Starting your own digital currency sounds like a big project. And yes, it takes work. But the good news? It’s more accessible than you might think.

Thousands of coins and tokens now exist. Some have real utility. Others are experiments. A few have failed completely. What separates success from failure often comes down to planning, execution, and community trust.

This guide walks you through the entire process. You’ll learn what a crypto coin actually is, how it differs from a token, the technical steps to build one, and what it takes to launch and grow your project.

By the end, you’ll know exactly how to create a crypto coin and what decisions matter most.

Ready? Let’s get started.

What is a Cryptocurrency and its Types?

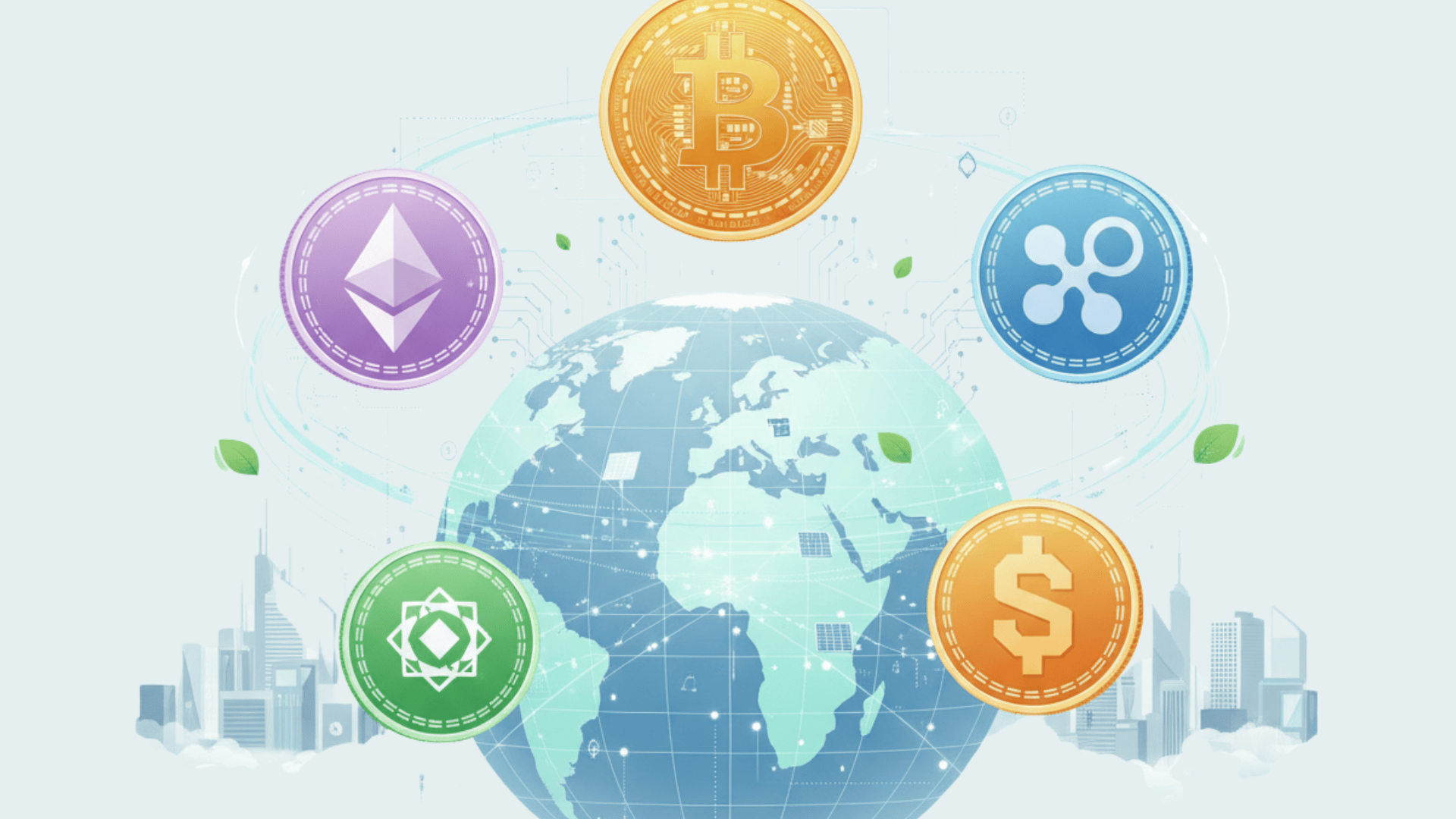

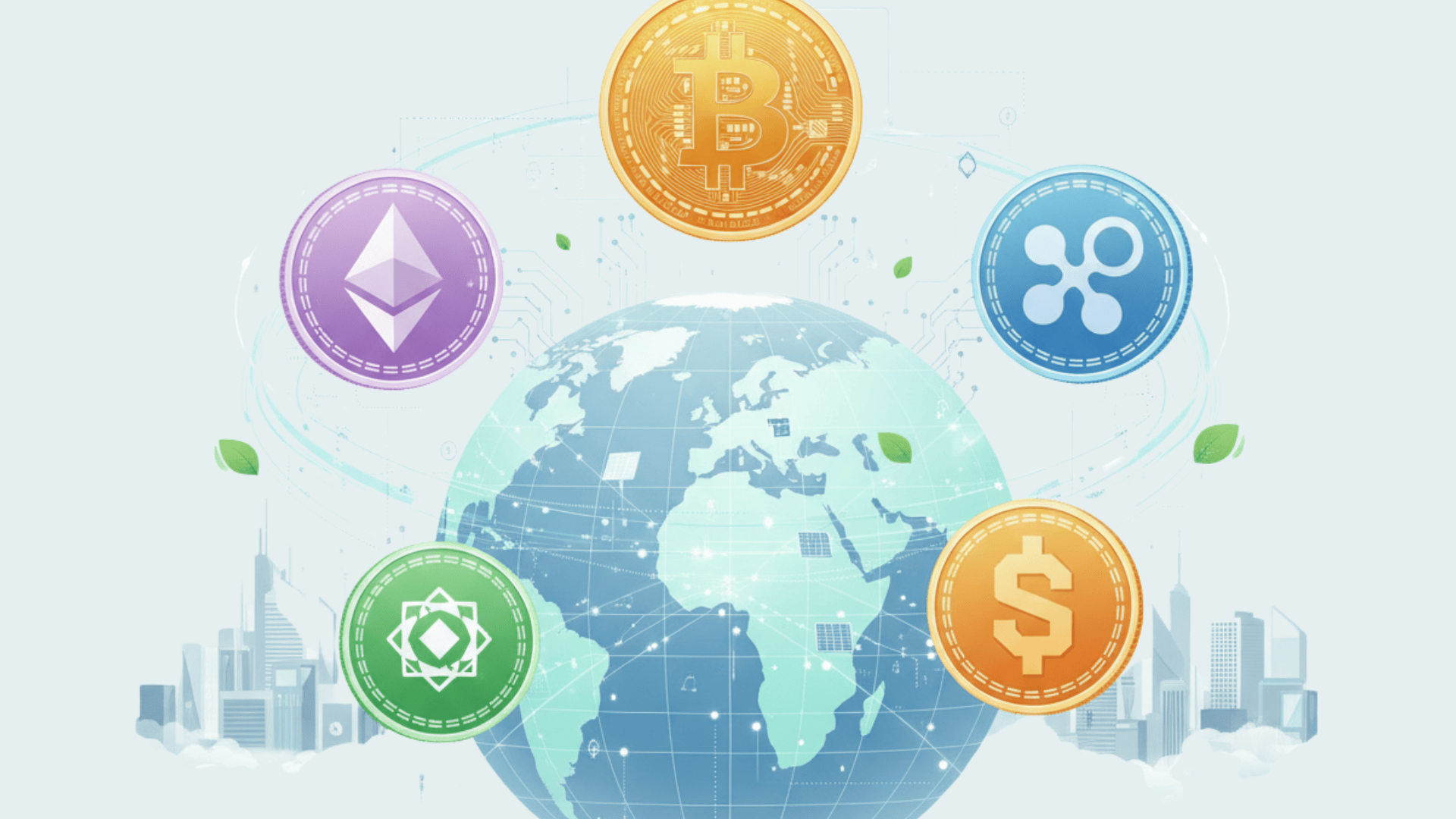

A cryptocurrency is a digital asset that uses cryptography for security. It operates on a blockchain or distributed ledger. This means transactions happen without banks or middlemen.

