Generating a steady income from options sounds great until you see the price tag. A traditional covered call requires you to first buy 100 shares. If the stock trades at $100, you need $10,000 just to start.

Here’s the good news: the synthetic covered call gives you the same income potential with a fraction of the cost. You get covered-call-like returns using only options.

In this guide, you’ll learn what a synthetic covered call is, how it works, and when to use it. We’ll walk through real examples, compare them to other strategies, and cover common mistakes to avoid.

If you want covered call income without tying up huge amounts of capital, this strategy could change how you trade.

What is a Synthetic Covered Call?

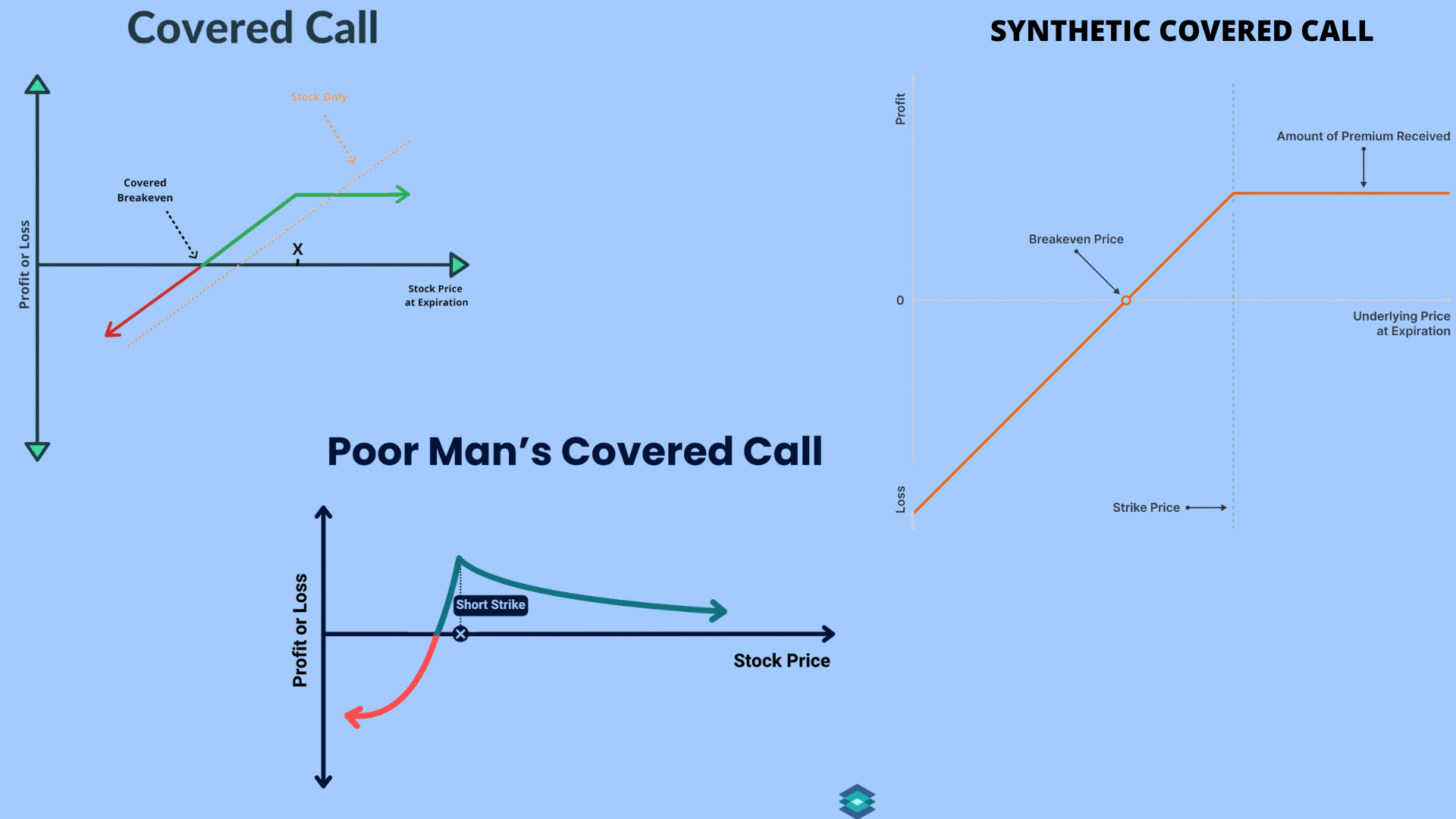

A synthetic covered call is an options strategy that mimics a traditional covered call without owning the actual stock.

You create the same income potential and risk profile using only two option contracts. This approach lets you trade as if you owned 100 shares with much less upfront money.

Here’s the structure:

- Long Call (Deep ITM): Buy one in-the-money call option that acts like owning the stock itself.

- Short Call (OTM): Sell one out-of-the-money call option to collect premium income.

The word “synthetic” means you’re simulating stock ownership through options. Traders use this strategy when they expect the stock to stay steady or rise slightly in neutral to mildly bullish markets.

For example, instead of spending $10,000 to buy 100 shares of a $100 stock, you might spend only $800 on a long call and sell a short call for $200, dropping your net cost to $600 for similar exposure.

How a Synthetic Covered Call Works

The logic is simple. Your long call moves with the stock almost dollar-for-dollar. Your short call generates premium income but limits your potential profit if the stock rallies. Together, they create the same risk and reward as owning stock and selling a call against it.

