If you’ve ever wanted to trade without staring at charts all day, swing trading might be your perfect balance. You get to take part in market moves without the pressure of minute-by-minute decisions.

In this guide, I’ll walk you through the best swing trading strategies that traders use to find consistent setups. You’ll learn how to spot trends, manage risk, and plan trades that fit your schedule.

We’ll also look at tools, trade examples, and real community insights to help you build confidence in your approach.

By the end, you’ll know how to trade smarter, stay disciplined, and focus on what really matters: steady growth over time.

What is Swing Trading?

Swing trading is about catching short-term price moves in stocks. Most trades last between 2 to 10 days, sometimes a few weeks. You don’t watch every minute.

Instead, you wait for the right setup and ride the wave. Swing traders focus on price swings within a bigger trend.

They enter when the price dips and exit before it peaks. This method gives you time to think and plan your moves.

Example: If stock ABC trends upward from $80 to $100, a swing trader might enter around $84 after a pullback and exit near $98, taking the “middle” of the move.

Why Swing Trading Works?

Swing trading works because price patterns repeat. Stocks move between support and resistance levels in predictable ways. You can use this method in any market, stocks, forex, crypto, or ETFs.

It gives you full control over risk. You plan your entry, exit, and stop-loss before you trade. This removes guesswork and emotion. Best of all, it fits a busy life.

You don’t need to quit your job or skip classes. Check charts once or twice a day, set your trades, and let them run. It’s built for people who want results without constant screen time.

Who Can Do Swing Trading?

Before you start, ask yourself: Does this trading style match your life and mindset? Here’s who thrives with swing trading.

- For the planner: Swing trading suits those who like structure and clear rules over quick reactions.

- For the busy person: You only need to check charts once or twice a day, not every minute.

- For part-timers: It works great if you have a job, run a business, or attend classes.

- For the patient trader: You need calm thinking during pullbacks, not fast fingers.

- For the disciplined, Account size matters less than following your plan without emotion.

- For the rule-follower: Success comes from consistency and control, not guessing or hoping.

Swing Trading vs Day and Position Trading

Trading styles vary based on how long you hold a position and what kind of moves you want to capture. Here’s how swing trading compares to other common approaches:

| Style | Holding Period | Focus | Analysis Type | Ideal For |

|---|---|---|---|---|

| Day Trading | Minutes–Hours | Tiny intraday moves | Pure technical | Full-time traders |

| Swing Trading | Days–Weeks | Short-term momentum | Technical + some fundamentals | Part-time traders |

| Position Trading | Weeks–Months | Long-term trends | Mostly fundamentals | Investors |

Each style has its own pace, risk level, and strategy. Knowing the difference helps you choose the one that best fits your time, goals, and comfort with market swings.

Essential Swing Trading Terms

Before you wrap up, it helps to review a few key terms you’ll often see in swing trading. Understanding these basics makes charts, strategies, and discussions much easier to follow.

- Pullback: A short move against the main trend before it continues.

- R-Multiple: How much profit you earn relative to your risk.

- ATR (Average True Range): A measure of volatility to size stops correctly.

- Confluence: When multiple signals support the same direction.

