If you want to invest in Bitcoin but don’t want the hassle of buying and storing it yourself, Bitcoin ETFs like FBTC and IBIT can be a great choice.

I’ve invested in both of these popular Bitcoin ETFs because many people are asking which one is better to buy. These ETFs let you invest in Bitcoin through the stock market, just like buying shares of a company.

What’s cool is that they hold real Bitcoin, so their price moves with Bitcoin’s value. But even though they seem similar, there are important differences like fees, who manages them, and how they keep your Bitcoin safe.

In this blog, I’ll help you understand those differences so you can decide which ETF fits your investment goals best.

Understanding FBTC and IBIT: Bitcoin ETFs

Let’s take a closer look at both FBTC and IBIT to understand how they give investors access to Bitcoin and what makes them unique.

Fidelity Wise Origin Bitcoin Fund (FBTC)

FBTC is managed by Fidelity and aims to track Bitcoin’s price through a straightforward, passive investment. It holds actual Bitcoin and is designed for investors comfortable with high risk and crypto volatility.

FBTC uses self-custody for Bitcoin, providing an added layer of security through Fidelity Digital Assets.

iShares Bitcoin Trust (IBIT)

IBIT is managed by BlackRock, the largest asset manager in the world. Like FBTC, it holds Bitcoin directly and tracks its price closely.

IBIT uses third-party custody through Coinbase Prime. It offers a slightly lower expense ratio and appeals to institutional investors due to BlackRock’s strong reputation.

Both ETFs offer simple ways to invest in Bitcoin without owning it directly, but their management and custody differ.

Why Invest in Bitcoin ETFs?

Investing in Bitcoin ETFs offers an easier way to get Bitcoin exposure without dealing with the complexity of owning the actual cryptocurrency.

Many investors prefer ETFs because they are simpler to trade, regulated, and can fit into tax-advantaged accounts like IRAs.

- Liquidity: ETFs trade on major stock exchanges during market hours, making buying and selling easy.

- Regulatory Oversight: Bitcoin ETFs follow SEC rules, offering investor protections not available with direct Bitcoin ownership.

- Ease of Trading: You can buy Bitcoin ETFs through regular brokerage accounts without managing wallets or private keys.

- Tax Advantages: ETFs can be included in traditional and Roth IRAs, providing potential tax benefits.

- Suitable for Both Retail and Institutional Investors: They offer a regulated way to buy Bitcoin for various investor types.

- Bitcoin’s 2025 Volatility: Recent swings highlight that ETFs offer a controlled way to access Bitcoin’s price movements.

Bitcoin ETFs simplify investing while providing regulated exposure to Bitcoin’s growth potential.