Think of it as digital money. But instead of a central authority controlling it, the network itself maintains trust through code and consensus.

Understanding different types of cryptocurrencies helps you position your own project effectively.

- Bitcoin (BTC): The first and most popular cryptocurrency, designed as a decentralized digital currency for peer-to-peer payments.

- Ethereum (ETH): A blockchain platform enabling smart contracts and decentralized applications beyond simple transactions.

- Ripple (XRP): Focused on fast, low-cost cross-border payments for banks and financial institutions.

- Litecoin (LTC): A faster, lightweight version of Bitcoin designed for everyday transactions with lower fees.

- Cardano (ADA): A blockchain platform emphasizing sustainability, security, and research-driven development.

Coin vs Token: What’s the Difference?

This is one of the first questions people ask when they want to make a cryptocurrency.

| Feature | Coin | Token |

|---|---|---|

| Blockchain | Runs on its own blockchain | Built on an existing blockchain |

| Examples | Bitcoin, Ethereum, Litecoin | ERC-20 tokens on Ethereum, BEP-20 on BSC |

| Network | Has its own independent network and rules | Uses the infrastructure of another blockchain |

| Development | Requires building everything from scratch | No need to build a whole network |

| Cost | Higher development cost | Lower development cost |

| Complexity | More complex to create | Simpler to create |

| Control | Full control over all features | Limited by the host blockchain’s rules |

Choosing between a coin and a token is a major decision. It affects cost, complexity, and control.

Why Launch your Own Crypto Coin or Token?

People create crypto assets for many reasons:

- Build a payment system for a business or community

- Launch a governance token for a decentralized organization

- Create a reward system to incentivize users

- Test new blockchain technology or features

- Raise funds for a project or startup

Your reason matters. It shapes every decision that follows.