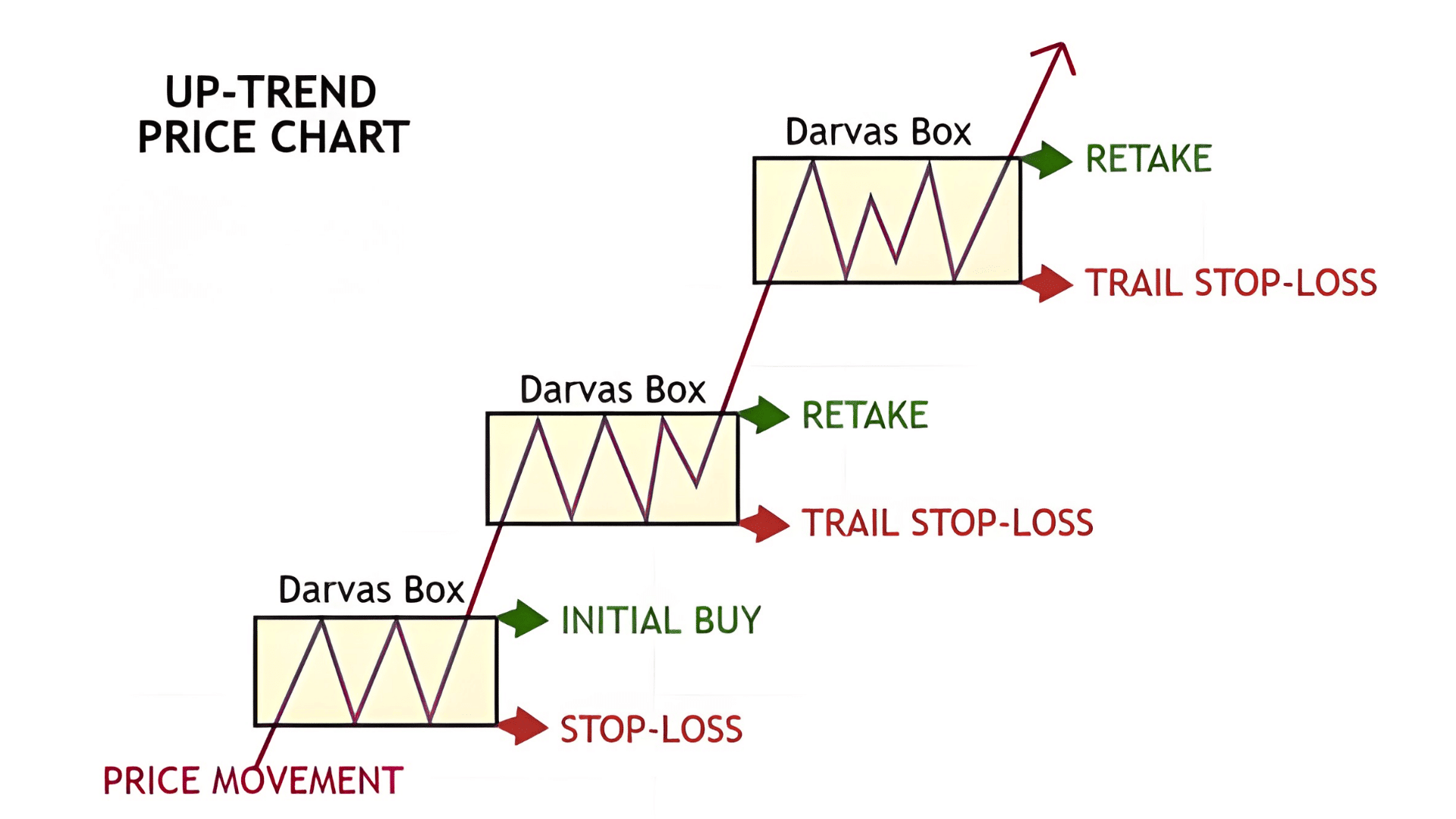

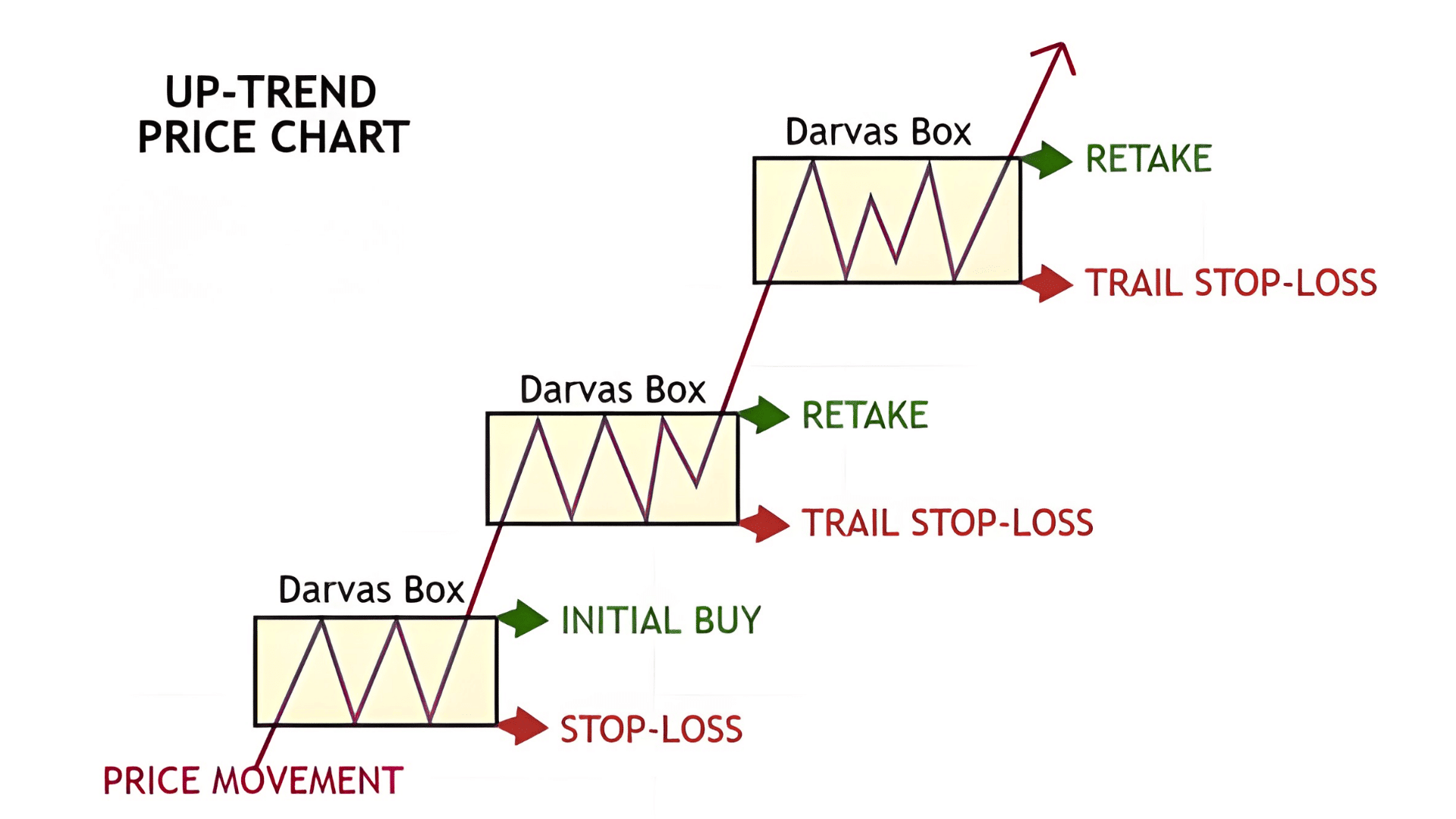

- Darvas Box: A range-trading concept that focuses on breakout zones.

Knowing these terms gives you a stronger foundation to read setups, plan trades, and communicate more clearly with other traders.

How Swing Trading Works: Simple Steps

Swing trading follows a simple, repeatable process:

- Pick a market: Focus on stocks, ETFs, forex, or crypto with strong volume. Stick to a few markets you understand well instead of jumping between many.

- Identify the trend: Use daily or weekly charts to spot overall direction. Trade in the same direction as the trend to increase your odds of success.

- Find entries: Zoom into smaller timeframes for precise setups. Look for pullbacks, breakouts, or support bounces that confirm momentum.

- Plan your trade: Set your entry, stop-loss, and take-profit before taking action. Knowing your risk in advance keeps you disciplined and calm.

- Execute your plan: Enter only when your setup matches all your rules. Avoid second-guessing or chasing price after the move starts.

- Manage and review: Move stops, take profits, and record each trade’s result. Reviewing your journal helps you find strengths and fix weak spots over time.

Think of it as a cycle: Scan → Plan → Execute → Manage → Review.

Swing Trade Essential Tools and Indicators

Before you start trading, it’s important to understand the tools that guide your decisions.

A well-organized chart setup helps you read price behavior clearly and spot opportunities without clutter or confusion.

| Category | Tools | Purpose |

|---|---|---|

| Charting | TradingView, ThinkorSwim, TrendSpider | Analyze price action & setups |

| Indicators | Moving Averages (20EMA, 50SMA), RSI, MACD, ATR | Identify trends, reversals, and volatility |

| Screeners | Finviz, MarketSmith | Find stocks near breakout or pullback levels |

| Risk Tools | ATR stop calculator, position size calculator | Manage consistent risk |

| Journaling | TraderSync, Edgewonk, Notion | Track trades, mistakes, emotions |

Keep your charts clean and focused on key information only. Using two or three indicators is enough to make smart, confident trading decisions as you move into strategy selection.

Proven Swing Trading Strategies

Here are eight of the most reliable setups that swing traders often rely on. Each strategy focuses on simple, repeatable rules that help you enter, manage, and exit trades with confidence.

Learning to recognize these setups will give you structure and improve your timing in the market.