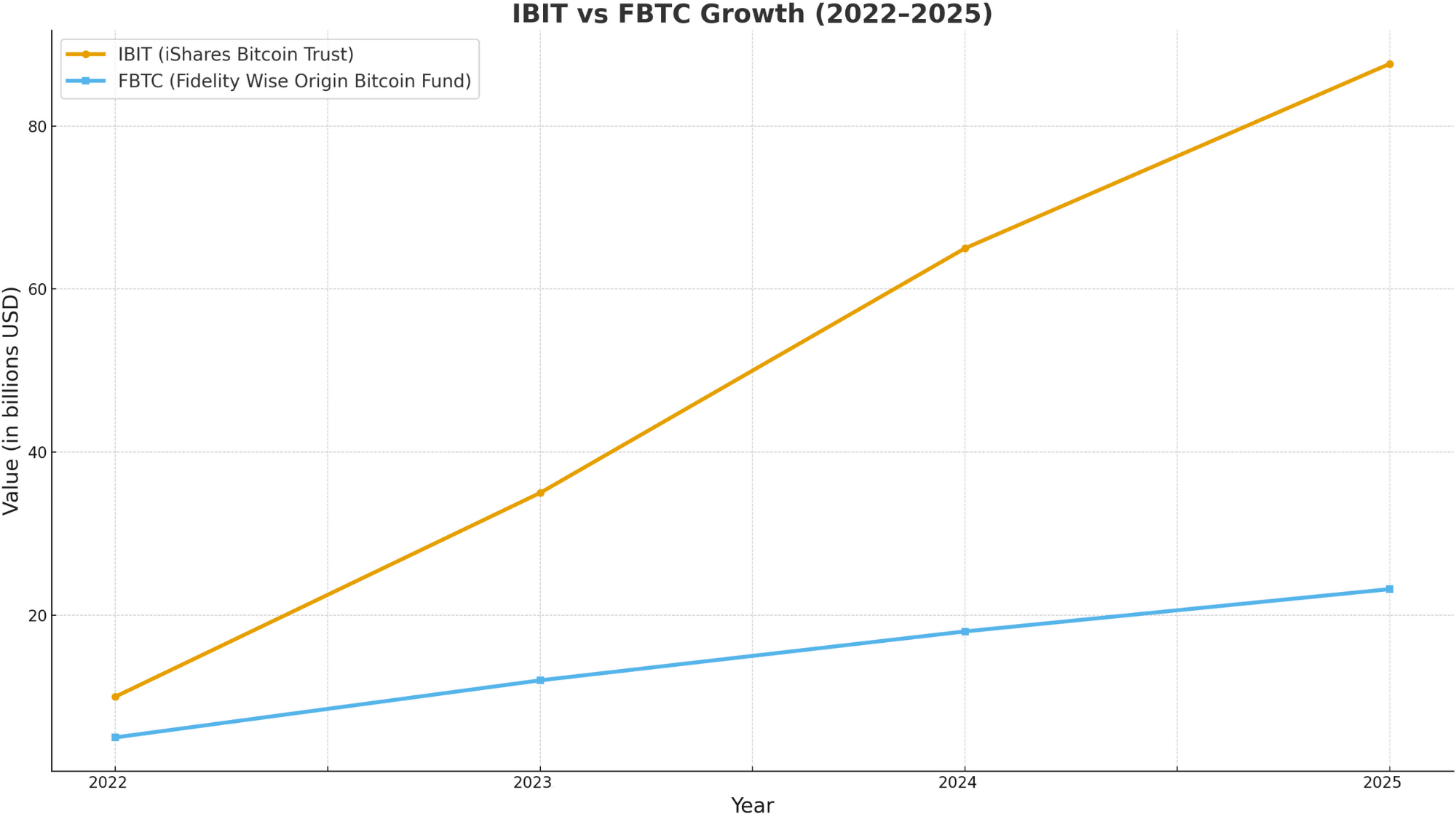

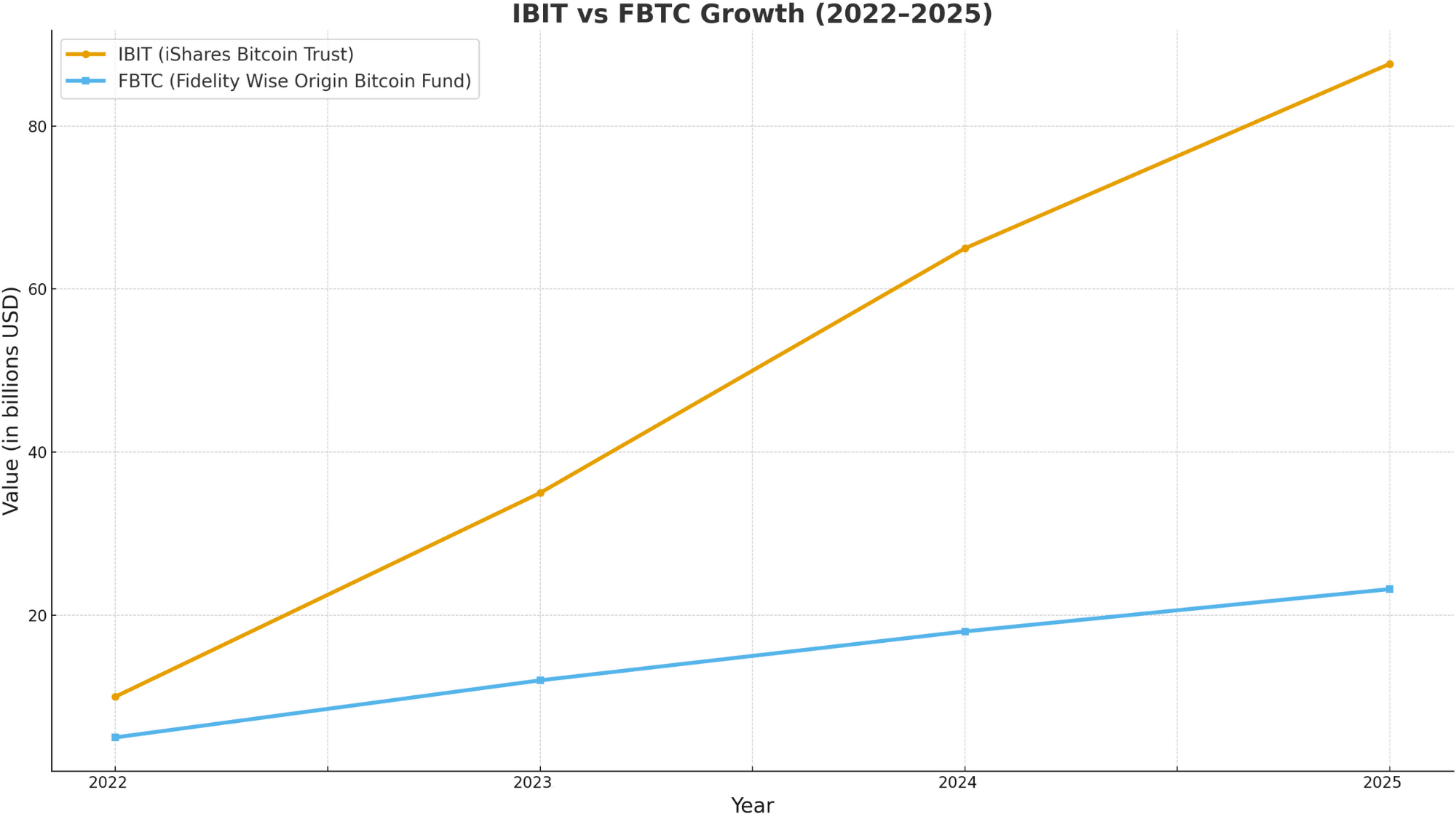

Performance Comparison: FBTC vs IBIT

When we compare the performance of FBTC and IBIT over the past year, both Bitcoin ETFs have delivered very similar returns. FBTC slightly outperformed IBIT, but the difference is minimal.

| Aspect | FBTC (Fidelity Wise Origin Bitcoin Fund) | IBIT (iShares Bitcoin Trust) |

|---|---|---|

| Assets Under Management (AUM) | Around $16.6 to $26 billion | Around $48.8 to $98.5 billion |

| Liquidity | Lower daily trading volume compared to IBIT | Higher daily trading volume and tighter bid-ask spreads |

| 1-Year Return | Approximately 137.65% | Approximately 137.32% |

| Long-Term Performance | Closely tracks Bitcoin spot price | Closely tracks Bitcoin spot price |

| Institutional Support | Popular among retail investors | Strong institutional adoption with high-profile investors |

| Expense Ratio | Around 0.25% | Around 0.25% (initially waived to 0.12%) |

| Custody | Self-custody via Fidelity Digital Assets | Third-party custody via Coinbase Prime |

| Price Volatility Impact | Subject to Bitcoin’s price swings, showing similar spikes and drops as Bitcoin | Same price volatility with Bitcoin, reflecting market events |

| Risk Factors | Volatility, regulatory risks, custody risks | Same as FBTC: volatility, regulatory risks, custody risks |

Both ETFs offer strong Bitcoin exposure with similar returns, but IBIT generally enjoys more liquidity and institutional backing, while FBTC emphasizes security through self-custody.

Recent Bitcoin price swings in 2025 have impacted both ETFs alike.

Fee Structure Comparison

IBIT and FBTC both offer Bitcoin exposure at competitive expense ratios compared to the broader market.

IBIT typically charges a lower expense ratio, starting around 0.12%, though it may increase to about 0.25%. In contrast, FBTC has a flat expense ratio of approximately 0.25%.

Although these fee differences seem small, they can have a big impact on investor returns over time. Lower fees mean more Bitcoin gains stay with you, crucial for long-term investors since fees compound and hinder growth.

Choosing the ETF with lower fees benefits investors aiming for cost efficiency, but it’s also important to weigh other factors like custody and liquidity alongside fees.

Lower expense ratios help maximize returns on Bitcoin ETF investments over the long run.

Liquidity and Market Presence of IBIT & FBTC

IBIT has a much higher liquidity and larger net assets, $87.63 billion as of October 2025. FBTC’s net assets are smaller, $23.19 billion as of October 2025.

This difference shows that IBIT attracts more institutional investors and tends to have higher trading volumes. Institutional adoption has favored IBIT due to its broad recognition and active trading.

IBIT often commands a larger market share in the U.S. spot Bitcoin ETF market, making it easier for investors to buy and sell without significantly impacting the price.

