I’ve learned that mastering options strategies isn’t just about making trades; it’s about stacking the odds in your favor when the market moves. Think of it as having different tools in your toolbox, each designed for specific market conditions.

Today, I want to walk you through one of my go-to strategies when I’m feeling moderately bearish: the bear put spread.

This isn’t about betting against the market with reckless abandon. Instead, it’s a calculated approach that lets me profit from downward price movements while keeping my risk defined and manageable.

Throughout this guide, I’ll break down exactly what a bear put spread is, show you how its components work together, walk through real examples, and help you understand both the advantages and potential pitfalls you’ll face when using this strategy.

Options trading involves substantial risk and isn’t suitable for everyone. You can lose your entire investment, so never trade with money you can’t afford to lose.

What is a Bear Put Spread?

A bear put spread is my go-to strategy when I expect a stock to decline moderately.

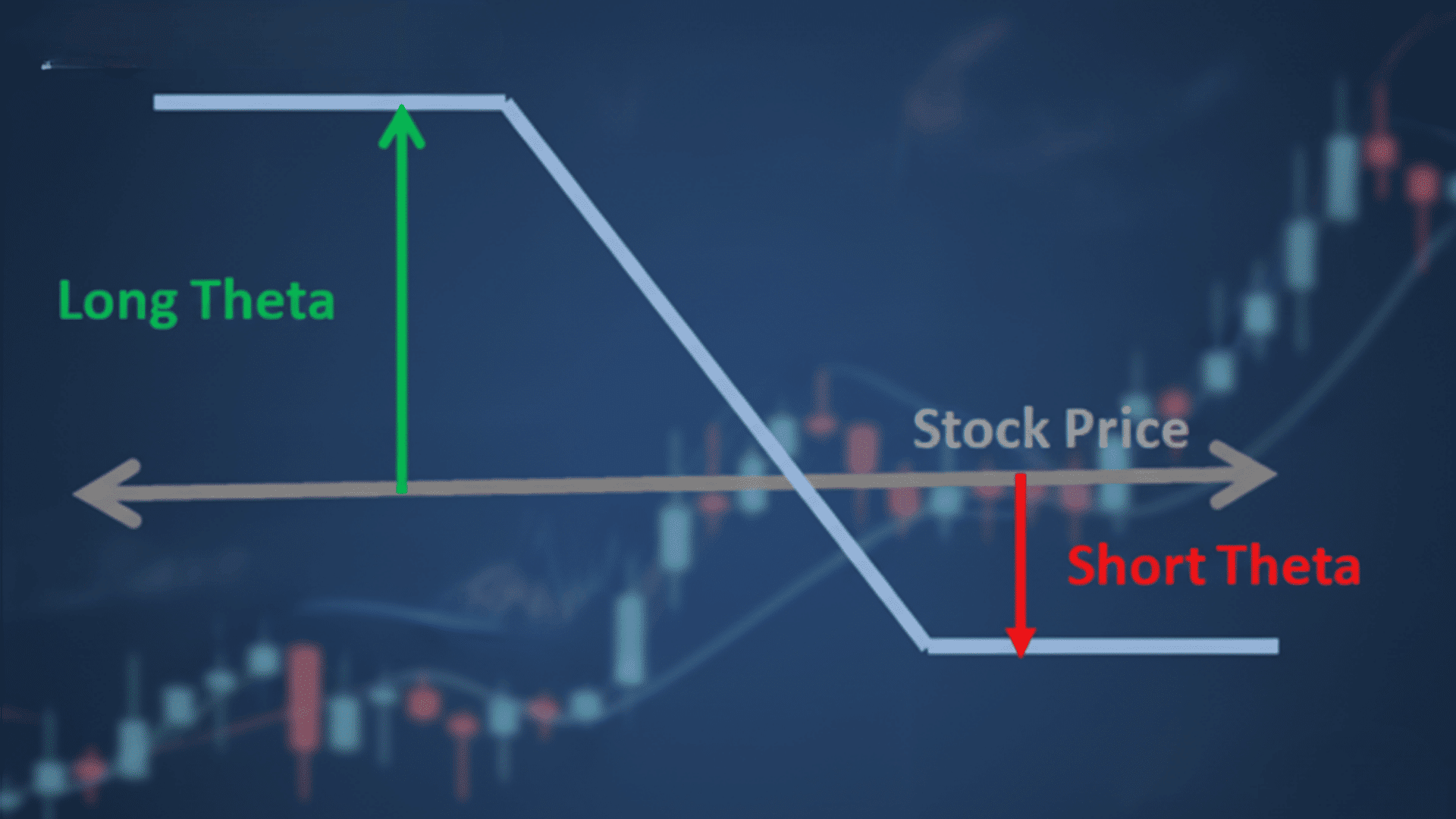

Here’s how it works: I buy a put option at a higher strike price while simultaneously selling another put at a lower strike price; both on the same underlying asset and with the same expiration date.

This combination lets me profit from downward price movements while capping both my maximum loss and potential gain.

I typically use this strategy on stocks, ETFs, and indices. The beauty lies in its defined risk profile, making it perfect for traders who want bearish exposure without unlimited downside risk.

