Can you really profit when crypto prices crash? Yes, and it’s called shorting.

Most traders only know how to make money when the market goes up. They buy low and hope to sell high. But what happens during bear markets or sudden crashes? Your portfolio bleeds while you watch helplessly.

Shorting flips this script. It lets you profit from falling prices instead of fearing them. You can make gains whether Bitcoin soars or tanks.

This guide shows you exactly how to short crypto safely. You’ll learn what shorting means, how it differs from regular trading, and which platforms let you do it. We’ll cover step-by-step instructions, key risks to avoid, and pro strategies that protect your money.

Ready to learn both sides of crypto trading?

What Does It Mean to Short Crypto?

Shorting crypto means betting that the price will drop. Here’s how it works: you borrow a cryptocurrency like Bitcoin, sell it at the current price, then wait for the price to fall.

When it drops, you buy it back at the lower price and return what you borrowed. The difference between your selling price and buying price becomes your profit.

For example, if you borrow 1 Bitcoin at $50,000, sell it immediately, and the price falls to $45,000, you buy it back for $45,000 and return the Bitcoin.

You keep the $5,000 difference as profit. This strategy only works when prices fall. If prices rise instead, you lose money because you still have to buy back at a higher price.

Short vs. Long Classes in Crypto Trading

Short positions mean you’re betting the price will fall. You profit when the market goes down. Long positions mean you’re betting the price will rise. You profit when the market goes up.

The difference between shorting and going long comes down to your market outlook. Going long is optimistic. You buy crypto hoping it gains value over time. Shorting is pessimistic. You bet against the asset, expecting it to lose value.

Short vs Long Crypto: Key Differences

| Factor | Short Position | Long Position |

|---|---|---|

| Market Bet | Price will fall | Price will rise |

| Profit When | The market goes down | The market goes up |

| Risk Level | Unlimited potential losses | Limited to initial investment |

| Capital Needed | Often requires margin/leverage | Can start with any amount |

| Best Market | Bear markets or corrections | Bull markets or growth phases |

| Trader Type | Experienced, risk-tolerant | Beginners to advanced |

| Hold Duration | Usually short-term | Can be short or long term |

| Stress Level | High (constant monitoring) | Lower (can hold and wait) |

Understanding short vs long crypto strategies helps you pick the right approach for your goals and risk tolerance.

Can You Short Crypto? Here’s How!

Yes, you can short crypto. Most major exchanges now offer tools that let traders profit from falling prices. This wasn’t always the case, but the crypto market has matured significantly in recent years.

Shorting is available on platforms like Binance, Kraken, Bybit, and many others. You don’t need special permissions in most countries, though some regulations apply depending on where you live.

Here are the main methods to short crypto:

- Margin Trading: You borrow cryptocurrency from the exchange, sell it at the current price, and buy it back later at a hopefully lower price.

- Futures Contracts: You agree to sell a cryptocurrency at a set price on a future date, profiting if the actual price drops below your contract price.

- Options Trading: You buy the right to sell crypto at a specific price, which becomes profitable when the market price falls below that level.

- CFDs (Contracts for Difference): Allow you to speculate on price movements without actually owning the cryptocurrency, simply betting on whether it will go up or down.

- Inverse ETFs or Tokens: You buy special tokens designed to increase in value when the underlying crypto decreases, offering a simpler way to short without borrowing.

Each method has different risk levels and requirements. Beginners often start with inverse tokens because they’re easier to understand. Experienced traders might prefer futures or margin trading for more control and potential profit.

The key is choosing a method that matches your experience level and risk tolerance. All of these options are legal and accessible on regulated exchanges.