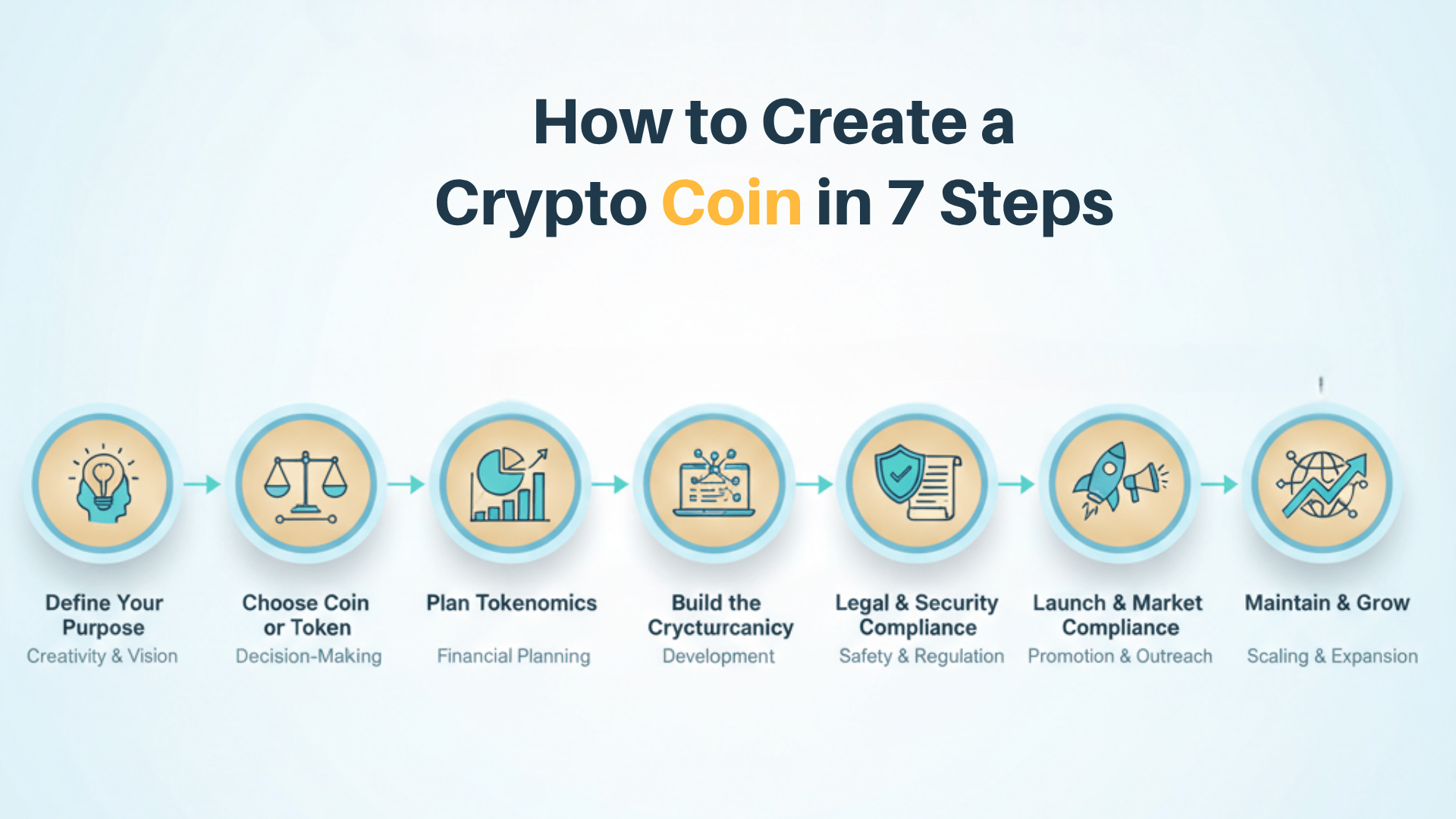

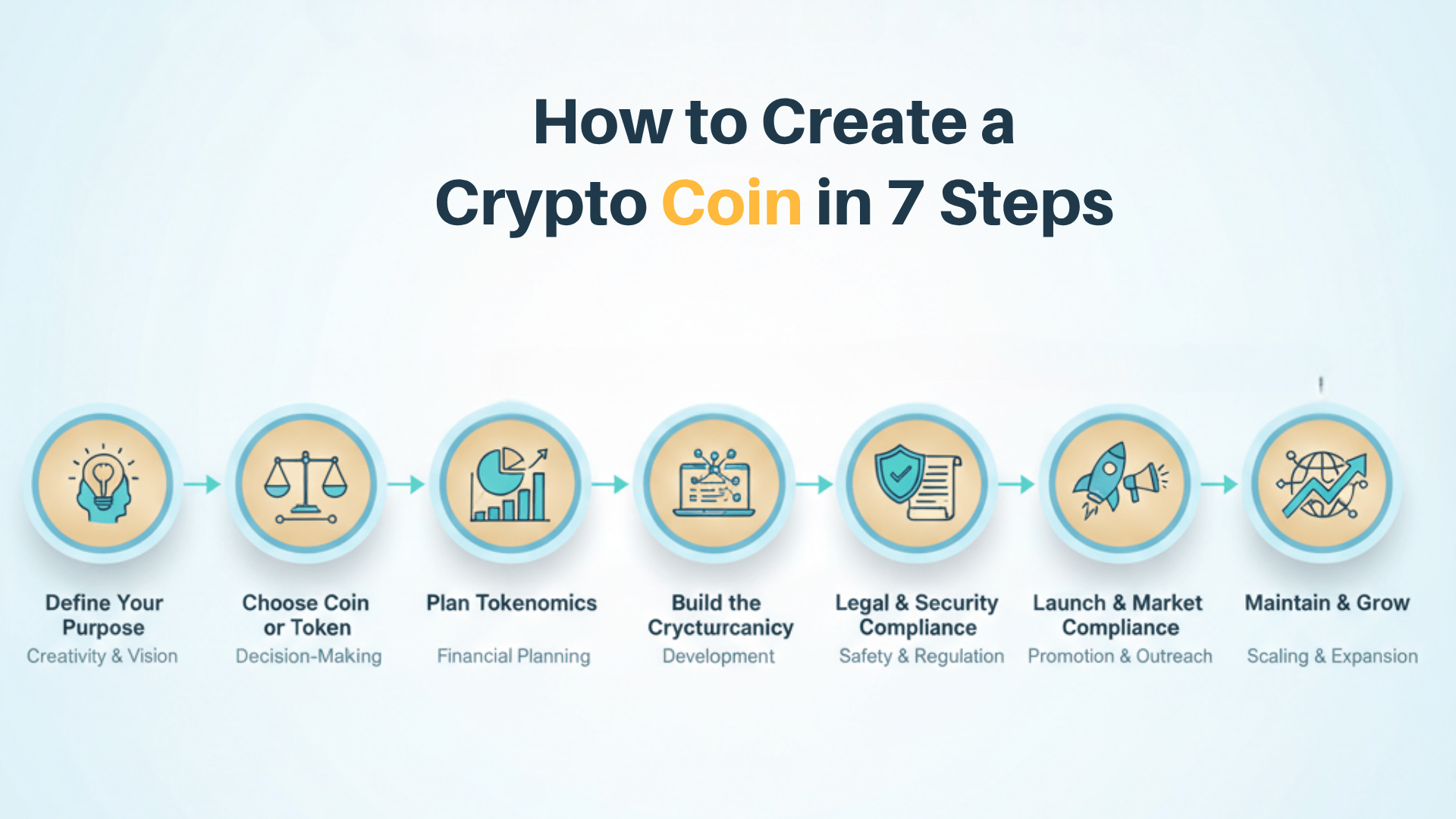

How to Create a Crypto Coin: Step-by-Step Process

Now that you understand the basics, let’s walk through the actual steps to make a crypto coin. Follow this process carefully to avoid common mistakes.

Step 1: Define the Purpose of Your Cryptocurrency

Before writing a single line of code, ask yourself:

- What problem does your coin solve?

- Who will use it: investors, businesses, or communities?

- What value will your crypto bring?

Example: A startup may create a coin for loyalty rewards. A DAO might launch a governance token. A gaming platform could build a token for in-game purchases.

Having a clear vision helps you design tokenomics, choose a blockchain, and attract early supporters. Without purpose, your project won’t gain traction.

Write down your answers. Share them with potential users. Get feedback early.

Step 2: Choose Between a Coin or a Token

There are two main ways to create a cryptocurrency. A coin has its own blockchain, like Bitcoin, Litecoin, or Ethereum, giving you full control over consensus rules and custom features.

A token is built on an existing blockchain, such as ERC-20 on Ethereum or BEP-20 on BNB Chain, offering a faster and more cost-effective start.

Create a token if you want speed, lower costs, and proven infrastructure that’s already in place.

Build a coin if you need a custom network, complete control over how transactions work, or your use case demands unique features not available on existing chains.

Most new projects begin with a token to save time and resources; it’s the practical choice for most people learning how to create a cryptocurrency.

Step 3: Design the Tokenomics

Tokenomics defines how your crypto works economically. Get this right or face problems later.

Key decisions include:

Total Supply: Will supply be fixed or inflationary? A fixed supply creates scarcity. Inflationary models can fund ongoing development.

Distribution: How much goes to different groups?

