When I first heard the term FP&A, I had no idea what it meant. It sounded complicated, but it’s actually one of the most important parts of how a business runs smoothly.

FP&A stands for Financial Planning and Analysis, and it helps companies plan for the future, make smart money decisions, and stay on track with their goals.

In this blog, I’ll walk you through what FP&A means, what the team actually does, how the process works step-by-step, and what skills you need if you want a career in this field.

We’ll also look at real examples, modern tools, and how FP&A is changing with new technology.

Understanding FP&A Meaning: The Basics

When someone asks “what is FP&A,” they’re really asking about one of the most important functions in modern business.

FP&A stands for Financial Planning and Analysis, and it’s the team that helps companies answer critical questions like:

- Can we afford to hire 50 new employees next quarter?

- Should we launch that new product line?

- Where are we spending too much money?

- Will we have enough cash to cover expenses next year?

Unlike accountants who focus on recording what has already happened, FP&A professionals look forward. They use past data to predict the future and help leaders make better decisions today.

Here’s the key difference: Accountants tell you what you spent last month. FP&A teams tell you what you’ll likely spend next month, and whether that’s a good idea.

What Does Financial Planning and Analysis (FP&A) Actually Do?

FP&A teams handle four main jobs that keep businesses running smoothly:

Financial Planning

This means setting financial goals and creating a roadmap to reach them. FP&A teams work with company leaders to decide:

- How much revenue does the company want to make this year

- Which projects deserve funding

- Where to invest for long-term growth

- What financial targets each department should hit

Forecasting

Forecasting is like checking the weather before planning a picnic. FP&A professionals predict:

- Future sales and revenue

- Cash flow (money coming in and going out)

- Potential financial problems before they happen

- How different business decisions might affect profits

Budgeting

Once plans and forecasts are ready, someone needs to divvy up the money. FP&A teams:

- Create budgets for each department

- Make sure spending aligns with company goals

- Track whether teams are sticking to their budgets

- Adjust budgets when business conditions change

Analysis and Monitoring

This is the ongoing work of watching how the business performs. FP&A analysts:

- Track key numbers like sales, expenses, and profits

- Spot trends and patterns in the data

- Explain what the numbers mean in plain language

- Alert leaders when something needs attention

The FP&A Process: How It Works Step-by-Step?

Every company’s FP&A process follows a similar cycle. Here’s how it typically works:

Step 1: Collecting and Organizing Data

First, the team gathers financial information from everywhere:

- Sales data from the sales department

- Expense reports from accounting

- Inventory numbers from operations

- Market trends from outside research

This step takes time because all this data needs to be cleaned up, organized, and double-checked. Bad data leads to bad decisions, so accuracy matters here.

Modern twist: Many companies now use artificial intelligence to automate this grunt work, saving hours of manual spreadsheet updates.

Step 2: Creating Plans and Forecasts

With clean data in hand, FP&A analysts build models to predict the future. They use three popular methods:

| Planning Method | What It Means | Example |

|---|---|---|

| Predictive Planning | Using past patterns to predict future results | “Sales grew 10% each of the last 3 years, so we’ll likely grow 10% next year.” |

| Driver-Based Planning | Focusing on key business factors that drive success | “Each new salesperson brings in $500K revenue, so hiring 5 more = $2.5M increase” |

| Scenario Planning | Preparing for multiple possible futures | “Best case: 15% growth. Realistic: 8% growth. Worst case: 2% decline” |

Most modern FP&A teams use scenario planning because markets change fast. Having backup plans helps companies pivot quickly when surprises happen.

Step 3: Building Budgets

Now comes the budgeting process. The FP&A team:

- Takes the strategic plan and breaks it down by department

- Assigns spending limits to each team

- Sets revenue targets for sales teams

- Gets buy-in from department heads

- Combines everything into one master budget

Many companies have moved away from annual budgets. Instead, they use continuous budgeting, updating forecasts and budgets every quarter or even monthly. This flexibility helps businesses adapt to rapid changes.