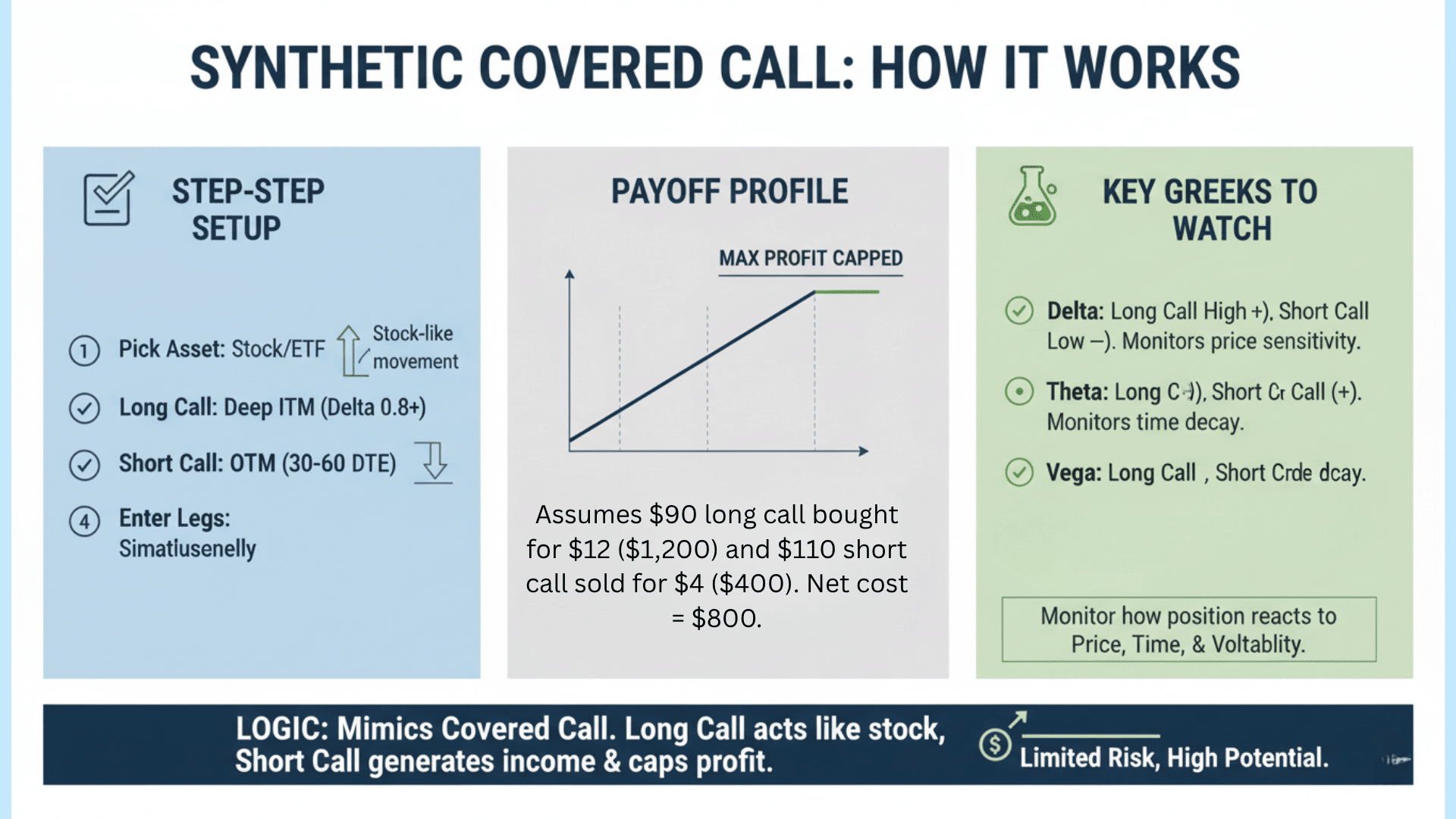

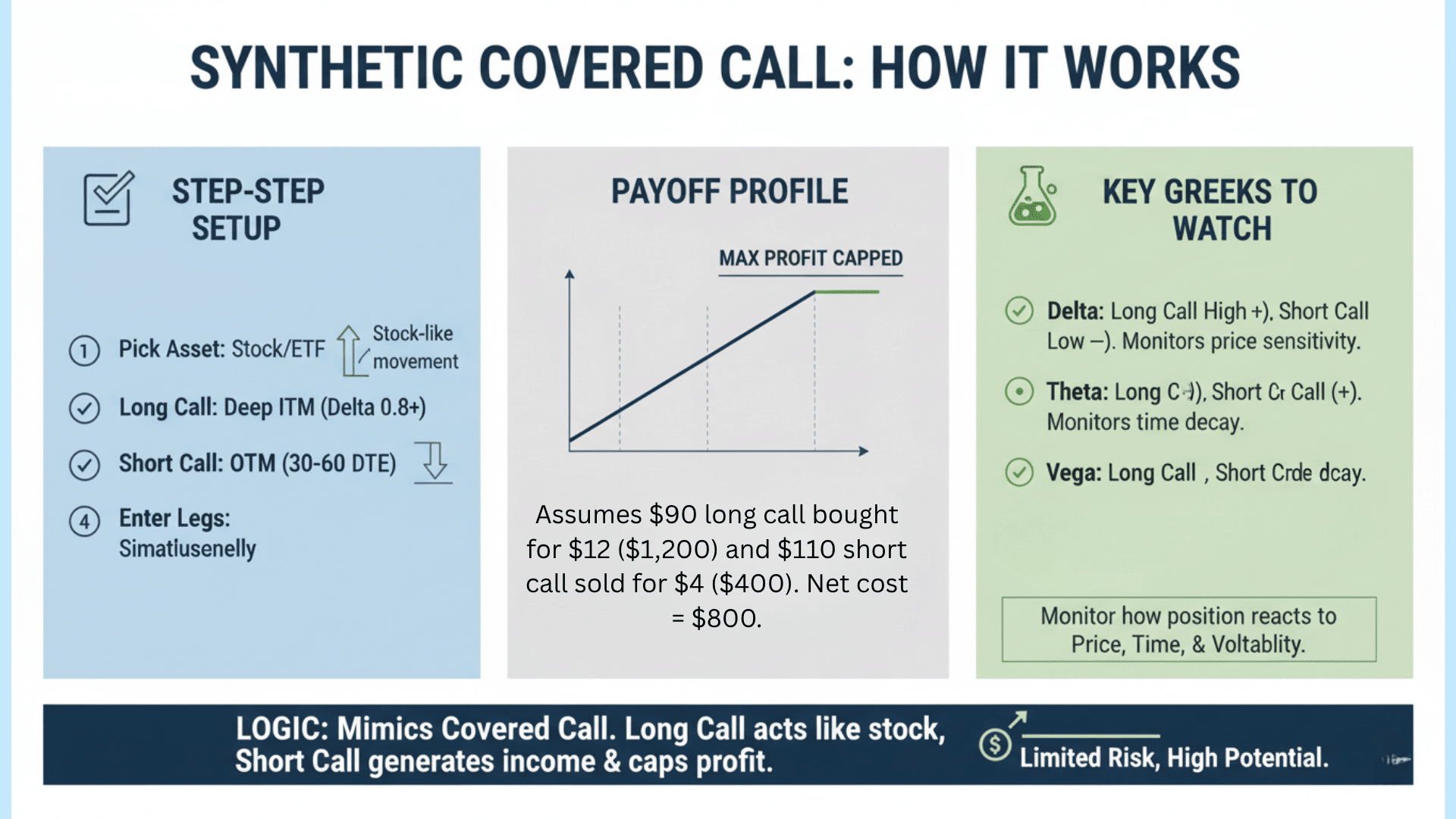

Step-by-Step Setup:

- Pick the underlying asset: Choose a stock or ETF you want exposure to.

