I’ll never forget the first time I missed a major reversal because I didn’t recognize the chart pattern staring right at me.

That moment taught me something invaluable: understanding chart patterns isn’t just helpful; it’s essential for protecting your capital and spotting high-probability trades.

Today, I want to walk you through one of the most dramatic yet often overlooked patterns in technical analysis: the megaphone pattern, also known as the broadening formation.

By the end of this guide, you’ll understand the pattern, how to identify it on your charts, proven trading strategies, and how to manage risk to avoid being caught on the wrong side of this volatile setup.

Trading financial instruments involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. Never invest more than you can afford to lose, and always seek professional financial advice before making trading decisions.

What is a Megaphone Pattern?

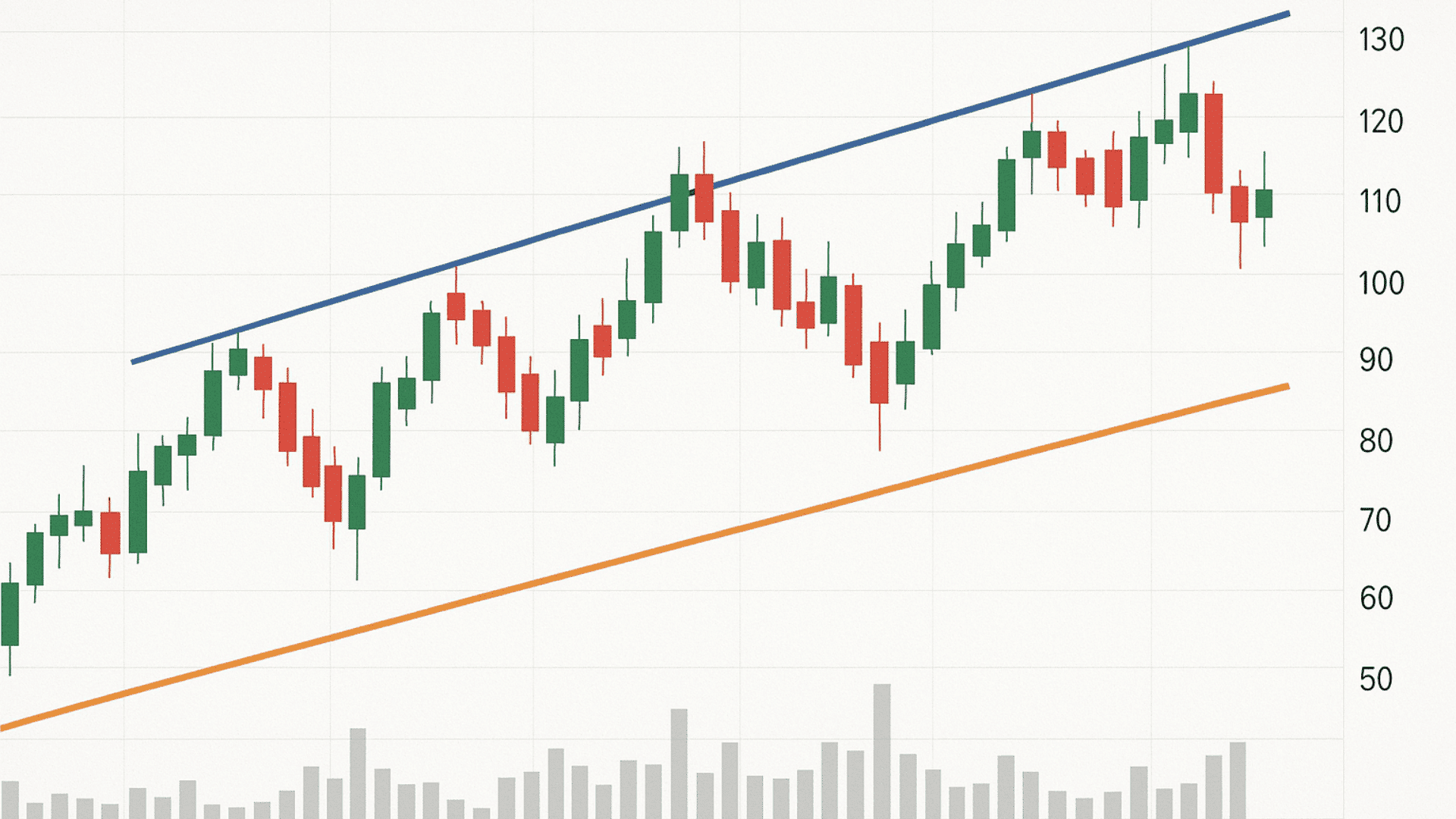

A megaphone pattern is exactly what it sounds like: a chart formation that widens over time, creating higher highs and lower lows that expand outward like a cone.