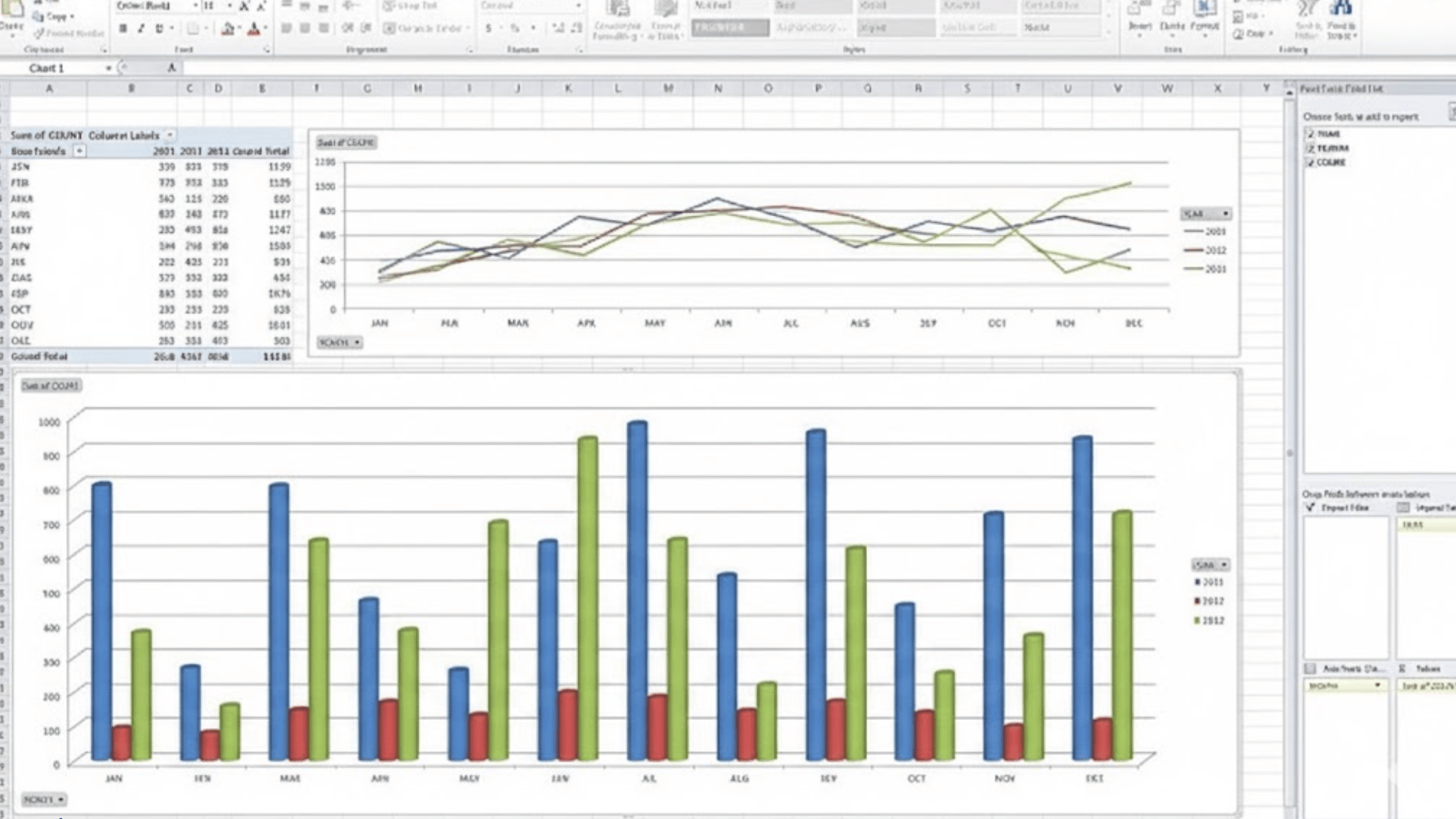

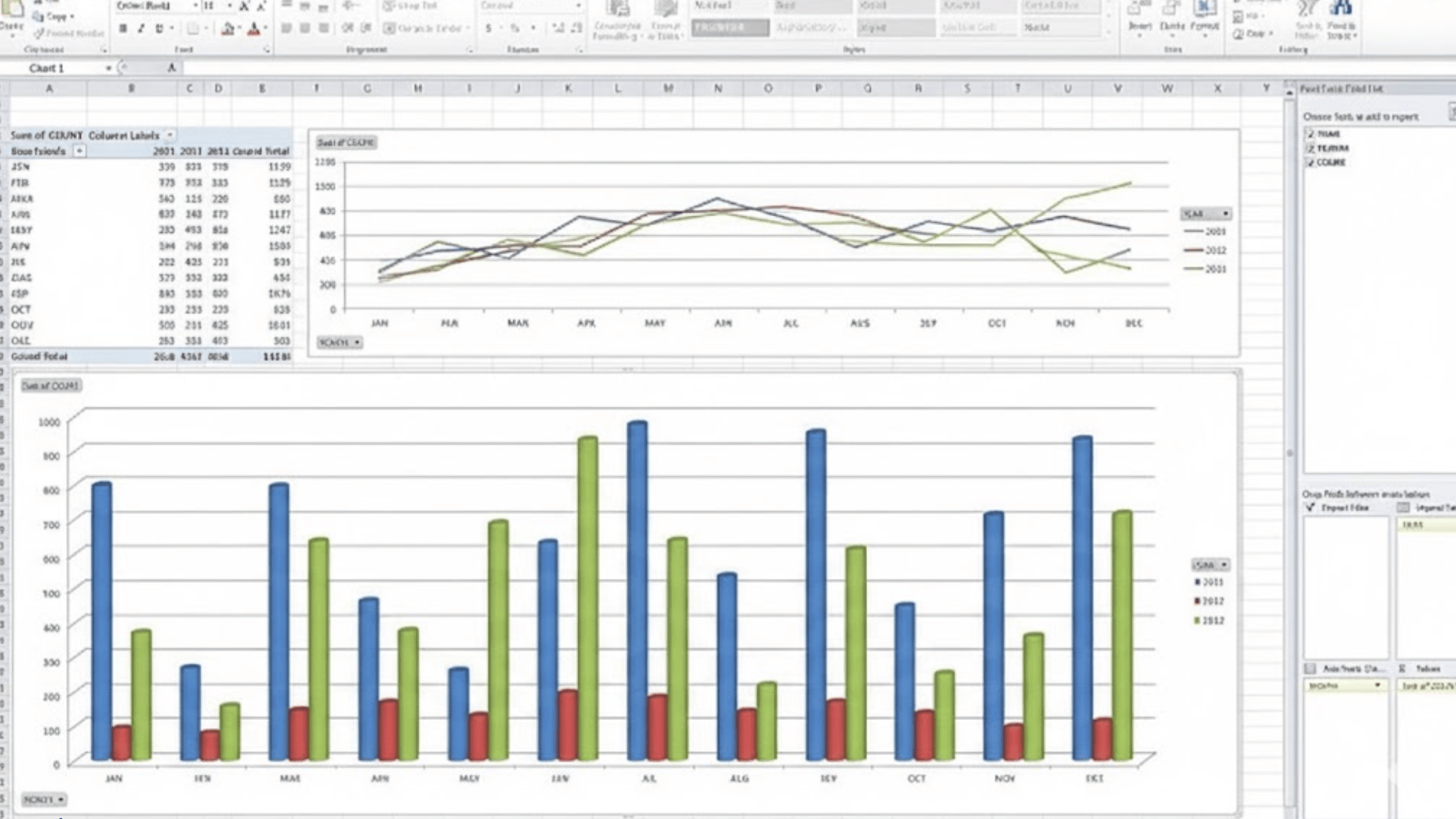

Step 4: Monitoring Performance and Reporting

The work doesn’t stop once budgets are set. FP&A teams constantly monitor:

- Are sales meeting targets?

- Are expenses staying within budget?

- Is cash flow healthy?

- Which products or departments are most profitable?

They create reports and dashboards that show leaders how the business is performing. When something looks off, they dig deeper to understand why.

Real Examples of FP&A Analysis

Example 1: Expense Breakdown Analysis

Imagine a company reviewing its consulting expenses:

| Vendor Name | Spending | Percentage of Total |

|---|---|---|

| KPMG | $15.4M | 50% |

| EY | $5.1M | 17% |

| ANZ Consulting | $3.1M | 10% |

| DBS Synergy | $2.4M | 8% |

| Others | $4.7M | 15% |

| TOTAL | $30.7M | 100% |

What the FP&A Team Notices: KPMG is getting half of all consulting dollars. This raises important questions:

- Are we too dependent on one vendor?

- Is KPMG charging more than competitors?

- Should we negotiate better rates or diversify our consultants?

This kind of analysis helps companies make smarter spending decisions.