- Choose the long call: Buy a deep in-the-money call with a delta between 0.8 and 0.9. This high delta makes it behave like a stock.

- Choose the short call: Sell an out-of-the-money call with a 30- to 60-day expiration. This generates your income.

- Enter both legs simultaneously to execute the trade as a single order, reducing slippage and getting better pricing.

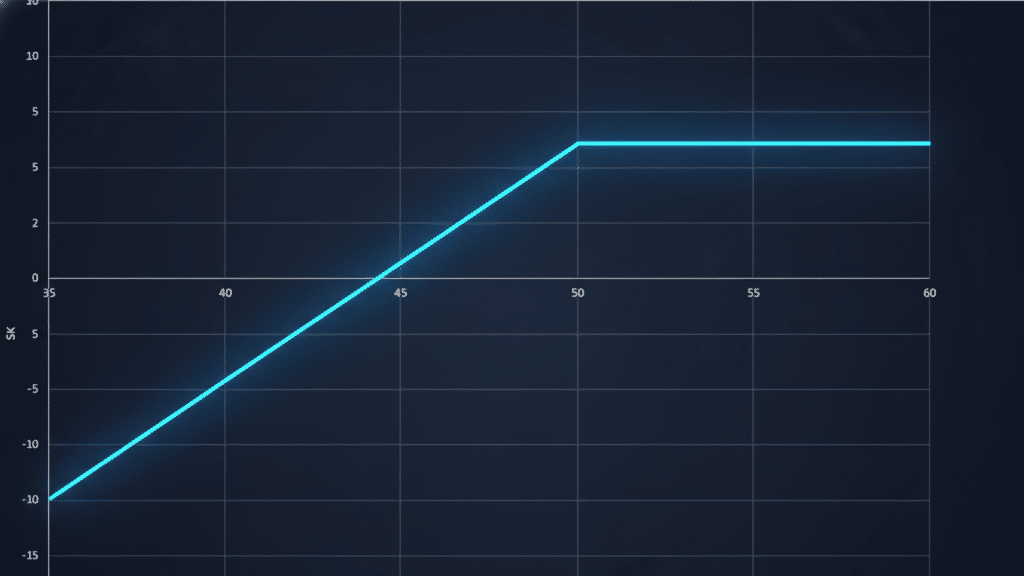

Understanding the Payoff Profile:

Your profit potential is capped at the short call strike price. If the stock soars past that level, you don’t make any more money. On the downside, you face a similar risk to a covered call. If the stock drops, your long call loses value, just as if you owned shares.

Mini Payoff Example:

| Stock Price at Expiry | Long Call Value | Short Call Value | Net Profit/Loss |

|---|---|---|---|

| $85 | $0 | $0 | -$800 (max loss) |

| $95 | $500 | $0 | -$300 |

| $105 | $1,500 | $0 | +$700 |

| $110 | $2,000 | -$500 | +$700 (max profit) |

| $120 | $3,000 | -$1,500 | +$700 (capped) |

Assumes $90 long call bought for $12 ($1,200) and $110 short call sold for $4 ($400). Net cost = $800.

Key Greeks to Watch:

- Delta: Your long call has a high delta (0.8+), so it moves almost like stock. Your short call has a lower delta.

- Theta: Time decay works against you on the long call but helps you on the short call. Net theta depends on your strikes.

- Vega: Both options are sensitive to volatility changes. Rising volatility helps your long call but hurts your short call.

Monitor these Greeks regularly. They tell you how your position will react to price moves, time passing, and volatility shifts.

When to Use the Synthetic Covered Call

So, when should you actually pull the trigger on a synthetic covered call? Let’s explore the ideal market setups and scenarios where this strategy truly shines.

- Neutral to Moderately Bullish Markets: This strategy works best when you think the stock will stay flat or rise slightly over the next month or two.

- Expensive Stocks: Use it on high-priced stocks like TSLA or NVDA, where buying 100 shares would tie up too much capital.

- Income Generation: The premium you collect from selling the short call creates steady income while you wait for modest price movement.

- Avoid Strong Trends: Skip this strategy if you expect the stock to skyrocket or crash, as it limits your upside and doesn’t fully protect your downside.

Quick Checklist:

- Expect moderate movement: You believe the stock will stay within a predictable range or drift higher slowly.

- Comfortable managing options: You understand how calls work and can adjust positions if needed.

- Looking for efficient capital use: You want stock-like exposure without spending thousands on shares.

- Expecting big rallies or crashes: You think the stock will make a huge move in either direction soon.

