverage | Asset coverage for debts |

| Focus | Capital sources (debt vs equity) | Asset ownership vs borrowing |

| Best Used By | Investors analyzing capital strategy | Lenders assessing repayment ability |

| Typical Range | 0.3 to 0.6 (30% to 60%) | 0.4 to 0.6 (40% to 60%) |

| High Ratio Means | More debt financing, higher leverage | More assets funded by debt |

| Low Ratio Means | More equity financing, lower risk | More assets owned outright |

Both ratios tell important stories about a company’s financial health. Using them together gives you a complete picture of how a business manages its money.

Real-World Applications of the Debt-to-Capital Ratio

Let’s look at how the debt-to-capital ratio works in actual companies. These examples show why context matters when analyzing financial leverage.

Example 1: Apple Inc. – Balanced Leverage Supporting Strong Credit Rating

Apple maintains a debt-to-capital ratio of around 0.35 to 0.40 (35% to 40%). This means about 35 to 40 cents of every dollar in capital comes from debt, while the rest is equity.

What This Means in Practice:

Apple uses debt strategically even though it has huge cash reserves. The company borrows at low interest rates and uses that money for share buybacks and dividends.

This keeps shareholders happy while maintaining a strong credit rating. Lenders see Apple as low risk because its debt level stays comfortable relative to its equity base.

Example 2: Tesla, Inc. – Evolving Debt Strategy as Equity Grows

Tesla’s debt-to-capital ratio has dropped significantly over recent years, from around 0.70 (70%) down to approximately 0.15 to 0.20 (15% to 20%).

What This Means in Practice:

Tesla relied heavily on debt in its early growth phase when profitability was uncertain. As the company became profitable and its stock price soared, equity grew faster than debt.

Now Tesla has much more financial flexibility. Investors gained confidence as the ratio improved, which pushed the stock even higher. This shows how a changing ratio tells the story of a company’s financial evolution.

Example 3: A Small Manufacturing Firm – High Debt Ratio Leading to Liquidity Challenges

Imagine a small manufacturing company with a debt-to-capital ratio of 0.75 (75%). Three-quarters of its financing comes from loans and bonds.

What This Means in Practice:

This company faces real problems. High monthly debt payments eat into cash flow, leaving little room for equipment upgrades or emergency expenses.

When a major customer delayed payment for 90 days, the firm nearly missed its loan obligations. Banks refused to extend more credit because the ratio was too high.

The owners had to inject personal funds or risk bankruptcy. This example shows why keeping debt in check matters, especially for smaller businesses with less financial cushion.

Key Lessons from These Examples:

- Size and stability matter: Apple can handle moderate debt because of its massive cash flow. Smaller firms need lower safety ratios.

- Growth stage affects strategy: Tesla’s high early debt was acceptable because investors believed in future profits. The improving ratio confirmed that belief.

- Industry context is critical: Manufacturing requires significant capital investments, but too much debt can turn those assets into liabilities during slow periods.

Each company’s ratio tells a different story. The number itself is just the starting point. You need to understand the business, industry, and financial health behind that number.