Example 2: Resource Allocation Problem

A tech company’s FP&A team notices something interesting:

- The R&D department has 44% of all employees

- But R&D products only generate 27% of total revenue

The FP&A response: Something doesn’t add up. Either:

- R&D is overstaffed for what it produces

- R&D projects aren’t turning into successful products

- The company should shift resources to higher-performing departments

This analysis sparks conversations about whether to restructure teams or change strategy.

Who Works in FP&A: The Team Structure

FP&A departments vary significantly in size depending on the organization. Small companies may have one person managing all FP&A tasks, whereas large firms often have specialized teams.

Understanding the typical hierarchy helps clarify career progression and expectations at each level.

FP&A Career Ladder

The FP&A career ladder shows how finance professionals grow from entry-level analysts to strategic leaders, outlining key responsibilities, experience levels, and salary expectations at each stage.

| Position | Experience Required | Salary Range |

|---|---|---|

| Director or VP of FP&A | 10-15 years | $145,000 – $200,000+ |

| FP&A Manager | 5-10 years | $70,000 – $150,000 |

| Senior FP&A Analyst | 3-5 years | $65,000 – $125,000 |

| FP&A Analyst | 0-3 years | $50,000 – $70,000 |

- Director or VP of FP&A: Lead all FP&A functions, report to CFO, develop financial strategy, review team performance, and present insights to executives and shareholders.

- FP&A Manager: Manage analyst teams, collaborate with executives on decisions, build complex models, oversee budgets and forecasts, coordinate cross-functional projects.

- Senior FP&A Analyst: Conduct advanced forecasting and scenario analysis, present to executives, perform variance analysis, build predictive budgets, and make strategic recommendations.

- FP&A Analyst: Build financial models, track key metrics, create monthly reports, evaluate investments, identify cost-cutting opportunities, and assess financial risks.

FP&A Function: Small Business vs. Large Corporation

The FP&A function looks quite different depending on company size. At small companies, the owner, CEO, or CFO often handles FP&A duties directly.

One person might wear multiple hats, juggling various financial responsibilities. While the process is less formal, the work remains critically important for business success.

At large corporations, you’ll find complete FP&A departments with specialized roles. Junior analysts might focus exclusively on one product line or business segment.

These organizations typically have more structured processes and use sophisticated planning tools. The hierarchy is clearly defined, with multiple levels between entry-level analysts and executive leadership.

Skills Needed to Succeed in FP&A

Want to work in FP&A? Success requires a combination of technical expertise, analytical thinking, and soft skills that many candidates overlook.

1. Technical Skills

Excel Mastery stands as the most important technical skill for any FP&A professional. This goes far beyond basic formulas and includes:

- Building financial models that update automatically

- Creating pivot tables and complex formulas (VLOOKUP, INDEX-MATCH, SUMIFS)

- Using Power Query to automate repetitive tasks

- Making clear charts and dashboards that tell a story

Beyond Excel, FP&A professionals work with financial planning software, data visualization tools like Power BI, ERP systems that store company data, and statistical analysis programs.

Familiarity with these platforms becomes increasingly important as you advance in your career.

2. Analytical Skills

FP&A professionals need to solve complex problems by breaking them into smaller, manageable pieces.

They spot patterns and trends in numbers that others might miss, think critically about what the data reveals, and anticipate potential issues before they become serious problems.

Running “what-if” scenarios to test different options is a daily activity that requires both technical skill and business judgment.

3. Communication Skills

Numbers don’t speak for themselves, which is why communication skills often separate good FP&A analysts from great ones.

Consider this real-world example: telling the CEO “our EBITDA margin compressed 200 basis points” doesn’t help much.

Saying “our profit margin dropped from 15% to 13% because shipping costs jumped unexpectedly” gets the point across clearly and prompts action.

FP&A analysts must:

- Explain financial concepts to non-financial people

- Tell the story behind the data

- Present findings clearly to executives

- Write reports that are easy to understand

- Work effectively with teams across the company

4. Leadership Skills

As professionals move up the ladder, technical skills alone aren’t enough. They need to manage and mentor junior analysts, build trust with senior leadership, coordinate across departments, and drive change initiatives.

These soft skills become increasingly important at the manager level and above.