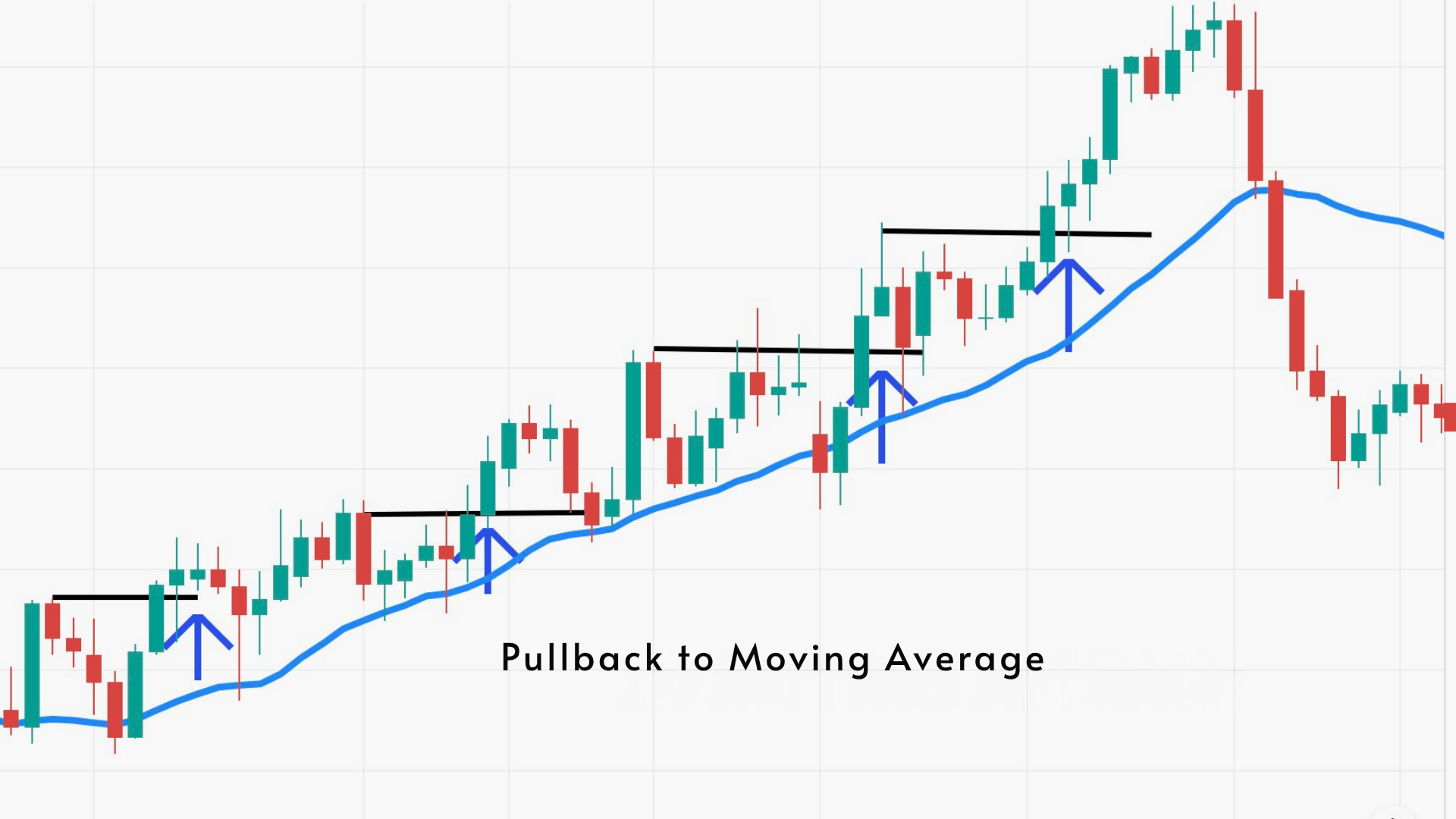

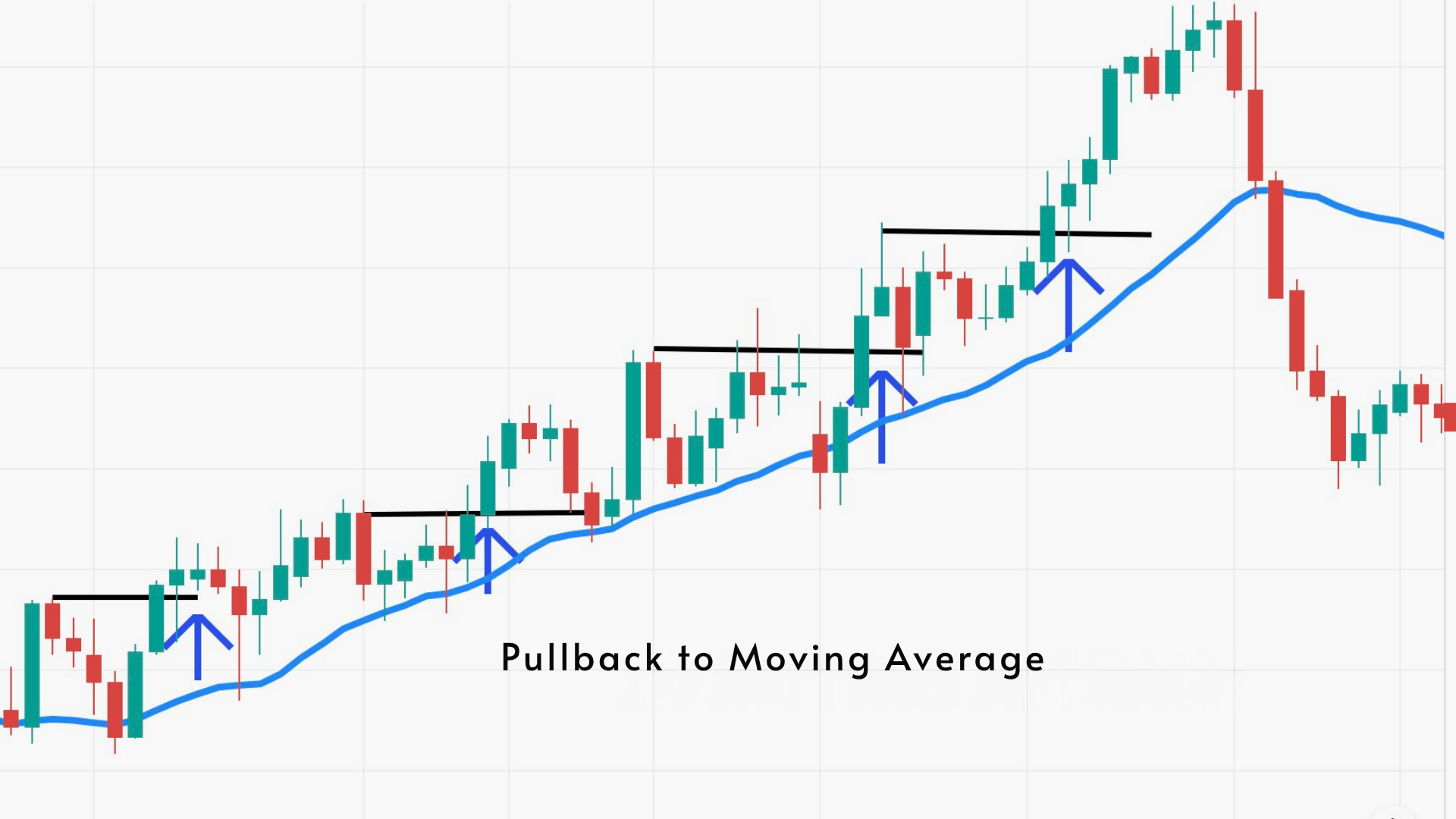

1. Trend Pullback to Moving Average

This setup uses the 20 EMA or 50 SMA to guide your trades in the direction of the trend.

You wait for the price to pull back toward the moving average and then look for signs of strength, such as RSI rebounding near 40–50.

- Buy in the direction of the trend, not against it

- Use the moving average as a visual guide for entry and exit