You might also hear traders call it a broadening wedge or expanding triangle, but they’re all referring to the same setup.

I’ve spotted this pattern across every market I trade: stocks, forex, crypto, and commodities. It doesn’t discriminate.

When you look at your chart, imagine drawing two diverging trendlines: one connecting the rising peaks, another connecting the falling troughs.

That expanding shape signals increasing volatility and indecision in the market, which is precisely what makes it both risky and rewarding to trade.

Characteristics of a Megaphone Pattern

Understanding the key traits of this pattern has saved me from countless bad trades. Let me break down the four characteristics I always watch for when I suspect a megaphone is forming on my charts.

1. Widening Price Action

The defining feature I always look for is that each price swing grows progressively larger. When I see a peak that’s higher than the last one, followed by a trough that’s lower than the previous low, I know the pattern is building.

This expanding volatility tells me that bulls and bears are fighting harder with each round, creating those dramatic swings that define the megaphone shape.

2. Volume Trend

Here’s something I’ve noticed consistently: volume tends to climb as the pattern develops. Those initial swings might happen on moderate volume, but as the price action widens, participation increases.

I pay close attention to this because rising volume confirms that more traders are getting involved, which validates the pattern and often precedes a significant breakout move.

3. Trend Ambiguity

This is where the megaphone pattern gets tricky. Unlike cleaner formations, I can’t automatically assume it’s bullish or bearish.

Sometimes it signals a reversal at major tops or bottoms, other times it’s just a continuation pattern within an existing trend. I always check what came before the pattern and where it’s forming in the bigger picture to gauge its likely direction.

4. Timeframe Variations

I’ve found megaphone patterns on every timeframe I analyze, from quick intraday charts to weekly and monthly views. A pattern forming on a daily chart carries different implications than one on a five-minute chart.

The longer the timeframe, the more significant the eventual breakout typically becomes, so I adjust my position sizing and targets accordingly.