- Team and advisors: 15-25%

- Community rewards: 20-35%

- Public sale: 20-30%

- Ecosystem fund: 15-25%

- Reserves: 5-15%

Utility: What will users do with it?

- Make payments

- Vote on governance decisions

- Stake for rewards

- Access premium features

Incentives: Will there be rewards, burns, or staking yields? These mechanisms drive demand and engagement.

Vesting schedules: Lock team tokens for 12-24 months. This prevents early dumps and builds trust.

Strong tokenomics build trust and sustainability. Study successful projects before finalizing your model.

Step 4: Build or Generate the Cryptocurrency

You have three technical routes:

Option 1: Develop from scratch

Use frameworks like Cosmos SDK or Substrate. This gives you complete control but requires significant development resources.

Best for: Projects needing custom consensus or unique blockchain features.

Option 2: Create a smart contract

Build on Ethereum, BNB Chain, or Solana. Write a contract that defines your token’s properties.

Common standards:

- ERC-20 for Ethereum

- BEP-20 for BNB Chain

- SPL for Solana

Best for: Most projects wanting speed and lower costs.

Option 3: Use a no-code generator

Platforms exist that automate token creation. You input parameters and generate a token in minutes.

Best for: Simple experiments or testing ideas quickly.

Development best practices:

- Always deploy on a testnet first

- Test every function thoroughly

- Use well-audited code templates

- Implement safety mechanisms

- Make contracts upgradeable if needed

Pro Tip: Start simple. Add features gradually. Complex code has more vulnerability points.

Step 5: Ensure Legal & Security Compliance

Building trust is crucial. This step protects both you and your users.

Legal considerations:

- Check local regulations, especially securities laws, if you sell tokens. In the U.S., tokens may be considered securities under certain conditions.

- Implement KYC/AML: If raising funds, you likely need Know Your Customer and Anti-Money Laundering procedures.

- Tax obligations: Understand reporting requirements for token sales and distributions.

- Terms of service: Create clear terms that protect your project legally.

Get proper legal advice. Don’t skip this step. Regulatory problems can shut down your entire project.

Security measures:

- Audit your smart contract: Hire a reputable security firm. Audits cost $5,000-$50,000+ but prevent million-dollar exploits.

- Store private keys securely: Use hardware wallets or multisig solutions. Never keep keys on internet-connected devices.

- Verify contracts publicly: Publish verified code on block explorers. This builds transparency.

- Monitor activity: Set up alerts for unusual transactions or security threats.

- Have a response plan: Know what to do if something goes wrong. Speed matters during incidents.

Transparency and compliance make your project credible to investors and users.

Step 6: Launch and Promote Your Coin

Your launch plan determines whether people notice your project.

Pre-launch preparation:

- Build a professional website: Include clear information about your project, team, tokenomics, and roadmap.

- Write a whitepaper: Explain your vision, technology, and plans. Make it detailed but readable.

- Create brand assets: Design a logo, choose colors, and maintain a consistent visual identity.

- Set up community channels: Start Discord, Telegram, or Reddit communities. Begin engaging people before launch.

Launch activities:

- List on DEXs: Add liquidity on Uniswap, PancakeSwap, or similar platforms. This lets users trade immediately.

- Lock liquidity: Lock a portion for 6-12 months. This prevents rug pulls and proves commitment.

- Announce everywhere: Post on social media, email lists, and community channels.

- Offer incentives: Consider airdrops, early supporter rewards, or referral programs.

Marketing strategies:

- Share educational content about your project

- Post regular development updates

- Engage directly with community questions

- Partner with relevant projects or platforms

- Use social media consistently

Goal: Create awareness and liquidity so users can easily find and trade your coin. Don’t spend everything on launch. Save budget for ongoing marketing.

Step 7: Maintain, Grow & Scale

Post-launch success depends on consistent updates. This is where most projects fail.

Community engagement:

- Respond to user questions promptly: Quick replies show you care and build trust with your community.

- Share transparent updates about progress: Regular communication keeps supporters informed and engaged.