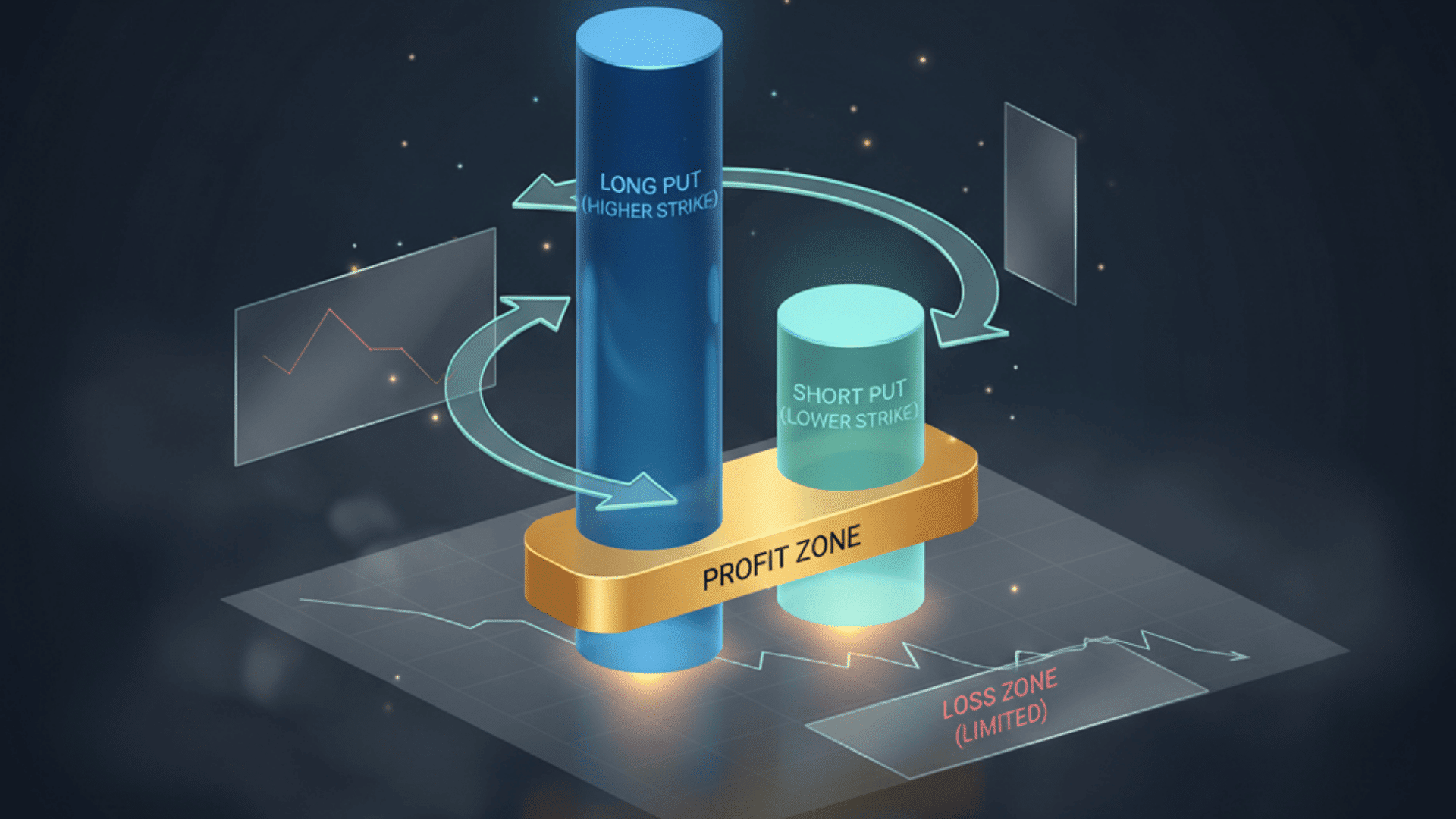

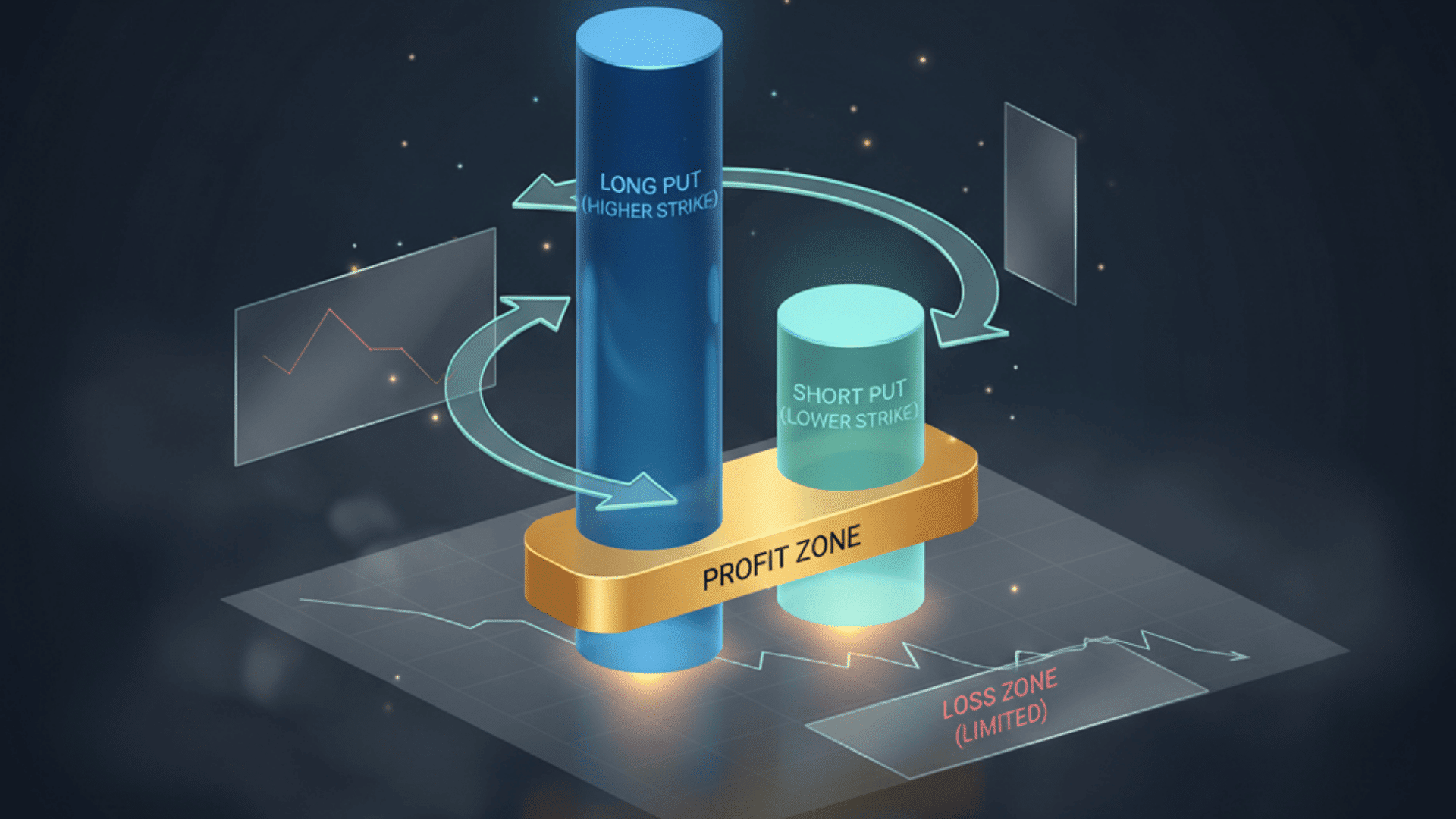

Components of a Bear Put Spread

Every bear put spread is built from the same essential components working in harmony. Let me break down each piece so you can see exactly how they fit together to create this powerful strategy.

