I’ve watched smart money concepts completely reshape how traders approach the markets. The focus on price imbalances and institutional footprints has opened up a whole new dimension of understanding market structure.

You’ve probably heard about fair value gaps; those inefficient price zones where the market moved too quickly.

But here’s what really caught my attention: inverse fair value gaps work in the exact opposite way, and they’re incredibly powerful for spotting when price is about to rebalance or reverse.

Think of them as the market’s way of signaling overextension.

I’m going to break down exactly what IFVGs are, how they form, how to identify them on your charts, and the practical trading strategies that actually work with them.

What is an Inverse Fair Value Gap?

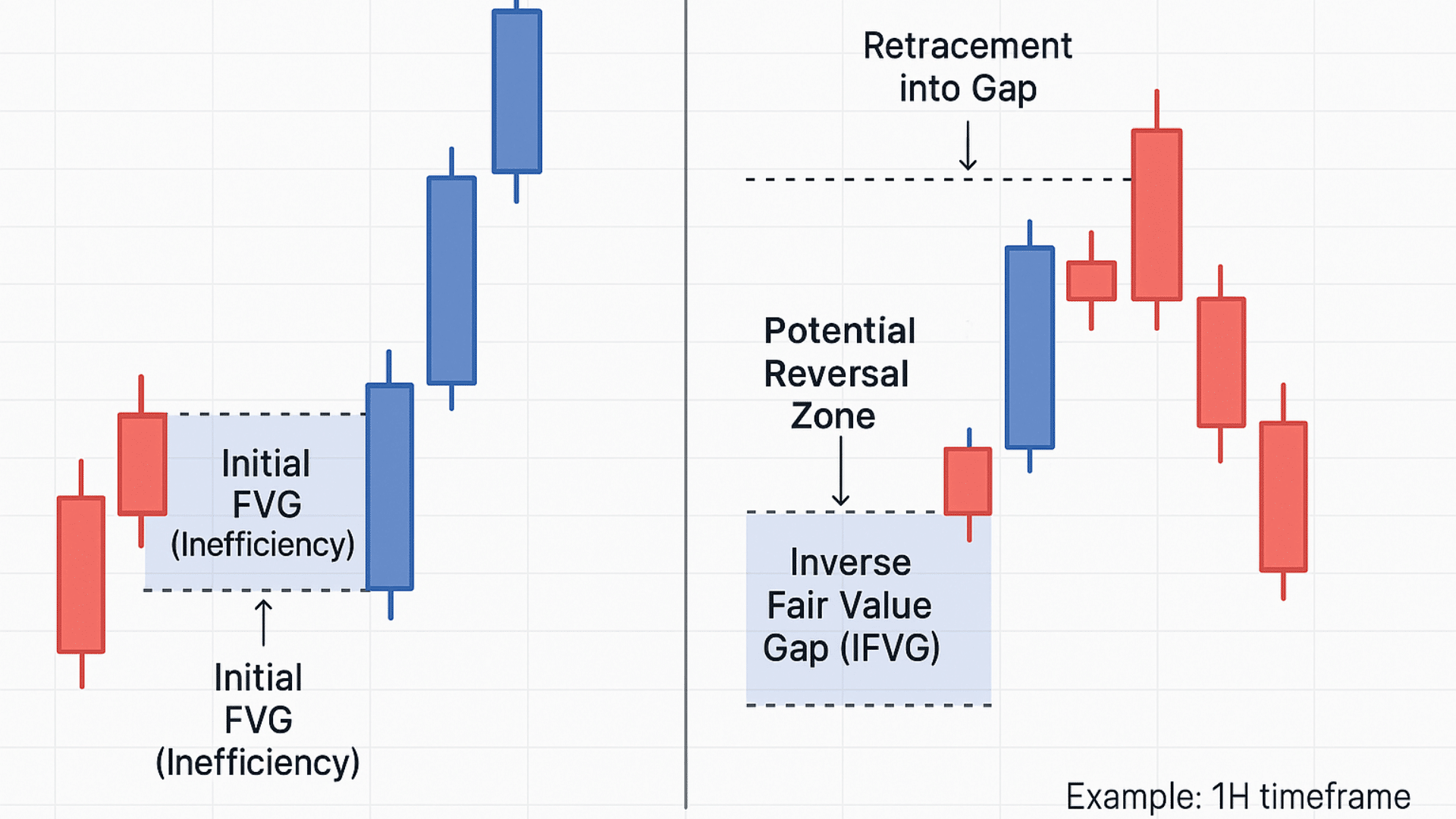

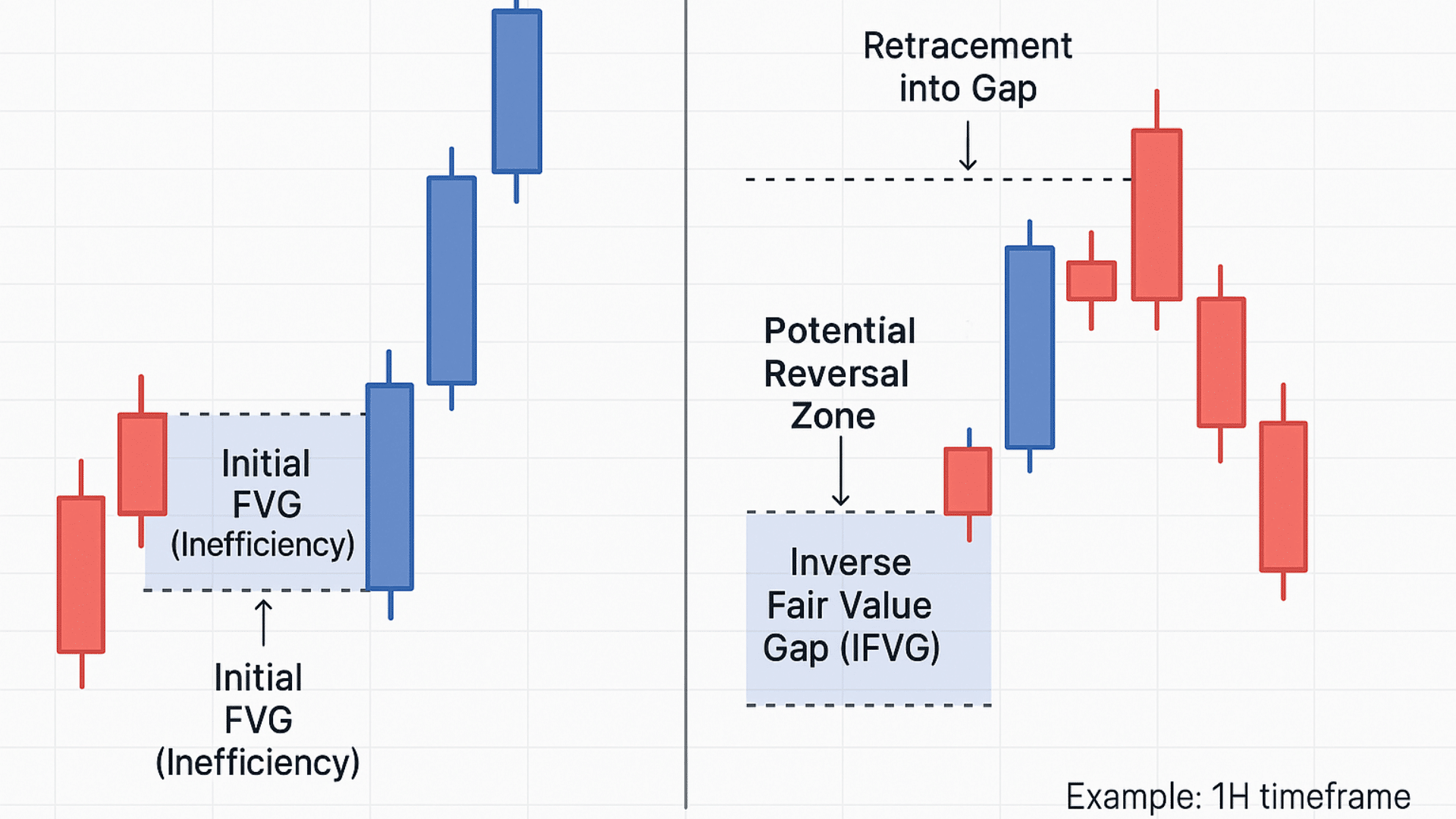

An inverse fair value gap happens when price moves back to fill a previous fair value gap from the opposite direction, and it’s often a signal that market structure might be shifting.