Higher liquidity typically means tighter trading spreads and smoother trading. FBTC, while less liquid, remains a solid option but may have slightly wider bid-ask spreads.

This influences trading efficiency and cost for active traders.

Pros and Cons of IBIT & FBTC

| Feature | IBIT (iShares Bitcoin Trust) | FBTC (Fidelity Wise Origin Bitcoin Fund) |

|---|---|---|

| Expense Ratio | Lower (0.12% initially, rising to ~0.25%) | Higher (~0.25%) |

| Assets Under Management (AUM) | Higher ($87.63 billion as of October 2025) | Lower ($23.19 as of October 2025) |

| Custody | Coinbase Prime (third-party custody) | Fidelity Digital Assets (self-custody) |

| Performance | Slightly lower 1-year returns (around 137.32%) | Slightly higher 1-year returns (around 137.65%) |

| Institutional Use | Stronger institutional support, preferred by large investors | More popular among retail investors |

| Crypto Expertise | Newer to crypto products, started offering in 2021 | Over a decade of cryptocurrency experience |

IBIT is favored for its lower fees, large institutional backing, higher liquidity, and options trading availability.

FBTC stands out with its decade-long crypto expertise and self-custody security model, appealing more to retail investors willing to accept slightly higher fees.

Both ETFs provide excellent ways to gain Bitcoin exposure with minor trade-offs depending on investor preferences.

How to Choose Between FBTC and IBIT?

Choosing between FBTC and IBIT can be tricky since both ETFs aim to give investors exposure to Bitcoin, but they differ in fees, custody options, and liquidity.

Here’s a detailed breakdown to help you decide which one fits your investing style best.

1. Expense Ratio Sensitivity

If you are sensitive to investment costs, IBIT is likely the better choice because it offers a lower expense ratio starting at about 0.12%, which may increase up to 0.25%.

Over the long term, even small differences in fees can add up to significant savings and improved returns.

FBTC’s expense ratio is fixed at around 0.25%, which means it might cost more in fees, especially for long-term investors focused on maximizing net gains.

2. Risk Tolerance

Both FBTC and IBIT are exposed to Bitcoin’s high volatility, so potential investors must assess their tolerance for risk carefully.

Aside from price swings, differences in custody methods affect operational risk: FBTC offers self-custody through Fidelity Digital Assets, which some view as safer, while IBIT uses third-party custody via Coinbase Prime.

Consider which custody model reduces your perceived risk of loss or hacking.

3. Custody Preferences

Custody arrangements differ: IBIT employs Coinbase Prime for third-party custody, catering well to institutional investors who approve of regulated, established crypto custody services.

In contrast, FBTC uses Fidelity’s self-custody model, leveraging a decade of cryptocurrency expertise, which appeals more to investors who prioritize direct control and a longer institutional track record in crypto management.

4. Liquidity Needs

IBIT typically has higher liquidity thanks to larger assets under management and more active institutional adoption.

This increased liquidity leads to tighter bid-ask spreads and lower trading costs, benefiting active traders and large institutional investors.

FBTC, while liquid and publicly traded, may have slightly wider spreads, making it more suitable for buy-and-hold retail investors who trade less frequently.

5. Investor Suitability

Choosing between FBTC and IBIT depends largely on your investor profile, financial goals, and preferences in trading and custody.

- Institutional investors and traders often prefer IBIT for its liquidity, lower fees, and market presence.

- Retail investors and those valuing custody security may lean toward FBTC for its crypto expertise and self-custody model.

- Long-term investors focusing on cost-efficiency and solid management might choose IBIT, while retail investors comfortable with slightly higher fees might opt for FBTC.

Ultimately, both FBTC and IBIT provide strong Bitcoin exposure, your best choice comes down to balancing cost, security, and trading flexibility.

Wrapping It Up

I’ve learned a lot while researching and investing in FBTC and IBIT, and finally, here’s what I think. Both ETFs give great ways to invest in Bitcoin without buying it directly, and their returns have been very close.

FBTC might have a tiny edge in performance, but IBIT usually wins on cost and liquidity because of its lower fees and bigger market presence.

I also like that FBTC offers self-custody, which some investors prefer for security, while IBIT relies on Coinbase’s custody.

Choosing between them depends on what’s most important to you—whether it’s fees, security, liquidity, or how active you plan to trade.

Take the next step in your investment life, research both FBTC and IBIT further, and choose the Bitcoin ETF that fits your financial goals today. Don’t wait to build your future!