Real-World Examples of Synthetic Covered Calls

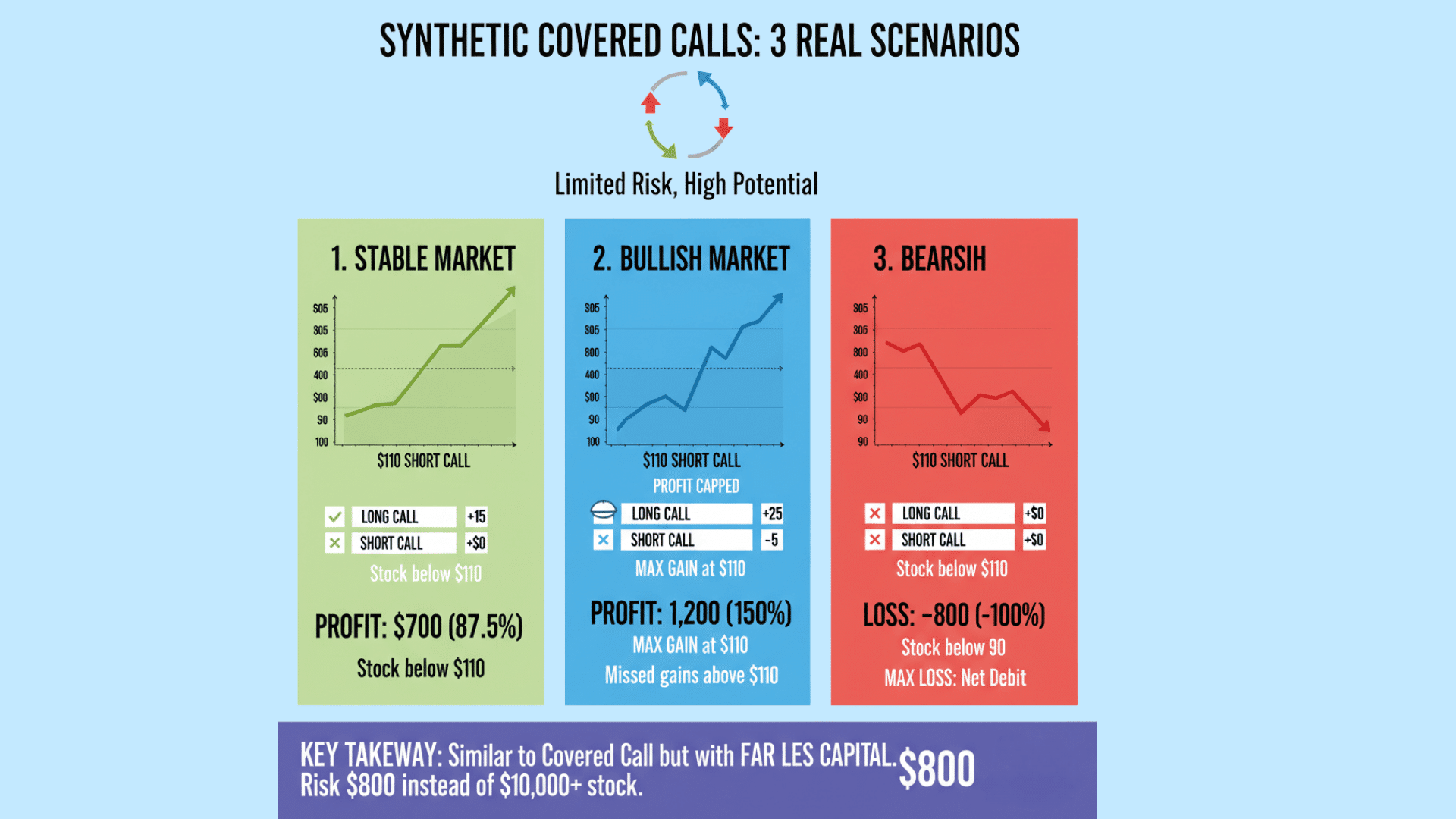

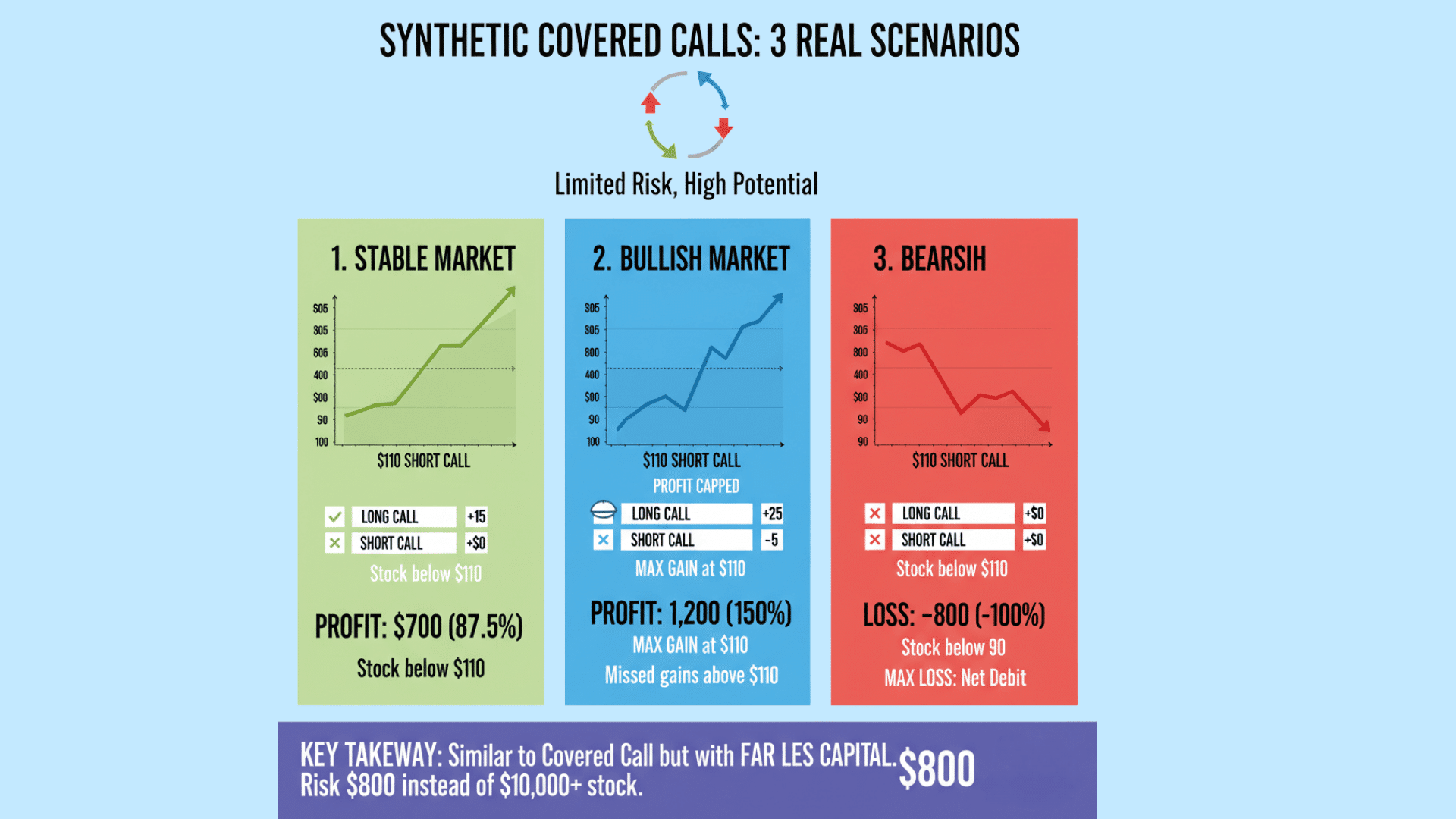

Let’s look at three real scenarios to see how the synthetic covered call performs in different market conditions. These examples show you what to expect when the stock stays stable, rallies hard, or drops.