Step-by-Step Guide: How to Short Crypto Safely

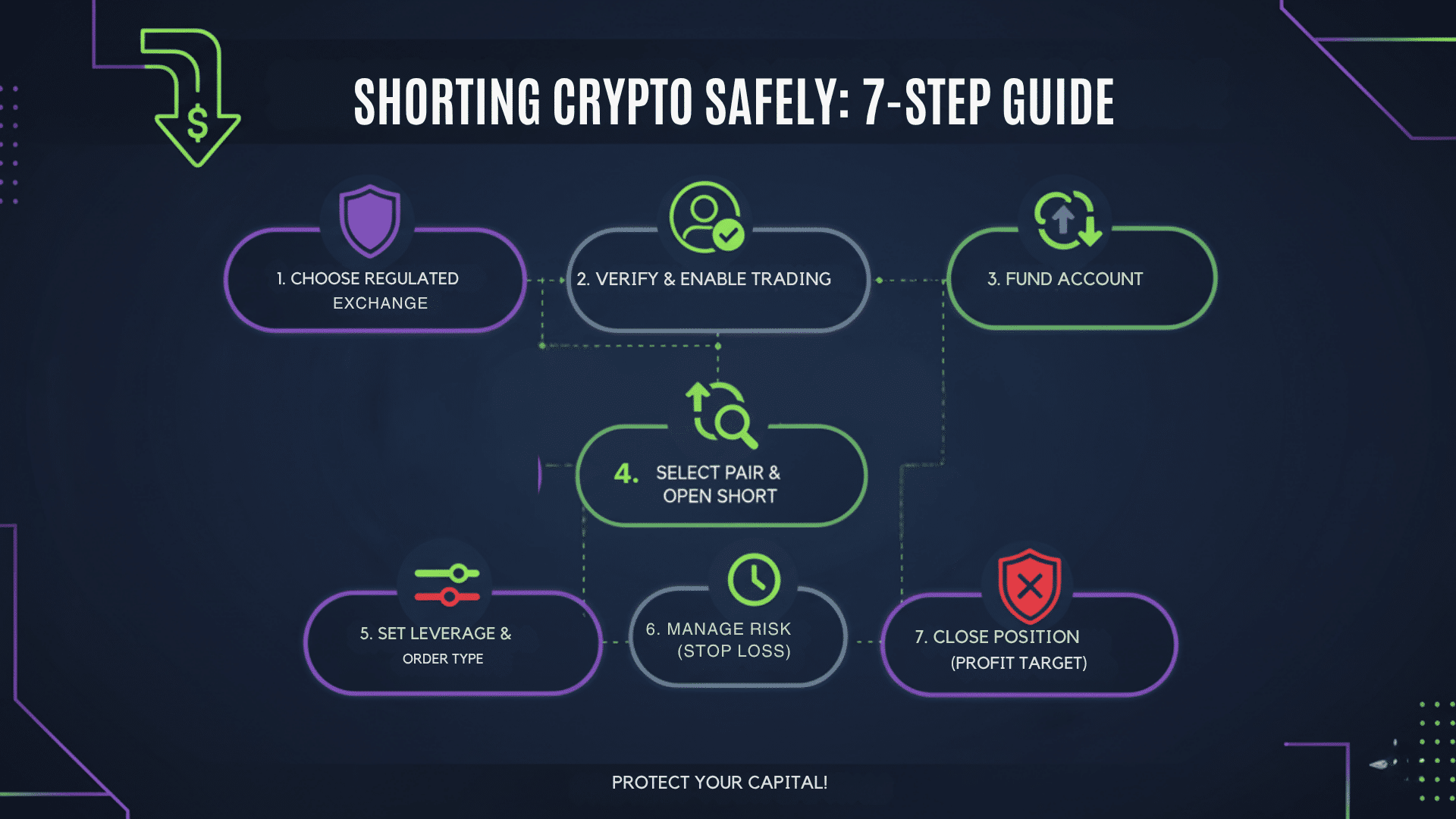

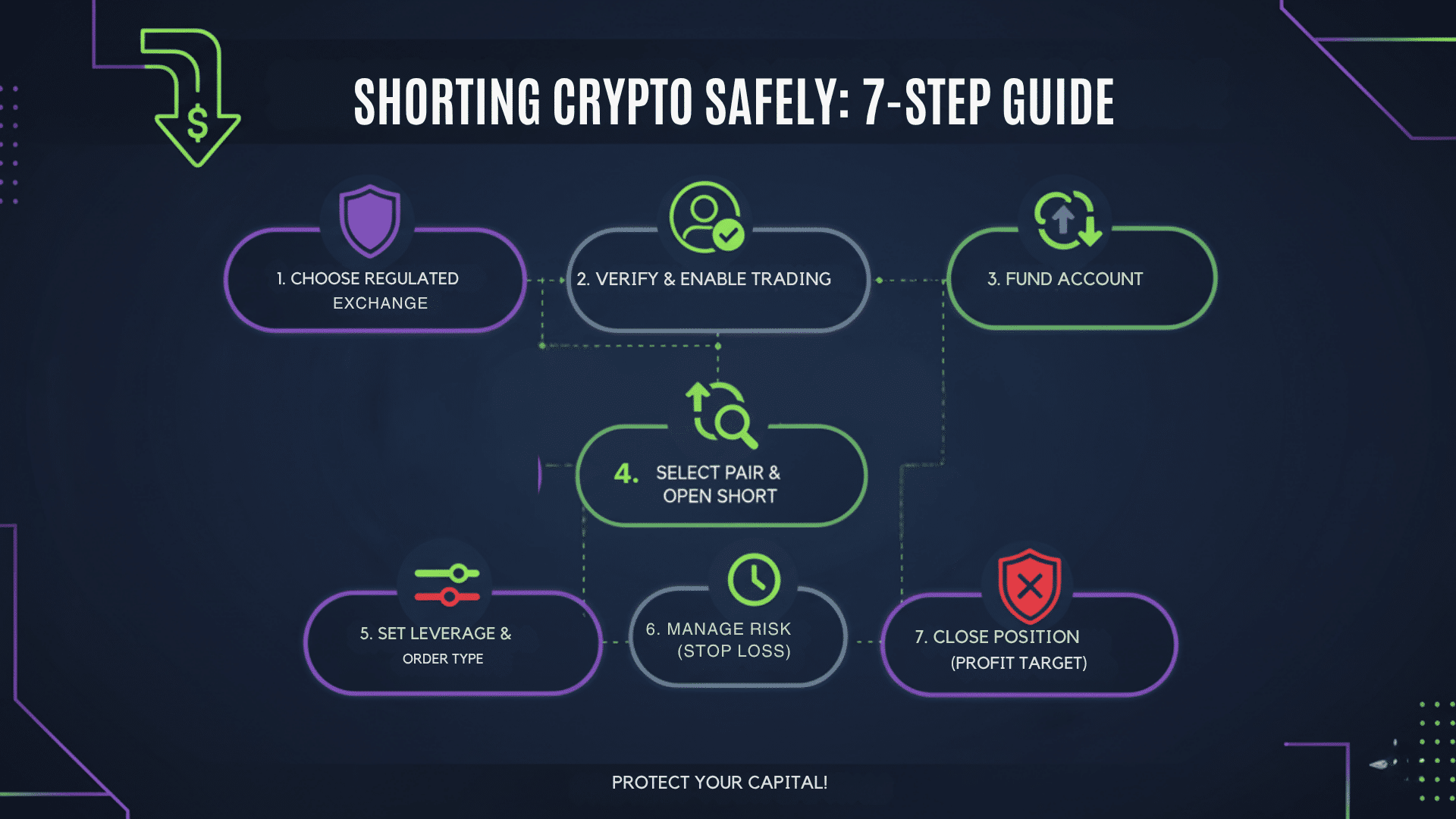

Learning how to short crypto step by step takes careful preparation. Rushing into short positions without a proper setup can lead to major losses. Follow these steps to protect yourself while shorting.

1. Choose a Regulated Exchange or Broker

Pick a platform with a solid reputation and proper licenses. Check if it operates legally in your country and has strong security measures.

Popular choices include Binance, Kraken, and Bybit, but verify they’re allowed where you live.

2. Verify Your Account and Enable Advanced Trading Features

Complete the KYC process by submitting your ID and proof of address. This usually takes a few hours to a few days. Once verified, go to settings and enable margin trading or futures trading features.

3. Fund Your Account (Crypto or Fiat)

Deposit money into your exchange account using a bank transfer, a credit card, or by transferring crypto from another wallet.

Make sure you fund the correct account type, as some exchanges separate spot and margin balances. Start with an amount you can afford to lose while learning.

4. Select a Trading Pair and Open a Short Position

Choose which cryptocurrency you want to short, like BTC/USDT or ETH/USDT. Look for the “sell” or “short” button in the margin or futures section. Enter the amount you want to short and review the terms before confirming.

5. Set Leverage and Order Type (Limit, Stop Limit, etc.)

Decide on your leverage ratio, keeping it low if you’re new to this. Choose between market orders for instant execution or limit orders to set your preferred entry price. Stop limit orders help you enter positions only when certain price conditions are met.