- Place your stop below the recent swing low to protect capital

Lesson: Pullbacks often offer safer entries with better risk-to-reward potential. The trend is your friend; ride it instead of fighting it.

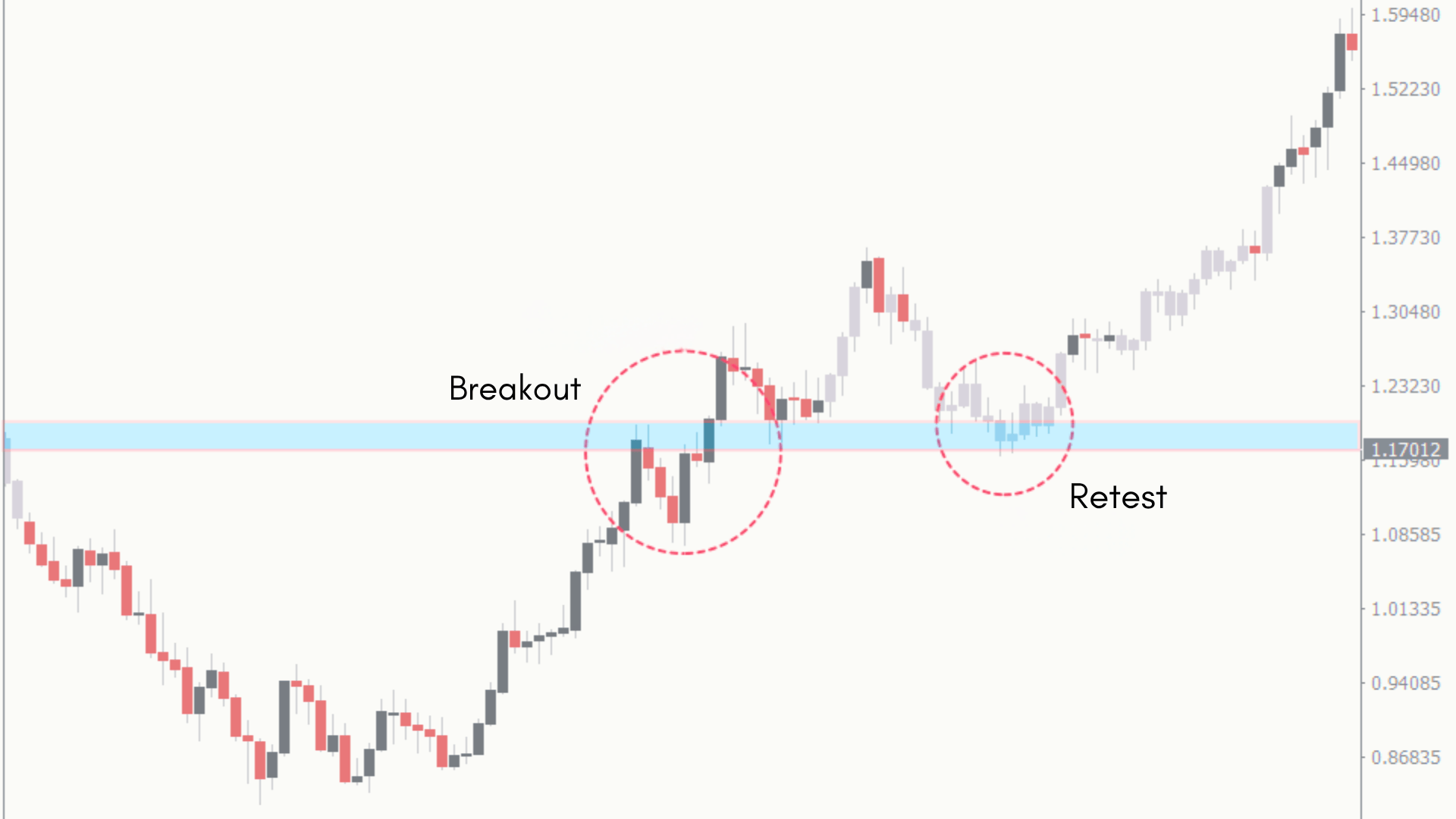

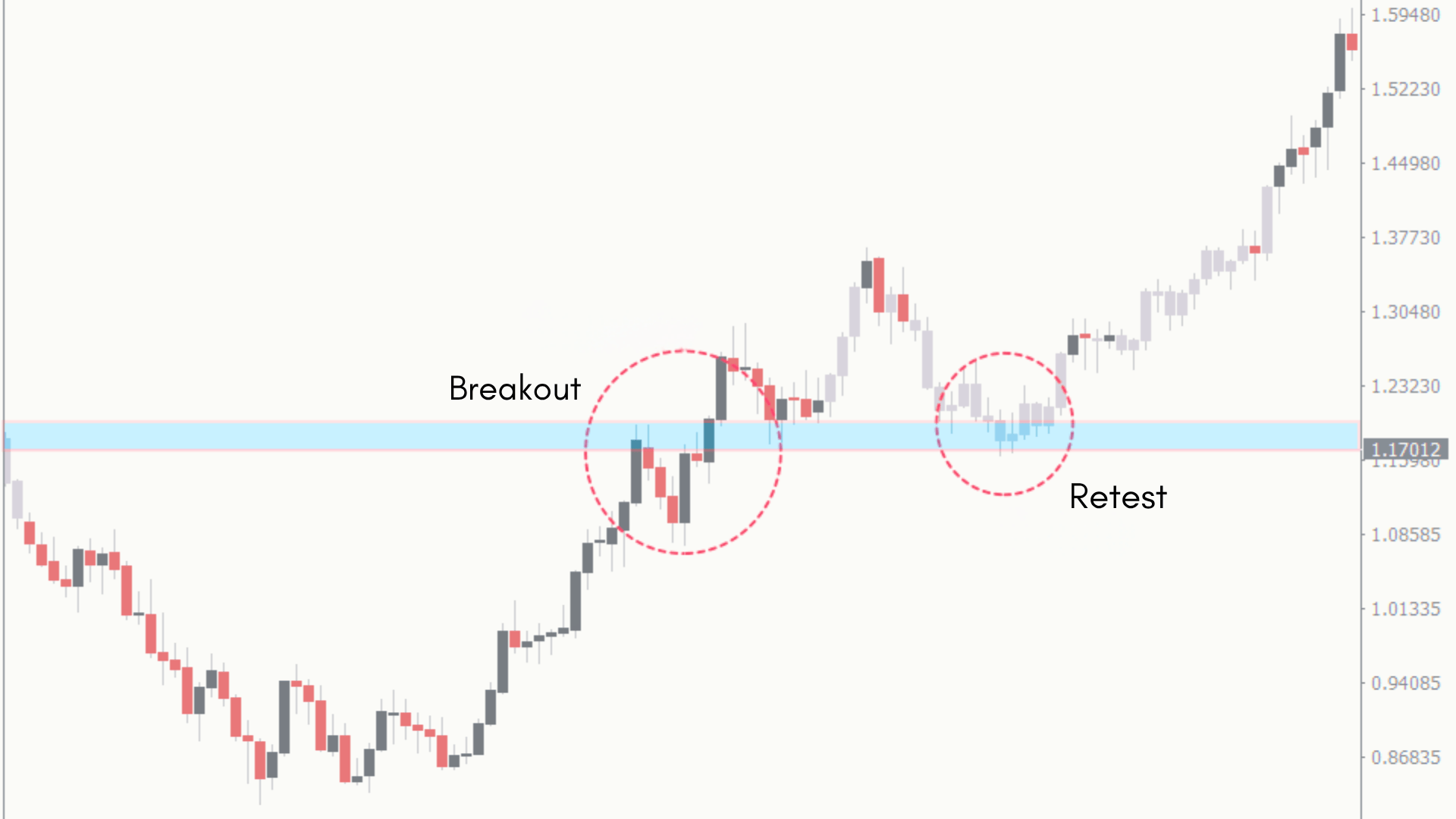

2. Breakout and Retest

The breakout and retest setup focuses on catching a move after the price breaks through a key level and then pulls back to test it. This gives you a second chance to enter before momentum continues.