Example 1: Stable Market

Imagine a stock trading at $100. You buy a $90 call for $12 ($1,200 total) and sell a $110 call for $4 ($400 credit). Your net cost is $8 per share, totaling $800.

At expiration, the stock sits at $105. Your short call expires worthless because the stock didn’t reach $110. Your long call is now worth $15 ($105 stock price minus $90 strike). You subtract your $8 net cost and walk away with a $7 profit per share, for a total of $700.

Key Points:

- Stock stayed below your short call strike

- You kept the full premium from the short call

- Your long call gained value as the stock rose

- Total return: 87.5% on your $800 investment

Example 2: Bullish Market

Now the stock surges to $115 by expiration. Your long call is worth $25 ($115 minus $90). But your short call is also in the money. You owe $5 on it ($115 minus $110). Your net value is $25 minus $5, which equals $20. Subtract your $8 cost, and your profit is $12 per share, or $1,200 total.

Key Points:

- Stock blew past your short call strike

- Your profit is capped at $12 per share, no matter how high the stock goes

- You miss out on gains above $110

- Total return: 150% on your $800 investment, but you left money on the table

Example 3: Bearish Market

The stock drops to $90 at expiration. Both calls expire worthless. Your long call has no value because the stock equals the strike price. Your short call also expires worthless. You lose your entire $8 net debit, or $800.

Key Points:

- Stock fell below your long call strike

- Both options expired with zero value

- You lost 100% of your net cost

- Maximum loss is always limited to your net debit

Takeaway:

The synthetic covered call gives you similar risk and reward to a traditional covered call. Your upside is limited by the short call strike. Your downside protection is minimal, just the premium you collected.

But you enter the trade with far less capital. Instead of tying up $10,000 in stock, you risk only $800.

This efficiency lets you spread capital across multiple positions or trade expensive stocks you couldn’t otherwise afford.

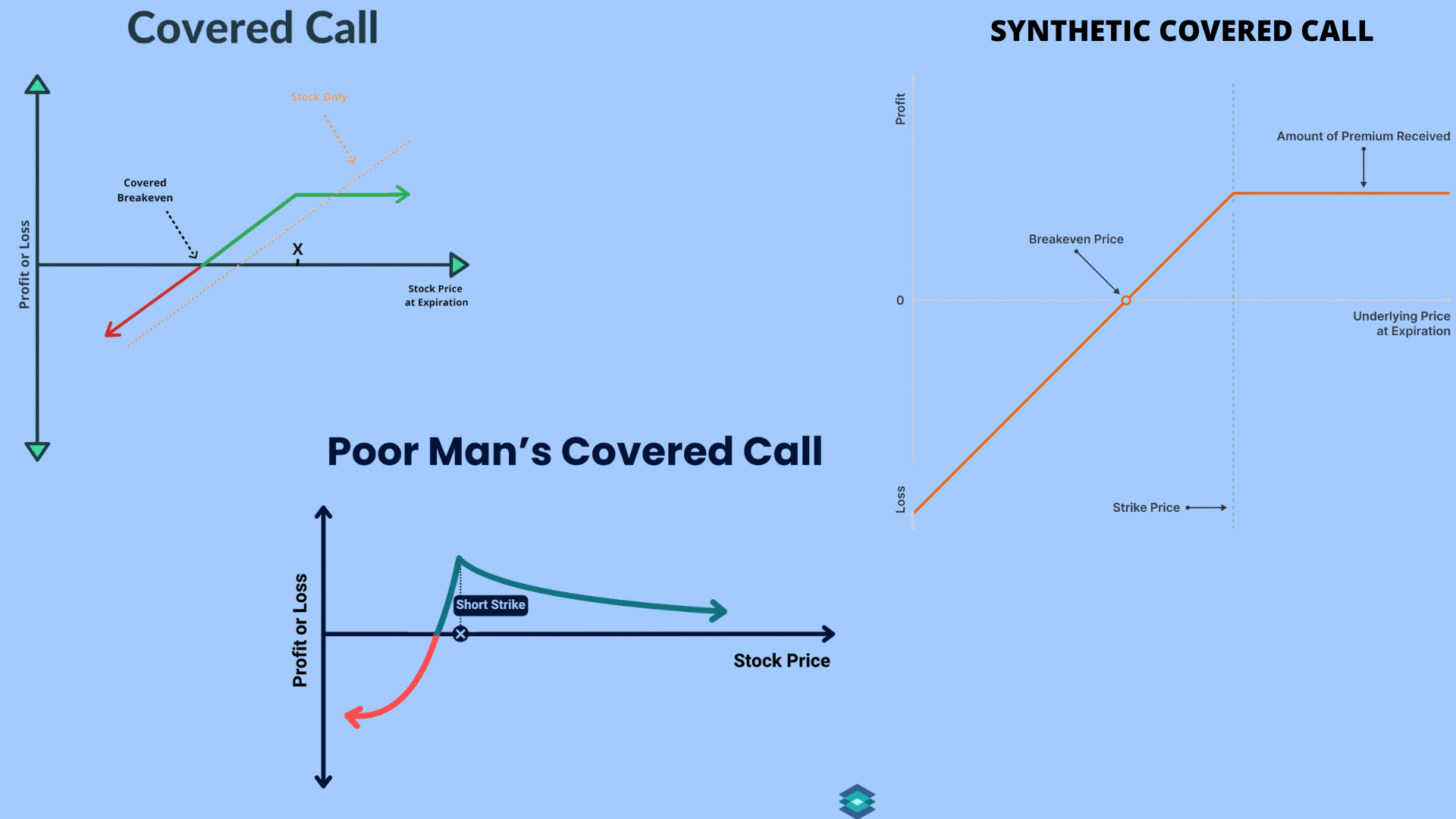

Comparison of Covered Call Strategies

Not all covered call strategies are built the same. Each approach offers different capital requirements, time frames, and trade-offs. Here’s a quick comparison to help you choose the right one for your goals.