Let me simplify this: a regular FVG forms when price moves so aggressively that it skips over certain levels, creating inefficiency.

An IFVG occurs when the price later retraces into that same zone but from the other side.

Why does this matter? These zones highlight where the market is rebalancing itself or potentially grabbing liquidity before making its next significant move.

I see them as critical pivot points where institutional players often reveal their hand.

How Does an Inverse Fair Value Gap Form?

Understanding the formation process is crucial for identifying IFVGs in real-time. The sequence follows a predictable pattern that repeats across all market conditions and timeframes.

Step 1: The Initial Fair Value Gap Creation

Everything starts with a strong directional move that creates the original fair value gap. This happens when price moves so aggressively, whether bullish or bearish, that it leaves behind an imbalance or gap between candle bodies.

You’ll notice the middle candle’s wick doesn’t overlap with the candles on either side. This inefficiency represents areas where minimal trading occurred, and the market essentially skipped price levels.

These gaps form during momentum-driven moves, often triggered by news events, institutional orders, or breakouts from consolidation zones.

Step 2: Price Retraces Into the Imbalance

After the initial aggressive move, the price eventually loses momentum and begins retracing. This is where things get interesting.

Instead of continuing in the original direction, price pulls back and starts filling the gap it previously created. The retracement happens from the opposite direction, essentially revisiting those skipped price levels.

This filling process can occur quickly or gradually, depending on market conditions. Many traders miss this critical phase because they’re still focused on the initial trend direction rather than watching for the rebalancing behavior.

Step 3: The Inverse FVG Marks a Structural Shift

Once price fills the original gap from the opposite direction, you’ve got your inverse fair value gap.

This moment is significant because it suggests the market has rebalanced that inefficiency and may now be ready for a reversal or continuation in the new direction. The IFVG zone becomes a reference point for potential support or resistance.

Smart money often uses these zones to enter positions, which is why you’ll frequently see price reactions when these areas are tested again later.

Timeframes to Watch for this Gap

IFVGs appear across all timeframes, but certain intervals provide cleaner signals with less noise. Here are the timeframes I focus on:

- 1H (Hourly): Ideal for intraday traders looking for quick reversals and short-term structural shifts

- 4H (Four-Hour): Perfect for swing traders who want to catch multi-day moves with better accuracy

- Daily: Best for position traders seeking high-probability setups with longer holding periods

Matching your timeframe to your trading style makes all the difference in how effectively you can capitalize on IFVGs.

Fair Value Gap vs. Inverse Fair Value Gap

Knowing the difference between FVGs and IFVGs is essential because they serve distinct purposes in your trading analysis. Although opposite, they together provide a complete view of market structure and institutional behavior.

| Feature | Fair Value Gap (FVG) | Inverse Fair Value Gap (IFVG) |

|---|---|---|

| Direction | Continuation of the original move | Retracement/reversal move |

| Purpose | Marks inefficiency left by institutions | Indicates market rebalancing |

| Trading Bias | Trend continuation | Counter-trend or reversal |

| Common Setup | Buy/sell from the FVG zone | Watch for a reversal from the IFVG zone |

How Do They Complement Each Other?

I’ve found that using both concepts together creates a powerful framework for reading price action.

FVGs help you identify where the market is heading with momentum, while IFVGs warn you when that momentum might be exhausting or reversing. Think of FVGs as the accelerator and IFVGs as the brake signal.

When you spot an FVG getting filled and forming an IFVG, you’re witnessing the market’s attempt to restore balance: a critical moment where smart money often repositions.

Don’t trade every FVG or IFVG you see. The most profitable setups occur when these zones align with key support/resistance levels, order blocks, or significant liquidity pools.

Why Inverse Fair Value Gaps Matter in Trading?

IFVGs give you a window into what institutional players are actually doing behind the scenes. They reveal those moments when smart money is rebalancing positions and cleaning up price inefficiencies.

What makes them invaluable is their ability to pinpoint high-probability entry zones, especially after liquidity sweeps where retail traders get trapped.