- Wait for confirmation of the breakout before entering

- Enter the retest of old resistance that turns into support

- Place your stop just below the retest candle or structure

Lesson: The retest helps confirm the breakout’s strength. Patience prevents you from getting caught in false moves.

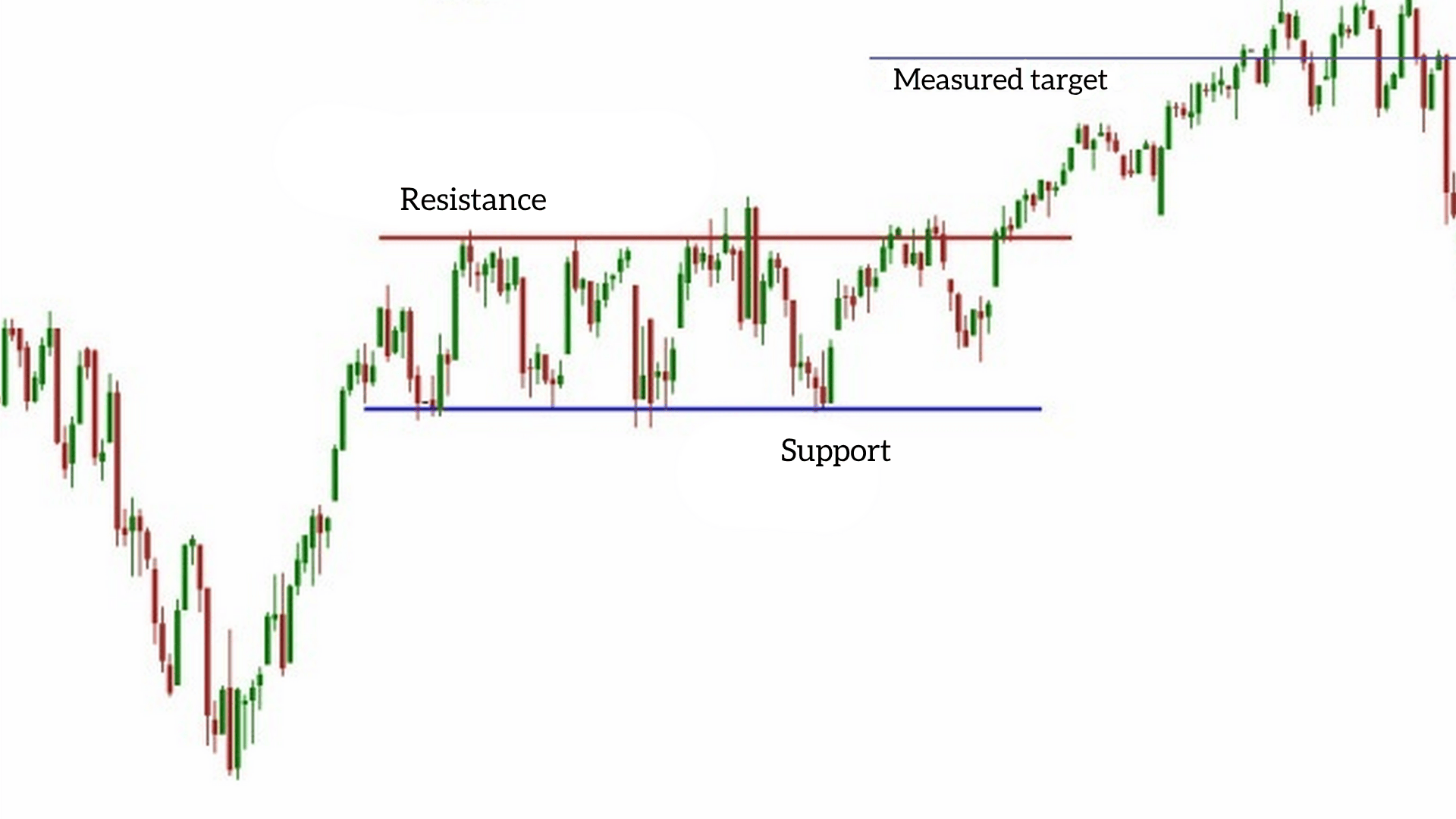

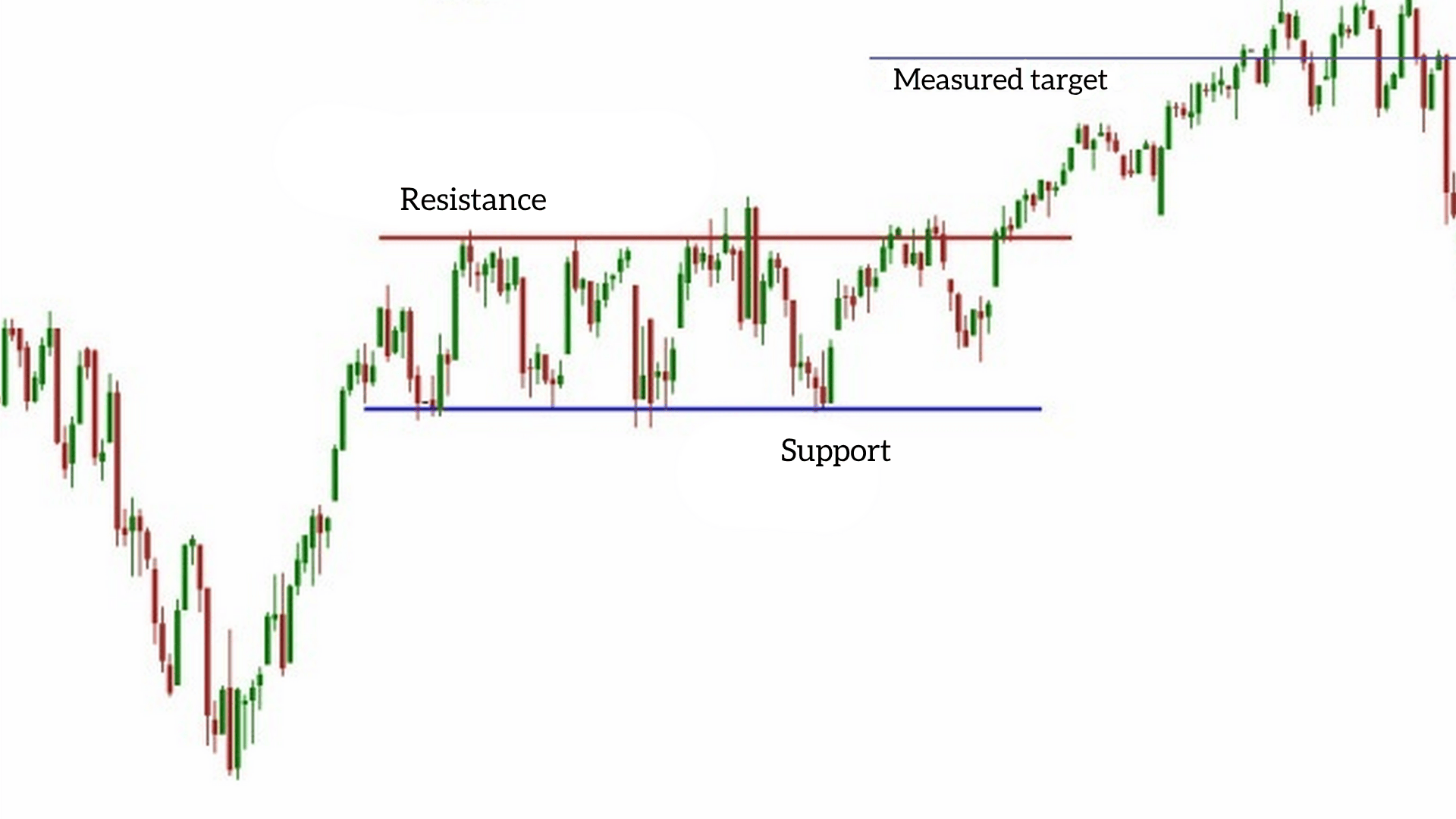

3. Support and Resistance Bounce

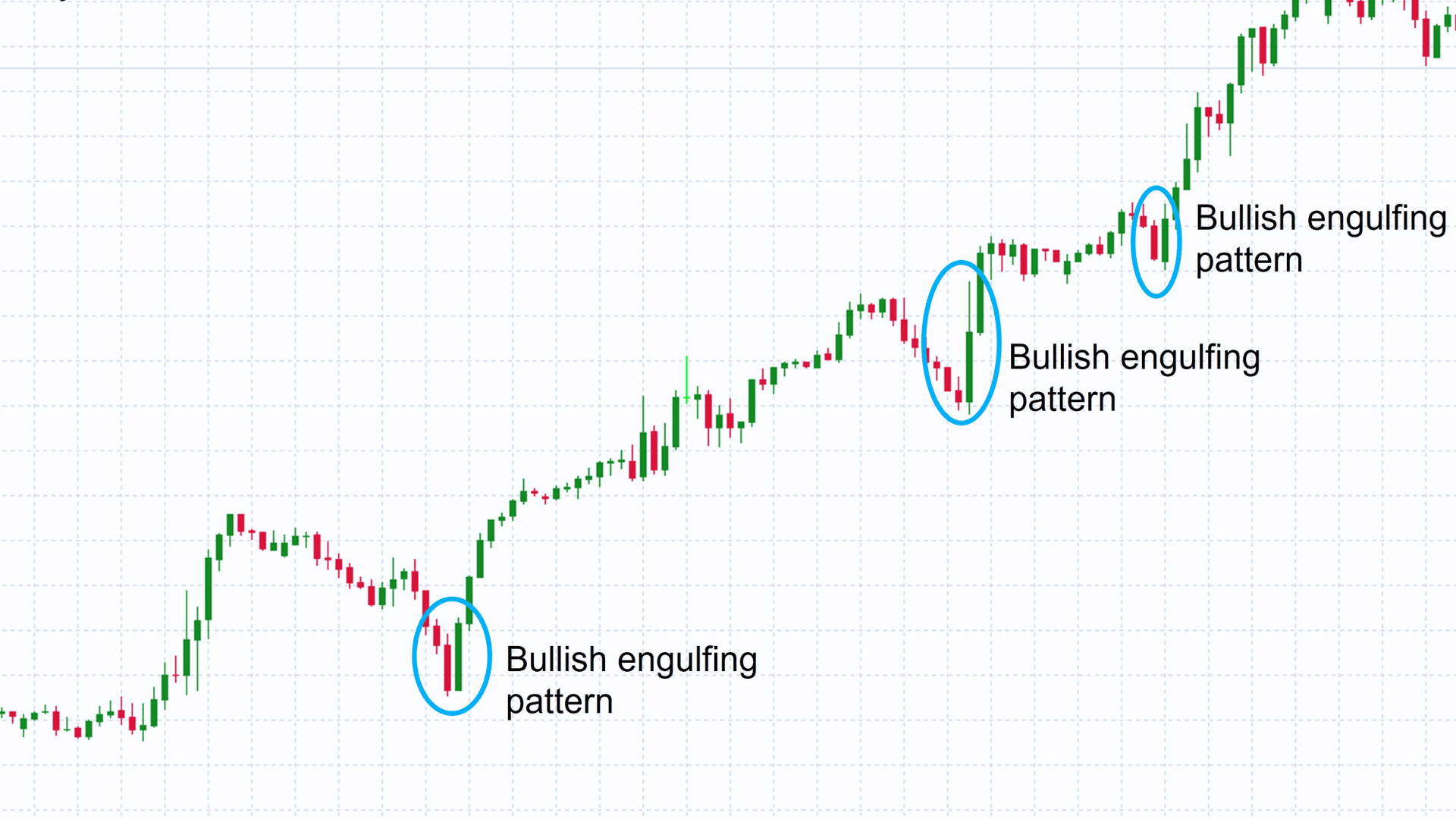

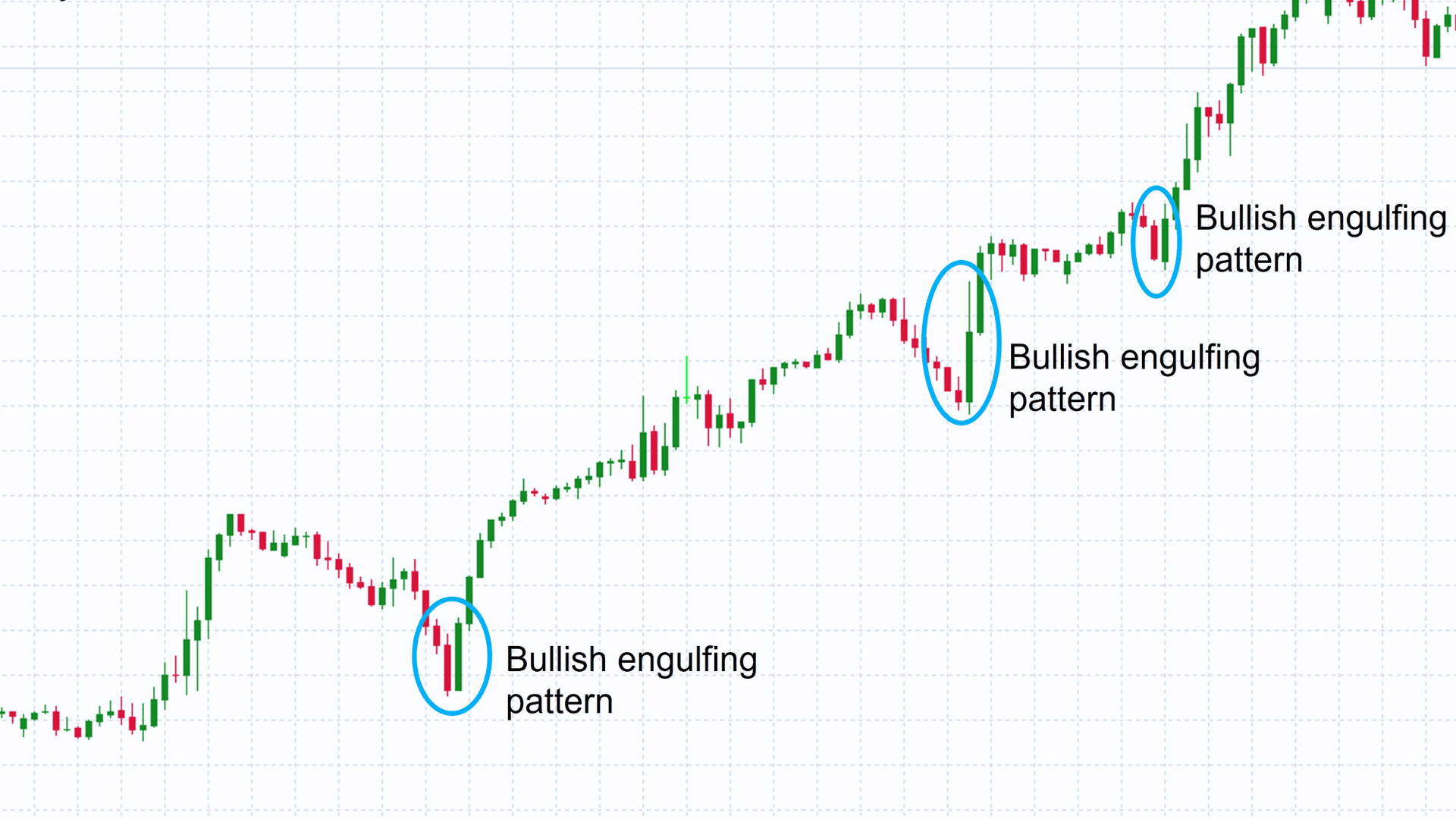

This strategy works best in clear trading ranges or at strong price zones. You buy when the price hits a tested support area and forms a reversal candle, like a hammer or bullish engulfing pattern.

- Identify areas that price has respected multiple times

- Look for strong reversal candles for confirmation

- Target the next resistance level and place your stop below support

Lesson: The more times a level holds, the stronger it becomes. Wait for signs of buying pressure before entering.