Modern FP&A Technology: Tools That Change the Game

FP&A has evolved far beyond basic spreadsheets, with technology transforming how analysts work.

| Technology | Key Benefits | Time Savings Example |

|---|---|---|

| Cloud-Based Platforms | Access data anywhere, easy collaboration, automatic connections, scalable | Real-time updates replace waiting for file transfers |

| AI & Machine Learning | Analyze massive data quickly, spot hidden trends, accurate forecasts | AI analyzes thousands of transactions instantly vs. hours manually |

| Robotic Process Automation | Pulls data automatically, formats reports, updates forecasts | 10-hour tasks reduced to 10 minutes |

| Extended Planning (xP&A) | Cross-department integration, shared tools, synchronized plans | Eliminates redundant data entry across teams |

AI and Machine Learning in Action

AI helps FP&A teams analyze massive amounts of data quickly, spot trends humans might miss, create more accurate forecasts, automate repetitive tasks, and predict future outcomes with greater precision.

For example, AI can analyze thousands of transactions to predict which customers are likely to pay late, helping with cash flow forecasting.

Robotic Process Automation (RPA) Benefits

RPA automates manual tasks by pulling data, formatting reports, updating forecasts, and generating scheduled reports.

Tasks that once took 10 hours might now take 10 minutes, freeing analysts to focus on strategic thinking instead of data entry.

Why FP&A Matters: The Business Impact

Strong FP&A functions deliver real value to both leaders and the organization as a whole.

Company leaders can make decisions based on data rather than gut feelings, understand financial consequences before taking action, spot opportunities and risks early, and allocate resources more effectively.

Solid FP&A capabilities enable better cash flow management, accurate budgets, improved profitability, quick market responses, and a competitive edge through superior planning.

Real-World Impact

Companies with mature FP&A capabilities often outperform competitors because they can pivot faster and make smarter strategic bets.

The difference between having strong FP&A and weak FP&A can mean the difference between thriving and merely surviving in competitive markets.

Education and Career Path in FP&A

Building a successful FP&A career requires the right educational foundation, strategic certifications, and a clear understanding of typical progression milestones.

Getting Started

Common degree backgrounds include Finance, Accounting, Business Administration, Economics, and Statistics. While you don’t need a specific degree to enter FP&A, these fields provide the strongest foundation.

Valuable certifications that can accelerate your career include:

- FMVA (Financial Modeling and Valuation Analyst)

- CFP (Certified Financial Planner)

- FRM (Financial Risk Manager)

- MBA (Master of Business Administration)

Career Timeline

| Years of Experience | Typical Position | Primary Focus |

|---|---|---|

| 0-3 years | FP&A Analyst | Learning the ropes, building models, creating reports |

| 3-5 years | Senior Analyst | Complex analysis, scenario planning, and presenting to executives |

| 5-10 years | FP&A Manager | Leading teams, strategic projects, and cross-functional work |

| 10-15+ years | Director/VP | Setting strategy, making major decisions, and collaborating with the C-suite |

Exit Opportunities

Not everyone stays in FP&A forever. The skills developed in FP&A transfer well to other roles.

Common career moves include investment banking (about 10% transition here), private equity (another 10%), and business consulting (roughly 20% go independent).

Some move to other corporate roles like COO or VP of Strategy, while the majority stay in FP&A but move to bigger companies for higher pay and more responsibility.

The Future of FP&A: What’s Coming Next

FP&A continues to evolve rapidly as technology and business needs change.

Future FP&A systems will automatically update forecasts when market conditions change, alert teams to problems before humans notice them, suggest optimal budget allocations using AI, and run thousands of scenarios in seconds.

This shift toward autonomous planning represents a fundamental change in how FP&A operates.

The annual budget process is dying. Instead, we’re seeing rolling forecasts updated monthly or quarterly, agile budgeting that adapts quickly, real-time performance monitoring, and faster response to opportunities and threats.

Continuous planning is becoming the new standard across industries.

Final Thoughts

After learning about FP&A, I’ve realized it’s so much more than just numbers and spreadsheets; it’s about helping companies make smart choices for the future.

FP&A professionals turn data into clear insights that guide hiring, spending, and growth decisions. If you want to start a career in finance or simply understand how businesses plan ahead, knowing how FP&A works gives you a big advantage.

As technology like AI keeps improving, the role of FP&A will only get more exciting and strategic.

If you found this guide helpful, stick around. I’ll be sharing more simple, easy-to-follow blogs about finance and business that can help you level up your knowledge.