| Strategy | Structure | Capital Needed | Objective | Pros | Cons |

|---|---|---|---|---|---|

| Traditional Covered Call | Own 100 shares + Sell 1 OTM call | High | Generate income, reduce cost basis | Simple, stable income | Requires large capital, capped upside |

| Poor Man’s Covered Call (PMCC) | Buy deep ITM LEAPS call + Sell short OTM call | Moderate | Long-term version with less capital | Capital efficient, long duration | Complex roll management, time decay risk |

| Synthetic Covered Call | Buy ITM call + Sell OTM call (same expiry) | Low to Moderate | Short-term income trade | Most capital efficient, flexible | No dividends, faster time decay |

Pro Tip: If you want a short-term, flexible income trade, choose the synthetic covered call. If you want a longer-term play with staying power, use the PMCC. If you already own the stock and want simplicity, stick with the traditional covered call.

Benefits of the Synthetic Covered Call

The synthetic covered call offers several advantages that make it attractive for income-focused traders. Here’s why so many traders prefer this strategy over traditional methods.

- Capital Efficiency: You pay a fraction of what it costs to buy 100 shares, freeing up cash for other trades.

- Income Generation: The premium you collect from selling the short call creates steady returns month after month.

- Flexibility: You can easily roll your short calls to different strikes or expirations to adjust your position.

- Accessibility: Smaller trading accounts can now use strategies previously available only to high-net-worth traders.

- Diversification: Instead of tying up $50,000 in one stock, you can spread that capital across five or more positions.

Risks and Limitations of the Synthetic Covered Call

Every strategy has downsides, and the synthetic covered call is no exception. Understanding these risks helps you manage your positions more effectively and avoid costly mistakes.

- Capped Upside: Your profits stop at the short call strike, so you miss out on big rallies above that level.

- Time Decay: Your long call loses value faster as expiration approaches, especially in the final 30 days.

- No Dividends or Voting Rights: You don’t own the actual stock, so you forfeit dividend payments and shareholder benefits.

- Assignment Risk: Your short call can be exercised early, especially if it goes deep in the money before expiration.

- Downside Loss: If the stock drops significantly, your long call loses value just like owning shares would.

Risk Management Table

Here’s a clear breakdown of your position’s key risk metrics, illustrated with a real example.

| Metric | Calculation | Example |

|---|---|---|

| Net Cost | Long call premium minus short call premium | Buy $90 call for $12, sell $110 call for $4 = $8 net debit |

| Breakeven Price | Long call strike + net cost | $90 + $8 = $98 |

| Max Profit | Short call strike minus long call strike minus net cost | ($110 – $90) – $8 = $12 per share |

| Max Loss | Net cost paid to open the position | $8 per share (or $800 total) |

| Profit Range | Stock price between breakeven and short call strike | $98 to $110 |

Your maximum loss is always limited to what you paid to enter the trade. Your maximum profit happens when the stock reaches or exceeds your short call strike. Plan your position size accordingly and never risk more than you can afford to lose.