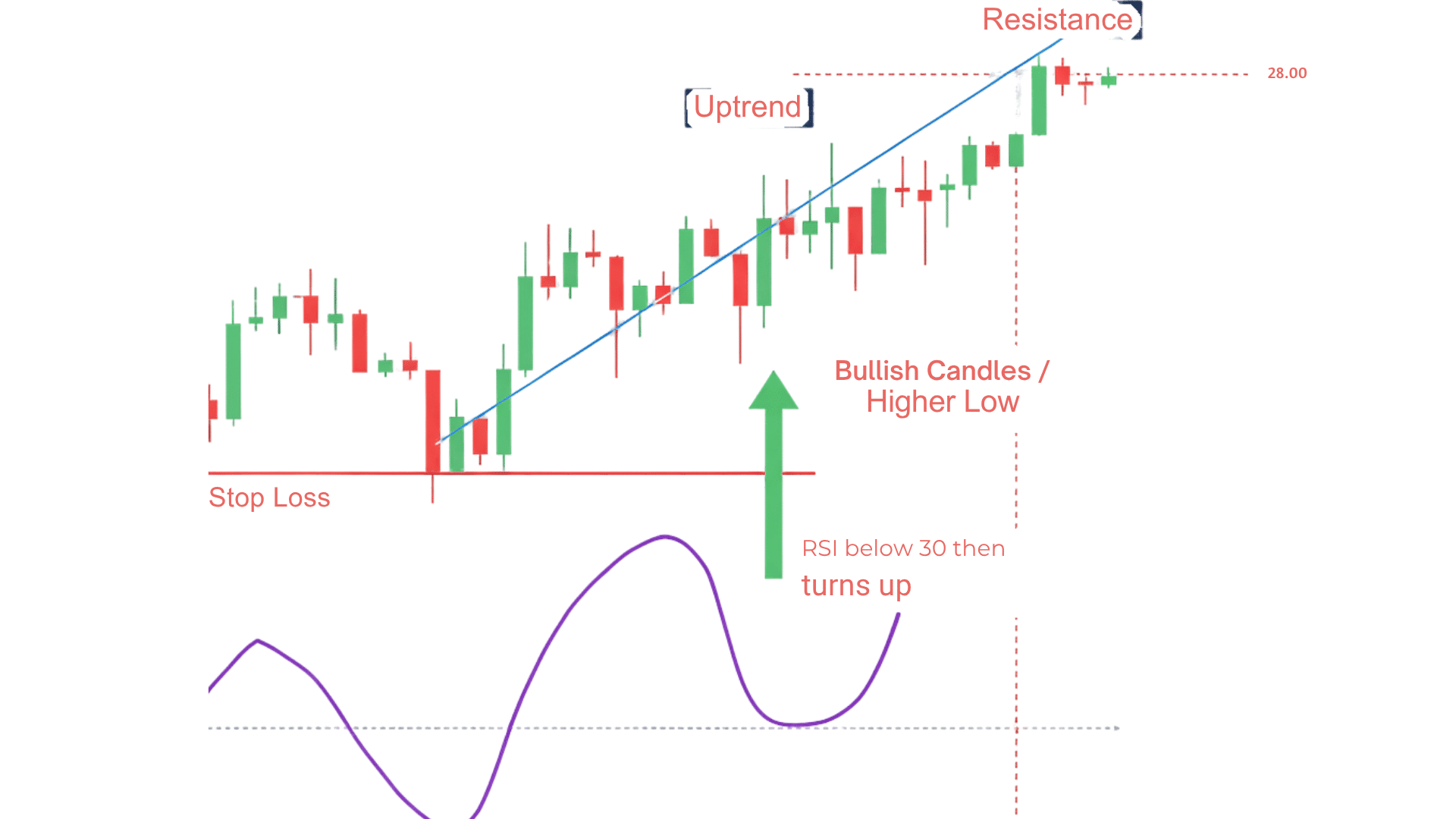

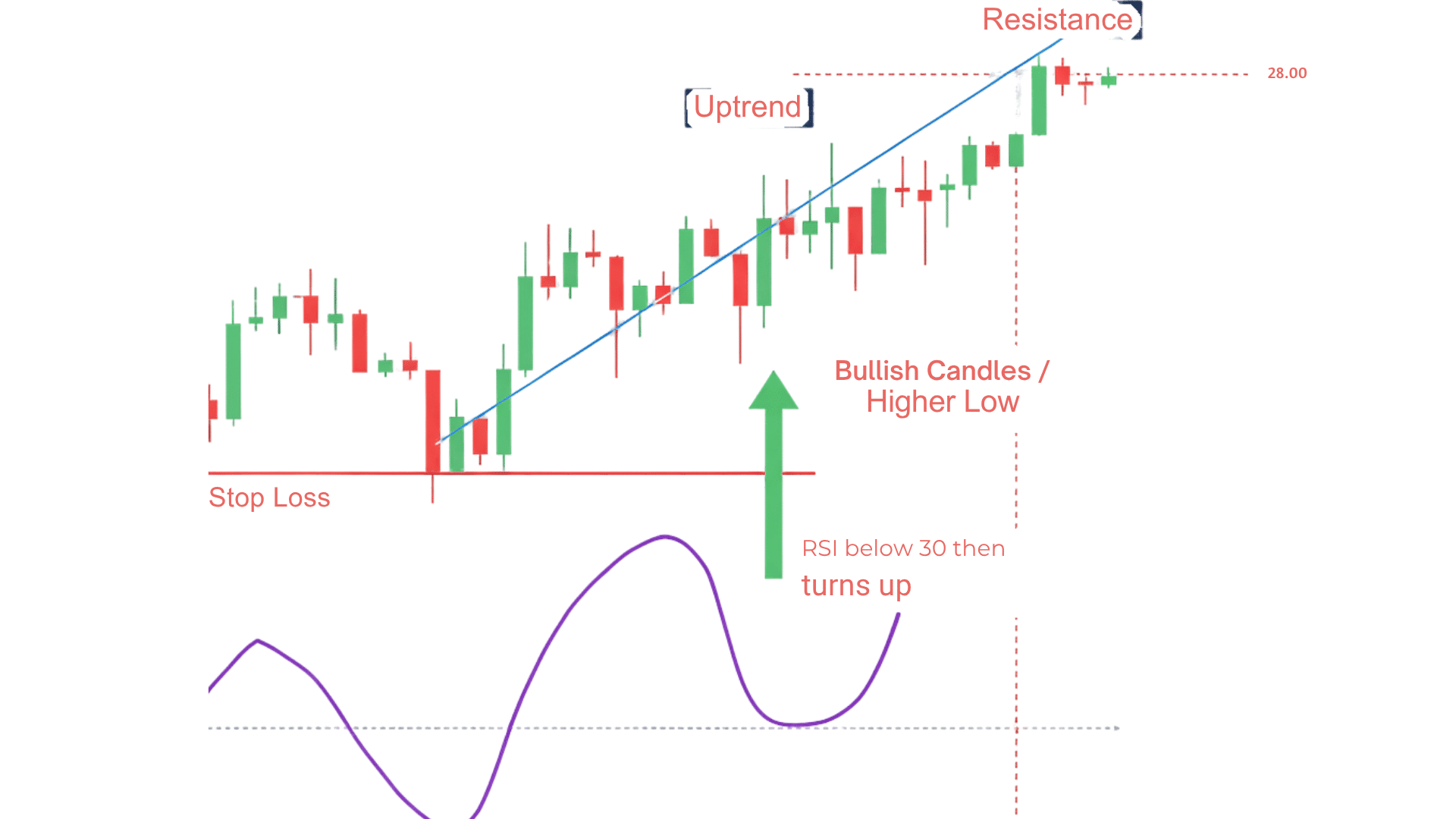

4. RSI Swing Reversal

The RSI swing reversal setup focuses on catching momentum shifts in a trend. You look for RSI to drop below 30 in an uptrend and then turn upward, indicating that buyers are stepping back in.

- Use RSI to spot early signs of reversal strength

- Confirm with higher lows on price or bullish candles

- Set your stop below the swing low and exit near resistance

Lesson: RSI reveals strength before price confirms it. Combining RSI with structure gives you higher-quality setups.

5. Candlestick Triggers

Candlestick triggers provide clear visual signals that the price may change direction. Patterns like the hammer, engulfing, or doji form at major support or resistance zones and often mark turning points.

- Wait for patterns to form at key levels, not in the middle of a range

- Confirm with rising volume or an RSI shift

- Exit near the next resistance or support for safer profits

Lesson: Candlestick patterns mean more when supported by context. Always pair them with levels or trends for reliability.

6. Darvas Box Momentum Strategy

This setup focuses on breakouts from consolidation zones. You draw boxes around recent highs and lows, then buy when the price breaks above the box with strong volume.

- Buy strength and enter only on confirmed breakouts

- Use volume as confirmation of momentum

- Place your stop below the box, low or last swing low

Lesson: Consolidation builds pressure for future moves. Volume confirms whether that breakout has true strength.