Types of Megaphone Patterns

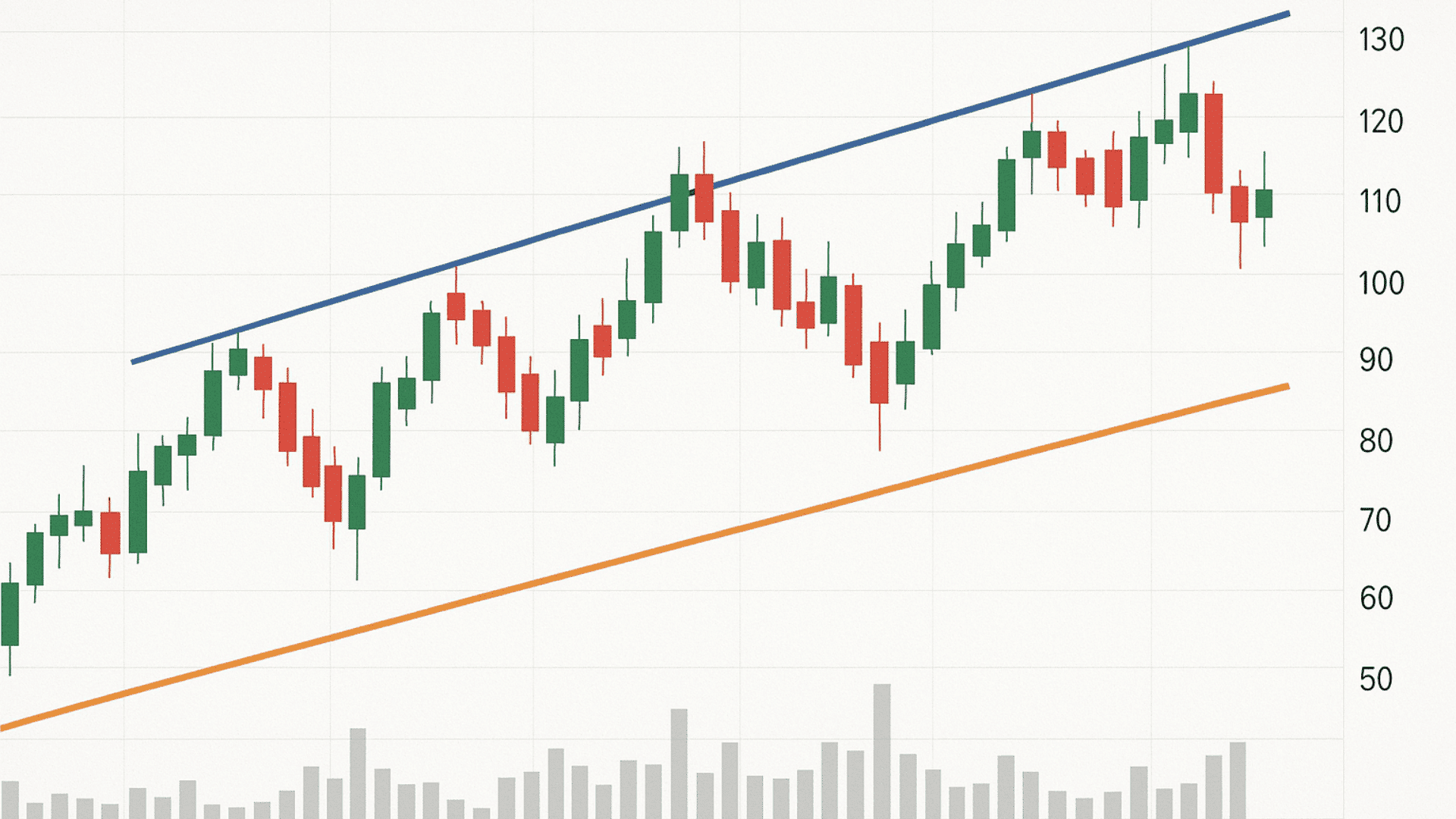

Not all megaphone patterns behave the same way, and recognizing the differences has completely changed how I approach my trades.

Here’s how I categorize them based on their directional bias and what that tells me about market sentiment.

| Pattern Type | Structure | Market Bias | Breakout Tendency | Risk Level |

|---|---|---|---|---|

| Ascending Megaphone | Higher highs and higher lows expanding outward | Bullish | Upside (65-70% probability) | Moderate-High |

| Descending Megaphone | Lower highs and lower lows are widening progressively | Bearish | Downside (60-70% probability) | High |

| Symmetrical Megaphone | Higher highs and lower lows expanding equally | Neutral/Uncertain | Either direction (50-50 split) | Very High |

The symmetrical megaphone is the most dangerous type I trade because it traps both bulls and bears repeatedly. I’ve learned to stay patient and let the pattern fully develop rather than trying to catch every swing, because that’s how accounts get shredded.

How to Identify a Megaphone Pattern?

Spotting a megaphone pattern accurately takes practice, but I’ve developed a simple checklist that keeps me from second-guessing myself.

Here’s my exact process for confirming this formation before I even think about placing a trade.

- Look for Expanding Price Swings: Each peak should be higher than the last, and each trough should be lower than the previous one.

- Draw Diverging Trendlines: Connect at least two highs and two lows; the lines should widen apart, not converge like triangles.

- Confirm Increasing Volume: Check that trading activity is rising as the pattern develops, validating the expanding volatility.

- Count the Touches: I need at least four or five price reversals (alternating touches on upper and lower boundaries) to trust the pattern.

- Assess the Bigger Picture: determine where this pattern sits in the overall trend to gauge whether it’s likely a reversal or continuation setup.

The biggest mistake I see traders make is confusing megaphones with triangle or flag patterns. Remember, triangles converge while megaphones expand. If trendlines converge instead of diverge, it indicates a different setup with distinct trading implications.

Trading Strategies Using Megaphone Patterns

This is where theory meets reality, knowing how to actually profit from megaphone patterns.

These five strategies have consistently delivered the best risk-reward setups and can be adapted to different trading styles and market conditions.

Trading megaphone patterns involves substantial risk due to their inherent volatility. Never trade with money you cannot afford to lose, and always use appropriate position sizing based on your risk tolerance and account size.

1. Breakout Trading

Wait patiently for the price to decisively break through either the upper or lower trendline with strong volume confirmation.

Once the breakout occurs, enter in the direction of the break, anticipating that the pattern’s built-up volatility will fuel a substantial move.

The key here is waiting for a clean close beyond the trendline, not just a quick spike that retreats immediately.

2. Reversal Strategy

When a megaphone forms near major support or resistance zones, reversals become highly probable.

Patterns developing at market tops after extended rallies often lead to downside breaks, while formations at significant bottoms frequently reverse upward.