1. Long Put (Higher Strike Price)

This is the foundation of my bear put spread. I purchase a put option at a higher strike price, which gives me the right to sell the underlying asset at that price. This is my main profit engine when the stock price falls.

The higher strike price is more expensive because it has greater intrinsic value potential. Think of this as my insurance policy that pays out when prices drop.

Example: I buy a put option with a strike price of fifty dollars, paying a premium of four dollars per share.

2. Short Put (Lower Strike Price)

To offset the cost of my long put, I simultaneously sell a put option at a lower strike price. This generates immediate income that reduces my net investment.

However, there’s a trade-off: selling this puts a cap on my maximum profit because both options will be in the money if the stock falls below this lower strike. I’m essentially giving up unlimited profit potential in exchange for a lower upfront cost.

Example: I sell a put option with a strike price of forty-five dollars, receiving a premium of two dollars per share.

3. Net Debit

This is the actual cash I’m putting at risk to establish the spread. I calculate it by subtracting the premium I receive from selling the lower strike put from the premium I pay for the higher strike put.

This net debit represents my maximum possible loss, which occurs if the stock stays above my higher strike price at expiration. Knowing this upfront gives me peace of mind.

Example: Net debit equals four dollars minus two dollars, resulting in two dollars per share, or two hundred dollars per contract.

4. Expiration Date

Both options must share the same expiration date for this strategy to work properly. I typically choose expiration dates based on my timeframe for the expected price decline.

Shorter expirations mean less time premium but faster resolution, while longer expirations provide more time for my bearish thesis to play out but cost more due to increased time value.

Example: Both my long and short puts expire on the third Friday of next month, giving me thirty days for the stock to decline.

Mechanics of a Bear Put Spread

Understanding how to execute this strategy is crucial for successful implementation. Let me walk you through the step-by-step process I follow every time I set up a bear put spread.

| Step | Action | Details |

|---|---|---|

| 1 | Identify the Underlying Asset | Select a stock, ETF, or index expected to decline moderately based on your analysis. |

| 2 | Buy the Higher Strike Put | Purchase a put at a higher strike price. This is your profit driver as the asset falls. |

| 3 | Sell the Lower Strike Put | Simultaneously sell a put at a lower strike with the same expiration to offset costs. |

| 4 | Calculate Net Debit |

Net debit = Premium paid – Premium received. |

| 5 | Monitor Until Expiration | Track price movement and decide whether to hold or close early to lock in gains. |

Market Expert Note: I’ve found that timing is everything with bear put spreads. The ideal setup occurs when implied volatility is relatively low before an anticipated decline, allowing you to enter at a reasonable cost. Always ensure the potential profit justifies the risk, and never use this strategy without a clear bearish catalyst.

When to Use a Bear Put Spread?

I deploy this strategy when I’m moderately bearish, expecting a decline but not a crash.

Unlike buying a plain long put, the bear put spread costs less upfront because the premium I collect from selling the lower strike put offsets my purchase cost. This makes it more capital-efficient.

Compared to a long put, I sacrifice unlimited profit potential but gain affordability.

Against a bear call spread, I prefer the bear put spread when I want defined risk from the start, rather than dealing with undefined risk if the market rallies unexpectedly. It’s my sweet spot for controlled bearish plays.

Important: Only use this strategy when you have a clear bearish thesis backed by research. Wrong market timing or direction will result in losses.

Profit and Loss Potential in Bear Put Spread

One of the aspects I appreciate most about bear put spreads is the clarity they provide. Before I even enter the trade, I know exactly how much I can make, how much I can lose, and where I break even.

The Three Key Metrics

Understanding these formulas helps me evaluate whether a trade is worth taking. Here’s how I calculate each critical metric:

- Maximum Profit = Difference Between Strike Prices – Net Debit Paid

(This represents the best-case scenario when the stock falls below my lower strike price at expiration.) - Maximum Loss = Net Debit Paid

(This is the worst-case outcome if the stock stays above my higher strike price, and both options expire worthless.) - Breakeven Point = Long Put Strike Price – Net Debit Paid

(At this price, I neither make nor lose money. The stock needs to fall below this point for me to profit.)