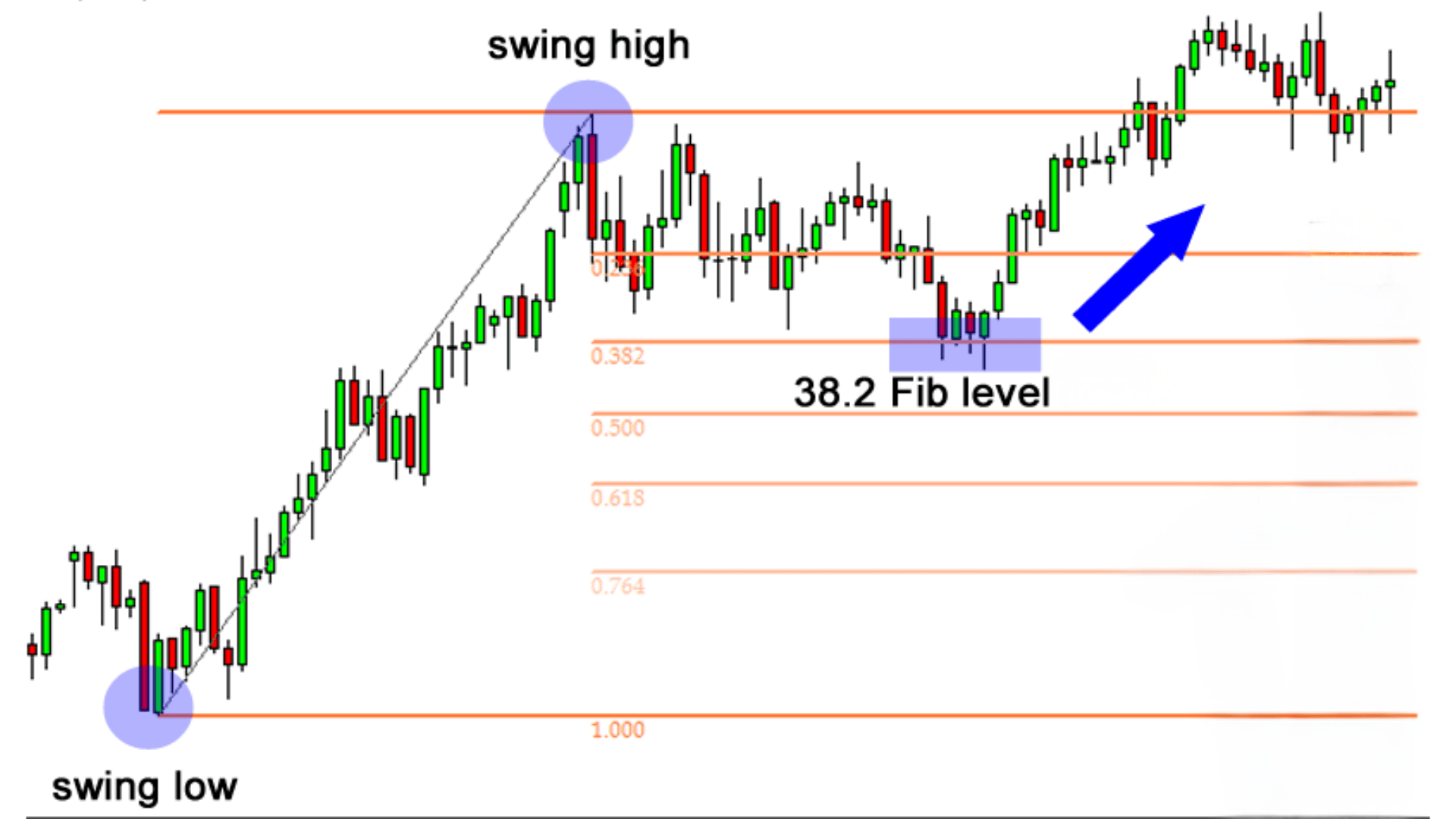

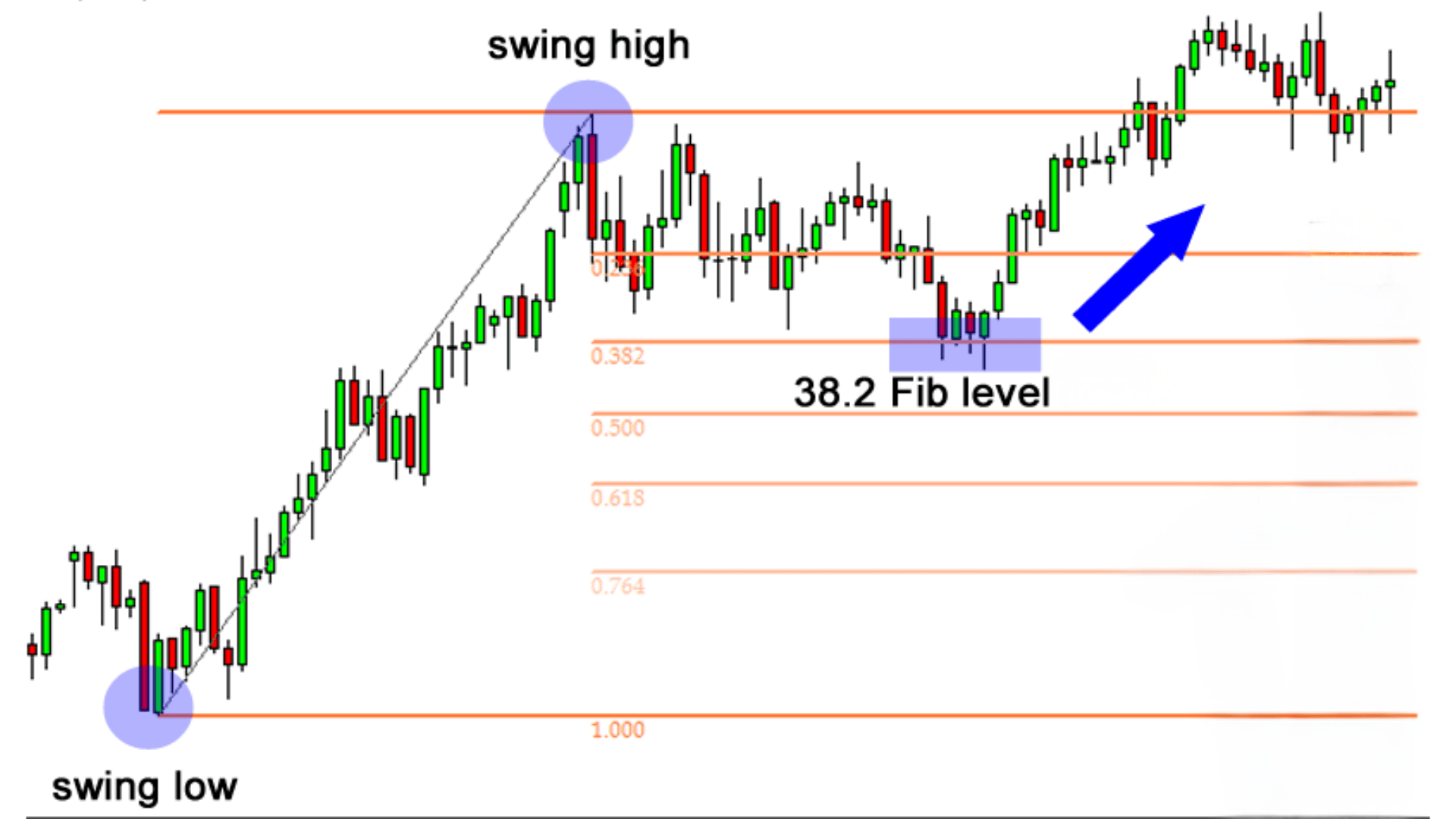

7. Fibonacci Pullback

The Fibonacci pullback helps identify high-probability entry points during a trending market. After a strong move, the price often retraces between 38.2% and 61.8% before continuing.

- Draw the retracement from swing low to swing high (or vice versa)

- Look for RSI or moving average confluence near Fibonacci levels

- Enter only if the price respects the retracement zone

Lesson: Fibonacci levels are most effective when they align with other signals. Don’t trade them in isolation.