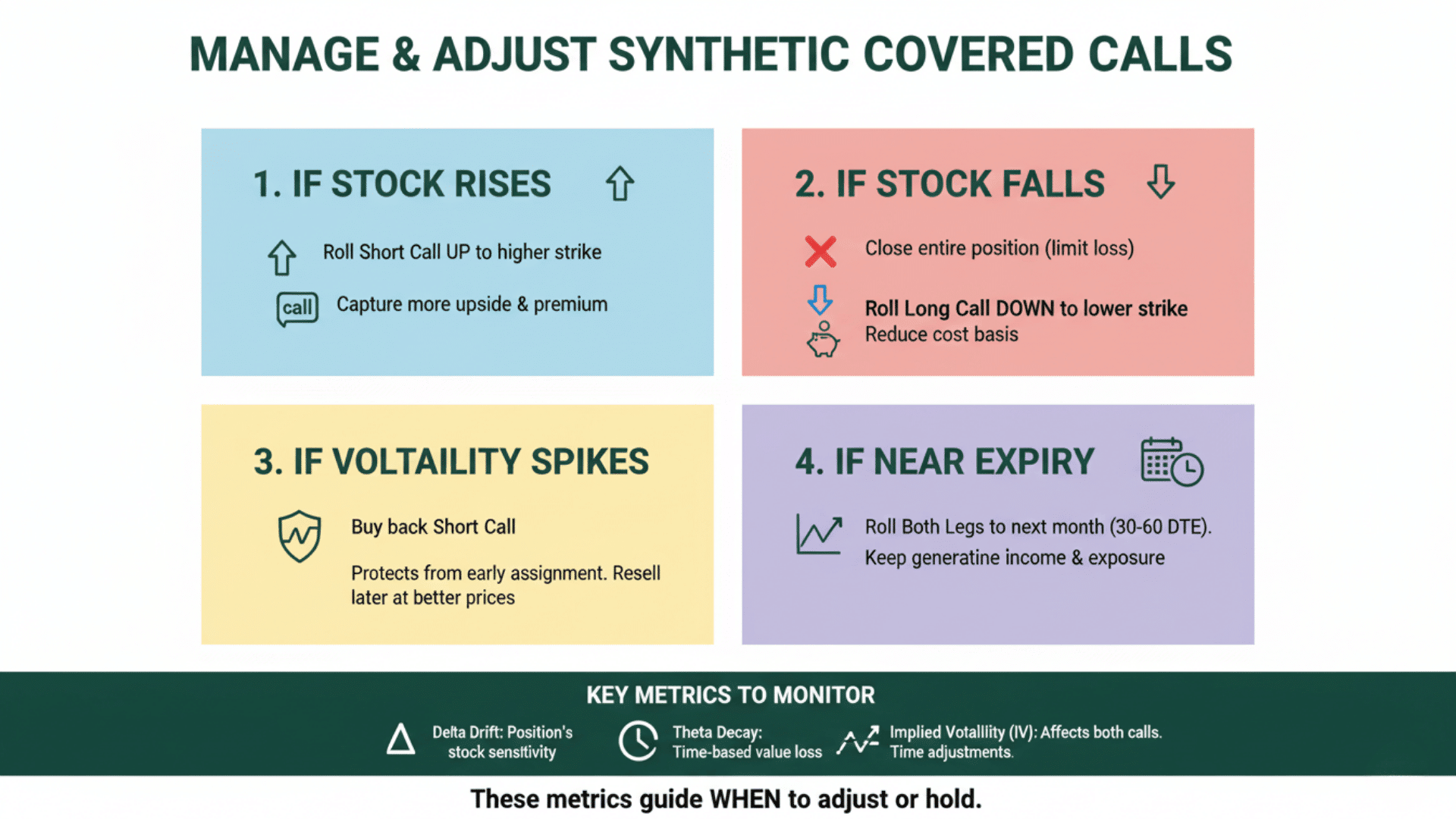

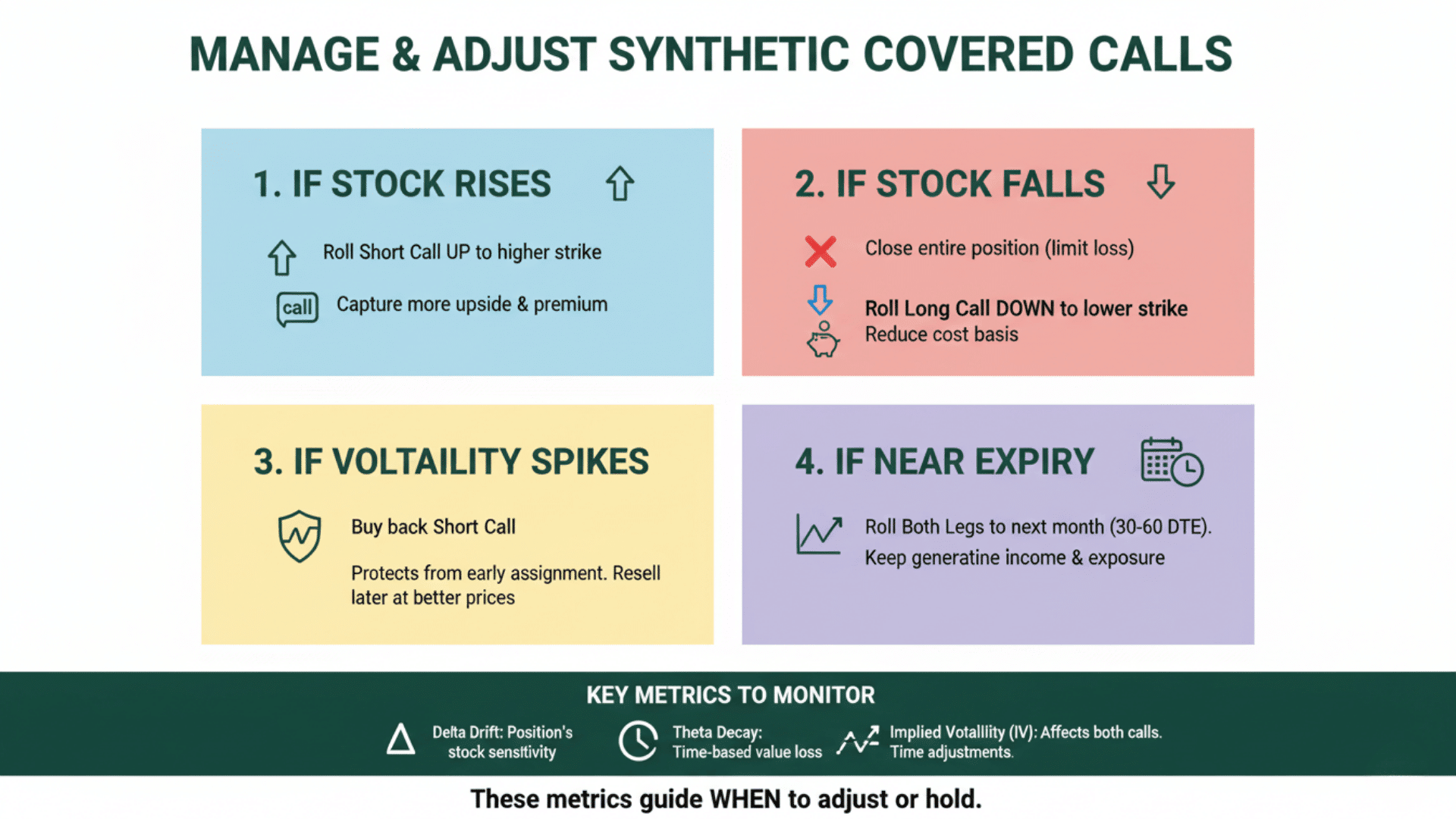

How to Manage and Adjust Synthetic Covered Calls

Managing your synthetic covered call actively can help you protect profits and limit losses. Here’s how to adjust your position based on what the market does.

1. If the Stock Rises

Roll your short call up to a higher strike price when the stock approaches your current strike.

This lets you capture more upside while collecting additional premium. You can do this before expiration to avoid assignment and keep the position open.

2. If the Stock Falls

Close the entire position early to limit your losses if the stock drops significantly below your breakeven. Alternatively, you can roll your long call down to a lower strike to reduce your cost basis.

This adjustment works best when you still believe in the stock’s potential but need to lower your entry point.

3. If Volatility Spikes

Buy back your short call when implied volatility jumps unexpectedly. High volatility increases the value of both options, but your short call poses assignment risk.

Closing it protects you from being exercised early and allows you to resell a new call at a better price later.

4. If Near Expiry

Roll both legs to the next month to keep generating income from the position. You close your current options and open new ones with 30 to 60 days until expiration.

This strategy works well when the underlying stock stays in your desired range and you want to maintain exposure.

Key Metrics to Monitor

Watch the delta drift to see how much your position moves with the stock. Track theta decay daily, especially in the final two weeks before expiration.

Monitor implied volatility because sudden changes affect both your long and short calls differently. These three metrics tell you when to adjust and when to hold steady.