6. Manage Risk Using Stop Loss Orders

Always set a stop loss before your position goes live. This automatically closes your trade if prices move against you past a certain point. For example, if you short Bitcoin at $50,000, set a stop loss at $51,000 to limit potential damage.

7. Close Position When Target Is Met

Monitor your position and close it when you reach your profit goal or if market conditions change. Click “close position” or place an opposite order to exit. Don’t get greedy by holding too long, as crypto prices can reverse quickly.

Key Risks of Shorting Crypto

Shorting crypto isn’t for everyone. The risks can wipe out your account faster than almost any other trading strategy. Understanding these dangers before you start is critical.

- Extreme Volatility Equals Quick Losses: Crypto prices can swing 10% or more in minutes, turning a profitable short position into a massive loss before you can react.

- Liquidation and Margin Calls: If the price moves against you too much, the exchange automatically closes your position and keeps your collateral to cover losses.

- Exchange Reliability (Hacks, Outages): Exchanges can go offline during high volatility or get hacked, leaving you unable to close positions or potentially losing your funds entirely.

- Market Irrationality (Prices Can Rise Longer Than You Can Stay Solvent): Crypto markets often defy logic, with prices climbing far beyond reasonable valuations while your short position drains your account.

- Leverage Magnifies Both Gains and Losses: Using 10x leverage means a 5% price move against you results in a 50% loss on your capital, accelerating how fast you can lose money.

- Legal and Tax Implications (Especially in the U.S.): Short sales create complex tax situations with short-term capital gains rates, and some jurisdictions restrict or ban certain shorting methods.

These risks make shorting one of the most challenging strategies in crypto trading. Even experienced traders lose money regularly when shorting volatile assets.