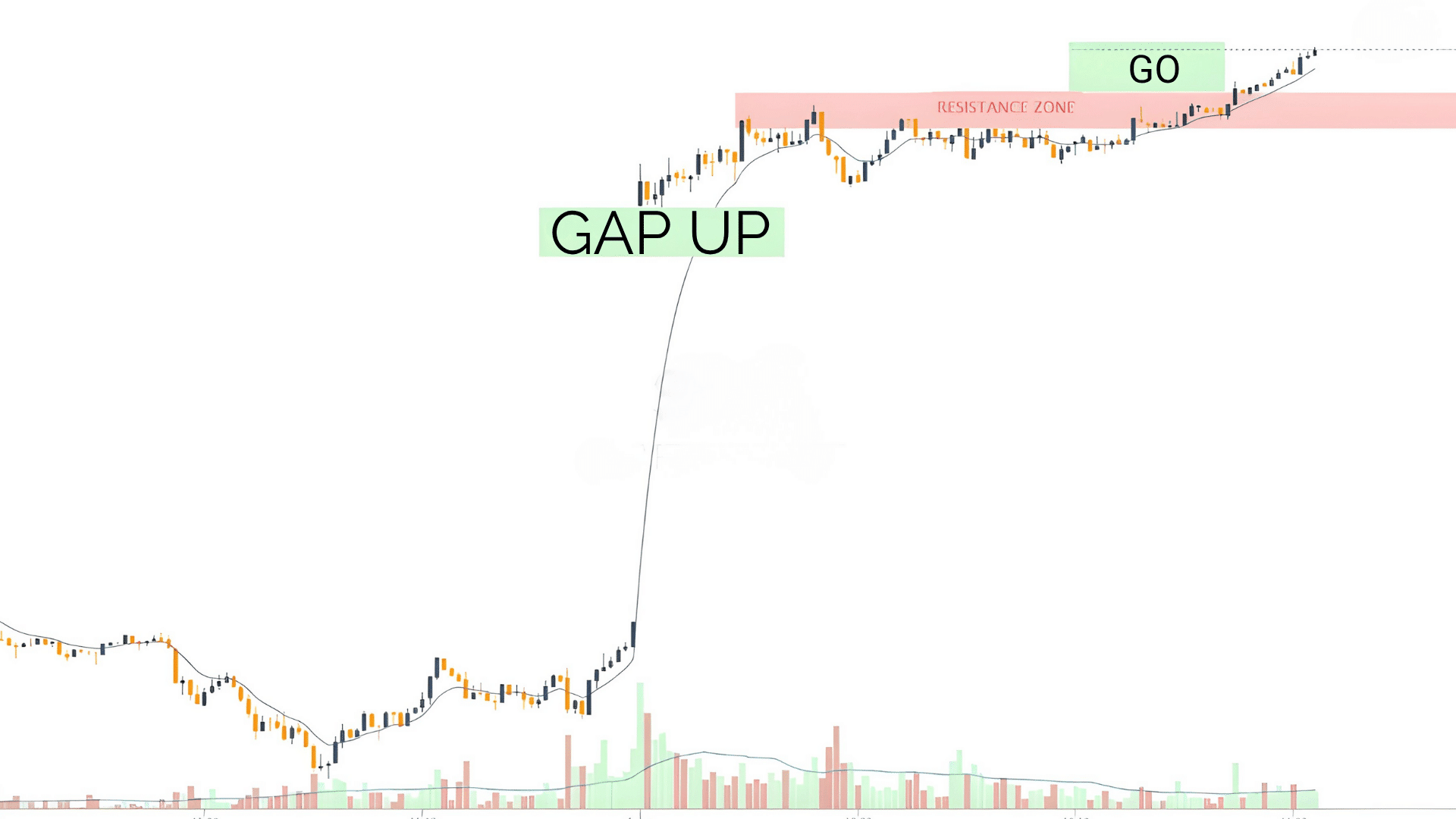

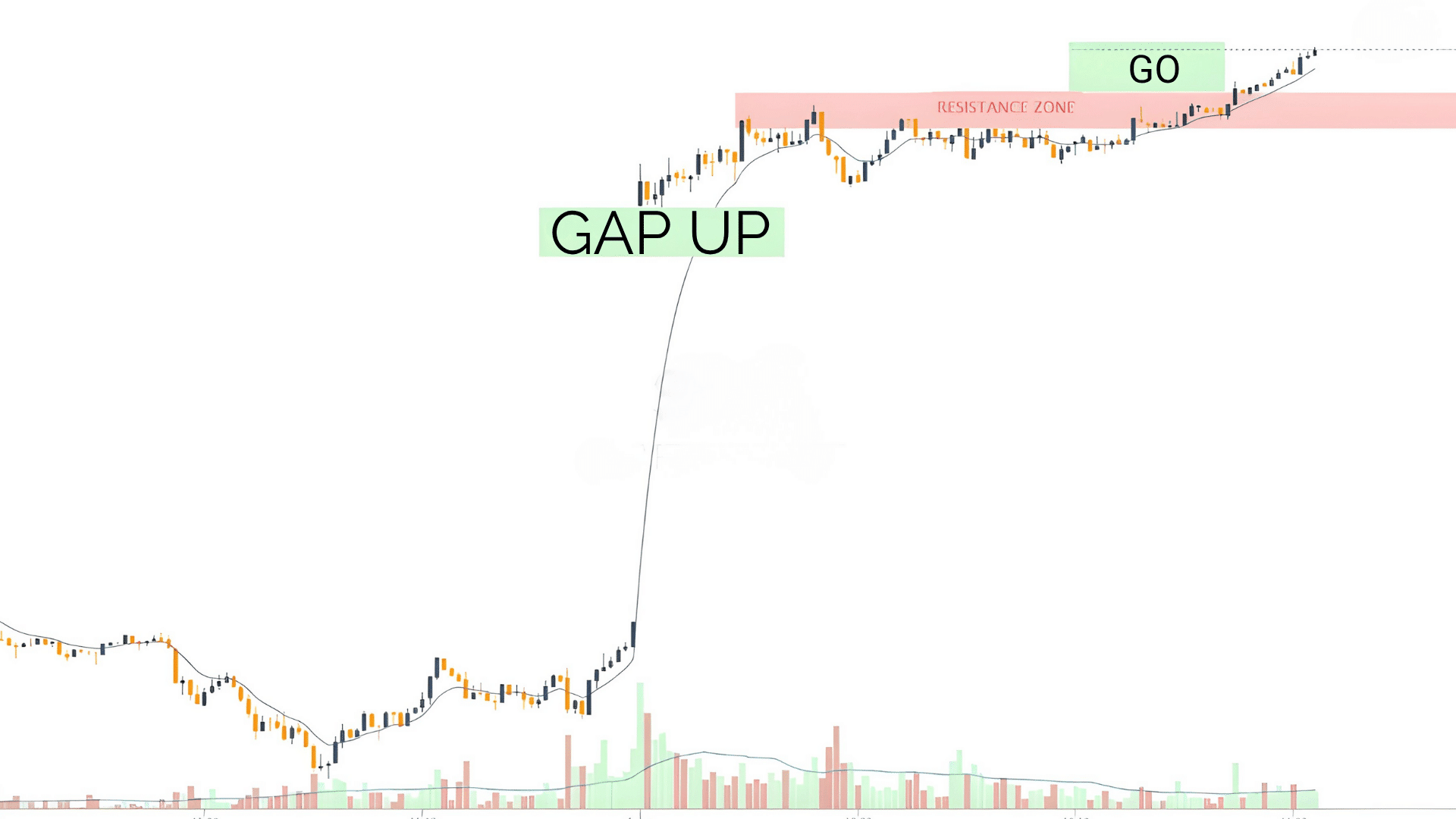

8. Gap and Go Setup

The gap and go setup works well on strong news or earnings days when a stock opens much higher than the previous close. The goal is to catch the continuation after the gap holds.

- Trade only gaps supported by high volume or major news

- Buy when the price holds above the gap and shows strength

- Set a tight stop below the morning low to manage risk

Lesson: Not every gap continues higher. Focus on those with strong fundamentals or catalysts to avoid false starts.

How to Manage Risk Like a Pro Swing Trader?

Good traders focus on risk before thinking about profit. Protecting your capital allows you to stay in the game long enough to benefit from experience.

Every trade should have a clear plan for risk, reward, and exit. Follow these core rules to manage both your trades and your emotions:

- Risk no more than 1–2% of your total capital per trade.

- Place stops using ATR or just below key technical levels for protection.

- Aim for a minimum 2:1 reward-to-risk ratio to make profits outweigh losses over time.

- Reduce position size before major events to limit overnight surprises.

- Take partial profits once the price reaches 1R or 2R to secure gains.

- Trail your stop-loss to lock in profits as the price moves in your favor.

- Exit immediately if the price structure breaks or invalidates your setup.

Never move your stop out of hope. Discipline is your real edge, and managing risk with consistency builds the foundation for steady results.

A Day in the Life of a Swing Trader

A strong daily routine keeps your trading organized and predictable. Instead of reacting to every price move, you follow a simple structure that helps you stay focused and consistent.

- In the morning, review the overall market and note key support and resistance levels. Check for upcoming economic reports or company news that could affect your trades.

- By midday, monitor open positions and adjust your stop-loss levels if needed. Set alerts on your charts so you don’t have to stare at the screen all day.

- In the evening, analyze potential setups for the next session. Update your trading journal with screenshots, notes, and results to track your progress.

Consistency matters more than constant monitoring. A steady routine helps you stay disciplined, reduce stress, and make better trading decisions over time.

Trading Errors That Kill Profits And Their Fixes

Even experienced traders slip up sometimes. The key is to recognize common mistakes early and develop habits that prevent them from happening again.

Here are a few you’ll want to watch out for and how to fix them:

| Mistake | Why It Hurts | How to Fix It |

|---|---|---|

| Overtrading | You chase every signal and lose focus. | Stick to 1–2 setups you trust. Quality beats quantity. |

| Ignoring the trend | You fight the market and lose more often. | Check higher timeframes first. Trade with the trend, not against it. |

| No stop-loss | One bad trade can wipe out weeks of profit. | Set your stop before you enter. Protect your capital always. |

| Impulsive entries | Emotion takes over, and you buy too early. | Wait for candle confirmation. Let the setup prove itself. |

| Skipping journaling | You repeat the same mistakes without knowing. | Review trades weekly. Track what works and what doesn’t. |

Learning from these small mistakes helps you grow faster and trade with more consistency. Every fix you apply moves you one step closer to steady results.

Community Swing Strategies and What Traders Say

Learning from other traders can make a big difference when you’re building your swing trading skills. Community discussions often reveal how real traders handle setups, risk, and discipline in day-to-day markets.

One valuable thread worth reading is this Reddit discussion: How do I get started as a swing trader?

In this discussion, traders share their early experiences, favorite strategies, and practical advice for newcomers.

It’s a good place to understand how people structure their trades, what mistakes to avoid, and how they refine their methods over time.

Wrap Up

Swing trading gives you the freedom to trade with structure and patience instead of stress. You’ve seen how simple swing trading strategies can guide your entries, exits, and daily decisions.

What matters most isn’t finding a secret formula; it’s sticking to your plan, managing risk, and learning from every trade. If you stay consistent, even small steps can lead to steady progress.

I hope this guide helps you build confidence in your trading process and avoid the common mistakes new traders make. Take what you’ve learned here, test it slowly, and keep refining your approach.

For more trading ideas and practical tips, check out my other blogs; they’ll help you keep improving with every setup.