I use IFVGs as confirmation tools; when they align with order blocks or breaker blocks, the setup becomes significantly stronger.

Most importantly, they act as early warning signals for potential reversals or trend exhaustion, giving you the edge to position yourself before the crowd catches on.

How to Identify an Inverse Fair Value Gap?

Identifying IFVGs accurately requires a systematic approach rather than guessing. I’m going to walk you through my exact process for spotting these setups with confidence.

- Step 1: Scan your chart for a three-candle pattern where the middle candle’s wick doesn’t touch the candles on either side.

- Step 2: Wait for the price to lose momentum and move back toward that gap from the opposite direction.

- Step 3: Check if the price creates a new imbalance going the other way as it fills the original gap.

- Step 4: Confirm your IFVG with a clear BOS or structural shift to increase the probability of success.

- Step 5: Mark zones with TradingView’s rectangle tool and consider broader trend, liquidity, and market structure before trading.

The key here is patience and context. Forcing IFVGs where they don’t exist is a fast track to losses. Let the market show you the setup clearly before you act.

How to Trade Using an Inverse Fair Value Gap?

Understanding IFVGs is one thing, but knowing how to actually trade them is where the real money gets made. Let me break down the practical setups and strategies I use to capitalize on these zones.

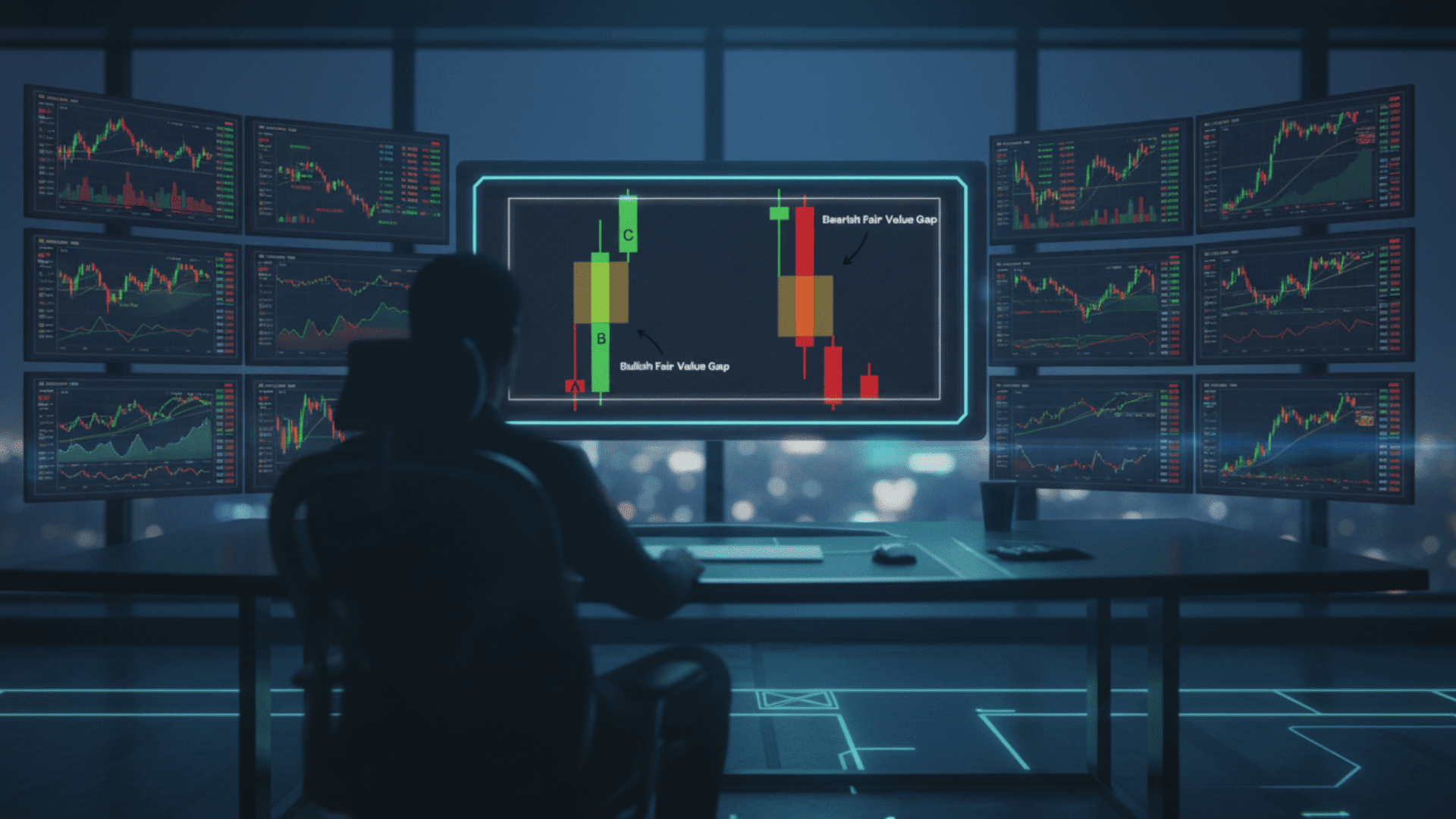

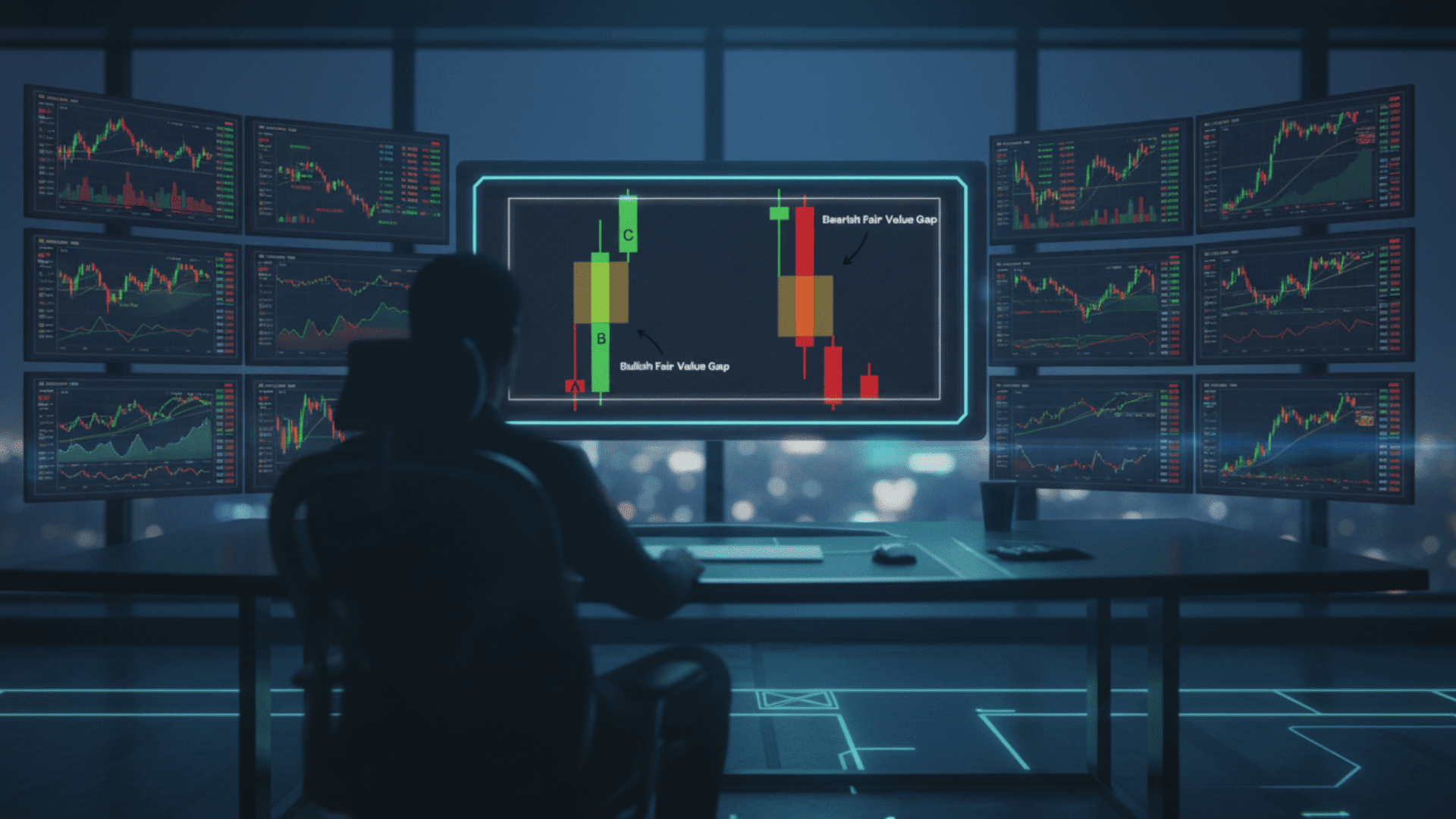

1. Recognizing Bullish and Bearish IFVG Setups

Bullish IFVG forms when price fills a bearish FVG from below, signaling potential upward reversal.

These appear after the market sweeps lows and show exhaustion on the downside. The zone acts as support where institutional buyers typically defend and initiate long positions.