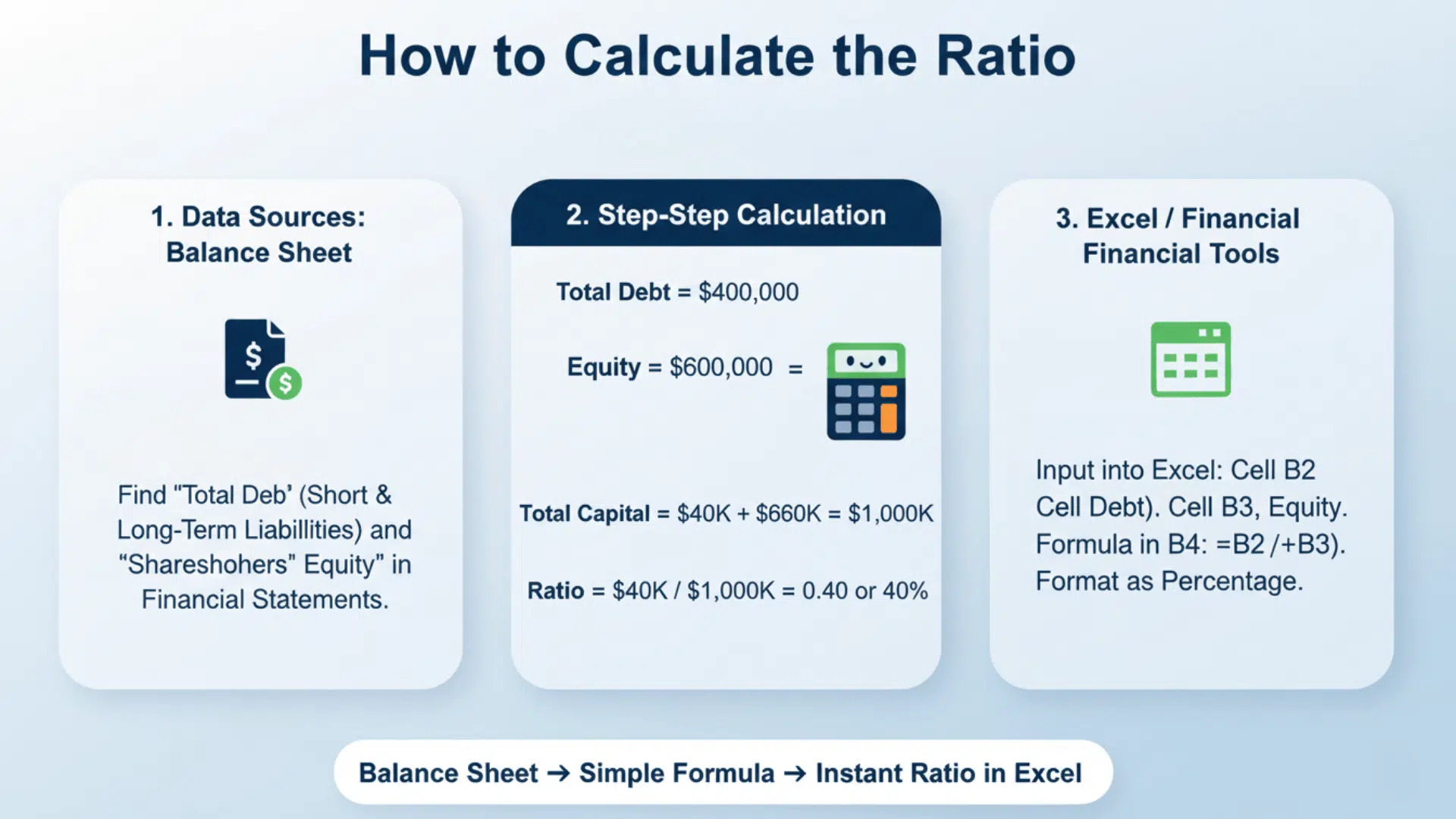

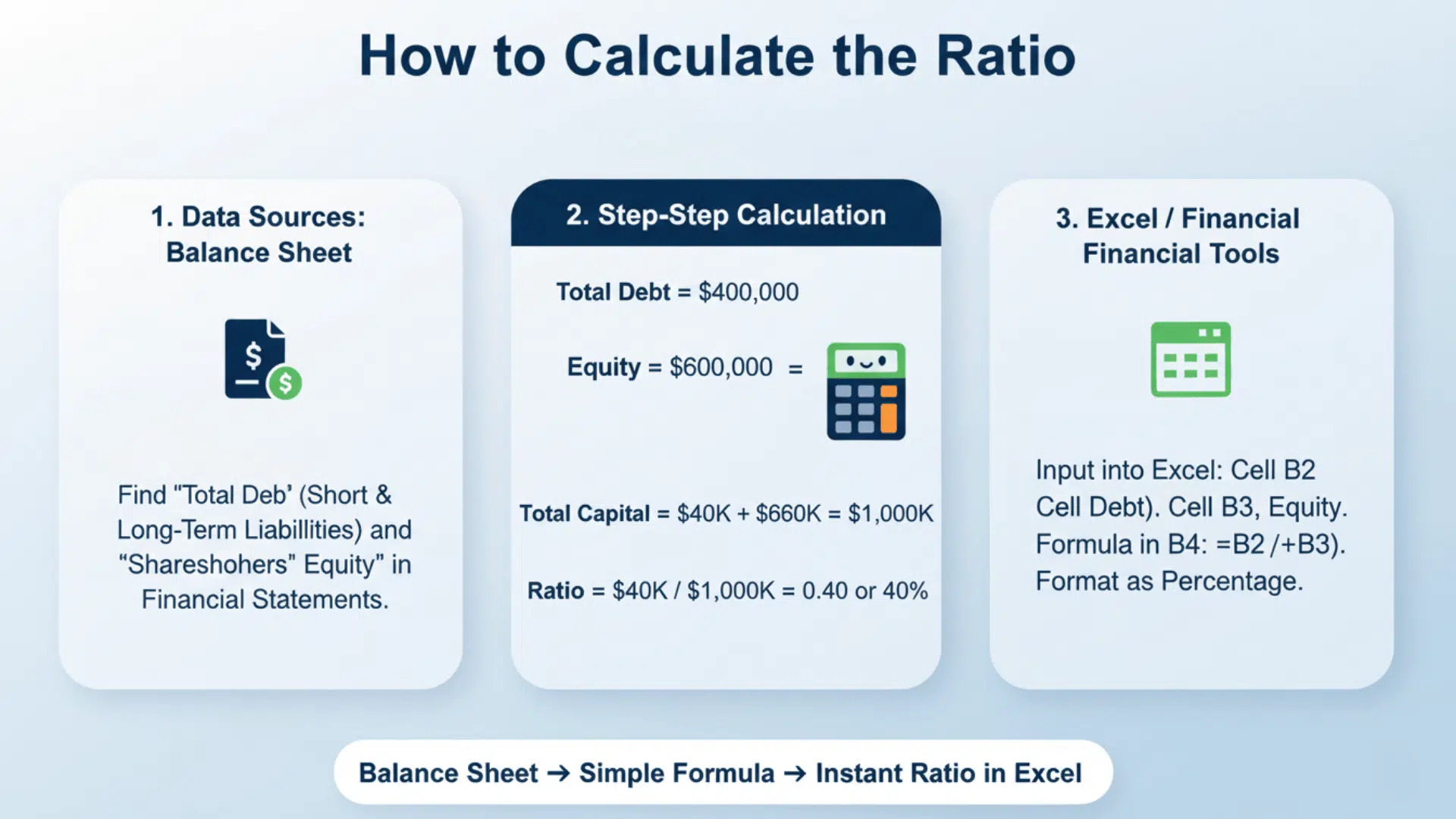

How to Calculate the Ratio Step-by-Step

Calculating the debt-to-capital ratio is easier than you might think. You just need the right numbers from a company’s balance sheet and a simple formula. Let’s walk through it step by step.

1. Data Sources: Balance Sheet Items

You’ll find everything you need on a company’s balance sheet, which is part of its financial statements.

Look for total debt (includes both short-term and long-term liabilities like loans and bonds) and shareholders’ equity (also called stockholders’ equity or owners’ equity).

These numbers are usually clearly labeled and appear in the liabilities and equity sections of the balance sheet.

2. Step-by-Step Calculation with Sample Numbers

Let’s say Company XYZ has total debt of $400,000 and shareholders’ equity of $600,000. First, add debt and equity together: $400,000 + $600,000 = $1,000,000 (this is your total capital).

Next, divide total debt by total capital: $400,000 ÷ $1,000,000 = 0.40. The debt-to-capital ratio is 0.40 or 40%, meaning 40% of the company’s capital comes from debt.

3. How to Use Excel or Financial Analysis Tools for Computation

In Excel, create three cells for your inputs: one for total debt (let’s say cell B2), one for equity (B3), and one for the formula. In cell B4, type: =B2/(B2+B3) and press Enter.