Combining this recognition with momentum indicators helps confirm the reversal signal before committing capital to the trade.

3. Swing Trading

For more active traders, playing the swings within the pattern itself offers opportunities, buying near the lower trendline and selling near the upper boundary.

This approach requires precision and discipline because those boundaries aren’t exact.

Only attempt this when the pattern is well-established with clear swing points, and always use tight stops since false breaks happen frequently.

4. Stop Loss and Risk Management

Place stops just outside the pattern’s most recent extreme, beyond the last swing high for short positions, or below the last swing low for long trades.

This protects against normal volatility while giving the trade room to work.

Never risk more than two percent of capital on these setups because megaphones can whipsaw violently before finally breaking out.

5. Profit Targets

Calculate targets using the pattern’s width at the breakout point, then project that distance in the direction of the trade.

Alternatively, measure the average swing size within the pattern and use that as the minimum target.

If the breakout shows particularly strong momentum with heavy volume, consider trailing stops to capture extended moves beyond initial targets.

Risk Management Tips

Megaphone patterns can destroy accounts just as easily as they can grow them. These risk management principles have saved traders from costly mistakes and should be non-negotiable parts of any megaphone trading plan.

- Avoid Low-Volume Markets: Patterns without sufficient trading activity produce unreliable signals and wider spreads that eat into profits.

- Confirm with Technical Indicators: Use RSI for overbought/oversold conditions, MACD for momentum shifts, and moving averages to validate the broader trend.

- Remember Volatility Doesn’t Equal Direction: Megaphones signal increasing price swings, not necessarily which way the breakout will occur.

- Start with Smaller Position Sizes: Reduce exposure by half until pattern recognition skills improve and confidence builds through successful trades.

- Wait for Confirmation: Never jump in on the first touch of a trendline; let the pattern develop fully with multiple touches before committing.

The traders who survive megaphone patterns are the ones who respect the uncertainty built into this formation. Patience and proper position sizing matter more here than in almost any other chart pattern.

Real-World Examples of Megaphone Patterns

Looking at historical megaphone patterns reveals valuable insights that textbooks often miss.

Bitcoin’s late rally formed a classic symmetrical megaphone before a sharp correction, while major forex pairs like EUR/USD have shown ascending megaphones during strong trending periods. Tech stocks frequently develop these patterns during earnings season volatility.

Successful trades typically share common traits: waiting for confirmed breakouts, placing stops beyond the pattern’s extremes, and taking partial profits at measured targets.

Failed trades usually result from premature entries, ignoring volume confirmation, or trading against the prevailing trend context.

The clearest lesson? Patience separates profitable megaphone traders from those who get whipsawed repeatedly within the pattern’s boundaries.

Advantages & Limitations of Trading Megaphone Patterns

Every pattern has its strengths and weaknesses, and the megaphone is no exception. Understanding both sides helps traders make informed decisions about when to engage with this volatile formation.

Advantages

- Signals Major Market Shifts: The pattern can indicate significant trend reversals at tops or bottoms, or continuation within existing trends.

- High Profit Potential: Wide price swings create opportunities for substantial gains when traded with proper timing and execution.

- Multiple Trading Opportunities: Allows both swing trading within pattern boundaries and breakout trading once the formation completes.

- Clear Visual Structure: Expanding trendlines provide defined boundaries for entry, exit, and stop-loss placement.

Limitations

- Extreme Volatility Increases Risk: Wider swings mean larger potential losses if trades move against the position, requiring careful position sizing.

- Difficult Pattern Identification: Beginners often confuse megaphones with triangles or other formations, resulting in misguided trading decisions.

- Requires Additional Confirmation: Volume analysis, momentum indicators, and trend context are crucial for filtering false signals and validating breakouts.

- Unpredictable Breakout Direction: Especially with symmetrical megaphones, determining which way the price will break demands patience and multiple confirmations.

Weighing these advantages against the limitations helps determine whether the megaphone pattern aligns with your trading style and risk tolerance.

The Bottom Line

The megaphone pattern represents one of the most challenging yet rewarding formations in technical analysis. These widening price swings signal critical moments where markets transition, offering both reversal and breakout opportunities.

Success hinges on three pillars: accurate identification of the expanding structure, disciplined execution of proven strategies, and rigorous risk management to protect against whipsaws.

Before risking real capital, I strongly encourage practicing pattern recognition using demo accounts. Master trendline drawing, volume confirmation, and breakout validation in a risk-free environment first.

What’s your experience with megaphone patterns? Share your thoughts and questions in the comments below.