- Address concerns honestly: Transparency about challenges builds credibility more than hiding problems.

- Celebrate milestones together: Recognizing achievements strengthens community bonds and motivation.

Development milestones:

- Keep hitting roadmap targets: Meeting deadlines proves reliability and maintains investor confidence.

- Fix bugs quickly: Fast responses to technical issues prevent user frustration and security risks.

- Add planned features on schedule: Delivering promised functionality keeps users excited about your project.

- Communicate delays honestly if they happen: Transparency about setbacks maintains trust better than silence.

Ecosystem growth:

- Integrate your coin into apps or services: Real-world use cases increase demand and prove utility.

- Form partnerships with complementary projects: Strategic alliances expand reach and add value for users.

- Support developers building on your platform: A thriving developer community creates lasting ecosystem value.

- Create bridges to other blockchains: Cross-chain compatibility increases accessibility and trading opportunities.

Governance implementation:

- Set up voting mechanisms: As delivering on governance commitments shows you respect token holder rights.

- Let holders propose changes: As community-driven proposals increase engagement and decentralization.

- Execute community decisions: Following through on votes proves governance is real, not theater.

- Maintain decentralized decision-making: Avoiding central control builds long-term credibility and trust.

Performance tracking:

Monitor these metrics:

- Holder count and growth rate: These metrics show how many people trust and invest in your project.

- Daily active users: Measures real engagement beyond just holding tokens.

- Transaction volume: Indicates actual usage and economic activity on your network.

- Liquidity depth: Shows how easily users can buy or sell without affecting the price.

- Community engagement levels: Tracks social media activity, forum posts, and overall participation.

Use this data to adjust your strategy. Double down on what works. Fix what doesn’t.

Long-term sustainability:

A strong ecosystem turns your token from an idea into a real-world utility. Keep building. Keep improving. Keep listening to users.

Projects that survive focus on continuous value creation. The initial launch is just the beginning.

Mistakes to Avoid When Creating a Crypto Coin

Even the best crypto ideas can fail if a few key details are overlooked. To help you stay on track, let’s look at the most common mistakes new creators make, and Why It’s a Problem.

| Mistake | Why It’s a Problem |

|---|---|

| Launching without a clear purpose | Without a defined goal or real-world use case, your coin fails to attract genuine users or investors. |

| Weak or unsustainable tokenomics | Poor supply models or unfair distribution can crash value and discourage long-term holders. |

| Skipping audits or ignoring regulations | Security flaws or legal violations can lead to hacks, bans, or a total project shutdown. |

| Poor community communication | Lack of transparency erodes trust and slows adoption, even for good technology. |

| No liquidity or exchange plan | If users can’t easily buy or sell your token, the project loses credibility and real-world utility. |

Future Trends in Cryptocurrency Development

The crypto landscape continues to shift rapidly. Layer-2 networks like Arbitrum and Optimism are solving scalability issues by processing transactions off the main chain.

AI integration is emerging, with projects using machine learning for security audits and automated trading systems.

Environmental concerns are pushing developers toward green consensus mechanisms that use far less energy than traditional Proof of Work. Interoperability is becoming essential; users want tokens that work across multiple blockchains without friction.

Cross-chain bridges and universal standards are making this possible. Projects launching in 2025 and beyond must consider these trends.

Building with scalability, sustainability, and cross-chain compatibility from the start positions your coin for long-term relevance in an increasingly connected blockchain ecosystem.

Conclusion

Creating your own cryptocurrency is possible. But it’s not a get-rich-quick scheme. Success requires careful planning, solid execution, and long-term commitment.

Start with a clear purpose. Choose the right technical approach for your goals. Design fair tokenomics. Build securely. Follow legal requirements. Market effectively. And keep improving after launch.

The crypto space moves fast. Competition is fierce. But projects that solve real problems, build strong communities, and operate with integrity can thrive.

Now you know how to create a crypto coin from start to finish. The question is: are you ready to build something meaningful?

Take the first step. Define your vision. And start turning your idea into reality.