Practical Example

Let me walk you through a real scenario to illustrate how these calculations work:

Setup:

- I buy a put option with a strike price of $55 for $4 per share

- I sell a put option with a strike price of $50 for $1.50 per share

- Net debit = $4 – $1.50 = $2.50 per share (or $250 per contract)

Calculations:

- Maximum Profit = ($55 – $50) – $2.50 = $5 – $2.50 = $2.50 per share (or $250 per contract)

(This occurs when the stock falls to $50 or below at expiration.) - Maximum Loss = $2.50 per share (or $250 per contract)

(This happens if the stock stays above $55 at expiration, and both options expire worthless.) - Breakeven Point = $55 – $2.50 = $52.50

(If the stock closes exactly at $52.50, I break even. Below this price, I start profiting; above it, I lose money up to my maximum loss.)

Advantages of a Bear Put Spread

I’ve found that bear put spreads offer several compelling benefits that make them a staple in my bearish trading toolkit.

Here’s why I keep coming back to this strategy:

- Defined Risk Profile: My maximum loss is limited to the net debit paid, eliminating the anxiety of unlimited downside exposure.

- Lower Capital Requirement: Selling the lower strike put reduces my upfront cost, making this strategy more accessible than buying a naked put.

- Favorable Risk-Reward Ratio: I can structure spreads where the potential profit significantly outweighs the initial investment.

- Flexible Hedging Tool: I can combine this strategy with existing long positions to protect my portfolio during anticipated downturns.

- No Margin Requirements: Unlike short selling or naked options, I don’t need a margin account since my risk is fully defined at entry.

These advantages make the bear put spread an intelligent choice when I want to capitalize on bearish sentiment without exposing myself to catastrophic losses. It’s about trading smarter, not harder.

Risks and Limitations of the Bear Put Spread

While I appreciate the benefits of bear put spreads, I’m always mindful that no strategy is perfect. Understanding the limitations helps me make informed decisions and avoid costly mistakes.

| Risk/Limitation | Impact on Position | When It Occurs |

|---|---|---|

| Total Loss Possible | Lose the entire net debit paid | Stock stays above the long strike at expiration |

| Capped Profit Potential | Gains are limited to the spread width minus debit | Stock falls below short strike; no benefit from further decline |

| Timing is Critical | Position expires worthless despite the correct direction | Stock declines too slowly or after the expiration date |