Bearish IFVG occurs when price fills a bullish FVG from above, indicating potential decline.

These materialize after liquidity grabs at major highs, where retail gets trapped. The zone becomes resistant where smart money distributes and initiates short positions.

2. Building Confluence for High-Probability Entries

Never trade an IFVG in isolation. Stack multiple confirmation factors to filter out weak setups and increase your edge.

Here’s what I look for before committing capital:

- Market Structure Shift: Look for clear BOS or CHOCH confirming directional change, not just noise.

- Liquidity Sweep: Best setups occur after stop-hunts near swing highs or lows where trapped traders exit.

- Order Block Alignment: Premium confluence happens when IFVG overlaps with institutional order blocks in the same zone.

The more boxes you can check, the stronger your conviction should be. I typically need at least two of these factors aligned before considering entry.

3. Managing Risk and Protecting Capital

Risk management determines whether you survive long enough to profit from IFVGs.

Here’s my non-negotiable framework:

- Stop-Loss Placement: Position stops just beyond the IFVG zone with a small buffer for wick tolerance.

- Set up Filtration: Trade only IFVGs with multiple confirming factors; skip isolated formations completely.

- Position Sizing: Adjust lot size based on distance to stop-loss, maintaining consistent risk per trade.

Following these rules keeps you in the game when setups fail and maximizes profits when they work.

Trading IFVGs involves substantial risk of loss. Never risk more than you can afford to lose, and always use proper position sizing relative to your account balance. Even the best setups fail, so protect your capital first.

Common Mistakes to Avoid When Working with IFVGs