Don’t Fall for These Synthetic Covered Call Traps

Even experienced traders make errors with synthetic covered calls. Here are the most common mistakes and how to avoid them.

| Mistake | The Problem | The Fix |

|---|---|---|

| Long calls too far OTM (low delta) | Won’t move with stock, loses synthetic behavior | Use deep ITM calls with 0.8-0.9 delta |

| Ignoring time decay | Long call loses value daily, especially near expiry | Monitor theta, roll 2-3 weeks before expiration |

| Short calls too close to the stock price | Caps profits early, frequent assignments | Sell calls 5-10% above the current price |

| Holding through earnings | Price swings blow past strikes | Close before earnings or hedge with puts |

| Ignoring the early assignment | Short call exercised anytime, especially near dividends | Watch ex-dividend dates, close deep ITM calls early |

These mistakes are easy to make but just as easy to avoid. Stay disciplined with your strike selection, manage time decay actively, and always have an exit plan before entering the trade.

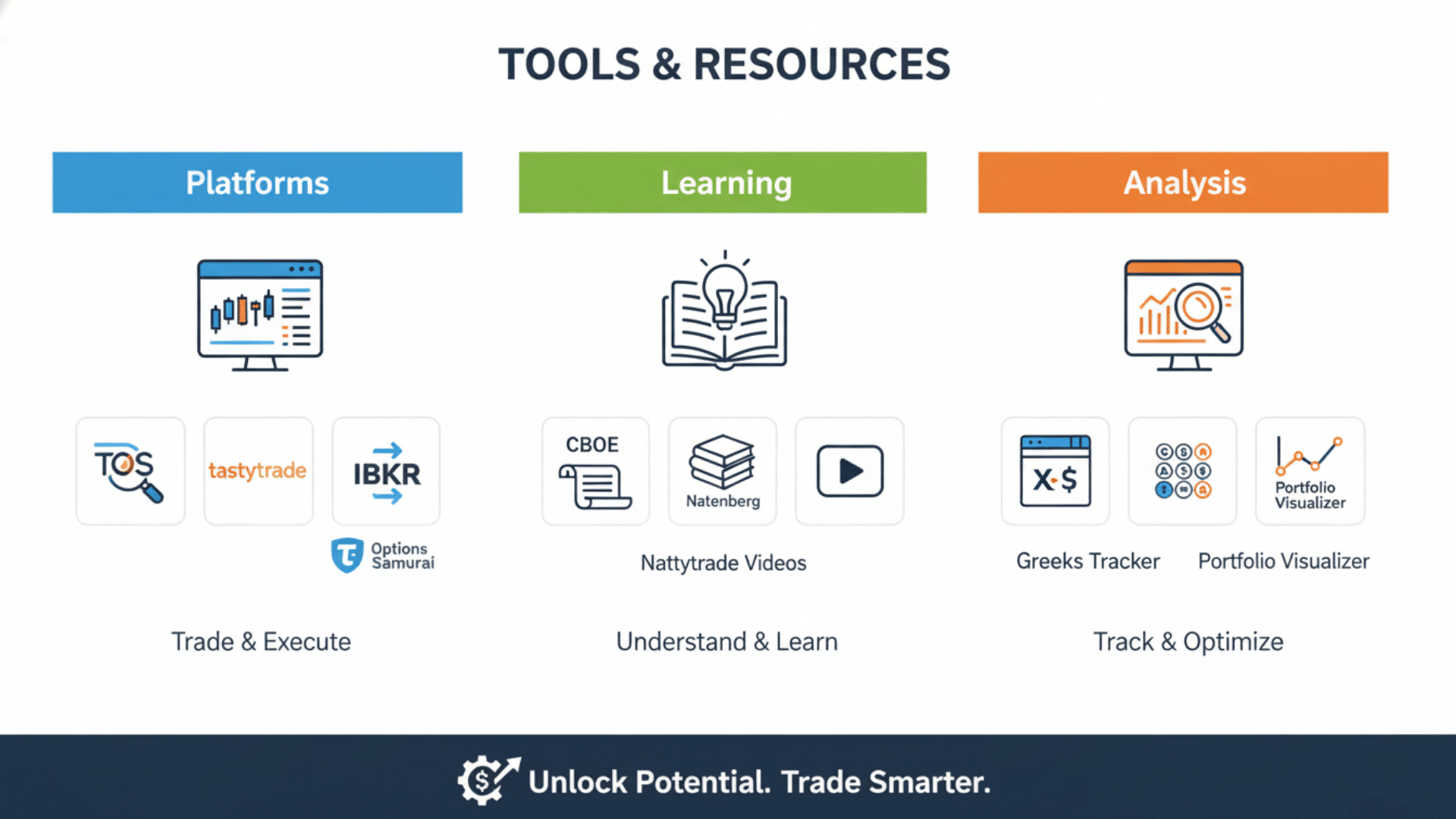

Tools and Resources for Trading Synthetic Covered Calls

The right tools make executing and managing synthetic covered calls much easier. Here are the best platforms, learning resources, and analysis tools to help you succeed.

Trading Platforms

- ThinkorSwim (TD Ameritrade): Offers a visual Greeks display and a powerful strategy builder for complex options trades.

- Tastytrade / Tastyworks: Designed specifically for multi-leg options with a clean interface and fast execution.

- Interactive Brokers (IBKR): Provides excellent margin rates and efficient order execution for active traders.

- OptionStrat & Options Samurai: Feature payoff simulation tools and detailed risk analysis before you enter trades.

Learning Resources

- CBOE Options Strategy Guides: Provides official documentation on structure, margin requirements, and best practices.

- Option Volatility & Pricing by Sheldon Natenberg: The classic book covering Greeks, volatility, and options theory in depth.

- Tastytrade’s Options Income Series: Offers free video tutorials walking through real trades step by step.

Tools for Analysis

- Excel/Google Sheets: Use spreadsheets to track every trade, calculate returns, and journal your decisions.

- OptionStrat’s Greeks Tracker: Monitors delta, theta, and vega daily so you know when to adjust positions.

- Portfolio Visualizer: Lets you backtest the strategy’s performance across different market conditions and time periods.

Final Thoughts

The synthetic covered call offers the same income potential as a traditional covered call but with far less capital required.

Instead of buying 100 shares, you use two options to replicate the position. This efficiency lets you trade expensive stocks and generate steady premium income.

Your long call acts like stock ownership. Your short call generates income but caps your upside. The risks are similar to owning shares, but you enter with just a fraction of the cost.

Start small and practice with paper trading first. Monitor your Greeks closely and adjust when needed. With proper management, this strategy can become a reliable source of income.

Ready to trade smarter? Try paper trading a synthetic covered call this week and see how it can change your approach to generating options income.