Excel will calculate the ratio instantly, and you can format it as a percentage by clicking the % button. For ongoing analysis, you can build a simple template and just update the debt and equity numbers each quarter to track changes over time.

Interpreting the Results

Once you’ve calculated the ratio, you need to know what the numbers actually tell you. Here’s how to read the results like a pro.

- What a High Ratio Means (Greater Leverage, Higher Risk): A high ratio above 0.60 means the company borrows heavily to fund operations, which increases profit potential but also raises the chance of financial trouble during downturns.

- What a Low Ratio Means (Lower Leverage, Conservative Financing): A low ratio below 0.30 shows the company uses mostly its own money to grow, which means less risk but possibly slower growth and missed opportunities.

- Industry Benchmarks – Examples from Manufacturing, Tech, and Utilities: Manufacturing companies typically run ratios between 0.40 and 0.60, tech firms stay lower at 0.20 and 0.40, while utilities often go higher at 0.50 and 0.70 because they have stable cash flows.

- Red Flags Investors Should Look For: Watch out if the ratio keeps climbing year after year, exceeds industry averages by a wide margin, or suddenly spikes without clear reasons like acquisitions or expansion.

Strategies to Improve the Debt-to-Capital Ratio

If your debt-to-capital ratio is too high, don’t panic. There are proven ways to bring it down and strengthen your financial position. Let’s look at practical strategies companies use to improve this important metric.

| Strategy | How It Works | Best Timing | Pros | Cons |

|---|---|---|---|---|

| Debt Repayment | Use cash to pay off loans early | When cash flow is strong | Direct ratio improvement saves interest costs | Reduces cash reserves, limits growth spending |

| Debt Refinancing | Replace expensive debt with cheaper loans | When interest rates drop | Lowers interest expense, extends payment terms | May involve fees, requires a good credit rating |

| Retained Earnings | Keep profits instead of paying dividends | During the growth phase | No dilution, builds equity naturally | Shareholders may want dividends, takes time |

| Issue New Shares | Sell stock to raise equity capital | When the stock price is high | Quick equity boost, no repayment needed | Dilutes ownership, may signal weakness to the market |

| Asset Sales | Sell assets and use proceeds to pay debt | When holding non-core assets | Fast debt reduction focuses on the business | Loses future income from sold assets |

| Hybrid Approach | Combine multiple strategies together | Any time based on conditions | Balanced improvement, flexible execution | Requires careful planning and coordination |

Which Strategy Should You Choose?

The best approach depends on your specific situation. Growing companies with high stock valuations might prefer issuing shares. Mature firms with steady cash flow often focus on debt repayment. Most successful companies use a combination of strategies rather than relying on just one method.

Remember that improving your ratio too quickly can sometimes backfire. If you slash debt by cutting essential investments, you might hurt long-term growth. The key is improving steadily while maintaining healthy operations.