Even experienced traders fall into predictable traps when working with IFVGs. I’ve made most of these mistakes myself, so let me save you the tuition fees by highlighting what to watch out for.

- Misidentifying Regular FVGs as Inverse Ones: Don’t confuse a simple retest with an actual IFVG; the gap must be filled from the opposite direction with clear structural implications.

- Ignoring Market Structure and Trend Direction: Trading IFVGs against the dominant trend without proper confirmation is a recipe for getting steamrolled by institutional flow.

- Trading Low-Liquidity Pairs or Sessions: Exotic pairs and off-hours produce unreliable IFVGs with erratic price behavior that doesn’t respect technical levels.

- Entering Before Confirmation: Jumping in without waiting for BOS, CHOCH, or liquidity sweeps means you’re gambling instead of trading with an edge.

These mistakes share a common thread: impatience and lack of discipline. The traders who consistently profit from IFVGs are the ones who wait for quality setups with proper confirmation rather than forcing trades.

Key Takeaways

IFVGs aren’t magic bullets; they’re rebalancing zones that reveal when the market might pause or reverse direction.

I’ve found them most effective when combined with order blocks, liquidity analysis, and clear breaks of structure rather than trading them standalone.

The biggest lesson here is that context matters more than the pattern itself. Not every imbalance deserves your capital, and the discipline to wait for high-confluence setups separates consistent winners from account blowers.

Remember that all trading carries significant risk. IFVGs are tools for analysis, not guarantees of profit. Always trade with money you can afford to lose, use strict risk management, and never let a single trade jeopardize your account.

What’s your experience with IFVGs? Drop a comment below and let me know if you’ve spotted these setups in your own trading.