Smart Strategies to Short Crypto Safely

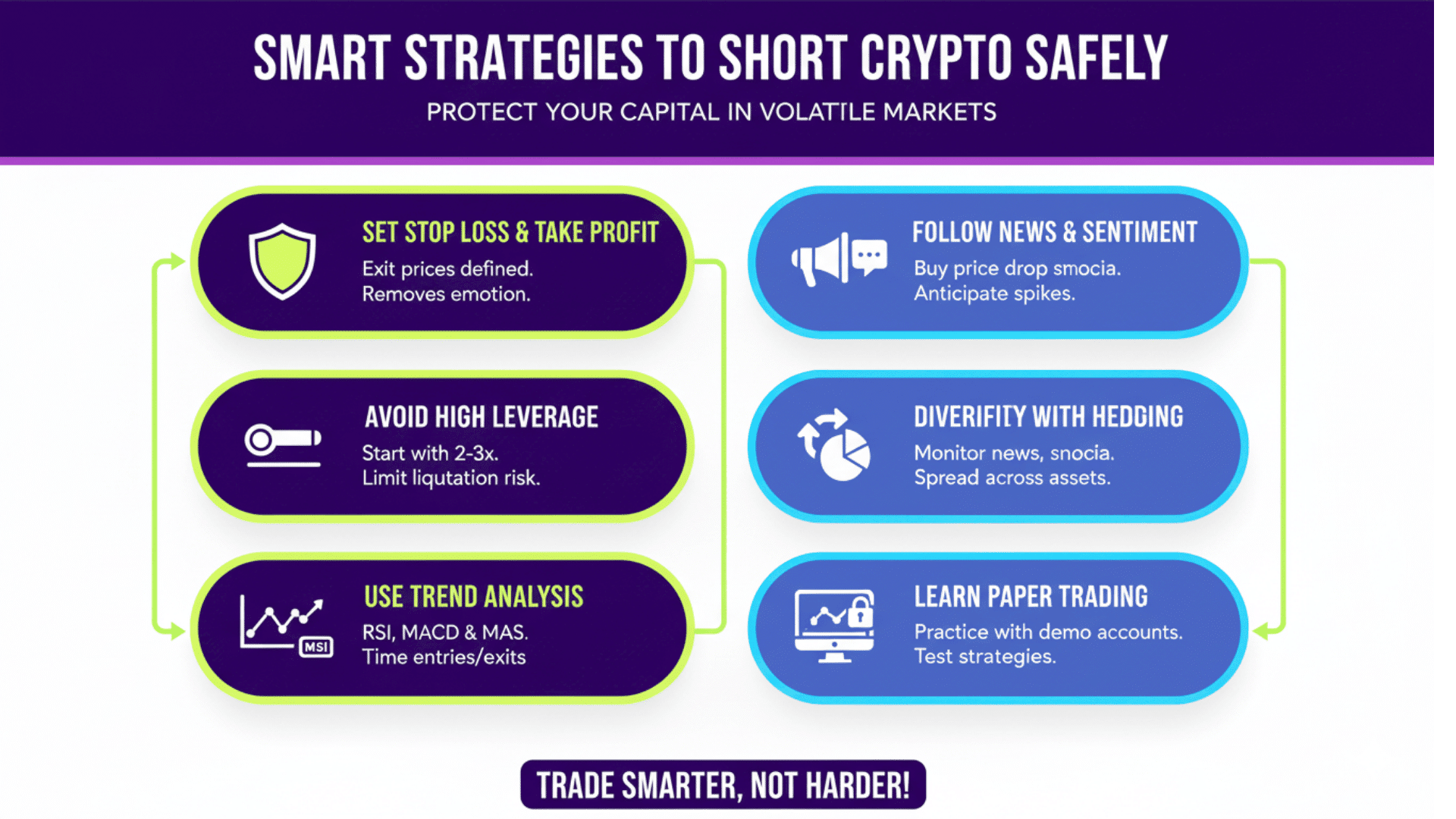

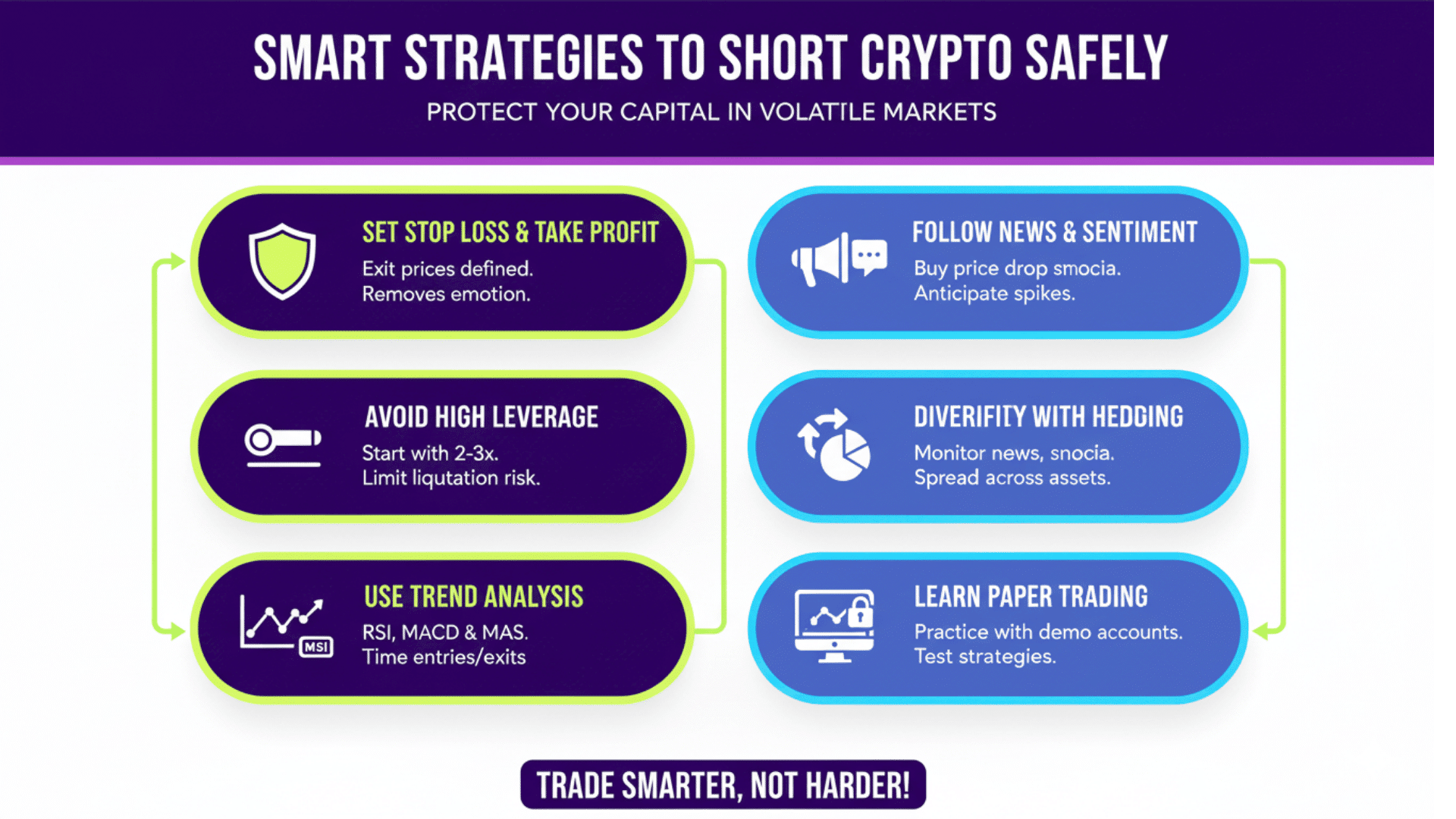

Shorting crypto without a proper strategy is like driving blindfolded. You need solid risk management to survive in volatile markets. Here are proven strategies that protect your capital.

Smart traders follow strict rules to limit losses. These strategies separate professionals from gamblers who blow up their accounts.

| Strategy | What It Means | Why It Matters |

|---|---|---|

| Set Stop Losses and Take Profit Levels | Define exact prices where you’ll exit, both for losses and gains | Removes emotion from trading and protects you from holding losing positions too long |

| Avoid High Leverage as a Beginner | Start with 2x or 3x leverage instead of 10x or higher | High leverage means small price moves can liquidate your entire position in seconds |

| Use Trend Analysis Tools | Study RSI, MACD, and moving averages to spot reversals | Technical indicators help you time entries and exits instead of guessing price direction |

| Follow News and Sentiment | Monitor crypto news, social media trends, and market sentiment | One tweet or regulation announcement can spike prices 20% and destroy short positions |

| Diversify with Hedging | Open opposite positions or spread shorts across multiple assets | If one short goes wrong, other positions can offset losses |

| Learn Paper Trading First | Practice with fake money on demo accounts | Let’s you test strategies and learn platform features without risking real capital |

Risk management isn’t optional when shorting crypto. It’s the difference between traders who last years and those who lose everything in weeks.

Best Platforms to Short Crypto

Choosing the right platform makes shorting easier and safer. Not all exchanges offer the same features, fees, or protections. Here’s where experienced traders go to short cryptocurrencies.

- Binance is the largest crypto exchange globally, offering futures, margin trading, and options with up to 125x leverage and competitive fees.

- Kraken is a veteran exchange known for strong security and regulation, providing margin trading with up to 5x leverage in most regions.

- Bybit is popular among derivatives traders, specializing in futures and perpetual contracts with up to 100x leverage and fast execution.

- eToro (for CFDs) is a beginner-friendly platform offering CFD trading on crypto without actually owning the assets, ideal for simple short positions.

- BitMEX (for Advanced Traders) one of the original crypto derivatives platforms, catering to experienced traders with complex order types and high leverage options.

Can You Short Crypto in the USA?

U.S. traders face significant restrictions. Many platforms limit leverage or don’t allow margin trading for American users. US offers fewer features than the international version.

Kraken works for U.S. traders but with lower leverage caps. BitMEX doesn’t accept U.S. customers at all. Always check if a platform serves your state before signing up, as regulations vary.