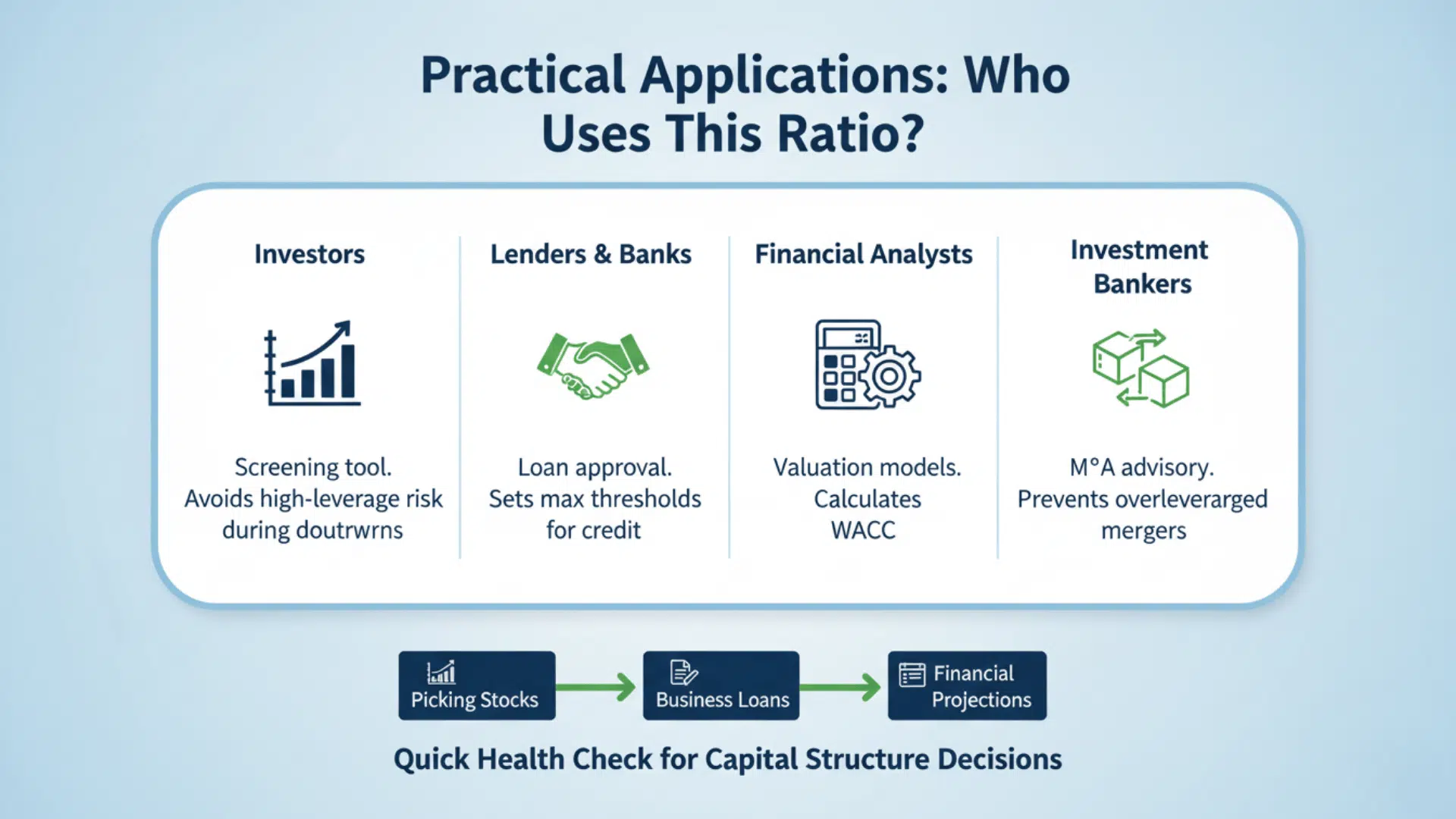

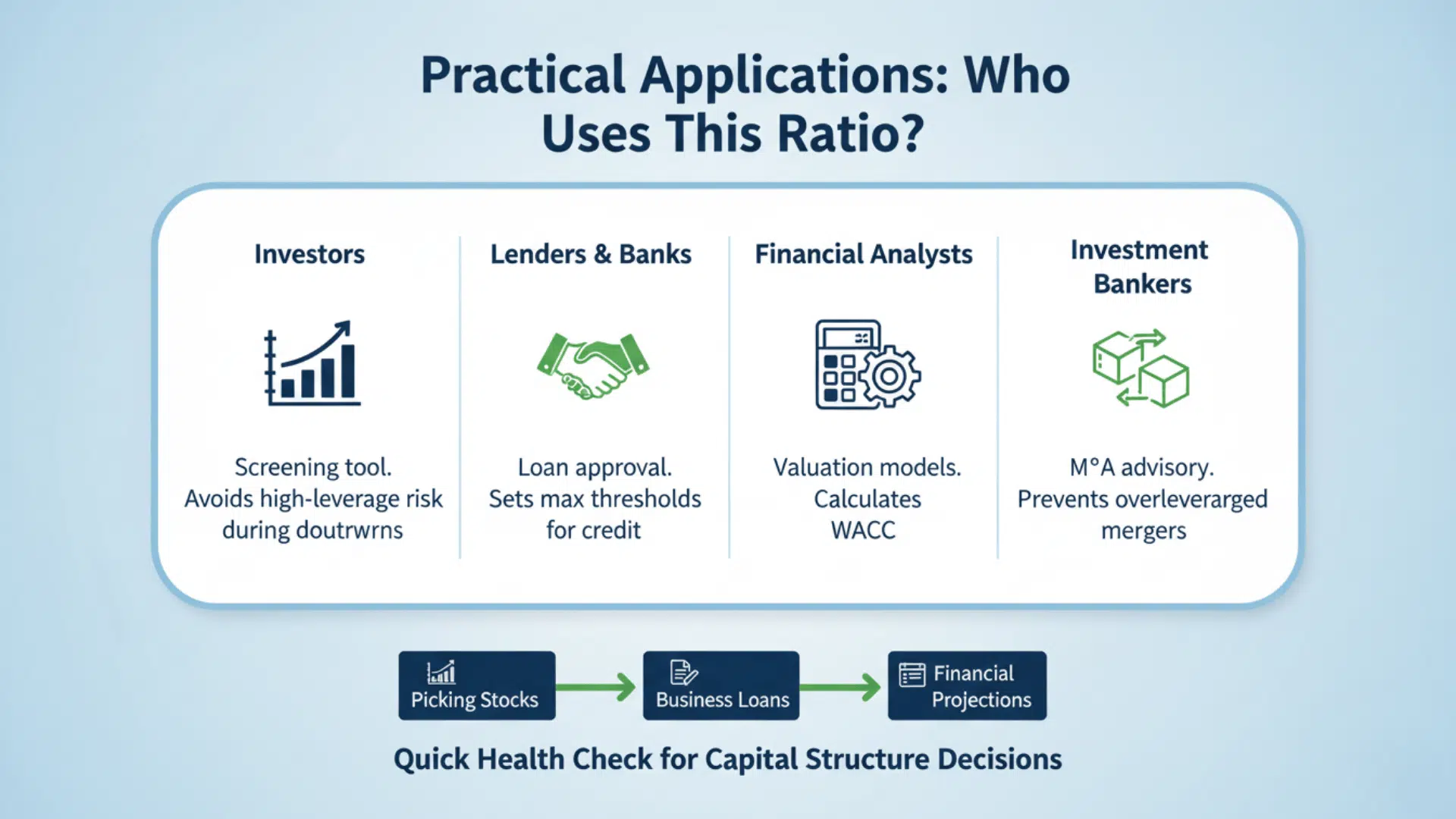

Practical Applications: How Different Professionals Use This Ratio

The debt-to-capital ratio isn’t just a number on paper. It has real uses across different areas of finance and investing.

Investors use the debt-to-capital ratio as a screening tool when building portfolios, filtering out companies with dangerously high leverage that could collapse during market downturns.

Lenders and banks rely on this ratio to decide whether to approve loans, setting maximum thresholds that borrowers must meet to qualify for credit at favorable rates.

Financial analysts incorporate the ratio into valuation models to calculate weighted average cost of capital (WACC), which directly affects how much a company is worth.

Investment bankers also check this ratio when advising on mergers and acquisitions, ensuring the combined entity won’t become overleveraged.

Whether you’re picking stocks, applying for a business loan, or building financial projections, this ratio serves as a quick health check for capital structure decisions.

The Bottom Line

The debt-to-capital ratio gives you a clear window into how companies fund operations and manage financial risk.

Whether you’re screening stocks, evaluating loans, or running a business, this ratio helps you make informed decisions.

Remember that 0.30 to 0.60 works for most industries, but context always matters. Compare companies within the same sector and watch for trends over time.

Understanding the story behind the ratio, like Apple’s strategic debt use and Tesla’s improving leverage, makes all the difference.

Start analyzing debt-to-capital ratios of companies in your portfolio today. Which ones are taking too much risk? Which is playing it too safe?

What’s your take on company leverage? Share your thoughts in the comments below, and let us know which financial ratios you’d like us to explain next.