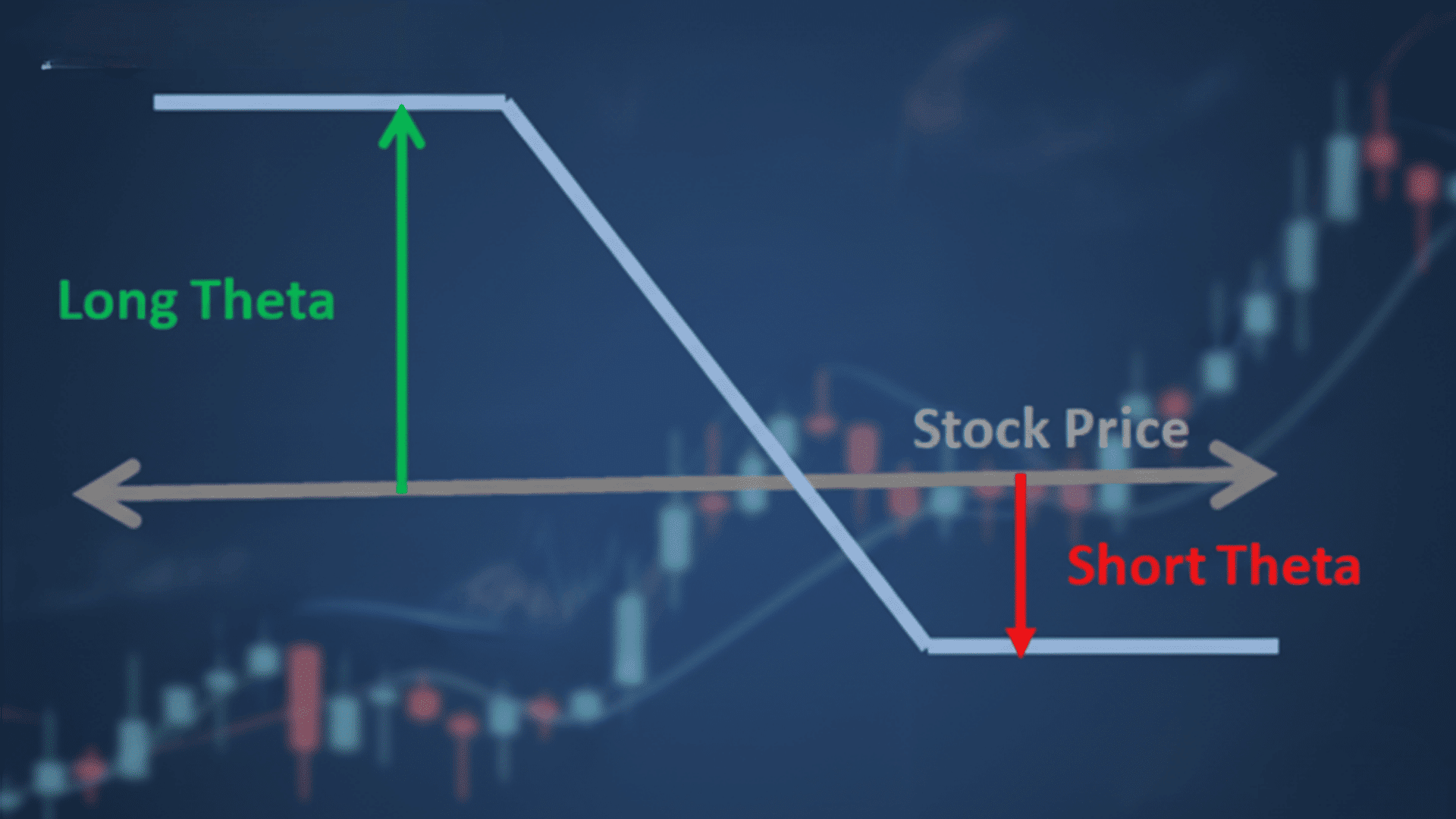

| Time Decay Erosion | Daily value loss accelerates near expiration | Stock moves sideways or fails to reach breakeven quickly |

| Volatility Sensitivity | Position loses value even with a favorable price move | Implied volatility drops after entry, crushing option premiums |

These limitations remind me that bear put spreads require disciplined execution and realistic expectations. I never risk more than I can afford to lose, and I always have an exit plan before entering the trade.

Remember: Past performance doesn’t guarantee future results, and every trade carries the risk of total capital loss.

Tips for Trading Bear Put Spreads

Over time, I’ve learned that successful bear put spread trading isn’t just about mechanics—it’s about discipline and preparation. These practical tips have saved me from costly mistakes and improved my win rate.

- Conduct thorough technical and fundamental analysis before entering to confirm your bearish thesis with multiple indicators.

- Avoid high-volatility assets unless you have a strong conviction, as unpredictable swings can quickly work against your position.

- Never risk more than 2-3% of your trading capital on a single spread to protect your portfolio from significant drawdowns.

- Set profit targets and stop-loss levels in advance, and stick to them without letting emotions dictate your decisions.

- Actively monitor your spread as expiration nears, and consider closing early if you’ve captured most of the potential profit.

Consistency and discipline separate successful options traders from those who struggle, and following these tips keeps me on the right side of that divide.

Summing It Up

The bear put spread has earned its place in my options arsenal because it delivers what every smart trader needs: controlled risk with clear profit potential.

By combining a long put with a short put, I can express my bearish outlook without the anxiety of unlimited losses or excessive capital requirements. It’s not about predicting market crashes; it’s about positioning myself intelligently when I anticipate moderate declines.

Before you jump in with real money, I strongly encourage you to practice with a paper trading account first.

Simulate different scenarios, test various strike prices, and watch how your spreads respond to price movements. This hands-on experience will build the confidence and intuition you need to trade bear put spreads successfully.

Final Risk Warning: Options trading is complex and carries significant financial risk. This guide is for educational purposes only and shouldn’t be considered financial advice.