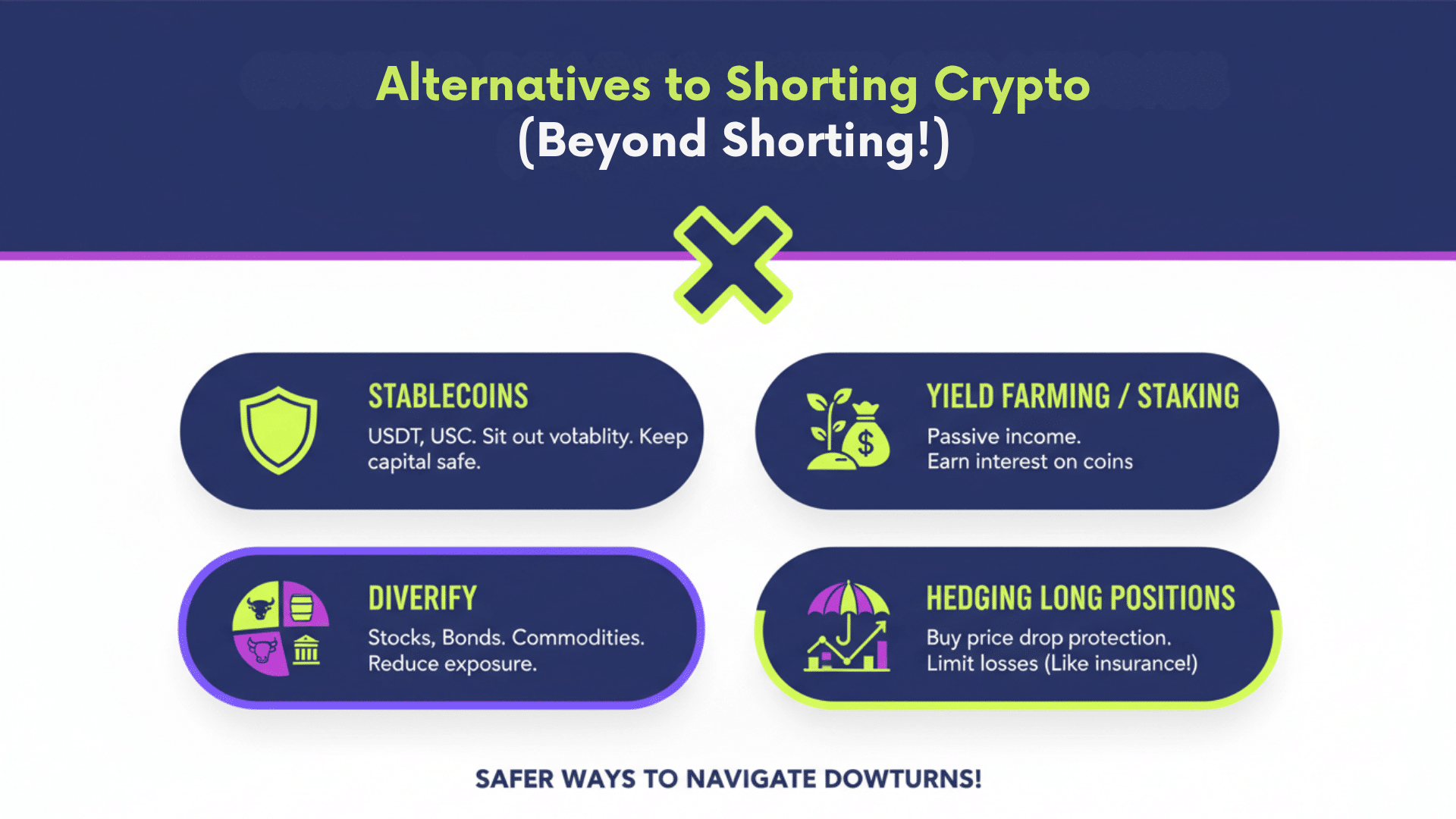

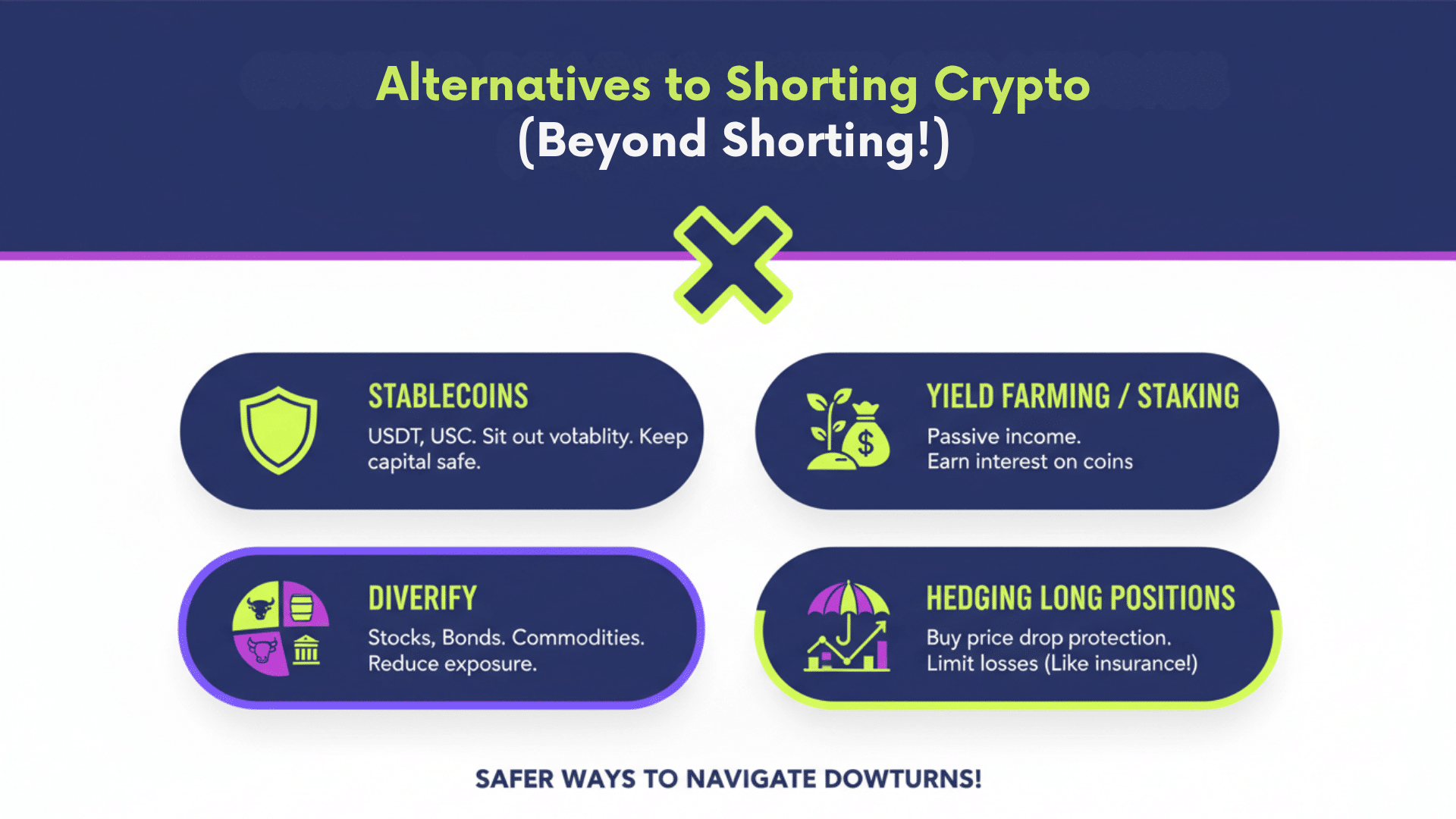

Alternatives to Shorting Crypto

Shorting isn’t the only way to protect yourself during market downturns.

Moving funds into stable coins like USDT or USDC lets you sit out volatility without leaving the crypto ecosystem, keeping your capital safe until conditions improve.

Staking or yield farming generates passive income even when prices fall, earning you interest on coins you already hold.

Diversifying into traditional assets like stocks, bonds, or commodities reduces your exposure to crypto crashes altogether.

Hedging long positions means keeping your crypto but buying protection against drops, similar to insurance, which limits losses without the unlimited risk of shorting.

These strategies offer safer ways to handle bear markets, especially for traders who find shorting too stressful or risky.

Closing Remarks

Shorting crypto opens up profit opportunities during market downturns, but it comes with serious risks.

You’ve learned what shorting means, how it differs from long positions, and the main methods available on major exchanges. The step-by-step process shows you can start shorting safely with proper preparation.

Remember the key risks: extreme volatility, liquidation, and leverage can quickly destroy accounts.

Use stop losses, avoid high leverage as a beginner, and practice with paper trading first. Platforms like Binance, Kraken, and Bybit offer tools, but U.S. traders face restrictions.

Consider alternatives like stablecoins or hedging if shorting feels too risky. The crypto market rewards those who understand both bullish and bearish strategies.

What’s your experience with shorting? Have you tried it, or are you planning to start? Share your thoughts in the comments below.